Company Confirms Presence of Higher-Grade Lithium in Shallow Soils Throughout Second Hole; Identifies Significantly Thicker Zone of Higher-Porosity Sand-Conglomerate Zone at Basin Bottom Overlain by Massive Interval of Evaporites

VANCOUVER, BC / April 12, 2023 / Usha Resources Ltd. (“USHA” or the “Company”) (TSXV:USHA)(OTCQB:USHAF)(FSE:JO0), a North American mineral acquisition and exploration company focused on the development of drill-ready lithium and other battery and precious metal projects, is pleased to provide an update on its on-going drill program at the Jackpot Lake Lithium Brine Property (“Project“).

Highlights:

- Lithium is present in drill hole JP22-02 at a grade of up to 820 ppm, with an average of 334 ppm Li in thirty samples collected from shallow surface soils (<500 ft), confirming that the soils at the Project are highly enriched in lithium. These results are over four times the reported historical average and compare very favourably to the reported average of 100 ppm for the Esmeralda Formation, one of the potential sources of the lithium enrichment for the brines present in Clayton Valley which hosts Albemarle’s Silver Peak Lithium Brine Mine, the only producing lithium operation in the United States[i].

- Similar stratigraphy has been encountered in JP22-02 as that in drill hole JP22-01, suggesting that the favourable stratigraphy identified in drilling is present throughout the basin as the two holes are 2.75 km apart. Identifying these similarities, especially in the basal conglomerates and evaporites, is a key finding that continues to support that Dry Lake, within which Jackpot is hosted, is a similar geologic setting to that of Clayton Valley.

- Significant evaporitic crystallization, indicative of a brine-forming environment, is present throughout JP22-02 with a notable interval of 146 feet of massive evaporites identified from a depth of 1,346 to 1,504 feet in addition to the interbedding, veining and inclusions found throughout the sediments above. Their presence supports that the Dry Lake Basin is a brine forming environment as crystallization of evaporites would not occur in a freshwater system.

- A large zone of higher-porosity sand and conglomerate has been identified at the bottom of JP22‑02, with at least 273 feet of a potentially pumpable aquifer present into which fluids from the zones above should drain. Per the Preliminary Economic Assessment (PEA) completed by Pure Energy Minerals for their Clayton Valley project, their sand and conglomerate zone was identified to contain a large volume of brine with superior grades[ii], and so the Company is making the identification of this zone throughout the basin a priority for its drill program.

Assay Results

Drill hole JP22-02 has been completed to a depth of 1,801 ft (core length). The Company is pleased to report that this drill hole has returned the highest grades of lithium encountered in drilling and reported historically to date on the Property, with shallow soils within the upper 500 feet averaging 334 ppm Li, almost twice the historical reported average of 175 ppm, and a high of 820 ppm, almost four times the historical average and 50% higher than the historical reported high of 550 ppm.

The core assay results from JP22-02 demonstrates the potential for Jackpot Lake to host higher-grade intervals at deeper depths within the basin and confirms that lithium-rich sediments are present in the upper portion of the basin which could theoretically concentrate and enrich a brine at depths over time.

“These drill results continue to demonstrate and validate the immense potential we saw when we first reviewed Jackpot Lake.” said Deepak Varshney, CEO of Usha Resources.

Mr. Varshney continued: “We have always looked to Clayton Valley as a reference for our own geological model and the leaching of enriched lithium clays within a basin is one of the primary mechanisms by which lithium is believed to have been introduced into the brine at Albemarle’s Silver Peak operation. Our reported historical average of 175 ppm Li in the surficial soils illustrated the potential of our project as it was very comparable to the reported average of 100 ppm for the Esmeralda Formation, one of the potential sources of the lithium enrichment in Clayton Valley. These higher grades further confirm our belief that there is a strong potential source for brine enrichment across the entire Jackpot Lake basin as well.”

Geological Summary

The Company is also pleased to announce that it has also encountered very favourable stratigraphy in the second hole, with evaporitic crystallization, indicative of a brine-forming environment, present throughout the core similar to the first hole as interbedding, veining and inclusions but also as a thick layer of massive evaporites from 1,346 to 1,504 feet. Furthermore, the second hole has a thicker zone of the higher-porosity clayey sand, sand and conglomerate, with at least 273 feet of this zone present in an interval that begins at 1,528 feet that extends to the bottom of the hole at 1,801 feet. The conglomerate encountered at 1,696 feet and below grades from smaller to larger clast sized at depth and is supported with a sandy matrix, creating a thick basal conglomerate sequence.

The identification of a larger sand-conglomerate zone within the second hole is a key finding as it demonstrates that this zone, which should contain the greatest porosity within the basin aquifer, is present in both drilled locations at sufficiently large intervals to serve as a potentially viable pumping zone for a large operation and is further evidence the basal conglomerate will persist across the entire basin floor. Per the Preliminary Economic Assessment (PEA) completed by Pure Energy Minerals for their Clayton Valley project, their sand and conglomerate zone was identified to contain a large volume of brine with superior grades, and so the Company is making the identification of this zone throughout the basin a priority for its drill program.

“The core from the second hole was a significant part of our decision to exercise our 100% option at Jackpot Lake prior to receiving assays.” said Deepak Varshney, CEO of Usha Resources. “The drilling to date has provided strong support that the Jackpot Lake system is in a similar geologic setting to that of Clayton Valley. Almost 150 feet of evaporites overlying several hundred feet of higher-porosity sand and conglomerate shows that this area not only has the right conditions for the formation of enriched brines, but that we also have a significant zone into which these fluids could drain and be pumped from. We are very much looking forward to completing this hole and proceeding with sampling as we work towards what we believe will be the next American lithium discovery.”

Drilling and Sampling Update

The Company also announces that, after reviewing the findings of the drill program to-date and discussion with the drill contractors, the Company has elected to use a larger, more powerful rig to install a deeper exploration well, instead of completing a shallower well installation at the current depth of 1,801 feet. Usage of this new rig will allow for drilling to continue to a depth of 2,000 feet, thereby expanding on the 273-foot interval of sand and conglomerate already identified in JP22-02 where the Company believes the best potential brines may be present.

Furthermore, the Company is also pleased to announce that, as a gesture of goodwill, the drill contractors, Harris Exploration Ltd., an Earth Drilling Co. Ltd. Company, has confirmed that they will also advance JP22-01 to a depth of 2,000 feet using the larger rig at no cost to the Company, thereby potentially greatly expanding on the 99-foot higher-porosity sand and conglomerate zone already identified in JP22-01.

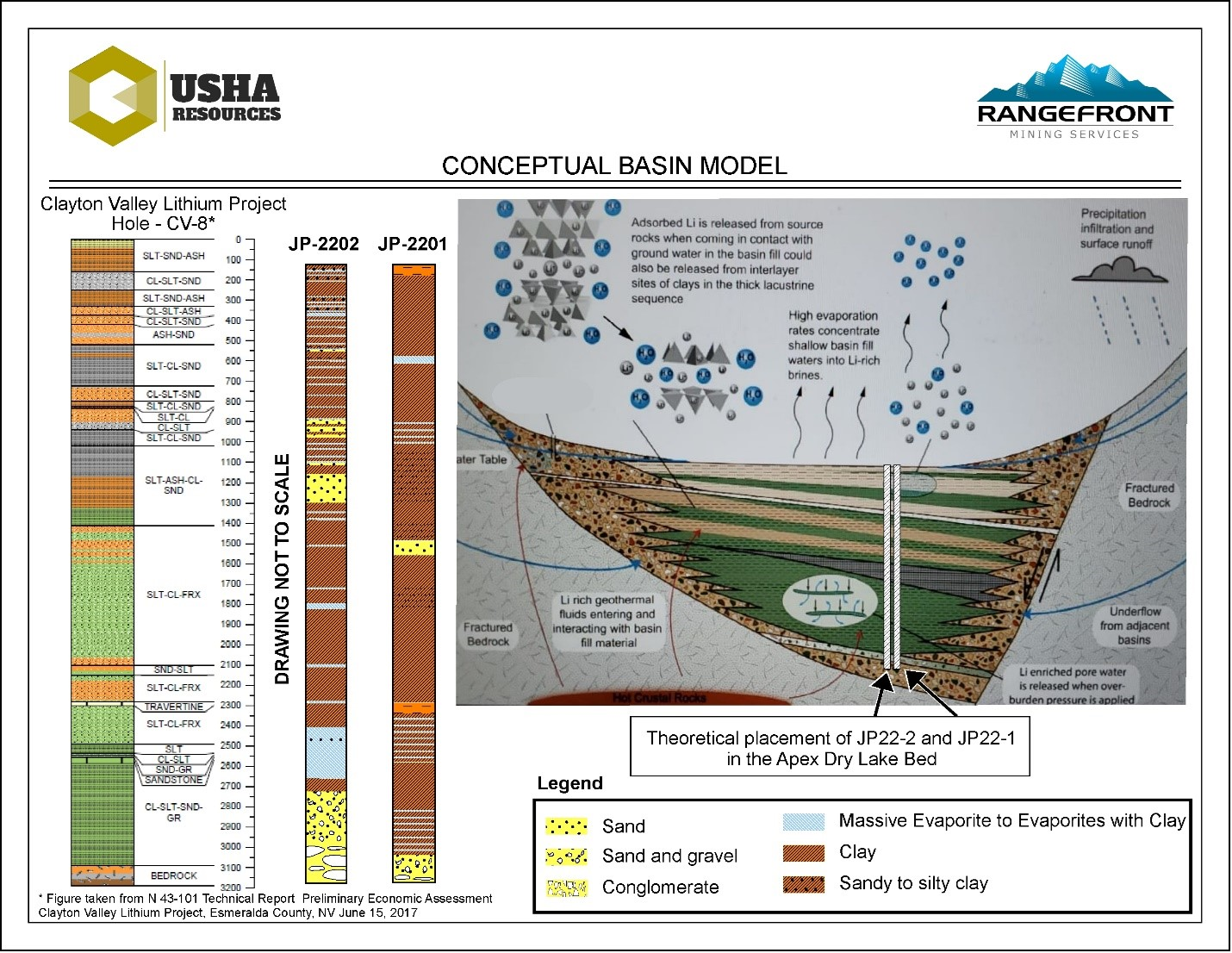

Based on the conceptual basin model, JP22-1 is approximately 200 feet closer to the eastern basin edge than JP22-2, which should result in a thicker basal conglomerate than JP22-2, so there should be another 170 feet of basal conglomerate at JP22-1 (JP22-1 was terminated at 1,728 feet). Because bedrock has not been encountered in JP22-2, 170 feet of additional basal conglomerate in JP22-1 may be a conservative estimate and this zone may extend beyond the maximum drilling depth of 2,000 feet.

The rig is anticipated to arrive within the next two weeks and the Company anticipates that both holes will be completed to 2,000 feet and sampled within the first half of May.

Finally, the Company also wishes to advise that it has not yet received further assay results from the first hole and that samples submitted to the analytical laboratory are still undergoing analysis.

Figure 1 – Core taken from 1734 to 1744 feet in JP22-2. Reaching this sand-conglomerate zone was a high priority for the program as it should contain the greatest porosity within the basin aquifer and serve as a pumpable zone into which the fluids above can drain. Per the Preliminary Economic Assessment (PEA) completed by Pure Energy Minerals for their Clayton Valley project, a sand-conglomerate zone was identified in their project to contain a large volume of brine with superior grades of lithium.

Figure 2 – Conceptual basin model illustrating the theoretical location of boreholes JP22-01 and JP22-02 with respect to the deposition anticipated in a geologic setting as that of Clayton Valley. The stratigraphic column on the left, taken from Pure Energy’s PEA, shows the stratigraphy of borehole CV-8, located in a similar position within the Clayton Valley basin. The general stratigraphy of CV-8 consisted of lacustrine sediments (clays, silts) overlaying a zone of sand and conglomerate where superior grades of lithium were identified which is similar to the stratigraphy observed in JP22-01 and JP 22-02. Figure adapted from Coffey et al. 2021[iii].

Jackpot Lake Lithium Brine Property

USHA’s Jackpot Lake Lithium Brine Project is located within Clark County, 35 kilometres northeast of Las Vegas, Nevada, and is comprised of 442 optioned and staked mineral claims that total 8,714 acres (approximately 35.3 km2).

The Project’s geologic setting is similar to that of Albemarle’s Silver Peak Nevada Lithium Mine, the only producing lithium mine in North America, which has operated continuously since 1966, where sediments from lithium‑rich surrounding source rocks accumulate and fill the deposit leading to a potential concentration of lithium brine due to successive evaporation and concentration events. Considering the elevated lithium concentrations identified in historic soil samples, such events could theoretically concentrate lithium as rainwater passes through these materials, developing enriched brines at depths.

The Company has permitted 2,700 metres over six holes and has commenced a maiden drill program with the goal of defining a 43-101 resource. The Project target was identified based on geophysical studies and 129 core samples collected by the USGS with an average lithium value of 175 ppm with a high of 550 ppm. Samples from the first two holes of its drilling program have identified lithium is present at a grades of up to 820 ppm within shallow surface soils (<500 ft), comparing very favourably to the reported average of 100 ppm for the Esmeralda Formation, one of the potential sources of the lithium enrichment for the brines present in Clayton Valley.

Modelling indicates that the Project target comprises the entirety of the Company’s core optioned claim block (2,800 acres; 11.3 km2) and is open in all directions for expansion. The target is shallow, predominantly above bedrock depths of 600 metres, and is approximately 450 metres thick. The total basin within which the target is situated is estimated to be approximately 10,900 acres of which the Company now controls 8,714 acres.

The Project’s Qualified Professional (QP) is Michael Rosko, a professional geologist with over 30 years of experience, with extensive experience with world-class lithium brine projects including Tier 1 projects such as Galaxy’s Sal de Vida Deposit, Millennial Lithium’s Pasto Grandes Deposit, and Lithium America Corp’s Cauchari-Olaroz Deposit.

Qualified Person

The technical content of this news release has been reviewed and approved by Mr. Seth Cude, P.G., CPG. RM, M.Sc., a qualified person as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”).

About Usha Resources Ltd.

Usha Resources Ltd. is a North American mineral acquisition and exploration company focused on the development of quality battery and precious metal properties that are drill-ready with high-upside and expansion potential. Based in Vancouver, BC, Usha’s portfolio of strategic properties provides target-rich diversification and consist of Jackpot Lake, a lithium project in Nevada; White Willow, a lithium project in Ontario; Nicobat, a nickel‑copper‑cobalt project in Ontario; and Lost Basin, a gold-copper project in Arizona. Usha trades on the TSX Venture Exchange under the symbol USHA, the OTCQB Exchange under the symbol USHAF and the Frankfurt Stock Exchange under the symbol JO0.

USHA RESOURCES LTD.

“Deepak Varshney” CEO and Director

For more information, please call Tyler Muir, Investor Relations, at 1-888-772-2452, email tmuir@usharesources.com, or visit www.usharesources.com.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-looking statements:

This news release may include “forward-looking information” under applicable Canadian securities legislation. Such forward-looking information reflects management’s current beliefs and are based on a number of estimates and/or assumptions made by and information currently available to the Company that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors that may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking information. Readers are cautioned that such forward-looking information are neither promises nor guarantees and are subject to known and unknown risks and uncertainties including, but not limited to, general business, economic, competitive, political and social uncertainties, uncertain and volatile equity and capital markets, lack of available capital, actual results of exploration activities, environmental risks, future prices of base and other metals, operating risks, accidents, labour issues, delays in obtaining governmental approvals and permits, and other risks in the mining industry.

The Company is presently an exploration stage company. Exploration is highly speculative in nature, involves many risks, requires substantial expenditures, and may not result in the discovery of mineral deposits that can be mined profitably. Furthermore, the Company currently has no reserves on any of its properties. As a result, there can be no assurance that such forward-looking statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements.

[i] Monk, L. et al. 2011. Geochemistry of Lithium-rich brines in Clayton Valley, Nevada, USA. Society of Geology Applied to Ore Deposits Bi-annual Meeting, Antofogasto, Chile.

[ii] Pure Energy Minerals, 2018. NI 43-101 Technical Report. Preliminary Economic Assessment (Rev. 1) of the Clayton Valley Lithium Project. Esmeralda County, Nevada.

[iii] Coffey, D.M. et al. 2021. Lithium Storage and Release From Lacustrine Sediments: Implications for Lithium Enrichment and Sustainability in Continental Brines. Geochemistry, Geophysics, Geosystems, 22, e2021GC009916. https://doi.org/10.1029/2021GC009916.

SOURCE: Usha Resources Ltd.

Featured Image MegaPixl @ Buranatrakul

Disclosure:

1) The author of the Article, or members of the author’s immediate household or family, do not own any securities of the companies set forth in this Article. The author determined which companies would be included in this article based on research and understanding of the sector.

2) The Article was issued on behalf of and sponsored by, Usha Resources Ltd. Market Jar Media Inc. has or expects to receive from Usha Resources Ltd.’s Digital Marketing Agency of Record (Native Ads Inc.) one hundred thirty eight thousand and six hundred USD for 26 days (19 business days).

3) Statements and opinions expressed are the opinions of the author and not Market Jar Media Inc., its directors or officers. The author is wholly responsible for the validity of the statements. The author was not paid by Market Jar Media Inc. for this Article. Market Jar Media Inc. was not paid by the author to publish or syndicate this Article. Market Jar has not independently verified or otherwise investigated all such information. None of Market Jar or any of their respective affiliates, guarantee the accuracy or completeness of any such information. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Market Jar Media Inc. requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Market Jar Media Inc. relies upon the authors to accurately provide this information and Market Jar Media Inc. has no means of verifying its accuracy.

4) The Article does not constitute investment advice. All investments carry risk and each reader is encouraged to consult with his or her individual financial professional. Any action a reader takes as a result of the information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Market Jar Media Inc.’s terms of use and full legal disclaimer as set forth here. This Article is not a solicitation for investment. Market Jar Media Inc. does not render general or specific investment advice and the information on pressreach.com should not be considered a recommendation to buy or sell any security. Market Jar Media Inc. does not endorse or recommend the business, products, services or securities of any company mentioned on pressreach.com.

5) Market Jar Media Inc. and its respective directors, officers and employees hold no shares for any company mentioned in the Article.

6) This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect management’s expectations regarding Usha Resources Ltd.’s future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to Usha Resources Ltd.’s industry; (b) market opportunity; (c) Usha Resources Ltd.’s business plans and strategies; (d) services that Usha Resources Ltd. intends to offer; (e) Usha Resources Ltd.’s milestone projections and targets; (f) Usha Resources Ltd.’s expectations regarding receipt of approval for regulatory applications; (g) Usha Resources Ltd.’s intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) Usha Resources Ltd.’s expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute Usha Resources Ltd.’s business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) Usha Resources Ltd.’s ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) Usha Resources Ltd.’s ability to enter into contractual arrangements with additional Pharmacies; (e) the accuracy of budgeted costs and expenditures; (f) Usha Resources Ltd.’s ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption to as a result of CV-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of Usha Resources Ltd. to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) Usha Resources Ltd.’s operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as CV-19 may adversely impact Usha Resources Ltd.’s business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing Usha Resources Ltd.’s business operations (e) Usha Resources Ltd. may be unable to implement its growth strategy; and (f) increased competition.

Except as required by law, Usha Resources Ltd. undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events. Neither does Usha Resources Ltd. nor any of its representatives make any representation or warranty, express or implied, as to the accuracy, sufficiency or completeness of the information in this document. Neither Usha Resources Ltd. nor any of its representatives shall have any liability whatsoever, under contract, tort, trust or otherwise, to you or any person resulting from the use of the information in this document by you or any of your representatives or for omissions from the information in this document.

7) Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of Usha Resources Ltd. or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of Usha Resources Ltd. or such entities and are not necessarily indicative of future performance of Usha Resources Ltd. or such entities.

Read more investing news on PressReach.com.Subscribe to the PressReach RSS feeds:- Featured News RSS feed

- Investing News RSS feed

- Daily Press Releases RSS feed

- Trading Tips RSS feed

- Investing Videos RSS feed

Follow PressReach on Twitter

Follow PressReach on TikTok

Follow PressReach on Instagram

Subscribe to us on Youtube