Diversified solutions provider Matthews International (NASDAQ:MATW) missed Wall Street’s revenue expectations in Q4 CY2024, with sales falling 10.7% year on year to $401.8 million. Its non-GAAP profit of $0.14 per share was 37.8% below analysts’ consensus estimates.

Is now the time to buy Matthews? Find out by accessing our full research report, it’s free.

Matthews (MATW) Q4 CY2024 Highlights:

- Revenue: $401.8 million vs analyst estimates of $426.9 million (10.7% year-on-year decline, 5.9% miss)

- Adjusted EPS: $0.14 vs analyst expectations of $0.23 (37.8% miss)

- Adjusted EBITDA: $40 million vs analyst estimates of $42.05 million (10% margin, 4.9% miss)

- EBITDA guidance for the full year is $210 million at the midpoint, above analyst estimates of $205.2 million

- Operating Margin: 14.1%, up from 2.9% in the same quarter last year

- Free Cash Flow was -$3.45 million compared to -$41.34 million in the same quarter last year

- Market Capitalization: $912.6 million

Company Overview

Originally a death care company, Matthews International (NASDAQ:MATW) is a diversified company offering ceremonial services, brand solutions and industrial technologies.

Specialized Consumer Services

Some consumer discretionary companies don’t fall neatly into a category because their products or services are unique. Although their offerings may be niche, these companies have often found more efficient or technology-enabled ways of doing or selling something that has existed for a while. Technology can be a double-edged sword, though, as it may lower the barriers to entry for new competitors and allow them to do serve customers better.

Sales Growth

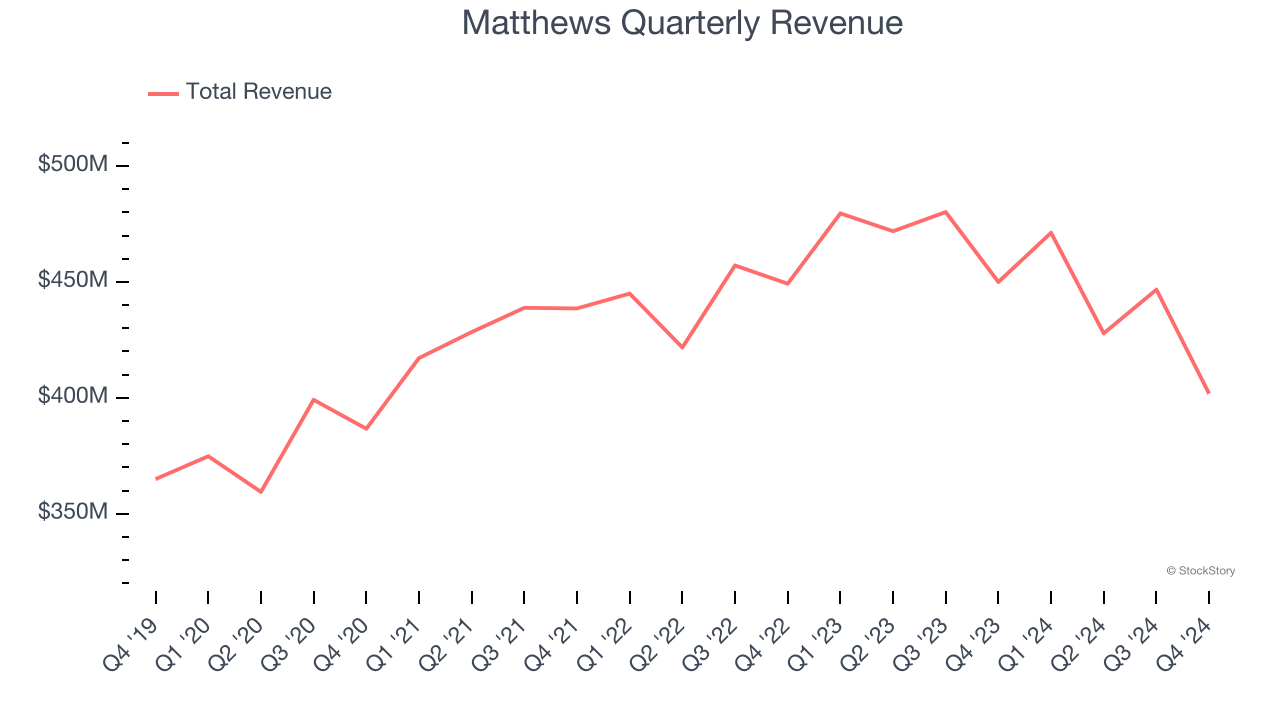

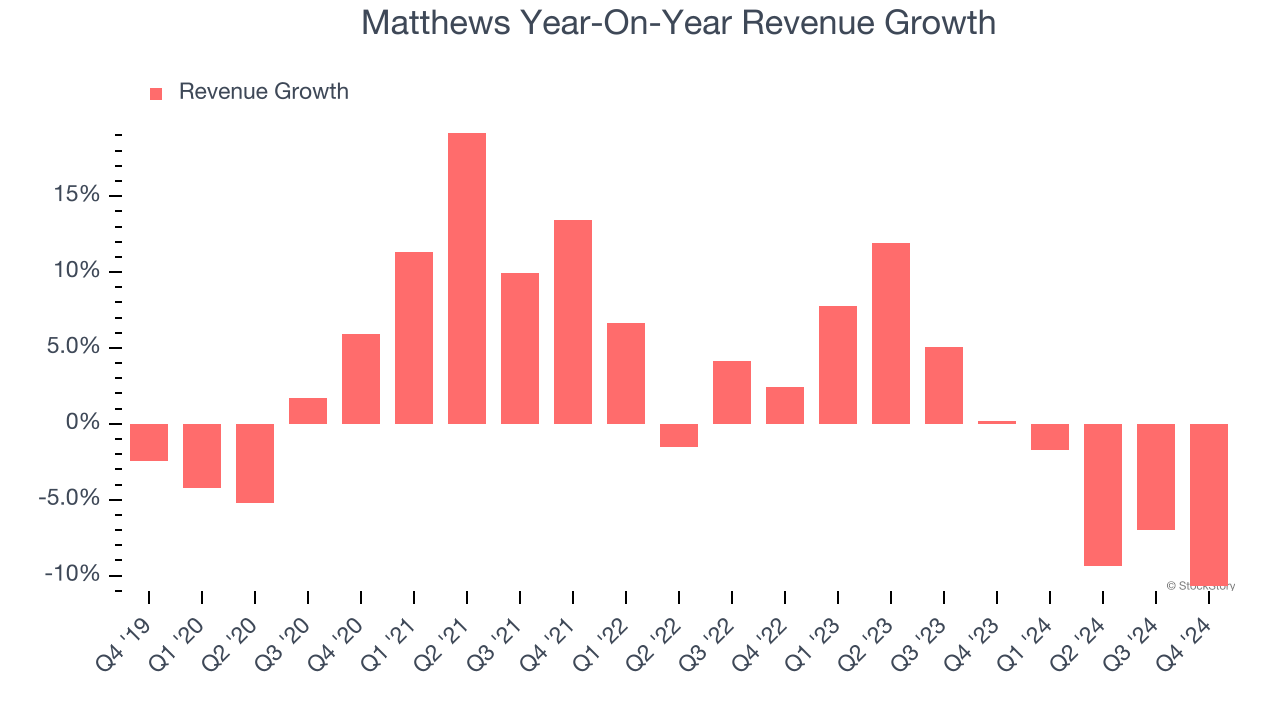

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Regrettably, Matthews’s sales grew at a weak 2.7% compounded annual growth rate over the last five years. This was below our standards and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Matthews’s recent history shows its demand slowed as its revenue was flat over the last two years.

This quarter, Matthews missed Wall Street’s estimates and reported a rather uninspiring 10.7% year-on-year revenue decline, generating $401.8 million of revenue.

We also like to judge companies based on their projected revenue growth, but not enough Wall Street analysts cover the company for it to have reliable consensus estimates.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

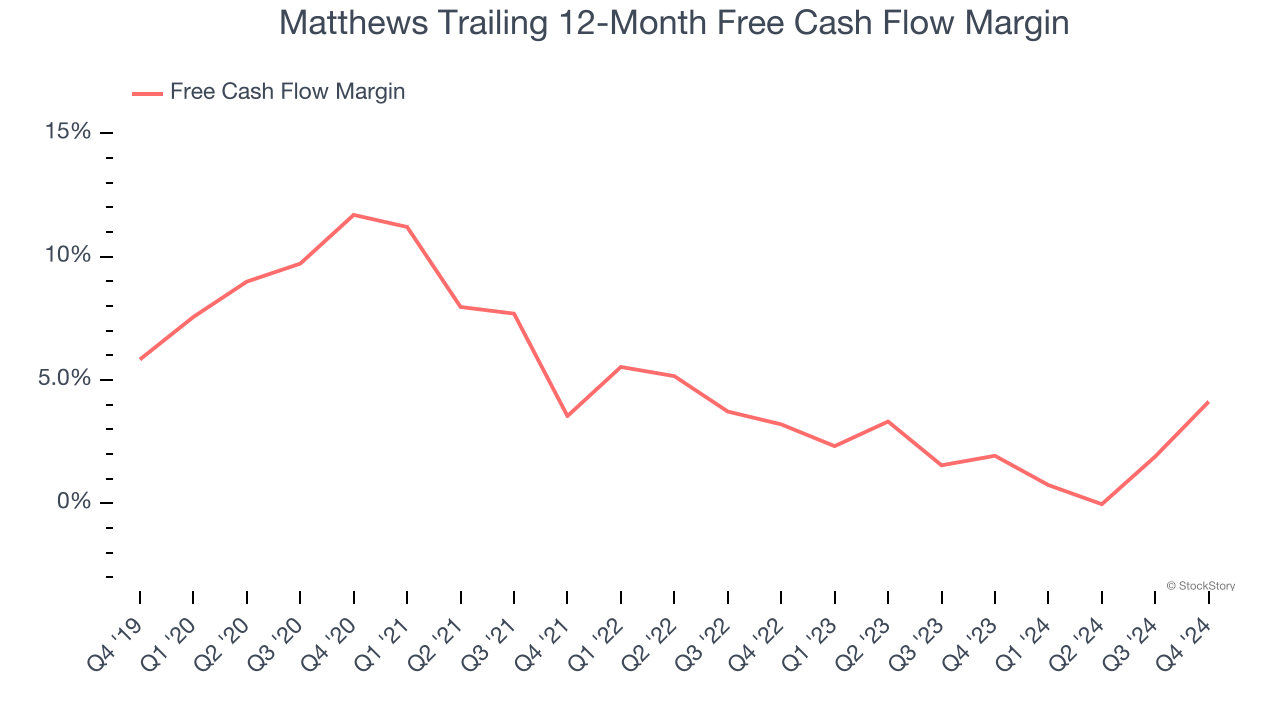

Matthews has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 3%, lousy for a consumer discretionary business.

Matthews broke even from a free cash flow perspective in Q4. This result was good as its margin was 8.3 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, leading to temporary swings. Long-term trends carry greater meaning.

Key Takeaways from Matthews’s Q4 Results

It was encouraging to see Matthews’s full-year EBITDA guidance beat analysts’ expectations. On the other hand, its revenue missed significantly and its EPS fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 3.1% to $28.60 immediately following the results.

Matthews’s latest earnings report disappointed. One quarter doesn’t define a company’s quality, so let’s explore whether the stock is a buy at the current price. If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.