Specialty business services company SP Plus Corporation (SP) in Chicago provides mobility solutions, parking management, ground transportation, baggage, and other ancillary services in North America. The company operates through the broad segments of Commercial and Aviation.

SP delivered solid growth in its last reported quarter. Furthermore, it expects its non-GAAP gross profit for its fiscal year 2022 to lie between $200 million and $220 million, while its non-GAAP net income and non-GAAP EPS are expected to come in between $56 - $61 million and $2.59 - $2.83, respectively.

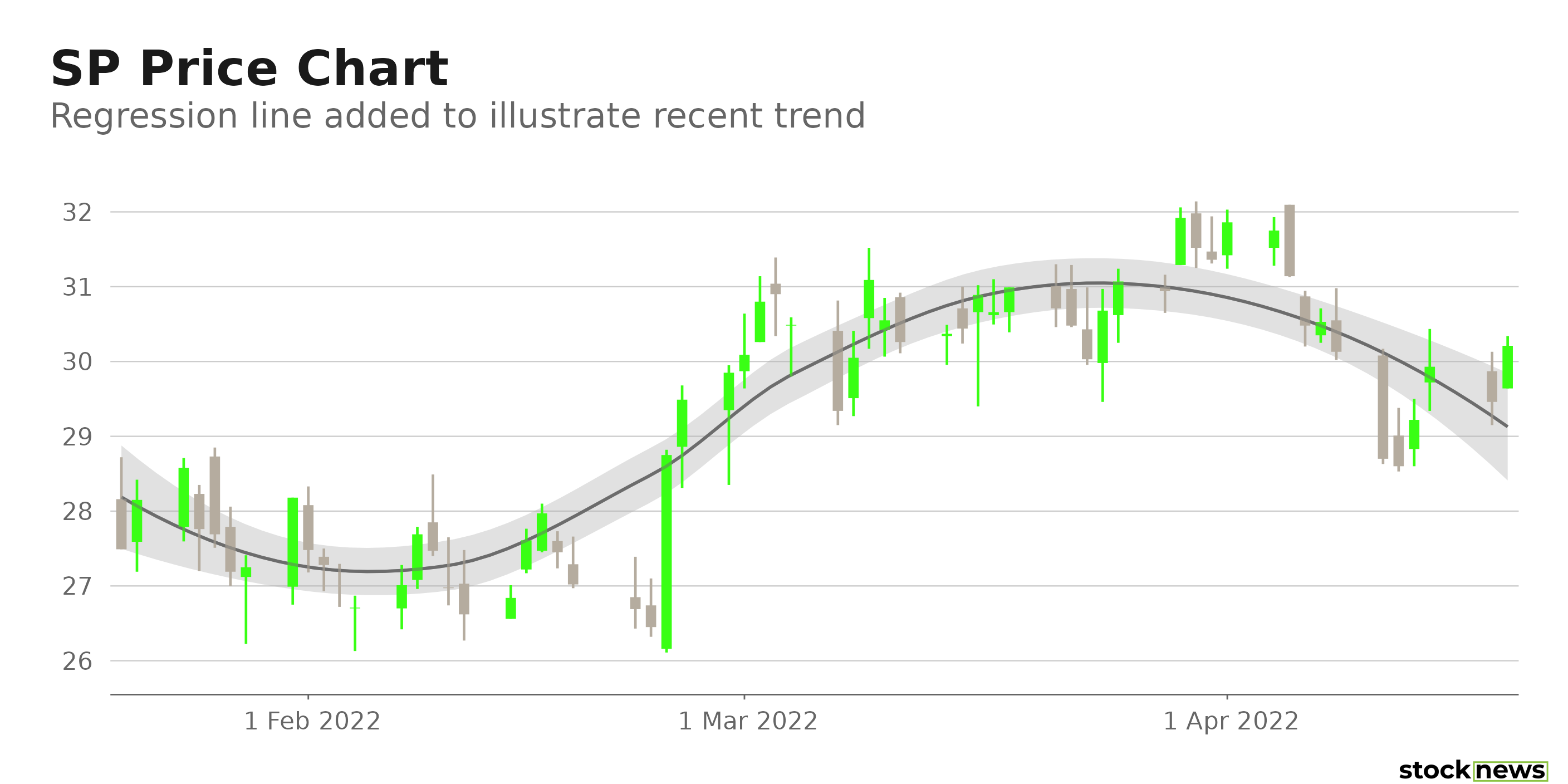

SP’s stock has gained 7.1% in price year-to-date and 7.6% over the past three months to close yesterday’s trading session at $30.21. However, the stock has declined 2.5% over the past month. SP is currently trading 16.8% lower than its 52-week high of $36.30.

Solid Bottom Line

For its fiscal fourth quarter, ended December 31, SP’s total services revenue increased 40.3% year-over-year to $343.20 million. Its non-GAAP gross profit rose 42.5% from the prior-year quarter to $49.30 million, while its non-GAAP operating income improved 143% from the same period the prior year to $20.90 million. Its non-GAAP net income attributable to SP and non-GAAP EPS came in at $10.90 million and $0.51, respectively, up 2,080% and 2,450% from the prior-year period.

Favorable Analysts Estimates

The $0.44 consensus EPS estimate for the quarter ended March 31, 2022, indicates a 63% year-over-year increase. Likewise, the consensus EPS estimate for the quarter ending June 2022, and fiscal 2022 of $0.66 and $2.64, respectively, reflects a 34.7% and 36.8% improvement from the prior-year periods. The Street’s $153.80 million, $159.05 million, and $660.65 million respective revenue estimates for the same periods indicates a 28.4%, 16.5%, and 9.8% rise year-over-year. The company’s EPS is expected to increase 10% per annum over the next five years.

Affordable Valuations

In terms of its forward non-GAAP P/E, SP is currently trading at 11.38x, which is 35.7% lower than the 17.69x industry average.Its 0.81 forward non-GAAP PEG multiple is 42.2% lower than the 1.41 industry average. In terms of its forward Price/Sales, the stock is trading at 1.05x, which is 22.6% lower than the 1.35x industry average.

Impressive Profit Margins

SP’s trailing 12-month EBIT margin, EBITDA margin, and levered FCF margin of 12.19%, 16.36%, and 8.59%, respectively, are 27.54%, 23.20%, and 100.74% higher than their 9.56%, 13.28%, and 4.28% respective industry averages.

And its 15.63% trailing 12-month ROE is 13.23% higher than the 13.81% industry average.

POWR Ratings Reflect Promising Prospects

SP’s strong fundamentals are reflected in its POWR Ratings. The stock has an overall B rating, which equates to Buy in our proprietary rating system. The POWR Ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

SP has a Growth and Sentiment grade of A, which is consistent with its solid bottom-line growth reported in the last quarter and its favorable analyst sentiments.

The stock has a B grade for Value in sync with its affordable valuations.

In the 43-stock Outsourcing – Business Services industry, SP is ranked #6. The industry is rated B.

Click here to see the additional POWR ratings for SP (Momentum, Stability, and Quality).

View all the top stocks in the Outsourcing – Business Services industry here.

Bottom Line

SP is expected to benefit from the growing business services market, given its sound fundamental positioning. According to International Data Corporation (IDC), the worldwide IT and business services revenue is expected to grow 5.6% in 2022, with the Americas service market expected to grow 5.3% this year. The stock is currently trading cheaply compared to its peers. Also, given the favorable analyst expectations regarding the stock, I think investors should take advantage of the dip and scoop up SP shares now.

How Does SP Plus Corporation (SP) Stack Up Against its Peers?

While SP has an overall POWR Rating of B, one might consider looking at its industry peers, ARC Document Solutions, Inc. (ARC) and Civeo Corporation (CVEO), which have an overall A (Strong Buy) rating, and The Brink's Company (BCO) and TriNet Group, Inc. (TNET), which have an overall B (Buy) rating.

Note that TNET is one of the few stocks handpicked by our Chief Value Strategist, Steve Reitmeister, currently in the POWR Value portfolio. Learn more here.

SP shares were unchanged in premarket trading Wednesday. Year-to-date, SP has gained 7.05%, versus a -6.01% rise in the benchmark S&P 500 index during the same period.

About the Author: Anushka Dutta

Anushka is an analyst whose interest in understanding the impact of broader economic changes on financial markets motivated her to pursue a career in investment research.

The post Should You Buy the Dip in SP Plus Stock? appeared first on StockNews.com