All financial figures are in Canadian dollars unless otherwise noted. This news release refers to certain financial measures and ratios that are not specified, defined or determined in accordance with Generally Accepted Accounting Principles ("GAAP"), including net revenue; adjusted earnings before interest, taxes, depreciation and amortization ("adjusted EBITDA"); adjusted cash flow from operating activities; and adjusted cash flow from operating activities per common share. For more information see "Non-GAAP and Other Financial Measures" herein.

Pembina Pipeline Corporation ("Pembina" or the "Company") (TSX: PPL; NYSE: PBA) announced today its financial and operating results for the fourth quarter and full year 2022.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230223005925/en/

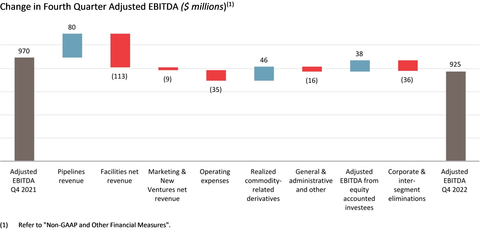

Adjusted EBITDA (Graphic: Business Wire)

Highlights

- Record Results - reported record 2022 full year earnings of $2,971 million and record full year adjusted EBITDA of $3,746 million, exceeding the high end of the Company's revised guidance range. Reported fourth quarter earnings of $243 million and fourth quarter adjusted EBITDA of $925 million.

- Redwater Expansion - sanctioned a $460 million expansion at its Redwater Complex to service growing customer demand and high utilization rates across the industry.

- Strategy - Pembina outlines a renewed long-term strategy that continues to build upon its core business while capitalizing on opportunities arising from the transition to a lower-carbon economy.

- Board of Directors Appointment - Mr. Andy Mah has been selected by the board of directors to join the board effective February 24, 2023.

- Quarterly Common Share Dividend - the board of directors has declared a common share cash dividend for the first quarter of 2023 of $0.6525 per share to be paid, subject to applicable law, on March 31, 2023, to shareholders of record on March 15, 2023.

Financial and Operational Overview

|

3 Months Ended December 31 |

12 Months Ended December 31 |

||

($ millions, except where noted) |

2022 |

2021 |

2022 |

2021 |

Revenue |

2,699 |

2,560 |

11,611 |

8,627 |

Net revenue(1) |

1,043 |

1,084 |

4,247 |

3,938 |

Gross profit |

681 |

785 |

3,123 |

2,647 |

Earnings |

243 |

80 |

2,971 |

1,242 |

Earnings per common share – basic (dollars) |

0.39 |

0.08 |

5.14 |

2.00 |

Earnings per common share – diluted (dollars) |

0.39 |

0.08 |

5.12 |

1.99 |

Cash flow from operating activities |

947 |

697 |

2,929 |

2,650 |

Cash flow from operating activities per common share – basic (dollars) |

1.72 |

1.27 |

5.30 |

4.82 |

Adjusted cash flow from operating activities(1) |

690 |

734 |

2,661 |

2,640 |

Adjusted cash flow from operating activities per common share – basic (dollars)(1) |

1.25 |

1.33 |

4.82 |

4.80 |

Common share dividends declared |

359 |

346 |

1,409 |

1,386 |

Dividends per common share (dollars) |

0.65 |

0.63 |

2.55 |

2.52 |

Capital expenditures |

143 |

176 |

605 |

658 |

Total volumes (mboe/d)(2) |

3,392 |

3,437 |

3,383 |

3,456 |

Adjusted EBITDA(1) |

925 |

970 |

3,746 |

3,433 |

(1) |

Refer to "Non-GAAP and Other Financial Measures". |

|

(2) |

Total revenue volumes. Revenue volumes are physical volumes plus volumes recognized from take-or-pay commitments. Volumes are stated in thousand barrels of oil equivalent per day ("mboe/d"), with natural gas volumes converted to mboe/d from millions of cubic feet per day ("MMcf/d") at a 6:1 ratio. |

|

Financial and Operational Overview by Division

|

3 Months Ended December 31 |

12 Months Ended December 31 |

||||||||||||||||||||||

|

2022 |

2021 |

2022 |

2021 |

||||||||||||||||||||

($ millions, except where noted) |

Volumes(1) |

Reportable

|

Adjusted

|

Volumes(1) |

Reportable

|

Adjusted

|

Volumes(1) |

Reportable

|

Adjusted

|

Volumes(1) |

Reportable

|

Adjusted

|

||||||||||||

Pipelines |

2,593 |

295 |

548 |

2,571 |

(70) |

548 |

2,524 |

1,415 |

2,127 |

2,586 |

917 |

2,102 |

||||||||||||

Facilities |

799 |

145 |

288 |

866 |

164 |

285 |

859 |

1,804 |

1,137 |

870 |

732 |

1,097 |

||||||||||||

Marketing & New Ventures(3) |

— |

96 |

171 |

— |

220 |

183 |

— |

708 |

721 |

— |

374 |

420 |

||||||||||||

Corporate |

— |

(206) |

(82) |

— |

(181) |

(46) |

— |

(708) |

(239) |

— |

(358) |

(186) |

||||||||||||

Total |

3,392 |

330 |

925 |

3,437 |

133 |

970 |

3,383 |

3,219 |

3,746 |

3,456 |

1,665 |

3,433 |

||||||||||||

(1) |

Volumes for Pipelines and Facilities divisions are revenue volumes, which are physical volumes plus volumes recognized from take-or-pay commitments. Volumes are stated in mboe/d, with natural gas volumes converted to mboe/d from MMcf/d at a 6:1 ratio. |

|

(2) |

Refer to "Non-GAAP and Other Financial Measures". |

|

(3) |

Marketed natural gas liquids ("NGL") volumes are excluded from Volumes to avoid double counting. Refer to "Marketing & New Ventures Division" in Pembina's Management's Discussion and Analysis dated February 23, 2023 for the year ended December 31, 2022 for further information. |

|

For further details on the Company's significant assets, including definitions for capitalized terms used herein that are not otherwise defined, refer to Pembina's Annual Information Form for the year ended December 31, 2022 filed at www.sedar.com (filed with the U.S. Securities and Exchange Commission at www.sec.gov under Form 40-F) and on Pembina's website at www.pembina.com.

Financial & Operational Highlights

Adjusted EBITDA

Pembina reported fourth quarter adjusted EBITDA of $925 million and record full year adjusted EBITDA of $3,746 million. This represents a $45 million or five percent decrease, and a $313 million or nine percent increase, respectively, over the same periods in the prior year.

For both the fourth quarter and full year, adjusted EBITDA was positively impacted by higher volumes on the Peace Pipeline system and Cochin Pipeline; higher tolls due to inflation; the joint venture transaction to create Pembina Gas Infrastructure Inc. ("PGI") (the "PGI Transaction"); and stronger performance from certain gas processing assets, including the Hythe Gas Plant, the Dawson Assets, the Cutbank Complex, and the Resthaven Facility. Both periods were negatively impacted by a lower contribution from Ruby and higher integrity costs.

Fourth quarter adjusted EBITDA was also negatively impacted by lower margins on NGL sales, partially offset by higher margins on crude oil sales; a lower contribution from Aux Sable; lower revenue related to recoverable costs on the Horizon Pipeline system; and higher general and administrative expense, largely due to higher long-term incentive costs driven by the change in Pembina's share price and its share price performance relative to a peer group, combined with higher consulting fees. The fourth quarter was positively impacted by a realized gain on commodity-related derivatives, compared to a loss in the fourth quarter of 2021, and the impact of a higher U.S. dollar exchange rate.

Full year adjusted EBITDA was also positively impacted by higher margins on crude oil and natural gas sales, partially offset by lower margins on NGL sales; lower realized losses on commodity-related derivatives; and higher contributions from Alliance and Aux Sable. The full year was negatively impacted by higher general and administrative expense, largely due to higher long-term incentive costs as described above, as well as higher consulting fees, salaries and wages, and legal fees. The full year was also negatively impacted by lower contracted volumes on the Nipisi and Mitsue Pipeline systems.

Earnings

Pembina reported fourth quarter earnings of $243 million and full year earnings of $2,971 million. This represents a $163 million or 204 percent increase, and a $1,729 million or 139 percent increase, respectively, over the same periods in the prior year.

In the fourth quarter, in addition to the factors impacting adjusted EBITDA, as noted above, earnings were positively impacted by lower impairment expense, lower restructuring costs, and a higher unrealized gain on commodity-related derivatives. These factors were partially offset by a Ruby Pipeline settlement provision.

For the full year, in addition to the factors impacting adjusted EBITDA, as noted above, earnings were positively impacted by the recognized $1.1 billion gain on the PGI Transaction compared to the receipt of the $350 million termination fee associated with Pembina’s proposed acquisition of Inter Pipeline Ltd. in 2021, net of related tax and associated expenses; a higher unrealized gain on commodity-related derivatives; lower impairment expense; and lower income tax expense, primarily as a result of the PGI Transaction, net of a deferred tax recovery related to prior year impairments. These factors were partially offset by increased finance costs due to foreign exchange losses compared to gains in 2021, higher interest on long-term debt, and lower interest income.

Cash Flow From Operating Activities

Cash flow from operating activities of $947 million for the fourth quarter and $2,929 million for the full year represent an increase of 36 percent and 11 percent, respectively, over the same periods in the prior year.

The increase in the fourth quarter was primarily driven by an increase in the change in non-cash working capital, higher distributions from equity accounted investees, and a decrease in taxes paid, partially offset by lower operating results and an increase in net interest paid.

The full year increase was primarily driven by an increase in the change in non-cash working capital, higher distributions from equity accounted investees, higher operating results net of the $350 million Arrangement Termination Payment received in the third quarter of 2021, and a decrease in taxes paid, partially offset by an increase in net interest paid and share-based compensation payments.

On a per share (basic) basis, cash flow from operating activities was $1.72 per share for the fourth quarter and $5.30 per share for the full year. This represents increases of 35 percent and 10 percent, respectively, compared to the same periods in the prior year.

Adjusted Cash Flow From Operating Activities

Fourth quarter and full year adjusted cash flow from operating activities of $690 million and $2,661 million, represent a six percent decrease and one percent increase, respectively, over the same periods in the prior year.

The fourth quarter decrease was largely due to lower operating results and an increase in accrued share-based payments, partially offset by higher distributions from equity accounted investees and lower current tax expense.

The full year increase was primarily due to the same items impacting cash flow from operating activities, discussed above, net of the change in non-cash working capital, taxes paid, and share-based compensation payments, combined with lower current tax expense and preferred share dividends paid, largely offset by an increase in accrued share-based payments.

On a per share (basic) basis, adjusted cash flow from operating activities was $1.25 per share for the fourth quarter and $4.82 per share for the full year. This represents a decrease of six percent and an increase of less than one percent, respectively, compared to the same periods in the prior year.

Volumes

Total volumes of 3,392 mboe/d for the fourth quarter and 3,383 mboe/d for the full year represent decreases of approximately one percent and two percent, respectively, over the same periods in the prior year. In both periods, volume decreases were attributable to both the Pipelines and Facilities divisions, including most notably the Nipisi and Mitsue pipeline system, the Ruby Pipeline, and the disposition of the E1 and E6 assets, as described below. Divisional volumes are discussed in further detail below.

Excluding the volume impact of the Nipisi and Mitsue pipelines, the disposition of the E1 and E6 assets, and the Ruby Pipeline fourth quarter and full year volumes would have increased approximately four percent and three percent, respectively, over the same periods in the prior year.

Divisional Highlights

-

Pipelines reported adjusted EBITDA of $548 million for the fourth quarter, and $2,127 million for the full year 2022, which represent no change and a one percent increase, respectively, compared to the same periods in the prior year. Both periods were positively impacted by higher volumes on the Peace Pipeline and the Cochin Pipeline, higher tolls due to inflation, and the impact of the higher U.S. dollar exchange rate. Both periods were negatively impacted by a lower contribution from Ruby, higher general and administrative expense due to long-term incentives, and higher integrity costs. In addition, the fourth quarter was negatively impacted by lower revenue related to recoverable costs on the Horizon Pipeline system. The full year was also positively impacted by higher contributions from Alliance and negatively impacted by the expiration of contracts on the Nipisi and Mitsue Pipeline systems.

Pipelines had fourth quarter reportable segment earnings before tax of $295 million compared to a loss of $70 million in the same period in the prior year. For the full year, Pipelines had reportable segment earnings before tax of $1,415 compared to $917 million in the same period in the prior year. In addition to the factors impacting adjusted EBITDA, as noted above, excluding the lower contribution from Ruby, the increase in both periods was largely due to a $437 million impairment recognized in the fourth quarter of 2021 associated with certain oil sands assets, partially offset by the Ruby settlement provision recognized in the fourth quarter of 2022. In addition, the full year was impacted by lower depreciation expense and higher legal costs.

Pipelines volumes of 2,593 mboe/d in the fourth quarter and 2,524 mboe/d for the full year, represent a one percent increase and a two percent decrease, respectively, compared to the same periods in the prior year. Volumes for both the fourth quarter and full year were impacted by higher volumes on the Peace Pipeline system and Cochin Pipeline, partially offset by lower volumes on the Ruby Pipeline. In addition, the fourth quarter was positively impacted by higher recognition of deferred take-or-pay revenue volumes in the fourth quarter of 2022 compared to the prior period and higher volumes on AEGS due to third-party outages and planned turnarounds in the fourth quarter of 2021. The full year was also impacted by contract expirations on the Nipisi and Mitsue Pipeline systems, and higher volumes on the Drayton Valley Pipeline.

Excluding the volume impact of the Nipisi and Mitsue pipeline systems and Ruby Pipeline, fourth quarter and full year Pipelines volumes would have increased approximately four percent and three percent, respectively, over the same periods in the prior year.

-

Facilities reported adjusted EBITDA of $288 million for the fourth quarter and $1,137 million for the full year, which represent a one percent and four percent increase, respectively, over the same periods in the prior year.

Both periods were positively impacted by the PGI Transaction and stronger performance from certain gas processing assets, including the Hythe Gas Plant, the Dawson Assets, the Cutbank Complex and the Resthaven Facility. In addition, full year adjusted EBITDA benefited from higher realized gains on commodity-related derivatives, partially offset by higher integrity costs.

Facilities had reportable segment earnings before tax of $145 million for the fourth quarter and $1,804 million for the full year, representing a decrease of 12 percent and an increase of 146 percent, respectively, over the same periods in the prior year. In addition to the factors impacting adjusted EBITDA, as noted above, both periods were positively impacted by higher unrealized gains on commodity-related derivatives. In addition, in the fourth quarter, the positive impacts captured in the adjusted EBITDA from PGI were offset by interest expense on long-term debt, income tax expense, and depreciation resulting from the PGI assets recorded at fair value, and an unrealized loss on commodity-related derivatives, which are all included in share of profit from PGI following the PGI Transaction. Full year segment earnings before tax were positively impacted by the $1.1 billion gain recognized on the PGI Transaction in the third quarter of 2022, and lower impairments recognized in 2022 compared to the prior year.

Facilities volumes of 799 mboe/d in the fourth quarter and 859 mboe/d for the full year, represent decreases of eight percent and one percent, respectively, compared to the same periods in the prior year. The quarterly and full year decreases were primarily due to the disposition of Pembina’s interest in the E1 and E6 assets at Empress, as described further below, partially offset by the impact of the PGI Transaction, higher volumes at the Hythe Gas Plant and Dawson Assets, and higher volumes at the Younger facility. The fourth quarter was also impacted by higher volumes at the Redwater Complex due to a third-party outage in the fourth quarter of 2021. Excluding the impact of the disposition of Pembina’s interest in the E1 and E6 assets, fourth quarter and full year Facilities volumes would have increased by five percent and two percent, respectively, compared to the same periods in the prior year.

-

Marketing & New Ventures reported adjusted EBITDA of $171 million for the fourth quarter and $721 million for the full year, which represent a seven percent decrease and a 72 percent increase, respectively, compared to the same periods in the prior year. The fourth quarter was negatively impacted by a lower contribution from Aux Sable; lower margins on NGL sales, partially offset by higher margins on crude oil sales; and a realized gain on commodity-related derivatives, compared to a loss in the prior period. The full year was positively impacted by higher margins on crude oil and natural gas sales and a higher contribution from Aux Sable, partially offset by lower margins on NGL sales and lower realized losses on commodity-related derivatives.

Marketing & New Ventures had reportable segment earnings before tax of $96 million for the fourth quarter and $708 million for the full year, representing a decrease of 56 percent and an increase of 89 percent, respectively, over the same periods in the prior year. In addition to the factors impacting adjusted EBITDA, as noted above, the fourth quarter was impacted by an unrealized loss on commodity-related derivatives compared to a gain in the prior period. The full year was impacted by a higher unrealized gain on commodity-related derivatives and higher net finance costs related to foreign exchange losses in the period compared to gains in 2021.

Marketed NGL volumes of 193 mboe/d in the fourth quarter and 190 mboe/d for the full year, represent no change compared to the same periods in the prior year.

Quarterly Common Share Dividend

Pembina's board of directors has declared a common share cash dividend for the first quarter of 2023 of $0.6525 per share to be paid, subject to applicable law, on March 31, 2023, to shareholders of record on March 15, 2023. The common share dividends are designated as "eligible dividends" for Canadian income tax purposes. For non-resident shareholders, Pembina's common share dividends should be considered "qualified dividends" and may be subject to Canadian withholding tax.

For shareholders receiving their common share dividends in U.S. funds, the cash dividend is expected to be approximately U.S. $0.4818 per share (before deduction of any applicable Canadian withholding tax) based on a currency exchange rate of 0.7384. The actual U.S. dollar dividend will depend on the Canadian/U.S. dollar exchange rate on the payment date and will be subject to applicable withholding taxes.

Quarterly dividend payments are expected to be made on the last business day of March, June, September and December to shareholders of record on the 15th day of the corresponding month, if, as and when declared by the board of directors. Should the record date fall on a weekend or on a statutory holiday, the record date will be the next succeeding business day following the weekend or statutory holiday.

Board of Directors Appointment

Pembina is pleased to announce that Mr. Andy Mah has been selected by the board of directors to join the board effective February 24, 2023.

Mr. Mah has over 40 years of experience in the oil and gas industry and was the Chief Executive Officer of Advantage Energy Ltd. ("Advantage") from January 2009 until his retirement on December 31, 2021. Mr. Mah has developed and transformed corporations, led large successful capital investment programs and has completed numerous corporate and asset level mergers, acquisitions and divestments. He also energized excellence in operational, financial, safety and environmental performance throughout his career in multinational, intermediate and junior oil and gas companies. Prior to his career at Advantage, he held leadership positions at Ketch Resources Trust, Unocal Corporation, Northrock Resources Ltd., and BP Canada. Mr. Mah also serves on the board of Advantage.

"I am thrilled to welcome Andy to the board of directors and look forward to working with him. Given his extensive and relevant experience, he will make a meaningful contribution to the board and support Pembina's continued success," said Henry Sykes, Chair of the Board.

Executive Overview and Business Update

Strong 2022 Results

2022 was a record financial year with Pembina generating adjusted EBITDA of $3.746 billion, a nine percent increase over 2021, driven by growing volumes on key systems and a strong performance from the marketing business.

Benefiting from a post-COVID recovery and strong commodity prices, volumes on Pembina's conventional pipeline systems, which generally serve as a good proxy for Pembina's broader business and activity in the Western Canadian Sedimentary Basin ("WCSB"), were approximately six percent higher in 2022 than in 2021. As well, volumes on the Cochin Pipeline increased approximately nine percent over the prior year and the Alliance Pipeline was highly utilized given prevailing global energy supply/demand dynamics and the Chicago-AECO natural gas price differential.

Within the gas processing business, excluding the impact of changing ownership interests resulting from the PGI Transaction, Pembina benefited from stronger underlying performance throughout 2022 from a number of gas processing assets, including the Hythe Gas Plant, Dawson Assets, the Cutbank Complex, and the Resthaven Facility.

In the marketing business, Pembina benefited from a favorable crude oil price environment and certain price differentials, including a wider Chicago-AECO gas price differential and a wider condensate price differential between western Canada and the U.S. Gulf Coast.

Strong financial results allowed Pembina to generate substantial free cash flow, which was allocated to strengthening the balance sheet and returning capital to shareholders. In 2022, Pembina raised the common share dividend by 3.6 percent, reached its target to repurchase $350 million of common shares, redeemed $300 million of preferred shares, and reduced leverage to the low end of the target range.

Pembina Gas Infrastructure

A milestone achievement in 2022 was the creation of PGI. PGI brought together three complementary platforms to create a premier, highly competitive western Canadian gas processing entity with the ability to serve customers from north central Alberta to northeast British Columbia ("NEBC") and to pursue future growth opportunities in a capital efficient manner.

Since closing the PGI transaction, integration activities have progressed well and operations have performed as expected, with no major interruptions to service. Commercially, we have successfully secured incremental volumes through fee-for-service, firm contracts with a number of existing customers at both the K3 and Wapiti facilities. The optionality and flexibility that comes with PGI's gas gathering and processing footprint is attractive to producers throughout the Montney and we continue to be in conversations with a number of key customers regarding debottlenecking expansions of a number of facilities.

Commercial Successes Reflect an Industry Poised for Growth

Amidst an expectation of continued growth, Pembina had incredible success in 2022 and into 2023 signing new long-term agreements and contracts.

- Entered into long-term midstream services agreements with three premier NEBC Montney producers for the transportation and fractionation of liquids. As a result of the long-term commitments under the three agreements, Pembina expects to have secured the transportation, fractionation, and marketing rights to a significant portion of forecasted future growth in the NEBC Montney, which collectively will support improved utilization of its existing assets as well as capital efficient expansion projects into the future.

- Renewed contracts and secured incremental volumes on the Company's conventional pipelines and its fractionation facilities, the latter reflective of the broader trend of increased utilization and tightening of capacity across the industry. We also extended a key contract on the Tioga portion of the Vantage Pipeline, maintaining existing take-or-pay volume commitments while providing incremental flexibility to increase contracted volumes with other shippers.

- The contracting of Alliance Pipeline progressed exceptionally well, highlighting the strong AECO-Chicago natural gas price differential and the value of Alliance's reliable and highly competitive access to mid-western U.S. gas markets, and as a conduit to the Gulf Coast and its robust LNG market. Following numerous open seasons, Alliance is now fully contracted for the next two years and has greatly enhanced its longer-term contractual profile.

- As previously announced, Pembina expects to reactivate the Nipisi Pipeline in the third quarter of 2023 to serve customers in the rapidly growing Clearwater oil play. During the fourth quarter of 2022, Pembina executed agreements for a significant long-term commitment with an anchor customer, which includes the construction of a newly connected truck-in facility approximately 40 kilometers north of Slave Lake, Alberta. Discussions continue with several Clearwater area producers regarding potential additional long-term contractual commitments.

- Subsequent to year end, Pembina closed an open season for capacity on the Cochin Pipeline, securing various commitments totaling 9,000 bpd for terms of 12-17 months. The successful offering crystallizes capacity, which was previously accessed on an interruptible basis.

- Subsequent to year end, Pembina extended a contract to supply ethane on a long-term basis to a key customer. Petrochemical consumption of ethane is an integral part of supporting the WCSB NGL value chain and Pembina is an important participant in Alberta's supply of ethane feedstock.

Progressing Growth Projects

Throughout 2022, we continued to progress our portfolio of growth projects, notably by completing the Phase VII and Phase IX Peace Pipeline expansions and the Empress Cogeneration project and successfully delivering these projects collectively under budget. Pembina also reactivated construction of the previously deferred Phase VIII Peace Pipeline expansion and we look forward to placing that project, which remains on time and on budget, into service in the first half of 2024.

Further, as discussed below in Projects & New Developments, Pembina is pleased to announce that it is proceeding with construction of a new 55,000 barrel per day ("bpd") propane-plus fractionator ("RFS IV") at its existing Redwater fractionation and storage complex (the "Redwater Complex"). The Redwater Complex is underpinned by long-term take-or-pay contracts and in recent quarters, Pembina has successfully extended existing contracts and signed incremental new contracts. The existing facility is highly utilized and RFS IV is needed to meet customer demand. In addition to recent contracting success, the previously announced commercial agreements with three leading NEBC producers are expected to provide significant volumetric support to the new facility. The decision to proceed with the RFS IV expansion project ensures Pembina's customers will benefit from a timely solution to growing volumes and constraints arising out of high utilization rates across the industry. Existing infrastructure at the Redwater Complex, including storage caverns and extensive unit train capable rail facilities, provide Pembina an ability to offer incremental fractionation capacity at a competitive cost.

In an increasingly competitive environment, Pembina continues to demonstrate that customers value the certainty and dependability of our infrastructure; the ability to execute projects safely, on time, and on budget; our competitive fees; and the Company's overall integrated service offering.

Pembina's Strategy

Following a recent period of succession and re-organization, Pembina’s executive and board viewed 2022 as an opportune time to review the Company's strategy to ensure it remains resilient into the future. In December, the board approved a strategy that will allow Pembina to build on its strengths by continuing to invest in and grow the core businesses that provide critical transportation and midstream services to help ensure reliable and secure energy supply. At the same time, Pembina will capitalize on exciting opportunities to leverage its assets and expertise into new service offerings that proactively respond to the transition to a lower-carbon economy. In continuing to meet global energy demand and its customers' needs, while ensuring Pembina's long-term success and resilience, the Company has established four strategic priorities:

-

To be resilient, we will sustain, decarbonize, and enhance our businesses. This priority is focused on strengthening and growing our existing franchise and demonstrating environmental leadership.

-

To thrive, we will invest in the energy transition to improve the basins in which we operate. We will expand our portfolio to include new businesses associated with lower-carbon commodities.

-

To meet global demand, we will transform and export our products. We will continue our focus on supporting the transformation of Western Canadian Sedimentary Basin commodities into higher margin products and enabling more coastal egress.

-

To set ourselves apart, we will create a differentiated experience for our stakeholders. We remain committed to delivering excellence for our four key stakeholder groups meaning that:

-

Employees say we are the ‘employer of choice’ and value our safe, respectful, collaborative, and inclusive work culture.

-

Communities welcome us and recognize the net positive impact of our social and environmental commitment.

-

Customers choose us first for reliable and value-added services.

- Investors receive sustainable industry-leading total returns.

-

Employees say we are the ‘employer of choice’ and value our safe, respectful, collaborative, and inclusive work culture.

In executing our strategy, we remain committed to our financial guardrails and delivering industry-leading returns through prudent capital allocation and a focus on return on invested capital.

Looking Ahead to 2023

Over the next 12-24 months, a key area of focus will be growing cash flow by enhancing utilization at our existing assets – gas plants, pipelines, and fractionation facilities – to serve our customers' growing volumes. This is highly accretive growth given the modest capital spending required.

Our outlook for continued growth in the WCSB was bolstered by the recent announcement on January 18, 2023, by the Province of British Columbia and the Blueberry River First Nation, regarding the finalization of an agreement allowing oil and gas activity to proceed within certain parts of NEBC. While future development is subject to certain provisions, Pembina is optimistic that the agreement will provide the needed clarity for producers to allocate capital to NEBC drilling programs and support larger development plans leading to growing volumes in the area. Pembina has a long history as an NEBC service provider. Through our existing NEBC Pipeline, which has significant expansion potential and is connected to the rest of our fully integrated value chain, we are well positioned with a readily available solution to meet new customer demand.

In 2023, we will continue to progress new projects, including the Phase VIII Peace Pipeline expansion, and RFS IV to add additional capacity to Pembina's integrated value chain. Aligning with our corporate strategy we will also continue to advance development of two transformational projects, Cedar LNG and the Alberta Carbon Grid, along with other development opportunities that support the transition to a lower-carbon economy.

We are reiterating our recently announced 2023 adjusted EBITDA guidance range of $3.5 billion to $3.8 billion. The midpoint of the guidance range reflects an approximately five percent increase in adjusted EBITDA contribution from Pembina’s fee-based business, reflecting higher tolls, growing volumes, and increasing utilization across its assets in the WCSB. While Pembina expects another strong contribution from its Marketing & New Ventures segment, results are expected to moderate relative to 2022.

The reiterated guidance includes the impact of a January 18, 2023 release of natural gas liquids on the Northern Pipeline system. In response to the incident, Pembina's emergency response procedures were activated and the pipeline was quickly isolated. The cause of the incident remains under investigation. The outage impacted a substantial portion of the volumes on the Northern and NEBC pipeline systems however, Pembina and its customers were able to mitigate a portion of the impact using truck terminals and directing volumes to the Peace Pipeline system. With a primary focus on the safety of our workers, the communities and the environment, resumption of service on the Northern Pipeline, at a reduced operating pressure, is currently underway following repair work, comprehensive testing, and approval by the Alberta Energy Regulator ("AER"). The Northern pipeline will continue to safely operate in a reduced pressure environment until root cause failure analysis and potential mitigations are completed and we have received AER approval to restore to full operating capacity. The overall impact to Pembina's adjusted EBITDA for the first quarter of 2023 is estimated to be approximately $30 million, including lost revenue and costs to return to service.

In December, we announced our 2023 capital program, which included investments related to the construction of the Phase VIII Peace Pipeline expansion, reactivation of the Nipisi Pipeline, pre-FID development activities for Cedar LNG, engineering activities for the Alberta Carbon Grid, sustainment of our operating assets, and advancing Pembina's portfolio of unsecured development opportunities. Pembina has revised its outlook for 2023 and now estimates a 2023 capital program of approximately $800 million, which relative to the original guidance of $730 million reflects primarily incremental spending related to several new minor infrastructure projects in the conventional pipelines business and the sanctioning of RFS IV.

2023 cash flow from operating activities is expected to exceed dividend payments and the capital expenditure program. Additional incremental cash flow generated in 2023 is expected to be used to pay down additional debt, further strengthening our balance sheet and preparing the Company to fund future capital projects, if sanctioned. Based on the current guidance for 2023, Pembina expects to remain firmly within its financial guardrails with ample liquidity and our leverage metrics are expected to remain well within the ranges for a strong 'BBB' credit rating.

While we celebrate the past 68 years and Pembina's track-record of reliably serving its stakeholders, our entire organization is focused on how we can remain resilient and thrive well into the future. Pembina is positioned at the nexus of the industry in Canada today and has an enormous opportunity to be part of a bright future, one where we continue to invest in our legacy businesses to ensure secure and reliable supplies of hydrocarbon-based energy to support the global economy, while at the same time taking concrete steps to support the ongoing energy transition. As we enter 2023, we remain optimistic about the state of the Canadian energy market and believe we are poised to deliver another strong year.

Projects and New Developments

Pipelines

- The Phase IX Peace Pipeline expansion was completed on-budget and was placed into service in December 2022. Phase IX was constructed to debottleneck the corridor north of Gordondale, Alberta, upgrade a pump station, convert existing batching pipelines into single product lines, and add a new Wapiti-to-Kakwa pump station.

- The Phase VIII Peace Pipeline expansion will enable segregated pipeline service for ethane-plus and propane-plus NGL mix from Gordondale, Alberta, which is centrally located within the Montney trend, into the Edmonton area for market delivery. The project includes new 10-inch and 16-inch pipelines, totaling approximately 150 kilometres, in the Gordondale to La Glace corridor of Alberta, as well as new mid-point pump stations and terminal upgrades located throughout the Peace Pipeline system. Phase VIII will add approximately 235,000 bpd of incremental capacity between Gordondale, Alberta and La Glace, Alberta, as well as approximately 65,000 bpd of capacity between La Glace, Alberta and the Namao hub near Edmonton, Alberta. Most procurement activities are complete or nearing completion with expected costs consistent with the announced project budget. Pipe manufacturing is underway, and construction commenced at several locations in the fourth quarter of 2022. The project has an estimated cost of approximately $530 million and is trending on-time and on-budget, with an expected in-service date in the first half of 2024.

- Subsequent to the fourth quarter of 2022, the United States Bankruptcy Court for the District of Delaware approved Ruby Pipeline L.L.C.’s (the “Ruby Subsidiary”) Chapter 11 plan of reorganization (the "the Ruby Subsidiary Plan") and an agreement between Pembina and certain of its subsidiaries with the Ruby Subsidiary that provides for the release of Pembina and such subsidiaries from any causes of action arising in connection with, among other things, the prepetition distributions and the Ruby Subsidiary bankruptcy in exchange for a U.S. $102 million payment by Pembina to the Ruby Subsidiary. The Ruby Subsidiary Plan provides for the sale of the Ruby Subsidiary's reorganized equity to a third-party, which sale was completed on January 13, 2023, and the distribution of the sales proceeds and cash on hand of the Ruby Subsidiary to the creditors of the Ruby Subsidiary, including approximately U.S. $14 million to an affiliate of Pembina in respect of the subordinated notes issued by the Ruby Subsidiary to that Pembina affiliate. Following the completion of the sale of the Ruby Subsidiary's reorganized equity, Pembina ceased to have any ownership interest in the Ruby Pipeline.

Facilities

- During the fourth quarter, Pembina closed the previously announced transaction with Plains Midstream Canada ULC ("Plains") to sell Pembina's minority interests in certain assets currently part of the Empress NGL Extraction Facility, namely, the Empress I Plant, Empress I Expansion Plant, and the Empress VI Plant (collectively "E1 and E6") in consideration for a long-term processing agreement that provides Pembina the right to first priority for 750 MMcf/d of extraction capacity at all Plains-operated assets at Empress. In future periods, the financial impact associated with the processing agreement will be reported within the Marketing & New Ventures segment.

- During the fourth quarter, the Empress Cogeneration Facility was brought into service on-time and on-budget. The facility uses natural gas to generate up to 45 megawatts of electrical power, thereby reducing overall operating costs by providing electricity and heat to the existing Empress NGL Extraction Facility. All the power is consumed on site, thereby supplying up to 90 percent of the site's electrical requirements. Further, this project contributes to annual greenhouse gas emission reductions at the Empress NGL Extraction Facility through the utilization of the cogeneration waste heat and the low-emission power generated.

- Subsequent to the fourth quarter, Pembina approved construction of a new 55,000 bpd propane-plus fractionator ("RFS IV") at its existing Redwater fractionation and storage complex (the "Redwater Complex"). RFS IV is expected to cost approximately $460 million and will leverage the design, engineering and operating best practices of its existing facilities. The project includes additional rail loading capacity at the Redwater Complex. Subject to regulatory and environmental approvals, RFS IV is expected to be in-service in the first half of 2026. With the addition of RFS IV, the fractionation capacity at the Redwater Complex will total 256,000 bpd.

- Pursuant to an agreement with the Competition Bureau, and consistent with Pembina's and KKR's intention to divest upon announcing their joint venture, on December 11, 2022 a subsidiary of PGI entered into an agreement to sell its 50 percent non-operated interest in the Key Access Pipeline System ("KAPS") which was contributed to PGI as part of the transaction. Closing is now expected to occur in the second quarter of 2023.

Marketing & New Ventures

-

Pembina has formed a partnership with the Haisla First Nation to develop the proposed Cedar LNG Project, a three million tonne per annum floating LNG facility strategically positioned to leverage Canada's abundant natural gas supply and British Columbia's growing LNG infrastructure to produce industry-leading low-carbon, cost-competitive Canadian LNG for overseas markets. Cedar LNG will provide a valuable outlet for WCSB natural gas to access global markets, achieving higher prices for Canadian producers, contributing to lower overall emissions, and enhancing global energy security. Given Cedar LNG will be a floating facility, manufactured in the controlled conditions of a shipyard, it is expected that the project will have lower construction and execution risk. Further, powered by BC Hydro, Cedar LNG is expected to be one of the greenest LNG facilities in the world. The Environmental Assessment ("EA") was referred to the B.C. Ministers of Environment and Energy and Mines on November 16, 2022, and the decisions of the B.C. Ministers as well as the federal Minister of Environment and Climate Change are expected to be received in the first quarter of 2023.

As with most of Pembina's assets, Cedar LNG is expected to be structured as a tolling business providing a low risk, long-term cash flow stream, and strengthening Pembina's financial guardrails. Cedar LNG is in active commercial discussions with potential counterparties, all of which are investment grade, for long-term commitments, and is working towards the signing of definitive agreements prior to a final investment decision. Work with EPC contractors in the development of the floating LNG Facility continues. The four current work streams – engineering, regulatory, commercial discussions, and financing – are expected to converge for a final investment decision to be made by the third quarter of 2023. - Pembina and TC Energy Corporation ("TC Energy") continue to develop the Alberta Carbon Grid ("ACG"), a carbon transportation and sequestration platform that will enable Alberta-based industries to effectively manage their greenhouse gas emissions, contribute positively to Alberta's lower-carbon economy, and create sustainable long-term value for Pembina and TC Energy stakeholders. In 2022, the Government of Alberta announced that ACG was successfully chosen to move to the next stage of the province's carbon capture utilization and storage process in the Industrial Heartland. Throughout the year, Pembina and TC Energy progressed surface and sub-surface engineering and planning, continued with ongoing engagement with customers and stakeholders, and recently signed an evaluation agreement with the Government of Alberta. The first phase of the system is the Industrial Heartland project, which will have the potential of transporting and storing up to 10 million tonnes of carbon dioxide ("CO2") annually. Pembina and TC Energy are also exploring options to create several hubs throughout Alberta. The long-term vision is to annually transport and store up to 20 million tonnes of CO2 through several hubs across Alberta.

Financing Activity

- During the fourth quarter, 1.8 million common shares were repurchased for cancellation under Pembina’s normal course issuer bid (“NCIB”) at a weighted average price of $45.91 per share and a total cost of approximately $84 million. Since late 2021, Pembina has repurchased 7.6 million common shares at a weighted average price of $46.03 per share and a total cost of $350 million. Subject to approval of the Toronto Stock Exchange, it is Pembina's intention to renew the NCIB following its expiration on March 9, 2023.

- On October 24, 2022, Pembina’s $450 million Senior Unsecured Medium-Term Notes Series 2, matured and were fully repaid.

- On November 15, 2022, Pembina redeemed all of the 12 million issued and outstanding Cumulative Redeemable Minimum Rate Reset Class A Preferred Shares, Series 23 for a redemption price equal to $25.00 per Series 23 Class A Preferred Share for a total redemption price of $300 million.

- Subsequent to the quarter, on January 16, 2023, Pembina announced that it did not intend to exercise its right to redeem the ten million Cumulative Redeemable Minimum Rate Reset Class A Preferred Shares, Series 25 (the "Series 25 Shares") outstanding on February 15, 2023. The annual dividend rate for the Series 25 Shares for the five-year period from and including February 15, 2023 to, but excluding, February 15, 2028 is 6.481 percent.

- Subsequent to the quarter, on January 30, 2023, Pembina announced that it did not intend to exercise its right to redeem the 16 million Cumulative Redeemable Minimum Rate Reset Class A Preferred Shares, Series 21 (the "Series 21 Shares") outstanding on March 1, 2023. The annual dividend rate for the Series 21 Shares for the five-year period from and including March 1, 2023 to, but excluding, March 1, 2028 is 6.302 percent.

- Subsequent to the quarter, on February 14, 2023, holders of an aggregate of 1,028,130 of the 16,000,000 issued and outstanding Series 21 Shares elected to convert, on a one-for-one basis, their Series 21 Shares into Cumulative Redeemable Floating Rate Class A Preferred Shares, Series 22 of Pembina ("Series 22 Shares"). As a result of the exercise of such conversion rights, on March 1, 2023, Pembina will have 14,971,870 Series 21 Shares and 1,028,130 Series 22 Shares issued and outstanding. The annual dividend rate applicable to the Series 22 Shares for the three-month floating rate period from and including March 1, 2023, to, but excluding, June 1, 2023, will be 7.706 percent.

Dividends

- In connection with the closing of the PGI Transaction on August 15, 2022, Pembina’s board of directors approved a $0.0075 per common share increase to its monthly common share dividend rate, commencing with the dividend paid on October 14, 2022.

- Pembina paid a dividend of $0.2175 per common share in October, November, and December 2022. These dividends were declared in September, October, and November 2022, respectively, for the applicable record dates. In addition, as part of the transition to a quarterly dividend starting in 2023, Pembina declared and paid a dividend of $0.2175 per common share on December 30, 2022 to holders of record on December 15, 2022.

- As noted above, subsequent to the quarter, Pembina's board of directors declared a common share cash dividend for the first quarter of 2023 of $0.6525 per share to be paid, subject to applicable law, on March 31, 2023, to shareholders of record on March 15, 2023.

- Pembina declared and paid quarterly dividends per Class A Preferred Share of: Series 1: $0.306625; Series 3: $0.279875; Series 5: $0.285813; Series 7: $0.27375; Series 9: $0.268875; and Series 21: $0.30625 to shareholders of record on November 1, 2022. Pembina also declared and paid quarterly dividends per Class A Preferred Share of: Series 15: $0.38525; Series 17: $0.301313; and Series 19: $0.29275 to shareholders of record on December 15, 2022. Pembina also declared and paid quarterly dividends per Class A Preferred Share of Series 23: $0.328125; and Series 25: $0.3250 to shareholders of record on October 31, 2022.

Fourth Quarter 2022 Conference Call & Webcast

Pembina will host a conference call on Friday, February 24, 2023 at 8:00 a.m. MT (10:00 a.m. ET) for interested investors, analysts, brokers and media representatives to discuss results for the fourth quarter of 2022. The conference call dial-in numbers for Canada and the U.S. are 416-764-8646 or 888-396-8049. A recording of the conference call will be available for replay until Friday, March 3, 2023 at 11:59 p.m. ET. To access the replay, please dial either 416-764-8692 or 877-674-7070 and enter the password 023183#.

A live webcast of the conference call can be accessed on Pembina's website at www.pembina.com under Investor Centre/ Presentation & Events, or by entering:

https://events.q4inc.com/attendee/612289257 in your web browser. Shortly after the call, an audio archive will be posted on the website for a minimum of 90 days.

About Pembina

Pembina Pipeline Corporation is a leading energy transportation and midstream service provider that has served North America's energy industry for more than 65 years. Pembina owns an integrated network of hydrocarbon liquids and natural gas pipelines, gas gathering and processing facilities, oil and natural gas liquids infrastructure and logistics services, and an export terminals business. Through our integrated value chain, we seek to provide safe and reliable energy solutions that connect producers and consumers across the world, support a more sustainable future and benefit our customers, investors, employees and communities. For more information, please visit www.pembina.com.

Purpose of Pembina: We deliver extraordinary energy solutions so the world can thrive.

Pembina is structured into three Divisions: Pipelines Division, Facilities Division and Marketing & New Ventures Division.

Pembina's common shares trade on the Toronto and New York stock exchanges under PPL and PBA, respectively. For more information, visit www.pembina.com.

Forward-Looking Statements and Information

This document contains certain forward-looking statements and forward-looking information (collectively, "forward-looking statements"), including forward-looking statements within the meaning of the "safe harbor" provisions of applicable securities legislation, that are based on Pembina's current expectations, estimates, projections and assumptions in light of its experience and its perception of historical trends. In some cases, forward-looking statements can be identified by terminology such as "continue", "anticipate", "schedule", "will", "expects", "estimate", "potential", "planned", "future", "outlook", "strategy", "protect", "trend", "commit", "maintain", "focus", "ongoing", "believe" and similar expressions suggesting future events or future performance.

In particular, this document contains forward-looking statements, including certain financial outlooks, pertaining to, without limitation, the following: Pembina's corporate strategy and the development of new business initiatives and growth opportunities, including the anticipated benefits therefrom and the expected timing thereof; expectations about industry activities and development opportunities, including operating segment outlooks and general market conditions for 2023 and thereafter; outlooks for commodity prices and the effect thereof on the business of the Company; expectations about future demand for Pembina's infrastructure and services; expectations relating to new infrastructure projects, including the benefits therefrom and timing thereof; Pembina's 2023 annual guidance, including the Company's expectations regarding its adjusted EBITDA; the Company's anticipated use of free cash flow generated in 2023; Pembina's future common share dividends, including the timing, amount and expected tax treatment thereof; planning, construction and capital expenditure estimates, schedules and locations; expected capacity, incremental volumes, completion and in-service dates; rights, activities and operations with respect to the construction of, or expansions on, existing pipelines systems, gas services facilities, processing and fractionation facilities, terminalling, storage and hub facilities and other facilities or energy infrastructure, as well as the impact of Pembina's growth projects on its future financial performance and stakeholders; the sale by PGI's subsidiary of its 50 percent non-operated interest in KAPS, including timing thereof; expectations regarding Pembina's financial strength and condition; expectations regarding Pembina's commercial agreements, including the expected timing and benefit thereof; expectations regarding the renewal of Pembina's normal course issuer bid, including the timing and terms thereof; expectations, decisions and activities related to the Company's projects and new developments; statements and expectations related to Pembina's commitment to, and the effectiveness and impact of, its sustainability goals and targets; the impact of current and expected market conditions on Pembina; statements regarding the Northern Pipeline outage, including the operational impact thereof, Pembina's response thereto and the expected impact on Pembina's financial results; expectations regarding the Company’s ability to return capital to shareholders; statements regarding the Company's capital allocation strategy, including its revised 2023 capital expenditure program and expected future cash flows and the sufficiency thereof; and statements regarding the conversion of a portion of the issued and outstanding Series 21 Class A Preferred Shares into Series 22 Class A Preferred Shares.

The forward-looking statements are based on certain assumptions that Pembina has made in respect thereof as at the date of this news release regarding, among other things: oil and gas industry exploration and development activity levels and the geographic region of such activity; the success of Pembina's operations; prevailing commodity prices, interest rates, carbon prices, tax rates, exchange rates and inflation rates; the ability of Pembina to maintain current credit ratings; the availability and cost of capital to fund future capital requirements relating to existing assets, projects and the repayment or refinancing of existing debt as it becomes due; future operating costs; geotechnical and integrity costs; that any third-party projects relating to Pembina's growth projects will be sanctioned and completed as expected; that the anticipated benefits of the PGI Transaction can be achieved in the manner expected by Pembina; assumptions with respect to our intention to complete share repurchases, including the funding thereof, existing and future market conditions, including with respect to Pembina's common share trading price, and compliance with respect to applicable securities laws and regulations and stock exchange policies; that any required commercial agreements can be reached in the manner and on the terms expected by Pembina; that all required regulatory and environmental approvals can be obtained on the necessary terms and in a timely manner; that counterparties will comply with contracts in a timely manner; that there are no unforeseen events preventing the performance of contracts or the completion of the relevant projects; prevailing regulatory, tax and environmental laws and regulations; maintenance of operating margins; the amount of future liabilities relating to lawsuits and environmental incidents; and the availability of coverage under Pembina's insurance policies (including in respect of Pembina's business interruption insurance policy).

Although Pembina believes the expectations and material factors and assumptions reflected in these forward-looking statements are reasonable as of the date hereof, there can be no assurance that these expectations, factors and assumptions will prove to be correct. These forward-looking statements are not guarantees of future performance and are subject to a number of known and unknown risks and uncertainties including, but not limited to: the regulatory environment and decisions and Indigenous and landowner consultation requirements; the impact of competitive entities and pricing; reliance on third parties to successfully operate and maintain certain assets; reliance on key relationships and agreements; labour and material shortages; the strength and operations of the oil and natural gas production industry and related commodity prices; the failure to realize the anticipated benefits and/or synergies of the PGI Transaction; assumptions with respect to the estimated financial impact of the Northern Pipeline outage; expectations and assumptions concerning, among other things: customer demand for PGI's assets and services; non-performance or default by counterparties to agreements which Pembina or one or more of its affiliates has entered into in respect of its business; actions by governmental or regulatory authorities, including changes in tax laws and treatment, changes in royalty rates, changes in regulatory processes or increased environmental regulation; the ability of Pembina to acquire or develop the necessary infrastructure in respect of future development projects; fluctuations in operating results; adverse general economic and market conditions, including potential recessions in Canada, North America and worldwide resulting in changes, or prolonged weaknesses, as applicable, in interest rates, foreign currency exchange rates, inflation rates, commodity prices, supply/demand trends and overall industry activity levels; risks related to the potential impacts of the COVID-19 pandemic; constraints on the, or the unavailability of, adequate infrastructure; the political environment in North American and elsewhere, and public opinion; the ability to access various sources of debt and equity capital; adverse changes in credit ratings; counterparty credit risk; technology and cyber security risks; natural catastrophes; and certain other risks detailed in Pembina's Annual Information Form and Management's Discussion and Analysis, each dated February 23, 2023 for the year ended December 31, 2022 and from time to time in Pembina's public disclosure documents available at www.sedar.com, www.sec.gov and through Pembina's website at www.pembina.com.

This list of risk factors should not be construed as exhaustive. Readers are cautioned that events or circumstances could cause results to differ materially from those predicted, forecasted or projected by forward-looking statements contained herein. The forward-looking statements contained in this document speak only as of the date of this document. Pembina does not undertake any obligation to publicly update or revise any forward-looking statements or information contained herein, except as required by applicable laws. Management approved the 2023 adjusted EBITDA guidance contained herein as of the date of this news release. The purpose of the 2023 adjusted EBITDA guidance is to assist readers in understanding Pembina's expected and targeted financial results, and this information may not be appropriate for other purposes. The forward-looking statements contained in this document are expressly qualified by this cautionary statement.

Non-GAAP and Other Financial Measures

Throughout this news release, Pembina has disclosed certain financial measures and ratios that are not specified, defined or determined in accordance with GAAP and which are not disclosed in Pembina's financial statements. Non-GAAP financial measures either exclude an amount that is included in, or include an amount that is excluded from, the composition of the most directly comparable financial measure specified, defined and determined in accordance with GAAP. Non-GAAP ratios are financial measures that are in the form of a ratio, fraction, percentage or similar representation that has a non-GAAP financial measure as one or more of its components. These non-GAAP financial measures and ratios, together with financial measures and ratios specified, defined and determined in accordance with GAAP, are used by management to evaluate the performance and cash flows of Pembina and its businesses and to provide additional useful information respecting Pembina's financial performance and cash flows to investors and analysts.

In this news release, Pembina has disclosed the following non-GAAP financial measures and non-GAAP ratios: net revenue, adjusted EBITDA, adjusted EBITDA from equity accounted investees, adjusted EBITDA per common share, adjusted cash flow from operating activities, and adjusted cash flow from operating activities per common share. These non-GAAP financial measures and ratios disclosed in this news release do not have any standardized meaning under International Financial Reporting Standards ("IFRS") and may not be comparable to similar financial measures or ratios disclosed by other issuers.

The measures and ratios should not, therefore, be considered in isolation or as a substitute for, or superior to, measures and ratios of Pembina's financial performance, or cash flows specified, defined or determined in accordance with GAAP, including revenue, earnings, cash flow from operating activities and cash flow from operating activities per share.

Except as otherwise described herein, these non-GAAP financial measures and non-GAAP ratios are calculated on a consistent basis from period to period. Specific reconciling items may only be relevant in certain periods.

Below is a description of each non-GAAP financial measure and non-GAAP ratio disclosed in this news release, together with, as applicable, disclosure of the most directly comparable financial measure that is determined in accordance with GAAP to which each non-GAAP financial measure relates and a quantitative reconciliation of each non-GAAP financial measure to such directly comparable GAAP financial measure. Additional information relating to such non-GAAP financial measures and non-GAAP ratios, including disclosure of the composition of each non-GAAP financial measure and non-GAAP ratio, an explanation of how each non-GAAP financial measure and non-GAAP ratio provides useful information to investors and the additional purposes, if any, for which management uses each non-GAAP financial measure and non-GAAP ratio; an explanation of the reason for any change in the label or composition of each non-GAAP financial measure and non-GAAP ratio from what was previously disclosed; and a description of any significant difference between forward-looking non-GAAP financial measures and the equivalent historical non-GAAP financial measures, is contained in the "Non-GAAP & Other Financial Measures" section of the management's discussion and analysis of Pembina dated February 23, 2023 for the year ended December 31, 2022 (the "MD&A"), which information is incorporated by reference in this news release. The MD&A is available on SEDAR at www.sedar.com, EDGAR at www.sec.gov and Pembina's website at www.pembina.com.

Net Revenue

Net revenue is a non-GAAP financial measure which is defined as total revenue less cost of goods sold including product purchases. The most directly comparable financial measure to net revenue that is determined in accordance with GAAP and disclosed in Pembina's financial statements is revenue.

3 Months Ended December 31 |

Pipelines |

Facilities |

Marketing &

|

Corporate &

|

Total |

||||||||||||||||

($ millions) |

|||||||||||||||||||||

|

2022 |

2021 |

2022 |

2021 |

2022 |

2021 |

2022 |

2021 |

2022 |

2021 |

|||||||||||

Revenue |

686 |

606 |

237 |

349 |

1,921 |

1,750 |

(145) |

(145) |

2,699 |

2,560 |

|||||||||||

Cost of goods sold, including product purchases |

— |

— |

— |

(1) |

1,734 |

1,554 |

(78) |

(77) |

1,656 |

1,476 |

|||||||||||

Net revenue |

686 |

606 |

237 |

350 |

187 |

196 |

(67) |

(68) |

1,043 |

1,084 |

|||||||||||

12 Months Ended December 31 |

Pipelines |

Facilities |

Marketing &

|

Corporate &

|

Total |

||||||||||||||||

($ millions) |

|||||||||||||||||||||

|

2022 |

2021 |

2022 |

2021 |

2022 |

2021 |

2022 |

2021 |

2022 |

2021 |

|||||||||||

Revenue |

2,508 |

2,279 |

1,268 |

1,363 |

8,471 |

5,577 |

(636) |

(592) |

11,611 |

8,627 |

|||||||||||

Cost of goods sold, including product purchases |

— |

— |

6 |

6 |

7,682 |

5,017 |

(324) |

(334) |

7,364 |

4,689 |

|||||||||||

Net revenue |

2,508 |

2,279 |

1,262 |

1,357 |

789 |

560 |

(312) |

(258) |

4,247 |

3,938 |

|||||||||||

Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization

Adjusted EBITDA is a non-GAAP financial measure and is calculated as earnings before net finance costs, income taxes, depreciation and amortization (included in operations and general and administrative expense) and unrealized gains or losses on commodity-related derivative financial instruments. The exclusion of unrealized gains or losses on commodity-related derivative financial instruments eliminates the non-cash impact of such gains or losses.

Adjusted EBITDA also includes adjustments to earnings for losses (gains) on disposal of assets, transaction costs incurred in respect of acquisitions, dispositions and restructuring, impairment charges or reversals in respect of goodwill, intangible assets, investments in equity accounted investees and property, plant and equipment, certain non-cash provisions and other amounts not reflective of ongoing operations. In addition, Pembina's proportionate share of results from investments in equity accounted investees with a preferred interest is presented in adjusted EBITDA as a 50 percent common interest. These additional adjustments are made to exclude various non-cash and other items that are not reflective of ongoing operations.

Adjusted EBITDA per common share is a non-GAAP ratio which is calculated by dividing adjusted EBITDA by the weighted average number of common shares outstanding.

3 Months Ended December 31 |

Pipelines |

Facilities |

Marketing &

|

Corporate &

|

Total |

|||||||||||||||

($ millions, except per share amounts) |

||||||||||||||||||||

|

2022 |

2021 |

2022 |

2021 |

2022 |

2021 |

2022 |

2021 |

2022 |

2021 |

||||||||||

Earnings (loss) before income tax |

295 |

(70) |

145 |

164 |

96 |

220 |

(206) |

(181) |

330 |

133 |

||||||||||

Adjustments to share of profit from equity accounted investees and other |

41 |

65 |

107 |

36 |

— |

5 |

— |

— |

148 |

106 |

||||||||||

Net finance costs (income) |

6 |

6 |

(8) |

1 |

6 |

3 |

109 |

97 |

113 |

107 |

||||||||||

Depreciation and amortization |

104 |

101 |

34 |

56 |

10 |

12 |

14 |

11 |

162 |

180 |

||||||||||

Unrealized (gain) loss on commodity-related derivative financial instruments |

— |

— |

(2) |

24 |

61 |

(54) |

— |

— |

59 |

(30) |

||||||||||

Transaction costs incurred in respect of acquisitions |

— |

— |

— |

— |

— |

— |

— |

5 |

— |

5 |

||||||||||

Impairment charges, transformation and restructuring costs, (gain) loss on disposal of assets and non-cash provisions |

102 |

446 |

12 |

4 |

(2) |

(3) |

1 |

22 |

113 |

469 |

||||||||||

Adjusted EBITDA |

548 |

548 |

288 |

285 |

171 |

183 |

(82) |

(46) |

925 |

970 |

||||||||||

Adjusted EBITDA per common share – basic (dollars) |

|

|

|

|

|

|

|

|

1.68 |

1.76 |

||||||||||

12 Months Ended December 31 |

Pipelines |

Facilities |

Marketing &

|

Corporate &

|

Total |

|||||||||||||||

($ millions, except per share amounts) |

||||||||||||||||||||

|

2022 |

2021 |

2022 |

2021 |

2022 |

2021 |

2022 |

2021 |

2022 |

2021 |

||||||||||

Earnings before income tax |

1,415 |

917 |

1,804 |

732 |

708 |

374 |

(708) |

(358) |

3,219 |

1,665 |

||||||||||

Adjustments to share of profit from equity accounted investees and other |

172 |

286 |

271 |

135 |

25 |

23 |

— |

— |

468 |

444 |

||||||||||

Net finance costs |

28 |

29 |

13 |

18 |

27 |

9 |

418 |

394 |

486 |

450 |

||||||||||

Depreciation and amortization |

396 |

413 |

196 |

214 |

44 |

50 |

47 |

46 |

683 |

723 |

||||||||||

Unrealized gain on commodity-related derivative financial instruments |

— |

— |

(50) |

(38) |

(83) |

(35) |

— |

— |

(133) |

(73) |

||||||||||

Arrangement Termination Payment |

— |

— |

— |

— |

— |

— |

— |

(350) |

— |

(350) |

||||||||||

Gain on PGI Transaction |

— |

— |

(1,110) |

— |

— |

— |

— |

— |

(1,110) |

— |

||||||||||

Transaction costs incurred in respect of acquisitions |

— |

— |

(1) |

— |

— |

— |

— |

31 |

(1) |

31 |

||||||||||

Impairment charges, transformation and restructuring costs, contract dispute settlement, (gain) loss on disposal of assets and non-cash provisions |

116 |

457 |

14 |

36 |

— |

(1) |

4 |

51 |

134 |

543 |

||||||||||

Adjusted EBITDA |

2,127 |

2,102 |

1,137 |

1,097 |

721 |

420 |

(239) |

(186) |

3,746 |

3,433 |

||||||||||

Adjusted EBITDA per common share – basic (dollars) |

|

|

|

|

|

|

|

|

6.78 |

6.24 |

||||||||||

Adjusted EBITDA from Equity Accounted Investees

In accordance with IFRS, Pembina's jointly controlled investments are accounted for using equity accounting. Under equity accounting, the assets and liabilities of the investment are presented net in a single line item in the Consolidated Statement of Financial Position, "Investments in Equity Accounted Investees". Net earnings from investments in equity accounted investees are recognized in a single line item in the Consolidated Statement of Earnings and Comprehensive Income "Share of Profit from Equity Accounted Investees". The adjustments made to earnings, in adjusted EBITDA above, are also made to share of profit from investments in equity accounted investees. Cash contributions and distributions from investments in equity accounted investees represent Pembina's share paid and received in the period to and from the investments in equity accounted investees.

To assist in understanding and evaluating the performance of these investments, Pembina is supplementing the IFRS disclosure with non-GAAP proportionate consolidation of Pembina's interest in the investments in equity accounted investees. Pembina's proportionate interest in equity accounted investees has been included in adjusted EBITDA.

3 Months Ended December 31 |

Pipelines |

Facilities |

Marketing &

|

Total |

||||||||||||

($ millions) |

||||||||||||||||

|

2022 |

2021 |

2022 |

2021 |

2022 |

2021 |

2022 |

2021 |

||||||||

Share of profit from equity accounted investees |

44 |

29 |

49 |

21 |

(14) |

33 |

79 |

83 |

||||||||

Adjustments to share of profit from equity accounted investees: |

|

|

|

|

|

|

|

|

||||||||

Net finance costs (income) |

5 |

26 |

37 |

7 |

(1) |

(1) |

41 |

32 |

||||||||

Income tax expense |

— |

— |

13 |

— |

— |

— |

13 |

— |

||||||||

Depreciation and amortization |

36 |

(4) |

39 |

29 |

7 |

6 |

82 |

31 |

||||||||

Unrealized loss (gain) on commodity-related derivative financial instruments |

— |

— |

11 |

— |

(6) |

— |

5 |

— |

||||||||

Transaction costs incurred in respect of acquisitions |

— |

— |

7 |

— |

— |

— |

7 |

— |

||||||||

Share of earnings in excess of equity interest(1) |

— |

43 |

— |

— |

— |

— |

— |

43 |

||||||||

Total adjustments to share of profit from equity accounted investees |

41 |

65 |

107 |

36 |

— |

5 |

148 |

106 |

||||||||

Adjusted EBITDA from equity accounted investees |

85 |

94 |

156 |

57 |

(14) |

38 |

227 |

189 |

||||||||

(1) |

Pembina's proportionate share of results from investments in equity accounted investees with a preferred interest is presented in adjusted EBITDA as a 50 percent common interest. |

|

12 Months Ended December 31 |

Pipelines |

Facilities |

Marketing &

|

Total |

||||||||||||

($ millions) |

||||||||||||||||

|

2022 |

2021 |

2022 |

2021 |

2022 |

2021 |

2022 |

2021 |

||||||||

Share of profit from equity accounted investees |

171 |

124 |

108 |

80 |

82 |

77 |

361 |

281 |

||||||||

Adjustments to share of profit from equity accounted investees: |

|

|

|

|

|

|

|

|

||||||||

Net finance costs |

21 |

72 |

79 |

31 |

— |

1 |

100 |

104 |

||||||||

Income tax expense |

— |

— |

14 |

— |

— |

— |

14 |

— |

||||||||

Depreciation and amortization |

149 |

156 |

138 |

104 |

25 |

22 |

312 |

282 |

||||||||

Unrealized loss on commodity-related derivative financial instruments |

— |

— |

27 |

— |

— |

— |

27 |

— |

||||||||

Transaction costs incurred in respect of acquisitions |

— |

— |

13 |

— |

— |

— |

13 |

— |

||||||||

Share of earnings in excess of equity interest(1) |

2 |

58 |

— |

— |

— |

— |

2 |

58 |

||||||||

Total adjustments to share of profit from equity accounted investees |

172 |

286 |

271 |

135 |

25 |

23 |

468 |

444 |

||||||||

Adjusted EBITDA from equity accounted investees |

343 |

410 |

379 |

215 |

107 |

100 |

829 |

725 |

||||||||

(1) |

Pembina's proportionate share of results from investments in equity accounted investees with a preferred interest is presented in adjusted EBITDA as a 50 percent common interest. |

Adjusted Cash Flow from Operating Activities and Adjusted Cash Flow from Operating Activities per Common Share