With a $610.77 million market cap, fuboTV Inc. (FUBO) in New York City is a TV streaming company. The company offers access to live sports, news, and entertainment content. It operates through two segments: streaming; and online wagering. The fuboTV platform enables customers to access content through streaming devices and smart TVs, mobile phones, tablets, and computers.

Investors have been bearish about FUBO due to its slowing growth and worsening losses. The company has a price point that is too low to cover the costs required to drive growth. FUBO’s total operating costs were 1.56 times its revenue in its fiscal 2022 first quarter. So, one of the key concerns with FUBO is its negative profit margins. Management’s reduced guidance and the weak quarterly results remain the major disappointments for investors.

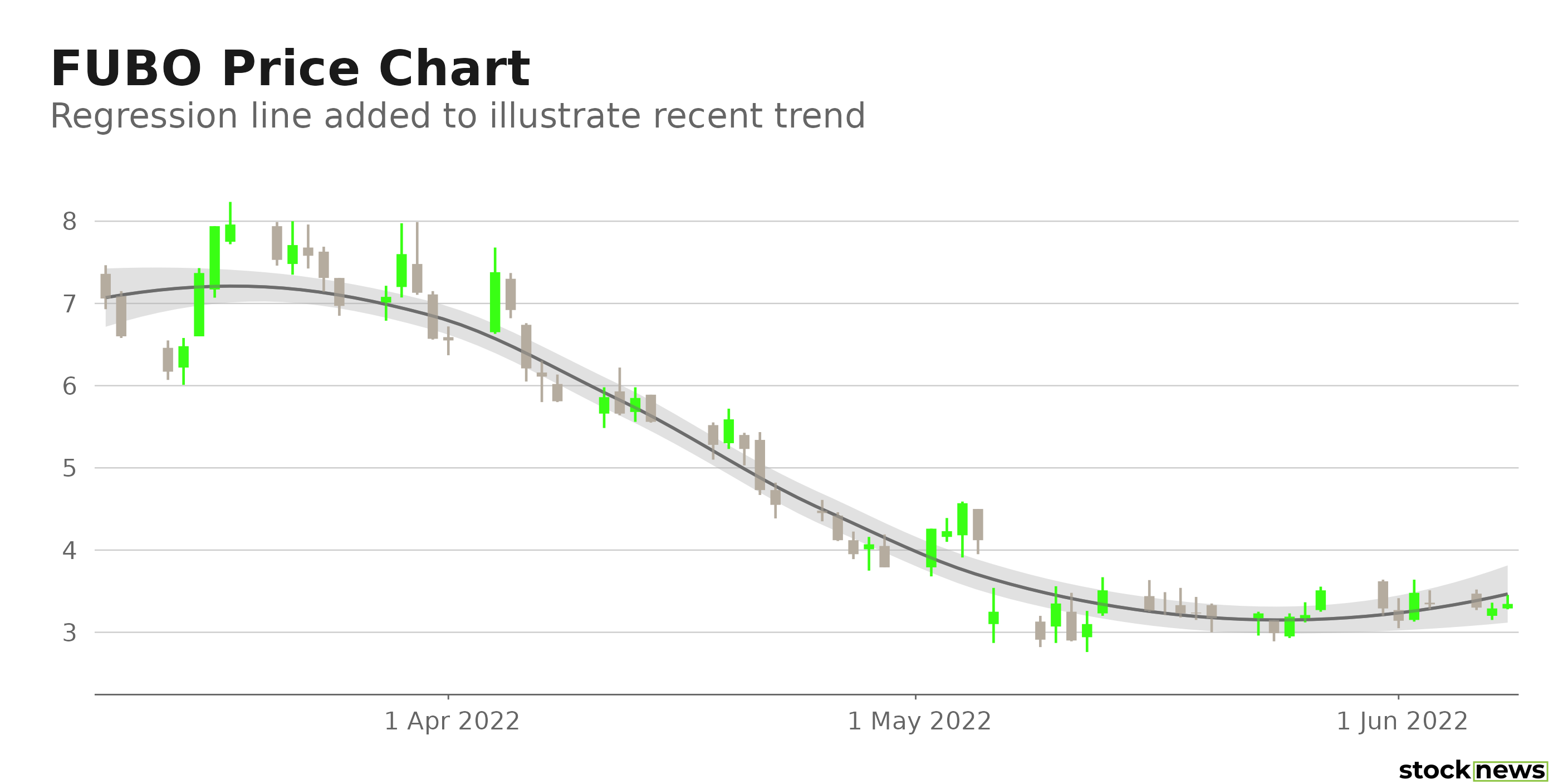

The stock has plummeted 79.7% in price year-to-date to close yesterday’s trading session at $3.29. FUBO is currently trading 966.9% below its 52-week high of $35.10, which it hit on June 25, 2021.

Here is what I think could influence FUBO’s performance in the upcoming months:

Deteriorating Financials

For its fiscal 2022 first quarter, ended March 31, 2022, FUBO's revenue improved 102.2% year-over-year to $242.02 million. However, its operating expenses increased 104.1% year-over-year to $377.26 million. And its operating loss widened 102.8% from the year-ago value to $135.24 million.

FUBO’s adjusted EBITDA loss amounted to $105.49 million, compared to a $46.50 million loss reported in the prior-year period. In addition, the company's net loss and net loss per share attributable to common shareholders came in at $140.82 million and $0.89, respectively, widening 100.6% and 50.8% year-over-year.

Lowered Guidance

For its fiscal 2022 second quarter, the company expects to generate between $220 million and $225 million in revenue. Also, it has forecasted that its subscribers will come in between 965,000 and 975,000, down from 1.05 million reported in the first quarter. For its fiscal year 2022, FUBO expects revenue of between $1.02 billion and $1.03 billion, which is lower than its prior guidance of $1.08 billion to $1.09 billion.

Mixed Growth Prospects

Analysts expect its revenues to rise 65.6% year-over-year to 1.06 billion in its fiscal year 2022 (ending Dec. 31, 2022). However, the $2.48 consensus loss per share estimate for the current year reflects a 26.8% increase from the last year. Also, the company’s loss per share for the current quarter is expected to be $0.58, indicating a 52.4% rise year-over-year. The company has missed the consensus EPS estimates in each of the trailing four quarters.

Negative Profit Margins

FUBO’s trailing-12-month gross profit margin is negative 3.98%, and its trailing-12-month EBITDA margin is negative 50.70%. Furthermore, the company’s trailing-12-month net income margin and ROCE are negative 59.61% and 65.51%, respectively.

POWR Ratings Reflect Bleak Prospects

FUBO has an overall F rating, which translates to Strong Sell in our proprietary POWR Ratings system. The POWR Ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

FUBO has an F grade for Stability and Quality. The stock’s relatively high 1.30 beta justifies the Stability grade. In addition, FUBO’s negative profit margins are in sync with the Quality grade.

FUBO is ranked #16 of 16 stocks in the F-rated Entertainment - Sports & Theme Parks industry.

Beyond what I have stated above, we have also given FUBO grades for Value, Growth, Sentiment, and Momentum. Get all the FUBO ratings here.

Bottom Line

FUBO has reported poor first-quarter results and hinted at decelerating growth. Furthermore, a potential economic slowdown or recession could worsen the company’s performance. So, we think the stock is best avoided now.

How Does fuboTV Inc. (FUBO) Stack Up Against its Peers?

While FUBO has an overall POWR Rating of F, one could check out Endeavor Group Holdings, Inc. (EDR) within the Entertainment - Sports & Theme Parks industry with a B (Buy) rating.

FUBO shares were trading at $3.33 per share on Wednesday morning, up $0.04 (+1.22%). Year-to-date, FUBO has declined -78.54%, versus a -12.39% rise in the benchmark S&P 500 index during the same period.

About the Author: Mangeet Kaur Bouns

Mangeet’s keen interest in the stock market led her to become an investment researcher and financial journalist. Using her fundamental approach to analyzing stocks, Mangeet’s looks to help retail investors understand the underlying factors before making investment decisions.

The post Down More Than 75% YTD, is Now a Good Time to Scoop Up Shares of fuboTV? appeared first on StockNews.com