VANCOUVER, BC / ACCESSWIRE / May 23, 2024 / Highlander Silver Corp. (CSE:HSLV) (the "Company" or "Highlander Silver") is pleased to announce that, further to its news releases dated November 30, 2023 and March 28, 2024, it has acquired the San Luis gold-silver project (the "San Luis Project") from SSR Mining Inc. ("SSR Mining"), pursuant to a share purchase agreement dated November 29, 2023 (as amended, the "Share Purchase Agreement"). The San Luis Project is located in the Ancash Department of central Peru.

Highlights

- Transformational acquisition for Highlander Silver of the San Luis Project.

- Historical Measured & Indicated mineral resources of 348,000 ounces (oz) of gold (Au) grading 22.4 g/t Au, and 9,003,300 oz silver (Ag) grading 578.1 g/t Ag.

- Multiple targets for growth on the property given limited and focused historical drilling, open extensions to resources, and undrilled targets supported by highly anomalous (> 4 g/t Au) trenching and rock samples.

- Extensive ground holding totalling 23,098 Ha has yet to be systematically explored with many structures that have not yet been sampled providing further exploration potential.

- Highlander Silver to implement a comprehensive program of geological mapping and sampling to develop targets for growth and discovery before more focused exploration on the highest priority targets.

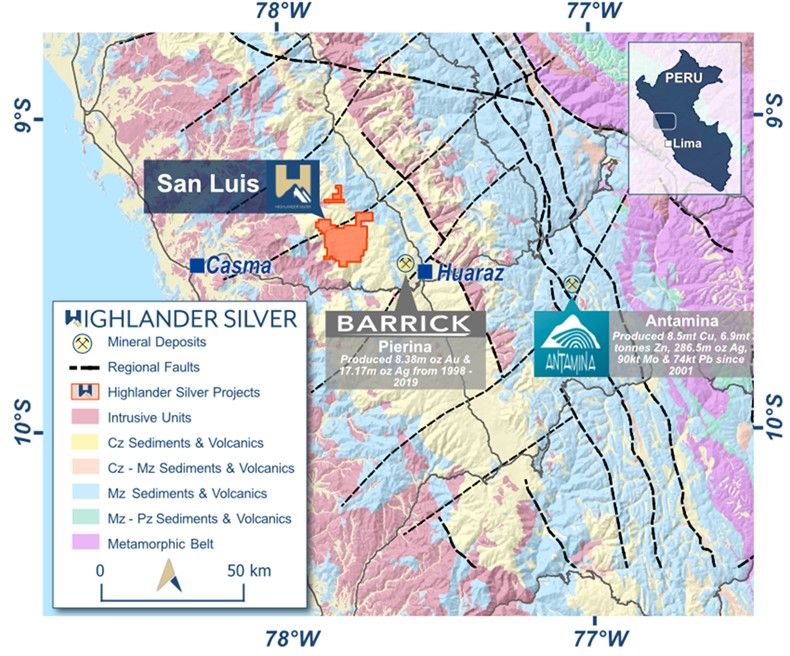

- Ancash Department is well-known for mining in Peru with major past and present production from the Pierina gold mine and Antamina copper-zinc mine, respectively.

- Financing for this transformative acquisition has been provided by the Augusta Group, members of the Lundin family and affiliates, and Eric Sprott.

(See "San Luis Historical Mineral Resource" below for further details.)

A qualified person has not done sufficient work to classify the historical estimate as a current mineral resource and the Company is not treating the historical estimate as a current mineral resource.

David Fincham, President and CEO commented: "We are thrilled to have acquired the high grade San Luis gold-silver project from SSR mining. I would like to thank our shareholders for their support and the SSR Mining team for their careful stewardship of the project to date.

We believe that the historical resource at the Ayelen - Ines vein system may be one of the highest-grade gold-silver deposits yet to be mined in the world, and we are very excited about the exploration potential given this district-scale property has only been partially prospected and explored. As such the acquisition has the potential to be transformative for Highlander Silver in delivering a world-class gold silver project that can benefit all our stakeholders."

Fig. 1 San Luis Project location

Historical Mineral Resource

The San Luis Project has a historical measured and indicated mineral resource estimate of 348,000 ounces (oz) of Au grading 22.4 g/t Au, and 9,003,300 oz Ag grading 578.1 g/t Ag. Test work developed on the historical mineral resource projected gold and silver recoveries of greater than or equal to 90% using conventional cyanide leach processing methods. The Company plans to undertake work to verify and update the historical estimate as a priority. See "San Luis Historical Mineral Resource" below for further details.

Exploration upside potential and first phase exploration plan

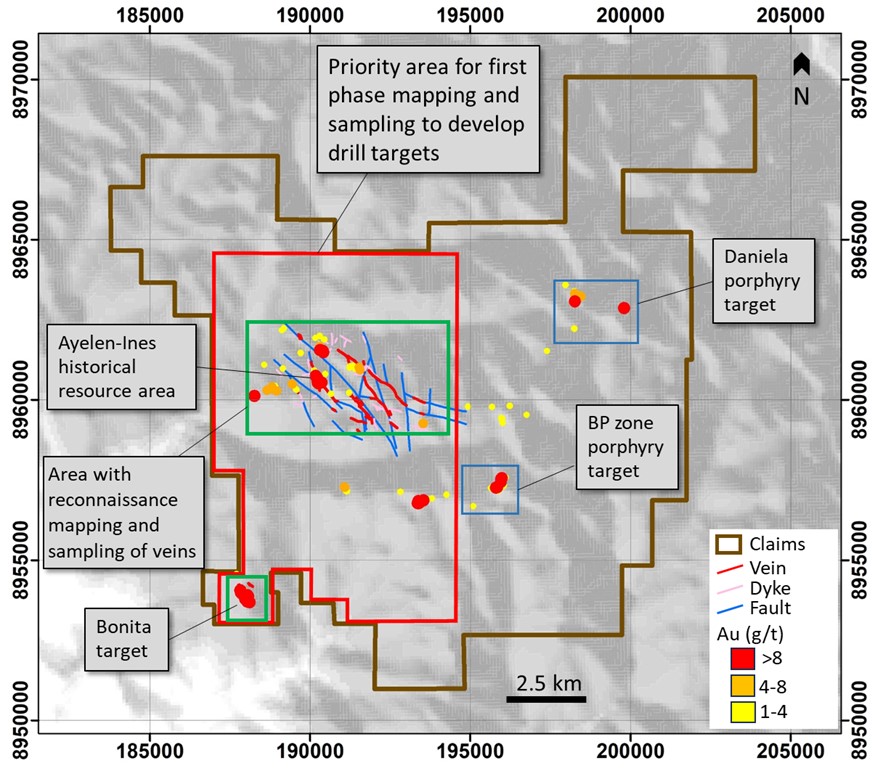

The San Luis Project is district-scale, with the mining concessions covering 23,098 hectares, or approximately 230 km². The fertility of the district has been demonstrated by both evidence of multiple deposit styles and by the high number of targets generated to date from limited exploration. Following discovery of the Ayelen - Ines vein systems where the historical resource is located, the main focus was on resource development, meaning that systematic exploration has yet to be completed across much of the property. Targets on the property include low to intermediate sulfidation epithermal gold-silver veins, copper - molybdenum porphyries, silver, lead, zinc ± copper hydrothermal breccias and silver, lead, zinc ± copper replacement mantos.

The Highlander technical team aims to start the first exploration phase by conducting prospecting work on what are considered to be the most prospective parts of the vein field, around known high grade mineral occurrences and on the underexplored areas in between them. The primary objective of this phase is to define and prioritize drill targets that have the potential to yield bonanza grade Ayelen-Ines vein style mineralisation.

Fig. 2 San Luis tenure map highlighting the priority area for the first phase of exploration, the historical resource area (Ayelen - Ines vein system), Bonita target and anomalous gold samples distributed across the property.

Information relating to the larger property exploration work including geological mapping, surface sampling, and the two holes drilled at the La Bonita target reflect work performed by SSR Mining on the property to-date. In October 2023 and April 2024 visits to the property by Highlander Silver staff, drill core from both Ayelen and the Bonita vein systems were inspected observing significant low-sulphidation style vein intercepts. In addition, work aimed at verifying sample data, analytical techniques or quality assurance and control measures that were in place during the execution of the exploration work as well as the historical mineral resource estimate is in progress but has not been concluded.

Community engagement

Community access agreements have been established by previous operators. As a new operator, the Company recognizes the opportunity to establish fresh long-term mutually beneficial relationships with the local communities and will strive to do this from the outset.

San Luis Project Acquisition

Pursuant to the Share Purchase Agreement, the Company acquired a 100% interest in the San Luis Project through the purchase of SSR Mining's direct and indirect shareholdings of four subsidiary companies, in consideration for an initial payment of US$5,000,000 in cash.

The Company may pay up to an additional US$37,500,000 in cash to SSR Mining as contingent consideration (the "Contingent Consideration") upon completion of certain milestones in relation to the San Luis Project. The Contingent Consideration is only accrued and payable if and when the following milestones are achieved:

| (a) | $2,500,000, after the commencement of an initial drilling program at the San Luis Project; |

| (b) | $5,000,000 after the completion of a feasibility study on any portion of the San Luis Project; |

| (c) | $10,000,000 after the beginning of commercial production; |

| (d) | $10,000,000 after the first anniversary of commercial production; and |

| (e) | $10,000,000 after the second anniversary of commercial production. |

A 4% net smelter returns royalty (the "Royalty") on the San Luis Project was granted to SSR Mining prior to closing of the Transaction. At any time before the commencement of mine construction on the San Luis Project, the Company may buy back half of the Royalty for US$15,000,000, which if, exercised, would reduce SSR Mining's royalty interest to 2%.

San Luis Historical Mineral Resource

The historical mineral resource is included in a Technical Report titled "Technical Report for the San Luis Feasibility Study, Ancash Department, Peru" (the "Technical Report"), with an effective date of June 4, 2010. The report was prepared as a National Instrument 43-101 - Standard of Disclosure for Mineral Projects ("National Instrument 43-101") technical report for Reliant Ventures S.A.C. and Silver Standard Resources Inc. by Mine and Quarry Engineering Services, Inc., RR Engineering, Milne & Associates, Resource Modeling Inc, Resource Evaluation Inc., and Montgomery Watson Harzag Americas Inc, and can be accessed on SSR Mining's SEDAR+ profile. The historical estimate is considered to be relevant and reliable for the purposes of the Company proceeding with the Transaction as it provides an indication of the potential significance of the San Luis Project.

The Technical Report provides details on mineral resources and reserves, as well a potential development option for the San Luis Project that considers underground mining and processing using conventional cyanide leach methods. However, the prices, costs, and development strategy and options are no longer current and need to be re-evaluated using assumptions and qualifications that are more reflective of today's environment.

Below is a summary of the historical resource estimate from the Technical Report.

The San Luis system is a volcanic hosted, low sulphidation, epithermal quartz, precious metals deposit. Gold occurs as electrum and silver is present as acanthite, electrum, and other silver sulphosalts.

The Ayelen vein is the better of the known vein structures with more than 85% of the historical mineral resource derived from this single structure. Trenching and diamond drilling have traced this structure along a NNW strike for over 700 meters, with a steep (80º) down dip extension of more than 300 meters. True thicknesses of individual vein segments vary from tens of centimeters to more than 10m, with an average width of 1.5m to 3.0m.

Mineral resource models were developed based on samples obtained from 96 surface trenches (947m) and 136 drill holes (22,354m). Capping was used to reduce the influence of erratic high-grade values. Block grades were estimated using one-meter composites and inverse distance weighting. Estimated blocks were classified as either Measured, Indicated or Inferred mineral resources based on distance to samples. For the Ayelen vein, blocks within 15 meters of surface trenches were classified as Measured. Ayelen vein blocks within 25m of sample data were classified as Indicated. The remaining estimated Ayelen blocks were classified as Inferred. An average dry density value of 2.61g/cm3 determined from 193 bulk density measurements was used for the resource calculation. The resulting historical mineral resource is shown in the table below.

Historical Mineral Resource Summary

Category |

Tonnes |

Average grades | Contained Metal | ||

| Au (g/t) | Ag (g/t) | Au (Oz) | Ag (Oz) | ||

Measured |

55,000 |

34.3 |

757.6 |

61,000 |

1,345,100 |

Indicated |

429,000 |

20.8 |

555.0 |

287,000 |

7,658,200 |

Measured & Indicated |

484,000 |

22.4 |

578.1 |

348,000 |

9,003,300 |

Inferred |

20,000 |

5.6 |

270.1 |

3,600 |

174,900 |

Notes:

- The historical mineral resources are reported using a 6.0g/t Au equivalent cutoff grade. The gold equivalent calculation assumed a gold to silver price ratio of 65:1, and metal recoveries were not considered.

- The historical measured, indicated and inferred mineral resources use categories as defined by the Canadian Institute of Mining, Metallurgy and Petroleum CIM Definition Standards on Mineral Resources and Mineral Reserves

A qualified person has not done sufficient work to classify the historical estimate as a current mineral resource and the Company is not treating the historical estimate as a current mineral resource. Additional work including some re-sampling of historical intervals and a review of the geological model, is ongoing to verify the historical resource estimate.

Qualified Person

All scientific and technical information contained in this news release has been reviewed and is approved by Graeme Lyall (FAusIMM Nº224791), non-executive Director at Highlander Silver Corp, who serves as the qualified person (QP) under the definitions of National Instrument 43-101.

About Highlander Silver

Highlander Silver Corp., backed by the Augusta Group, Lundin Family members & affiliates and Eric Sprott, is a mineral exploration company focused on the discovery of exceptional silver-gold-polymetallic projects in the Central Andes, leveraging the team's significant technical and operational experience in Peru and South America more widely. Currently the Company is developing the La Estrella project in central Peru. The Company is listed on the Canadian Securities Exchange ("CSE") under the ticker symbol HSLV and additional information about Highlander Silver and its mineral projects can be viewed on the Company's SEDAR+ profile at (www.sedarplus.ca) and its website at www.highlandersilver.com.

Neither the CSE nor the Canadian Investment Regulatory Organization accepts responsibility for the adequacy or accuracy of this news release.

For further information, please contact:

David Fincham

Chief Executive Officer

Highlander Silver Corp.

(604) 283 7630

info@highlandersilver.com

Forward - Looking Information

Certain information contained in this news release constitutes "forward-looking information" under Canadian securities legislation. This includes, but is not limited to the belief that the San Luis deposit is one of the highest-grade gold-silver deposits of its size that is yet to be mined in the world; information or belief that there is exceptional discovery potential on this large, partially explored property; that there are numerous compelling exploration targets based on previous field mapping and rock chip sampling, and we are confident that systematic exploration will likely produce several more; that the Company plans to undertake work to verify and update the historical estimates as a priority; that the Company may pay up to an additional US$37,500,000 in cash to SSR Mining as Contingent Consideration upon completion of certain milestones being completed in relation to the San Luis Project. Such forward looking information or statements can be identified by the use of words such as "anticipates", "plans", "suggests", "targets" or "prospects" or variations (including negative variations) of such words and phrases, or state that certain actions, events or results "will" be taken, occur, or be achieved. Forward-looking information involves known and unknown risks, uncertainties, and other factors which may cause the actual results, performance, or achievements of the Company and/or its subsidiaries to be materially different from any future results, performance, or achievements expressed or implied by the forward-looking information. Such factors include, among others, general business, economic, competitive, political and social uncertainties, uncertainty relating to the geologic potential of the project, and risks relating to the Company. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that could cause actions, events or results to differ from those anticipated, estimated or intended. Forward-looking information contained herein are made as of the date of this news release. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. The Company undertakes no obligation to update forward-looking information if circumstances or management's estimates or opinions should change, except as required by applicable securities laws. Accordingly, the reader is cautioned not to place undue reliance on forward-looking information.

SOURCE: Highlander Silver Corp.

View the original press release on accesswire.com