10,528 Hectares situated along the east-northeast trending Grease River Structure south of Lake Athabasca near the Fond Du Lac Uranium Deposit

Calgary, AB – February 7, 2023 – Traction Uranium Corp. (CSE: TRAC) (OTCQB: TRCTF) (FRA: Z1K) (the “Company” or “Traction”) is pleased to announce that it has entered into a property option agreement (the “Option Agreement”) with Forum Energy Metals Corp. (the “Vendor”) dated February 3, 2023 (the “Effective Date”), pursuant to which the Company has the right, at its option, to acquire up to a 100% interest in the Grease River Property located in Athabasca Basin, Northern Saskatchewan, Canada (the “Property”), in exchange for a series of cash payments, share issuances and funding of exploration expenditures, separated into three phases. The first phase entitles the Company to acquire a 51% interest in the Property by paying an aggregate of $250,000, issuing an aggregate of 1,625,000 common shares and funding an aggregate of $3,000,000 in exploration expenditures on the Property by December 31, 2025. Forum will be the operator of the Property until the Company completes the first phase.

Lester Esteban, Chief Executive Officer of Traction stated, “Our research team has been hard at work to complete the Hearty Bay “Quartz Degradation” research program (see Traction news release dated January 31st, 2023) and we are looking forward to providing the results once our team has finalized their report. With our Hearty Bay Project nearby, the Grease River Project is an exciting addition where we are looking to acquire 100% of the property and our interest in unlocking the uranium discovery potential in the Fond du Lac area. We look forward to bringing together our technical advisor Boen Tan Ph.D., P. Geo with Forum’s Dr. Rebecca Hunter Ph.D., P.Geo. and Ken Wheatley P. Geo., M.Sc. on this project, an esteemed team with a combined 100+ years of uranium exploration experience and numerous discoveries under their belt.”

Richard Mazur, President & CEO of Forum Energy Metals stated, “We are pleased to work with the Traction team to unlock the potential to host new, large uranium deposits along this underexplored, favourable structural corridor.”

The Grease River Property

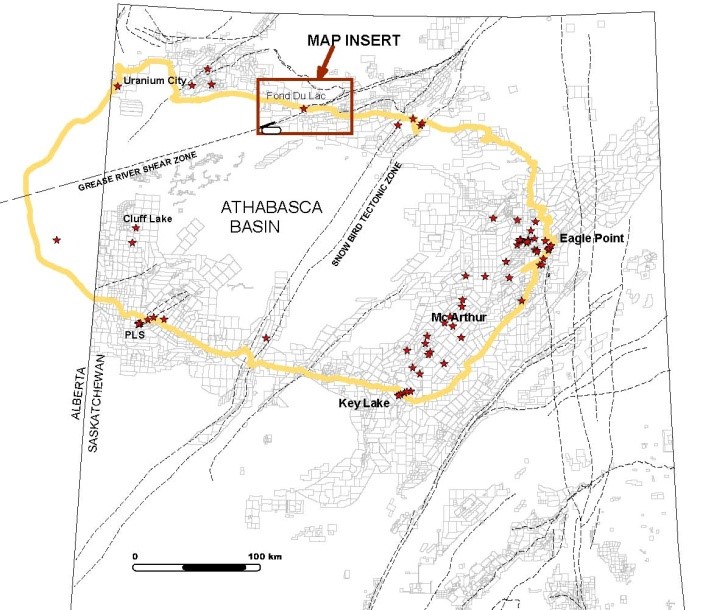

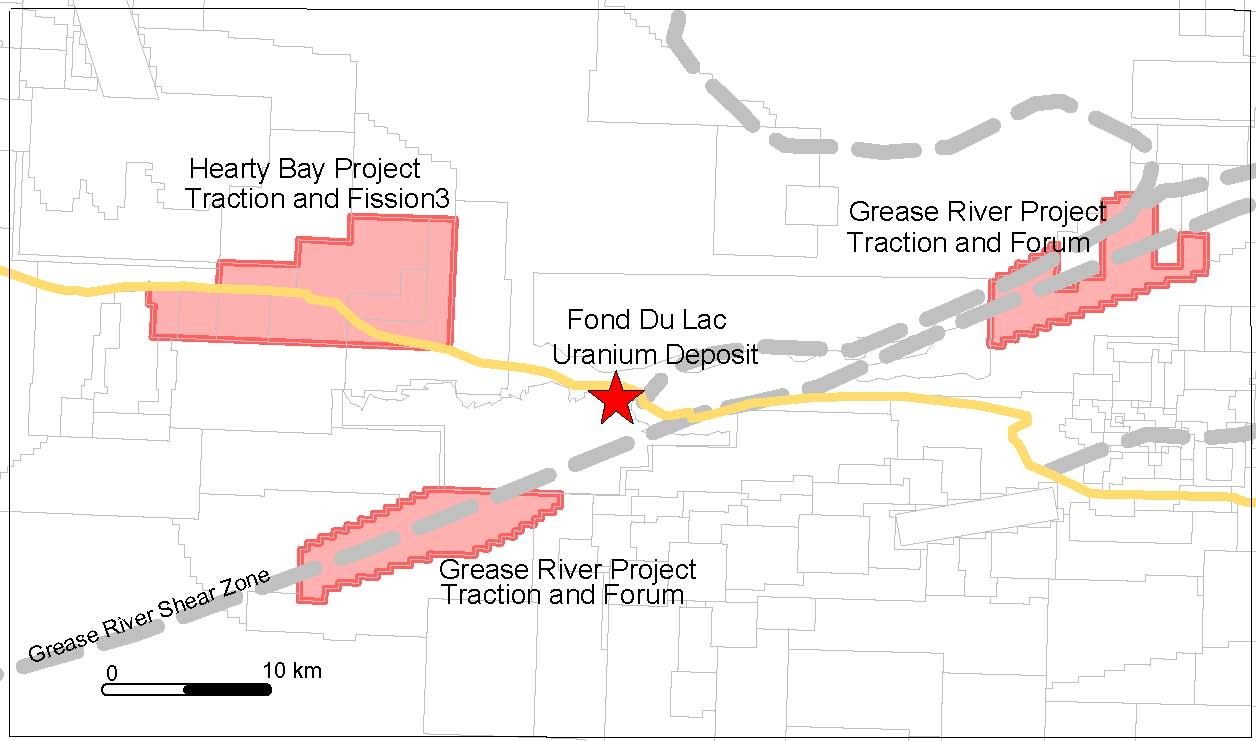

The Grease River Project is located within the north-central margin of the Athabasca Basin near the community of Fond du Lac (see Figure 1). The project consists of two separate claim blocks situated along the NE-trending Grease River Shear zone, a major intracontinental shear zone greater than 400 km long (see Figure 2). The nearby Fond du Lac uranium deposit was previously discovered within the shear zone by Amok and Eldorado in the 1970s with an estimated non-compliant historical resource of one million pounds uranium at an average grade of 0.25% U3O8*. The Grease River Project claims are located along trend of the deposit to the southwest and northeast. Limited exploration has been conducted in the property area and there is potential for additional uranium mineralization along the shear zone. Airborne geophysical surveys are planned in 2023 to aid in structural mapping and to define prospective drill targets.

Figure 1 (Location of Property):

Figure 2 (Map Insert):

Terms of the Agreement

Phase One

The Company is entitled to acquire a 51% interest in the Property (the “First Option”) by paying an aggregate of $250,000, issuing an aggregate of 1,625,000 common shares (the “Shares”) and funding an aggregate of $3,000,000 in exploration expenditures on the Property by December 31, 2025. The Company will become operator of the Property if it exercises the First Option.

Phase Two

If the Company exercises the First Option then it can acquire an additional 19% interest in the Property, for a total interest of 70% (the “Second Option”), by paying an aggregate of $700,000 in cash, issuing an aggregate of 2,500,000 Shares and funding an aggregate of $3,000,000 in exploration expenditures on the Property by December 31, 2027.

Phase Three

If the Company exercises the Second Option, then it can acquire an additional 30% interest in the Property, for a total interest of 100% (the “Third Option”), by paying an aggregate of $1,000,000 in cash, issuing an aggregate of 3,000,000 Shares and funding an aggregate of $3,000,000 in exploration expenditures on the Property by December 31, 2028.

If the Third Option is exercised, the Company would also be required to (i) grant the Vendor a 2% net smelter returns royalty (the “NSR Royalty”), (ii) pay an additional $1,000,000 upon completion of a preliminary economic assessment this as term is defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) in respect of the Property, (iii) pay an additional $2,000,000 to the Vendor upon completion and disclosure of a NI 43-101 compliant feasibility study , and (iv) pay an additional $5,000,000 to the Vendor upon commencement of commercial production on the Property.

All Shares issued to the Vendor pursuant to the Option Agreement will be subject to a statutory four month hold period pursuant to applicable Canadian securities laws.

Qualified Person

The technical content of this news release has been reviewed and approved by Boen Tan, Ph.D, P. Geo., who is a Qualified Person as defined by National Instrument 43-101, Standards of Disclosure for Mineral Projects. The information provides an indication of the exploration potential of the Property but may not be representative of expected results.

*Some historical estimates were completed prior to the implementation of NI 43-101 and others are internal estimates from previous operators. Given the extensive exploration work completed by experienced mineral resource companies, and the quality of the historical work completed, the Company believes the historical estimate to be relevant and reliable. However, a qualified person has not completed sufficient work to verify and classify the historical estimate as a current mineral resource, and the Company is not treating the historical estimate as a current mineral resource. Hence, the estimate should not be relied upon. It should be noted that mineral resources, which are not mineral reserves, do not have demonstrated economic viability as defined by NI 43-101 .

About Traction Uranium Corp.

Traction Uranium Corp. is in the business of mineral exploration and the development of discovery prospects in Canada, including its two flagship uranium projects in the world-renowned Athabasca Region. We invite you to find out more about our exploration-stage activities across Canada’s Western region at www.tractionuranium.com.

On Behalf of The Board of Directors

Lester Esteban

Chief Executive Officer

+1 (604) 561 2687

Forward-Looking Statements

This news release includes forward-looking statements that are subject to risks and uncertainties, including with respect to the Company completing Phase 1, Phase 2 and Phase 3, the Company acquiring any interest in the Property, timing of the cash payments, share issuances and funding/expenditure requirements, granting of the NSR Royalty and further exploration and development of the Property. The Company provides forward-looking statements for the purpose of conveying information about current expectations and plans relating to the future and readers are cautioned that such statements may not be appropriate for other purposes. By its nature, this information is subject to inherent risks and uncertainties that may be general or specific and which give rise to the possibility that expectations, forecasts, predictions, projections, or conclusions will not prove to be accurate, that assumptions may not be correct, and that objectives, strategic goals and priorities will not be achieved. These risks and uncertainties include but are not limited to risks that the Company will not complete Phase 1, Phase 2 or Phase 3 as contemplated, or at all, risks that the Company will not exercise the First Option, Second Option or the Third Option as contemplated or at all, risks that the Company may not acquire any interest in the Property or an interest less than 100%, risks that NSR Royalty will not be granted as contemplated, or at all, risks that the Property will not be explored or developed as contemplated, or at all, as well as those risk identified and reported in the Company’s public filings under the Company’s SEDAR profile at www.sedar.com. Although the Company has attempted to identify important factors that could cause actual actions, events, or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise unless required by law.

The CSE has neither approved nor disapproved the information contained herein.

SOURCE: Traction Uranium Corp.

The post Traction Uranium and Forum Energy Metals Enter into an Option Agreement for the Grease River Property in the Athabasca Basin appeared first on Financial News Media.