Carnival Corporation & plc (CCL) has shown signs of recovery following the significant challenges presented by the pandemic, which saw much of the travel industry at a halt and substantial capital raising necessary for continued operation. Current market conditions, buoyed by a resurgence in demand over the holiday season and growing investor confidence spurred by predictions of the Federal Reserve commencing rate reductions as early as 2024, have aided in its rebound.

This has facilitated a year-to-date yield of 122.8% on the stock. Nevertheless, despite these promising indicators and its return to profitability, the international cruise operator remains in turbulent waters with considerable debt, even in light of recent economic revival.

CCL's total debt is at an alarming $32.64 billion, with a net debt of $29.78 billion. Its total cash currently stand at $2.87 billion. Furthermore, the company displays negative metrics in key financial areas: it has a trailing-12-month levered free cash flow of negative $599.88 million, a debt-to-free cash flow ratio of negative 71.34, and a quick ratio of 0.33. These figures draw into question its capability to meet its liabilities.

While Carnival has taken important steps toward reducing debt and enhancing its profitability, further advancement is necessary, in my opinion, before recommending investment in its stock. The following provides detailed insight into the key figures informing my cautious position.

Analyzing Carnival Corporation's Financial Performance from November 2020 to August 2023

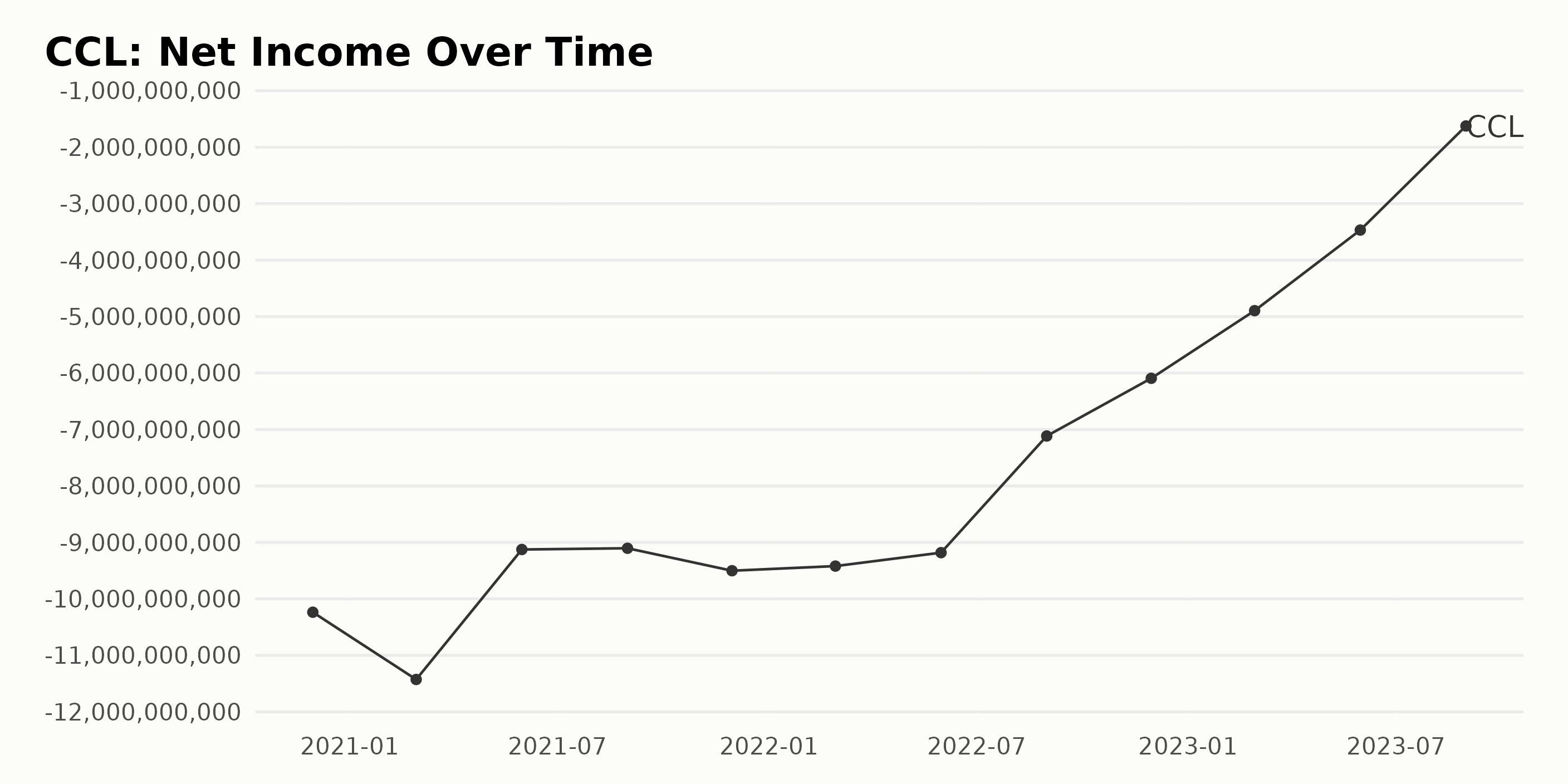

The trend in the trailing-12-month Net Income of Carnival Corporation (CCL) from November 2020 to August 2023 shows a negative fluctuation but with an improving trajectory over time. Here's a summary of this trend:

- As of November 30, 2020, the Net Income was at its lowest of -$10.24 billion.

- It slightly worsened to reach -$11.43 billion by the end of February 2021.

- From May 2021 onwards, there was a steady reduction in CCL's net deficit all through to August 2022, though the Net Income remained negative. By the end of August 2022, the Net Income had improved significantly to -$7.12 billion.

- After August 2022, the rate of improvement in the Net Income accelerated. By the end of November 2022, it was at -$6.09 billion and by February 28, 2023, it was reduced further to -$4.9 billion.

- The most notable leap in the income data occurred between February and August 2023. At the end of May 2023, the Net Income was -$3.47 billion, and by August 31, 2023, it had improved substantially to sit at -$1.62 billion.

Comparing the first value (November 2020) with the last value (August 2023), there is a significant reduction in the magnitude of the Net Income deficit, indicating a growth rate of about 84.16%. This reduction suggests an upward trend in which Carnival Corporation's financial situation is gradually improving, despite the Net Income remaining negative throughout this period. However, it's important to note that given this data only includes the Net Income up to August 2023, future trends will depend on various internal and external factors affecting Carnival Corporation. The most recent quarter ending August 2023 shows a significantly lower deficit than the previous periods, signaling potential progress towards positive Net Income figures in the subsequent years, if the current trend continues.

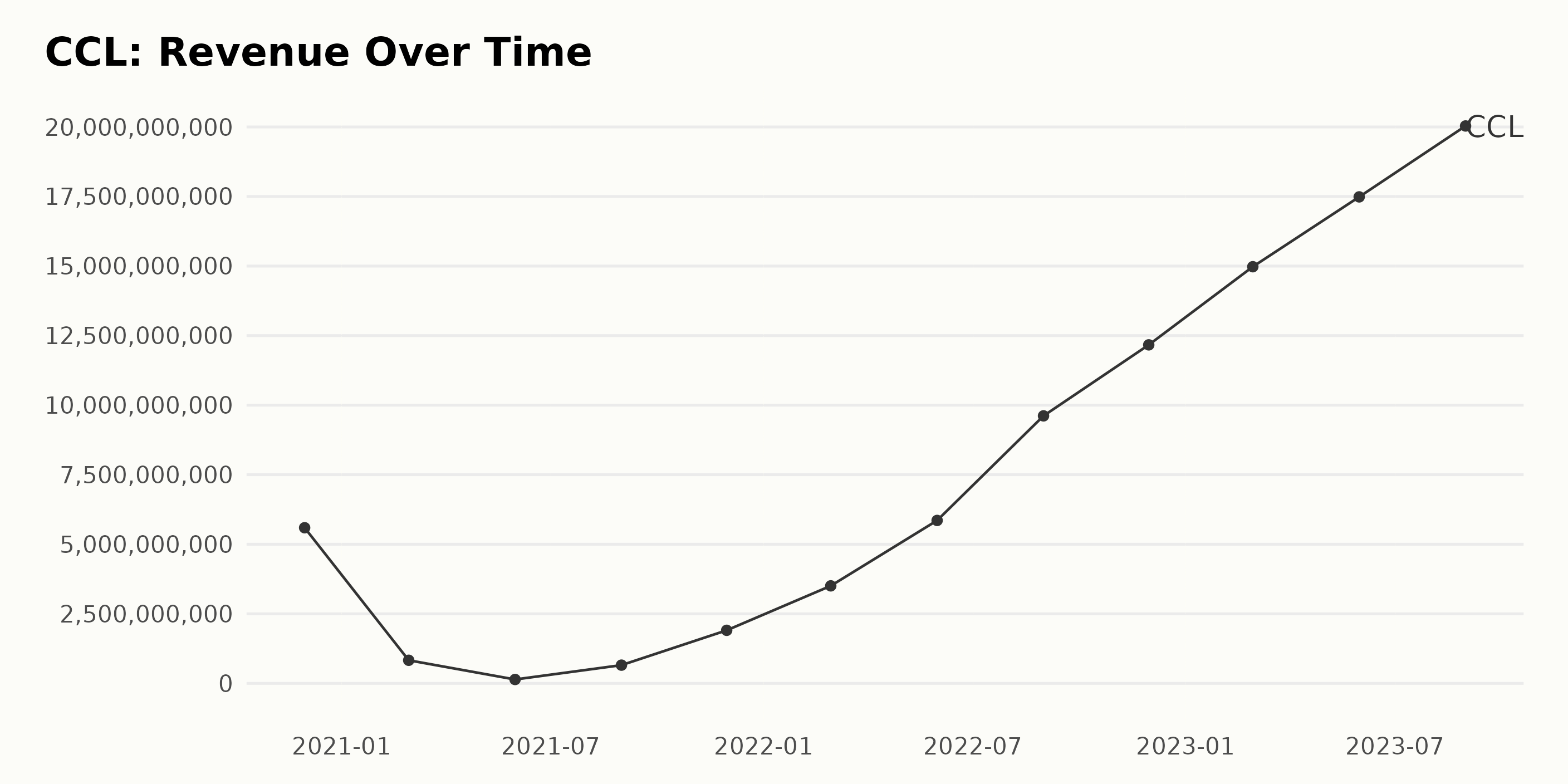

The overall trend of CCL’s trailing-12-month Revenue showed a significant increase throughout the observed time period from November 2020 to August 2023. Here are some key points analyzed from the data:

- At the starting point in November 2020, CCL's Revenue was $5.6 billion.

- The lowest point was observed in May 2021, with the Revenue dropping to $141 million.

- Following this trough, a strong recovery began. As of February 2022, the Revenue was $3.5 billion, demonstrating an impressive resurgence despite the earlier decrease.

- From then on, a steady upward trend can be seen, with CCL's Revenue reaching $9.6 billion in August 2022 and then to $12.2 billion in November 2022.

- The most recent data point in August 2023, shows their revenue had further increased to $20.04 billion.

Comparing the first and last figures, from $5.6 billion in November 2020 to $20.04 billion in August 2023, there has been substantial growth in CCL's Revenue over the period. This represents an approximate growth rate of 257%. On reviewing the fluctuations across this series of data, it indicates that despite initial decline, CCL has demonstrated remarkable resilience and growth, significantly increasing their Revenue over the considered timeframe.

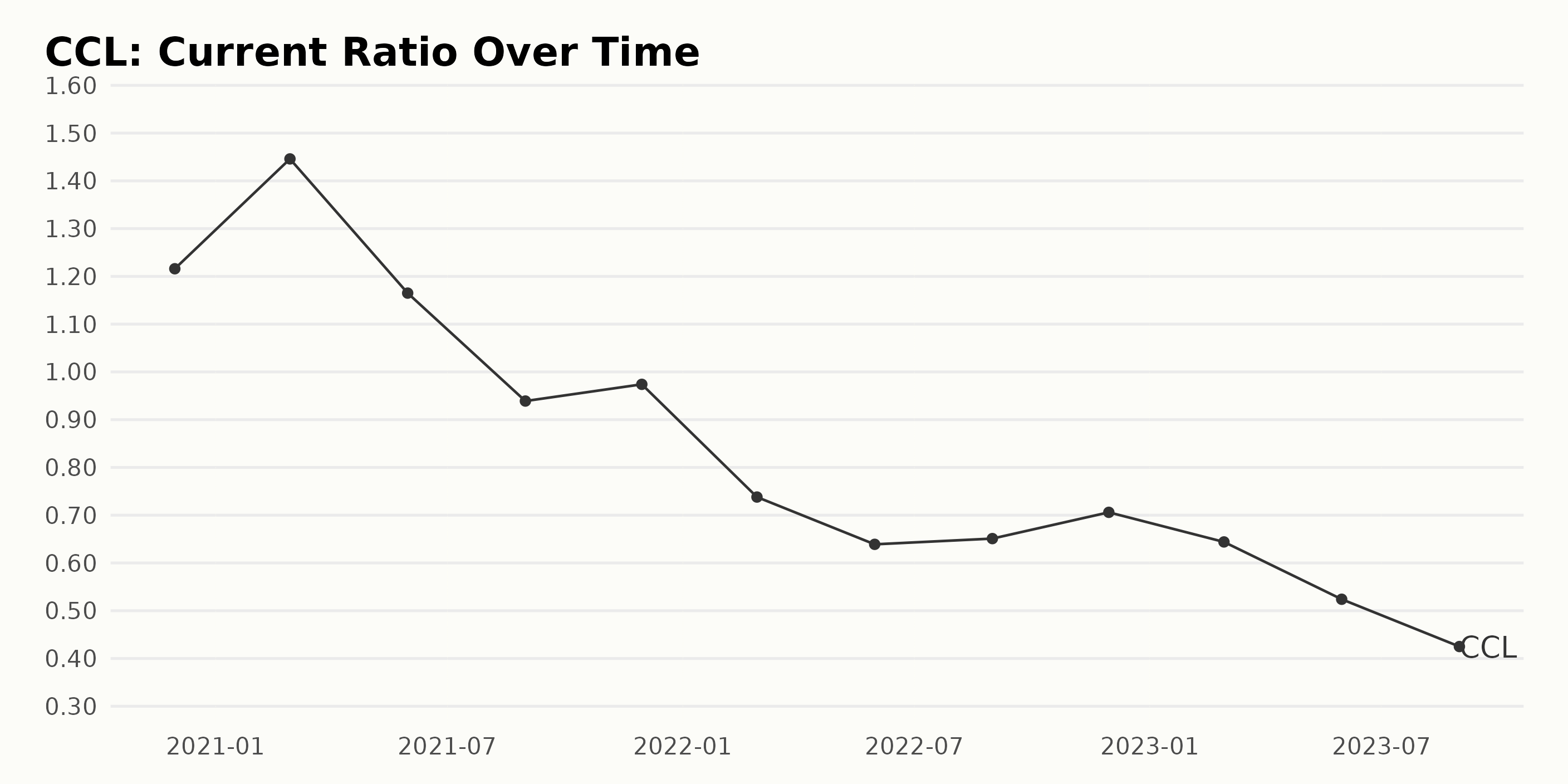

Summary of Current Ratio:

- On November 30, 2020, the Current Ratio of Carnival Corporation (CCL) stood at 1.22.

- The highest Current Ratio was observed on February 28, 2021, with a value of 1.45.

- From there, a generally declining trend has been evident in the Current Ratio. There were some fluctuations, notably an uptick at the end of November 2022 to 0.71 after a previous low of 0.65 in August of the same year.

- However, this increase did not sustain, and as of August 31, 2023, the ratio fell to 0.43.

Growth Rate: The growth rate, calculated by measuring the last value from the first one, indicated a negative trend. Specifically, the Current Ratio experienced a decrease of approximately -65%. Please note: this data suggests that Carnival Corporation's ability to cover its short-term liabilities with its short-term assets has been weakening over this period. This analysis places more emphasis on the more recent data and the last value in the series, as instructed.

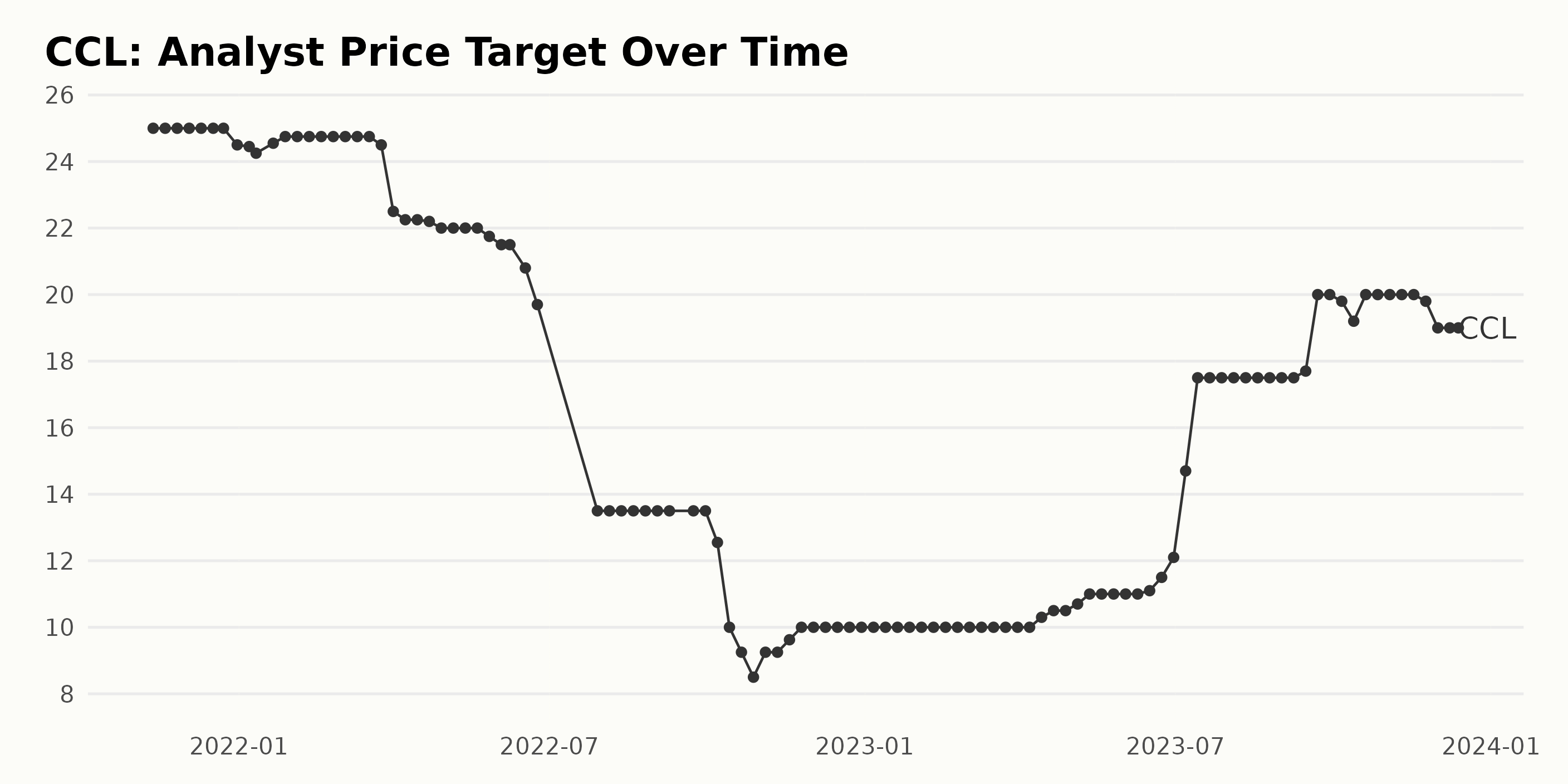

The data shows the fluctuations and trend of the Analyst Price Target for CCL from November 12, 2021, through December 13, 2023. Over this period, the Price Target underwent several changes, which can be grouped into several stages:

Stability at $25 (November 2021 - December 2021): The Analyst Price Target for CCL remained stable at $25 throughout November to late December 2021.

Gradual Decline (December 2021 - June 2022): Starting from the end of December 2021, the Price Target began a gradual decline, reducing from $24.5 on December 31, 2021, to $19.7 by the end of June 2022.

Sharp Drop (June 2022 - July 2022): There was a significant drop in the Price Target from $20.8 in mid-June 2022 to $13.5 by the end of July 2022.

Stability and Sharp Decline (July 2022 - October 2022): The Analyst Price Target then remained steady at $13.5 for about two months until early October 2022, when it dropped sharply again to a low of $8.5 by the end of October 2022.

Slow Increase (October 2022 - July 2023): From late October 2022 to July 2023, there was a slow but steady increase in the Analyst Price Target, rising from $9.25 to eventually peak at $17.5.

Stability and Gradual Increase (July 2023 - September 2023): The Price Target remained stable at $17.5 from July 2023 to mid-September 2023, before increasing gradually to $20 by late September.

Fluctuation and Decrease (September 2023 - December 2023): Into the final quarter of 2023, the Price Target experienced some fluctuations, initially decreasing to $19.2 in mid-October, then rising back up to $20, before finally settling at $19 by December 13, 2023.

The overall growth rate, measured by the difference in the Analyst Price Target value between November 12, 2021 ($25), and December 13, 2023 ($19), saw a decrease of 24%.

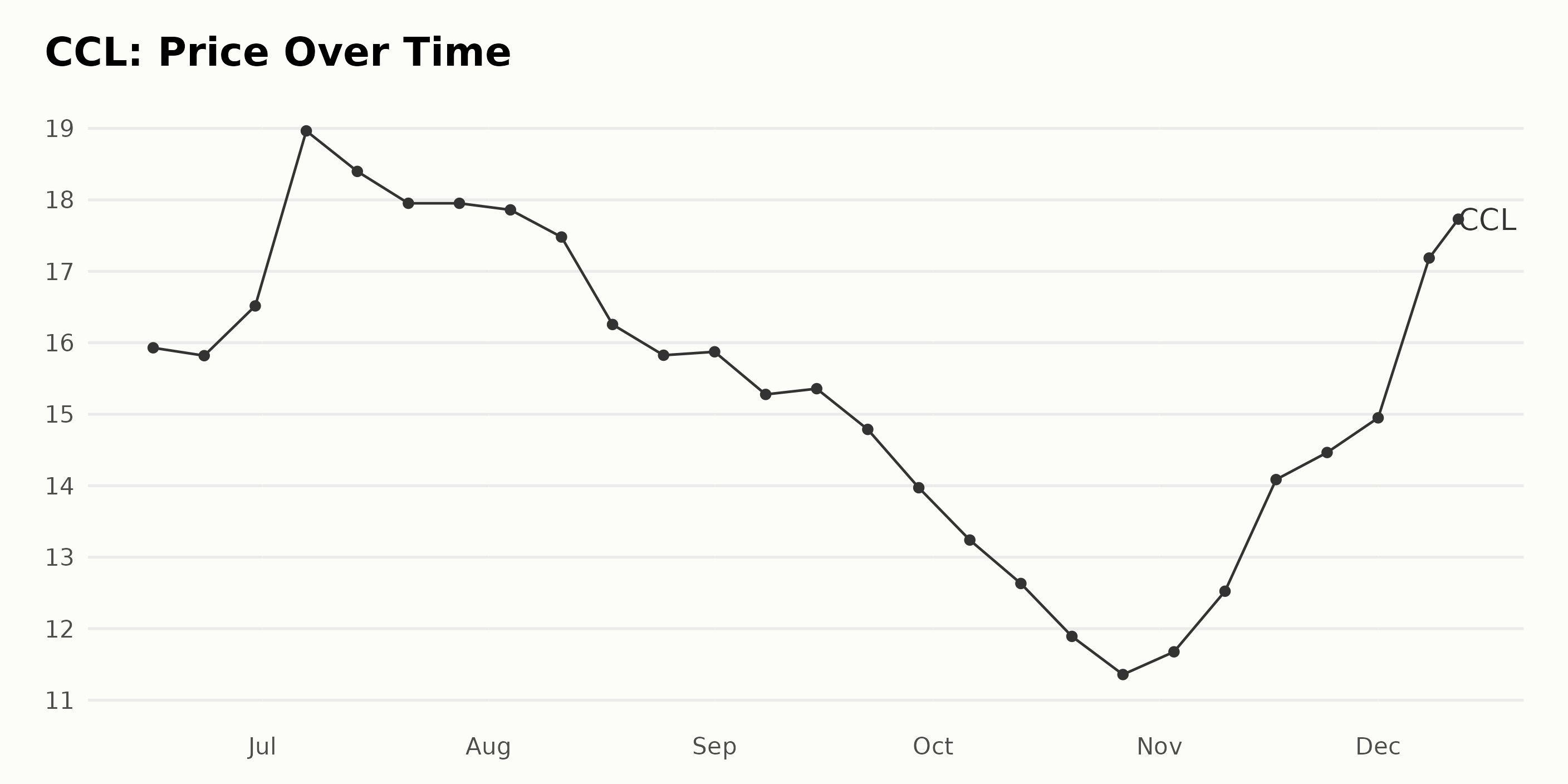

Analyzing Carnival Corporation's Share Price Fluctuations: June-December 2023

Based on the data provided, here's a brief overview of Carnival Corporation (CCL) share prices from June to December 2023:

- In June 2023, the share price showed a slight upward trend, climbing from $15.93 on June 16 to $16.52 by June 30.

- In July, there was a significant increase in the share price, reaching a peak of $18.97 on July 7. However, the trend turned slightly negative as the month progressed, closing at $17.95 on July 28.

- From August through September, the stock saw a notable downtrend. Starting at $17.86 on August 4, the price dropped to $13.97 by the end of September.

- October experienced further rapid decline with the price plummeting to $11.89 by October 20. However, it then entered a recovery phase, with the closing price on October 27 hitting $11.36.

- The recovery continued in November, and the price climbed back up to $14.46 by November 24.

- December marked a high growth phase for the shares, reaching a price of $17.73 by December 12.

It's worth noting that while CCL's share value fluctuated significantly during this period, a general pattern can be observed. There was an increase followed by a decrease in the middle of the year, a sharp drop towards the end of the year, and then a sudden spike in December. This introduces an overall volatility in the stock's performance. Here is a chart of CCL's price over the past 180 days.

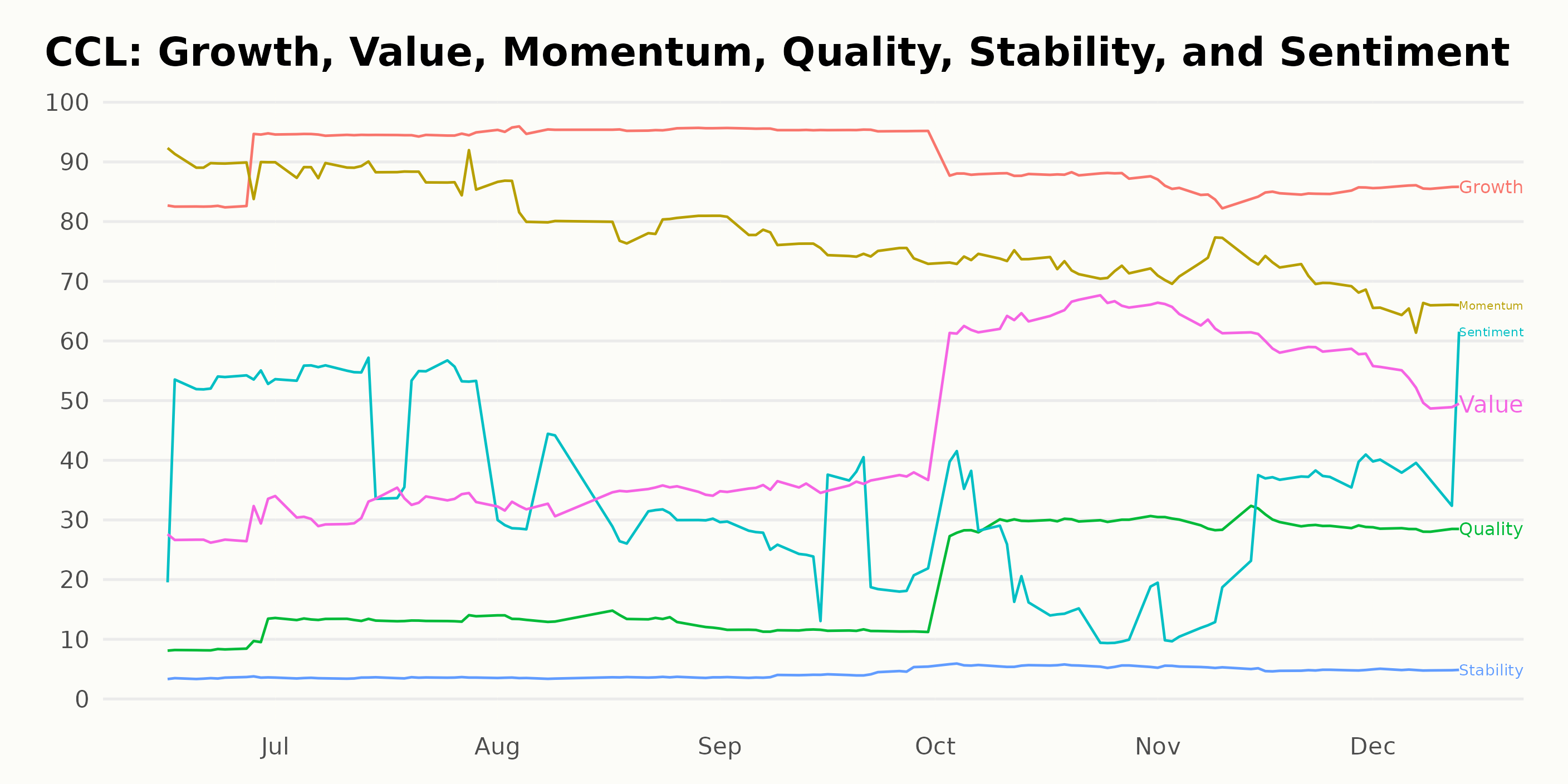

Analyzing Carnival Corporation's Growth, Momentum, and Value: A 2023 Trend Report

CCL has an overall C rating, translating to a Neutral in our POWR Ratings system. It is ranked #3 out of the four stocks in the Travel - Cruises category.

The POWR Ratings for CCL as of the following dates indicate some noteworthy trends across three significant dimensions: Growth, Momentum, and Value.

Growth - As of June 30, 2023, Growth was rated at 86. This rating saw a sizeable increase to 95 in July 29, 2023, and remained consistent for the next three months till September 30, 2023. It then decreased a bit to 88 in October 31, 2023 but surprisingly shot up to 86 by December 13, 2023.

Momentum - Momentum started strong with a rating of 90 in June 30, 2023. Since July 29, 2023, to December 13, 2023, it has been on a clear downtrend, decreasing gradually from 88 to 65.

Value - The Value dimension started at a modest 28 in June 30, 2023. However, it showed a gradual increasing trend till it peaked at 64 in October 31, 2023. Despite dropping slightly to 61 by November 30, 2023, it still remained significantly higher compared to its initial value and ended at a respectable rating of 52 by December 13, 2023.

How does Carnival Corporation (CCL) Stack Up Against its Peers?

Other stocks in the sector that may be worth considering are Bluegreen Vacations Holding Corp. (BVH), Genting Berhad (GEBHY) and Atour Lifestyle Holdings Ltd. (ATAT) -- they have better POWR Ratings.

What To Do Next?

Get your hands on this special report with 3 low priced companies with tremendous upside potential even in today’s volatile markets:

3 Stocks to DOUBLE This Year >

CCL shares were trading at $17.69 per share on Wednesday afternoon, down $0.13 (-0.73%). Year-to-date, CCL has gained 119.48%, versus a 22.73% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics.

The post Carnival (CCL) Travel Stock Breakdown: Bullish or Bearish? appeared first on StockNews.com