Home prices across the United States rose at an annualized rate of 11.5 percent in May 2021 from April 2021, according to Radian Home Price Index (HPI) data released today by Red Bell Real Estate, LLC, a Radian Group Inc. company (NYSE: RDN). The company believes the Radian HPI is the most comprehensive and timely measure of U.S. housing market prices and conditions available in the market today.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20210701005753/en/

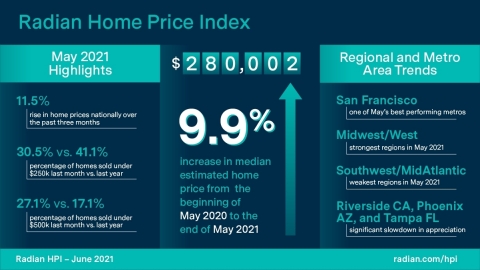

Radian Home Price Index (HPI) Infographic June 2021 (Graphic: Business Wire)

The Radian HPI also rose 9.9 percent year-over-year (May 2020 to May 2021), which was slightly higher than the year-over-year increase of 9.3 percent recorded last month. The Radian HPI is calculated based on the estimated values of more than 70 million unique addresses each month, covering all single-family property types and geographies.

“Unlike repeat sales or median price based indices, the Radian Home Price Index generates an estimated value on nearly all homes that make up the U.S. housing stock, every month, providing us a broader and more realistic view of home price changes,” noted Steve Gaenzler, SVP of Data and Analytics. “While home prices have been growing at higher than typical levels, recent reports of annual home prices being higher by 20 percent or more nationally do not represent the entire housing market, but rather the small segment of properties actually sold. This is an incomplete measure of understanding household wealth and equity. These measures only look at the median price of homes sold, not the estimated price change on all homes, including the majority of homes that are not currently on the market. As such, the changing mix of sales will influence the rates of increase reported in these other measures,” added Gaenzler.

NATIONAL DATA AND TRENDS

- Median home price in the U.S. rose to $280,002

- Percentage of lower priced homes sold fell to lowest on record.

Nationally, the Radian HPI estimated the median price for single-family and condominium homes rose to $280,002. Across the U.S., home prices nationally rose 11.5 percent over the last three months, slightly higher than the 10.5 percent reported for the three months from February through April. The impact of higher vaccination rates, job growth and more interest in homeownership appears to have increased the rate of appreciation. Moreover, it is common for home prices to accelerate their growth momentum into the summer season.

However, the mix of homes sold by price band provides valuable information on what is driving home price growth in median sale indices, and even repeat sales indices. In May, the percentage of homes sold under $250,000 stood at 30.5 percent of all sales. This is the lowest percentage recorded since before the Great Recession began. And in contrast, the percentage of homes sold over $500,000 represented 27.2 percent of all sales, which is more than 3.5 times larger than the 7.5 percent share recorded just a decade earlier. The shift to a larger count of higher priced homes being sold relative to lower priced homes has a beneficial impact on the growth rate of indices that only measure home prices of sold properties. The Radian HPI measures the change in value to properties based on the entire housing stock, not the mix of homes that happen to transact in a given month.

REGIONAL DATA AND TRENDS

- All US Regions appreciated at a faster rate in May

- Midwest and West see largest increases

In May, home price appreciation rose from the prior month in all regions. As the country records lower rates of infections from COVID-19 and higher job growth, the Radian HPI has seen stable growth in home prices broadly across geographies. The weakest regions this month were the Southwest, which was largely unchanged from the prior month, and the MidAtlantic Region, while the Midwest and West regions were the best performing month-over-month.

All six regions recorded actual 12-month price appreciation rates between 8.5 and 11.6 percent, signaling a robust market existing in all parts of the U.S. Regional economic indicators are also supportive of these far-reaching gains in home prices. From 1980 until 2010, the average annual number of new privately-owned housing units authorized with building permits averaged more than one million per year. However, over the subsequent decade (2010-2020) the U.S. only averaged a little over 650,000 permits for new homes per year creating a substantial shortage of newly constructed homes.

METROPOLITAN AREA DATA AND TRENDS

- Bay area bounces back from past weakness

- Slower, but positive, appreciation the norm in most metros

While all regions showed increasing appreciation rates, some of the 20-largest metro areas actually recorded lower rates of appreciation from the prior month. In fact, while all of the 20-largest had higher prices in May, only 8 of them grew faster than the month prior. One of the best performers last month was San Francisco. Over the past year, the Bay area has not been a leading metro for price appreciation, however, this month it recorded a double digit annualized one-month growth rate for only the third time since the beginning of 2020.

Three metro areas, Riverside, CA, Phoenix, AZ, and Tampa, FL, all showed substantial slowdowns in appreciation rates. In fact, the annualized one-month change for each was down more than 25 percent from the prior month’s appreciation rate. Each of them, however, has 12-month appreciation rates in excess of 10 percent.

ABOUT THE RADIAN HPI

Red Bell Real Estate, LLC, a subsidiary of Radian Group Inc., provides national and regional indices for download at radian.com/hpi, along with information on how to access the full library of indices.

Additional content on the housing market can also be found on the Radian Insights page located at https://radian.com/news-and-knowledge/insights.

Red Bell offers the Radian HPI data set along with a client access portal for content visualization and data extraction. The engine behind the Radian HPI has created more than 100,000 unique data series, which are updated on a monthly basis.

The Radian HPI Portal is a self-service data and visualization platform that contains a library of thousands of high-value indices based on both geographic dimensions as well as by market, or property attributes. The platform provides monthly updated access to nine different geographic dimensions, from the national level down to zip codes. In addition, the Radian HPI provides unique insights into market changes, conditions and strength across multiple property attributes, including bedroom count and livable square footage. To help enhance customers’ understanding of granular real estate markets, the library is expanded regularly to include more insightful indices.

In addition to the services offered by its Red Bell subsidiary, Radian is ensuring the American dream of homeownership responsibly and sustainably through products and services that include industry-leading mortgage insurance and a comprehensive suite of mortgage, risk, title, valuation, asset management and other real estate services. The company is powered by technology, informed by data and driven to deliver new and better ways to transact and manage risk. Visit http://www.radian.com to see how Radian is shaping the future of mortgage and real estate services.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210701005753/en/

Contacts

For Investors

John Damian – Phone: 215.231.1383

Email: john.damian@radian.com

For the Media

Rashi Iyer – Phone: 215.231.1167

Email: rashi.iyer@radian.com