Bank of America Ranks Highest in Merchant Services Customer Satisfaction

Long live credit cards, debit cards and digital wallets! With paper currency now used in just 19% of consumer payments,1 and use of payment cards, electronic payments and mobile payment apps surging, small businesses are increasingly reliant on a strong relationship with their merchant services payment processor. According to the J.D. Power 2022 U.S. Merchant Services Satisfaction Study,SM released today, payment processors have stepped up their game during the past year, with big banks leading the way to a significant surge in merchant services satisfaction.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220203005383/en/

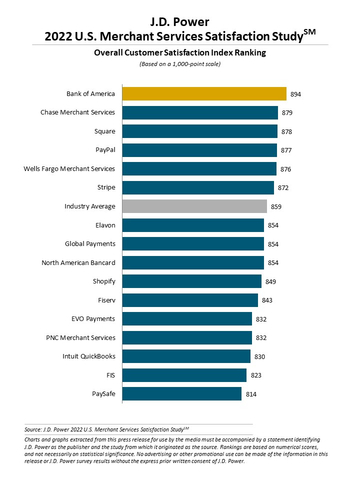

J.D. Power 2022 U.S. Merchant Services Satisfaction Study (Graphic: Business Wire)

“The past couple of years have been very challenging for most small businesses, but industry-wide efforts to simplify payment processing fee structures, ramp up customer support and speed up payments have had positive effects on merchant services satisfaction,” said Paul McAdam, senior director of banking and payments intelligence at J.D. Power. “The largest year-over-year satisfaction gains have been driven by the big banks, which have historically trailed fintech payment providers in delivering low-cost, user-friendly merchant services solutions. Now, the big banks are matching or exceeding fintechs in small business satisfaction with merchant services.”

Following are key findings of the 2022 study:

- Overall satisfaction surges, led by big banks: Overall small business satisfaction with merchant services providers is 859 (on a 1,000-point scale), up a significant 23 points from 2021. The top two performers in the study—Bank of America and Chase Merchant Services—have notable gains this year, with Bank of America increasing 45 points and Chase rising 35 points from last year’s study.

- Simplified fee structures and better customer support drive gains: This year’s significant increases in overall satisfaction are driven by a 33-point increase in satisfaction with cost of service and a 32-point increase in satisfaction with service interactions. Small businesses have improved understanding of payment processing fee structures, which have led to increased satisfaction with the ability to manage or control total payment costs. Small businesses also have experienced notably fewer problems with point-of-sale terminal/card reader hardware and software.

- Show me the money: Small businesses say they are receiving payments faster. More than one-third (34%) say the typical amount of time from transaction to funding their merchant accounts was faster than expected, up 10 percentage points from a year ago. Likewise, 65% of small businesses say they’ve received faster funding, so card payments are settled/posted same day or on non-business days, up 14 percentage points from 2021.

- Provider responses to COVID-19 earn goodwill among small businesses: Nearly three-fourths (73%) of small business customers say they are aware of at least one proactive measure their merchant services provider has taken in response to challenges caused by the pandemic, which has driven a 71-point increase in satisfaction with cost of service. Specific actions taken by providers in response to the pandemic include offering discounted products and services, updated fraud controls and faster funding turnaround times.

Study Ranking

Bank of America ranks highest in merchant services satisfaction with a score of 894. Chase Merchant Services (879) ranks second and Square (878) ranks third.

The overall satisfaction results of North American Bancard, Global Payments, Fiserv and FIS reflect their corporate results, meaning they include the results of various sub-brands (e.g., EPX, Heartland, Clover, Worldpay, and others) that operate under the respective corporate brand names. Two of the banks in the study—PNC Merchant Services and Wells Fargo Merchant Services—partner with Fiserv to provide merchant services to their small business clients. Fiserv also manages direct, standalone merchant services businesses that are distinct from these bank relationships.

The 2022 U.S. Merchant Services Satisfaction Study is based on responses from 4,406 small business customers of merchant services providers. The study was fielded in September-October 2021.

For more information about the U.S. Merchant Services Satisfaction Study, visit https://www.jdpower.com/business/resource/us-merchant-services-study.

To view the online press release, please visit http://www.jdpower.com/pr-id/2022007.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit JDPower.com/business. The J.D. Power auto shopping tool can be found at JDPower.com.

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

1 Source: Federal Reserve Bank of Atlanta https://www.frbsf.org/cash/publications/fed-notes/2021/may/2021-findings-from-the-diary-of-consumer-payment-choice/

View source version on businesswire.com: https://www.businesswire.com/news/home/20220203005383/en/

Contacts

Media Relations Contacts

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com

John Roderick; East Coast; 631-584-2200; john@jroderick.com