Over the past year, technological stocks have seen significant leaps and bounds, with substantial increases that far surpassed the tech-centric Nasdaq Index. Regrettably, PayPal Holdings, Inc. (PYPL) falls short of this success story, witnessing a slump of 26.3% over the past year.

In a further blow to the company, last month saw financial analysts downgrade PYPL, citing a variety of challenges from an increasingly competitive market to profitability pressures. Even Citigroup, despite maintaining a Buy rating for the PayPal shares, initiated a negative catalyst watch. The firm has grappled with downward pressure stemming from slower spending growth, unmet forecasts, and an industry rife with growing competitors.

Additionally, despite revealing ambitious plans focused on Artificial Intelligence (AI), PayPal finds itself unable to ignite substantial interest or excitement among investors.

For its fourth quarter 2023 guidance, PayPal projects net revenues to grow 6%-7% on a spot basis and 7%-8% FXN. GAAP EPS is expected to be $1.20, compared to $0.81 in the previous year period, while non-GAAP EPS is expected to grow 10% to $1.36, compared to $1.24 in the prior-year period.

Wall Street analysts forecast PYPL’s revenue and EPS to increase to $7.87 billion and $1.36, respectively, marking year-over-year growth of 6.6% and 9.9% for the quarter ended December 2023. PayPal managed to exceed these expectations in three out of four trailing quarters.

However, factors such as the current challenging macroeconomic scenario may pose substantial risks for the company. PayPal intends to announce fourth-quarter 2023 results on February 7. Investors might consider a cautious approach and await further updates before investing in PYPL stock. A detailed analysis of some of its core performance markers may prove insightful.

PayPal's Financial Performance: Analyzing Trends in Net Income, Revenue, Gross Margin and Key Metrics (20121-2023)

PayPal Holdings Inc.'s (PYPL) trailing-12-month Net Income has experienced both growth and fluctuations from March 2021 to September 2023.

- As of March 2021, the Net Income equated to $5.21 billion.

- The highest point was observed in March 2021 with a net income of $5.21 billion.

- On June 30, 2021, there was a deviation down to $4.87 billion and this trend continued until December 31st, 2021, where Net Income hit a low of $4.17 billion.

- Post-December 2021, PayPal's Net Income started declining for two quarters until it reached its lowest point at $2.05 billion on June 30, 2022.

- However, from this low, an uptick in earnings was noticeable with a gradual increase up to $2.42 billion by December 31, 2022.

- Continuing into 2023, amidst minor fluctuations, overall Net Income saw a positive trend. As of March 31, 2023, PayPal hit $2.71 billion, followed by a significant surge to $4.07 billion on June 30, 2023.

- Lastly, a slight dip was noticed, positioning the Net Income at $3.76 billion as of September 30, 2023.

The Net Income data for PayPal Holdings indicates a mix of highs and lows. Comparing the most recent data (September 2023 - $3.76 billion) with the initial figure of the series (March 2021 - $5.21 billion), it translates to a decline of about $1.45 billion. This represents an approximate decrease of 28%, suggesting a negative growth rate over the period under consideration.

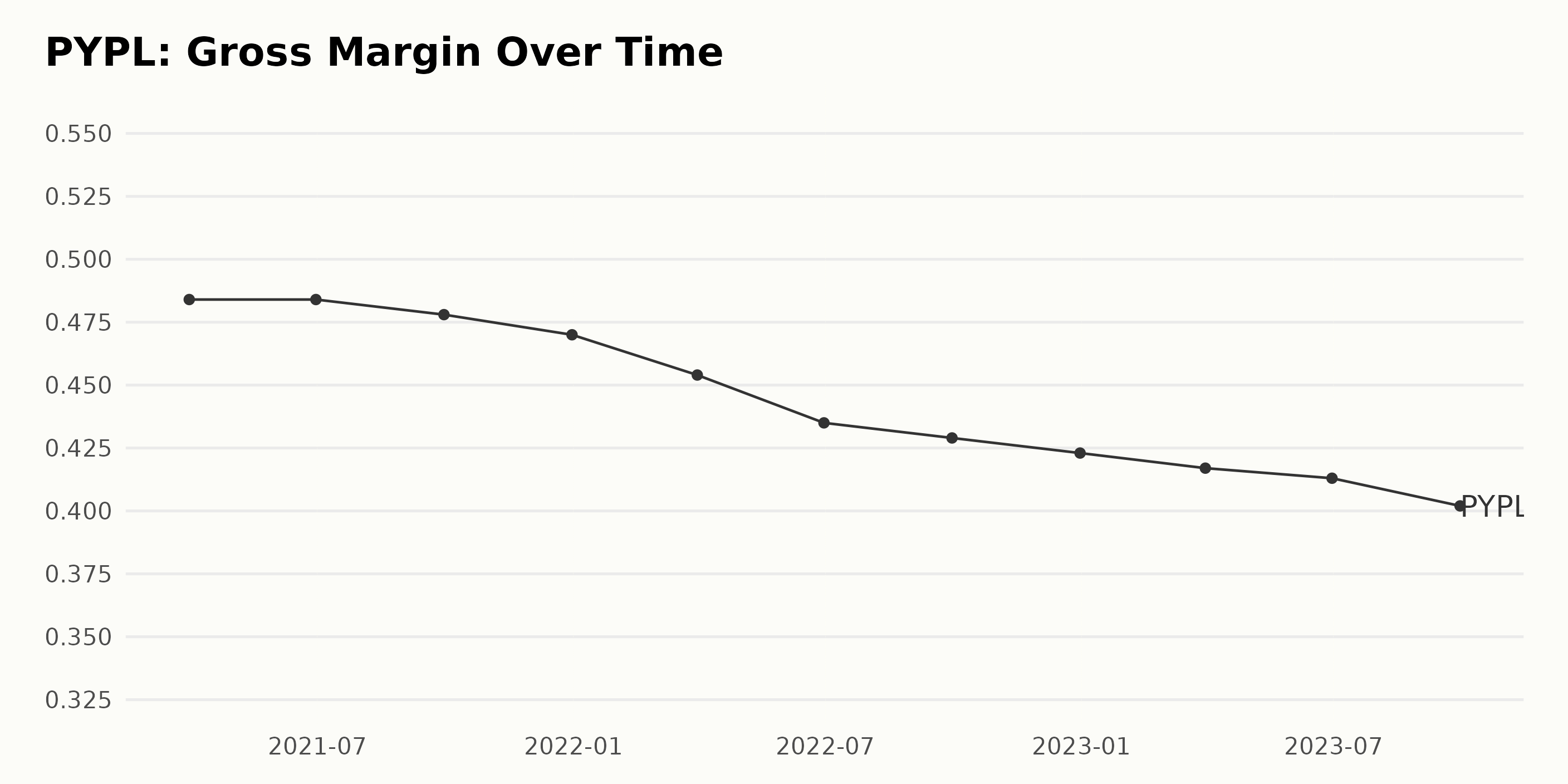

The Gross Margin for PayPal Holdings Inc. (PYPL) displayed in this dataset demonstrates a consistent downward trend over the time period provided. In simpler terms, the Gross Margin had been shrinking consistently. Here are key points to note:

- As of March 2021, it was reported at 48.4%, and it has been progressively declining since then.

- By the end of 2021, it reached down to 47.0% according to data from December 31, 2021.

- The Gross Margin saw further decrease in the year 2022 ranging from 45.4% in the first quarter (March-2022) to 42.3% by the end of the year (December-2022).

- In 2023, it dipped below the mid-40% mark, recording 41.7% in the first quarter (March-2023) and sliding to 40.2% by September 2023.

When comparing the first value (48.4% in March-2021) with the last value in the series (40.2% in September-2023), we can see an overall decline of 8.2 percentage points. This decline represents a drop of approximately 16.94% in the Gross Margin during this period.

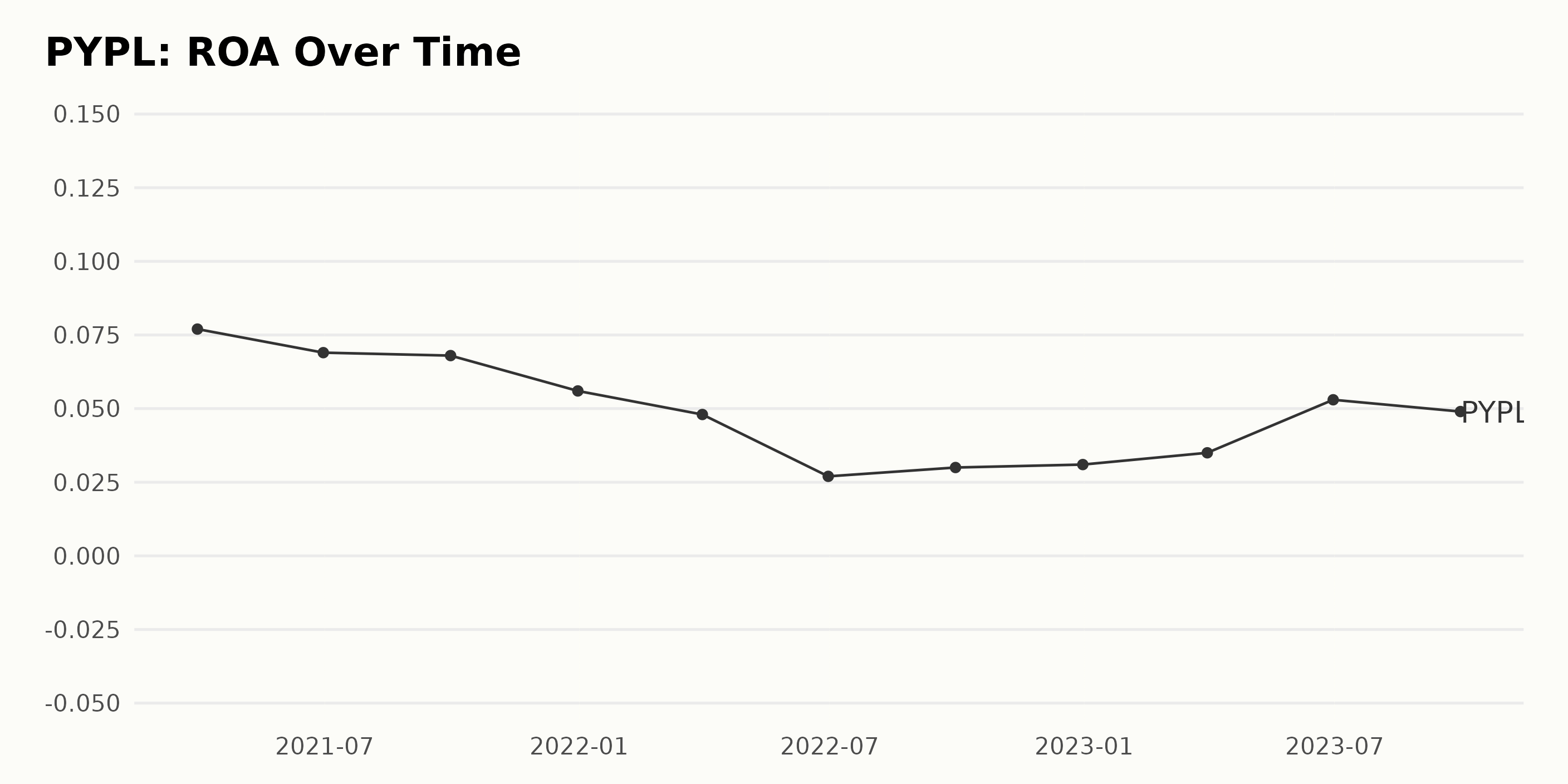

The series data represents the Return on Assets (ROA) of PayPal Holdings Inc. (PYPL) over a specified period. Notably, there has been a general downward trend in the company’s ROA since March 2021.

- On March 31, 2021, PYPL reported an ROA value of 0.077 or 7.7%.

- The ROA experienced subtle fluctuations between June 2021 and September 2021, decreasing slightly from 6.9% to 6.8%.

- BY the end of 2021, on December 31, there was a notable drop in ROA to 5.6%.

- In the first quarter of 2022, ending March 31, PYPL's ROA fell further to 4.8%. By mid-year (June 30, 2022), there was a more significant reduction, with the ROA being reported at 2.7%.

- However, there was a slight recovery in subsequent quarters with the ROA rising to 3.1% by December 31, 2022, and further to 3.5% by March 31, 2023.

- The highest increase was noted on June 30, 2023, with an ROA value reaching 5.3%, only to slightly decrease again to 4.9% in September 2023.

In summary, the most recent value on September 30, 2023 indicates a 4.9% ROA, a reduction compared to the first recorded value of 7.7% ROA on March 31, 2021. This reflects a total negative growth rate of around 36%, indicating a decreasing efficiency in using assets to generate profits during this period. Although recent data shows a modest increase in ROA from December 2022, the overall trend points to a decrease in performance over time.

The Analyst Price Target of PayPal Holdings Inc. (PYPL) as provided in the data series displays a general downward trend from November 2021 to January 2024, experiencing various fluctuations within this timeframe. Here is a brief summary of this trend:

- Starting from an Analyst Price Target valuation of $283.54 in November 2021, the target price experienced an initial decrease dropping to $272.79 in December 2021.

- A steep decline is observed from January 2022 ($268.97) to May 2022 ($128.26), falling by more than half its value in just five months.

- The lowest point in this period appears in July 2022, where the Analyst Price Target fell to $115. However, we see an uptick till September 2022, peaking at $123.79 before it begins to decrease again.

- The data series ends with the Analyst Price Target at its lowest point yet at $71 in January 2024, which is significantly less than the starting value.

In terms of growth rate, calculated by the last value relative to the first value, there's a massive contraction of 75%. This indicates a significant diminishing optimism among analysts regarding the company's future stock price over these years.

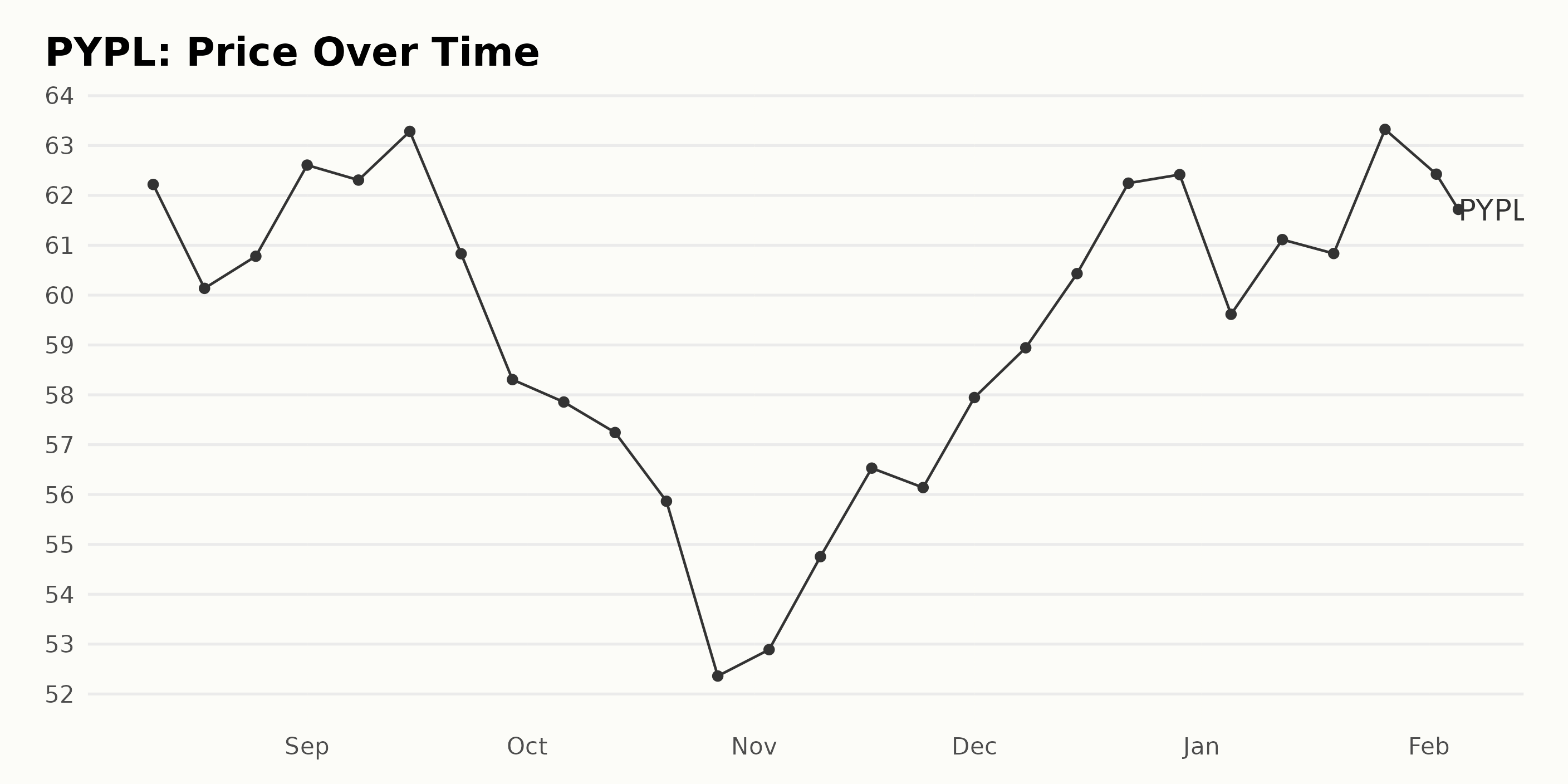

Analyzing Trends in PayPal Holdings Inc.'s Share Price from August 2023 to February 2024

Analyzing the data provided, the trend and growth rate for the share price of PayPal Holdings Inc. (PYPL) from August 2023 to February 2024 can be described as follows:

- From August 11, 2023, to August 18, 2023, there was a slight decrease in the price from $62.22 to $60.14. This indicates a downward trend in the share price.

- Subsequently, between August 18, 2023, and September 15, 2023, the share price exhibited an upward trend, pricing in at $63.28 on September 15, 2023.

- However, this upward trend began to decelerate starting September 15, 2023, reaching its lowest point of $52.36 by October 27, 2023.

- From the end of October 2023, there was a steady recovery, with the share price peaking at $63.32 January 26, 2024. This suggests a clear accelerating trend in the final months of 2023 into the beginning of 2024.

- In the last span of time available, from January 26, 2024, to February 5, 2024, the share price reveals a mild decline, dropping from $63.32 to $61.72. This represents a slight deceleration in the previously identified growing trend.

In conclusion, the overall fluctuating pattern of PayPal's share price reflects alternating stages of growth and decline throughout this period. Despite periods of deceleration and declines, the general trend from late 2023 into early 2024 was upward or growing, reflecting resilience in the stock's performance. Here is a chart of PYPL's price over the past 180 days.

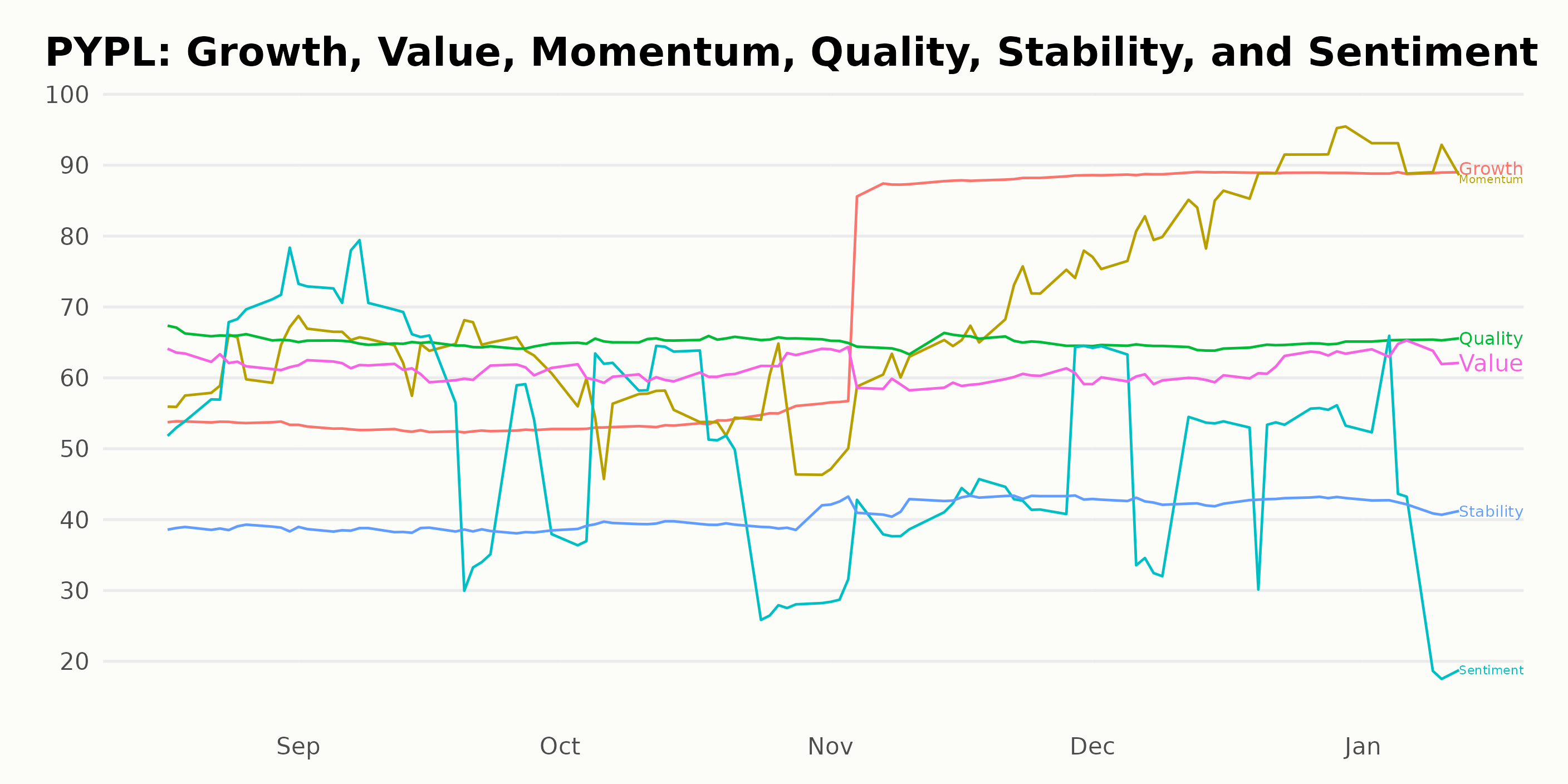

Analyzing Growth, Momentum, and Quality of PayPal Holdings from August 2023 - January 2024

PYPL has an overall C rating, translating to a Neutral in our POWR Ratings system. It is ranked #19 out of the 45 stocks in the Consumer Financial Services category.

Analyzing the POWR Ratings data for PayPal Holdings Inc. (PYPL) across six dimensions from August 2023 to January 2024, there are apparent findings in three dimensions that are significant.

Firstly, it's noteworthy that the Growth dimension saw a substantial increase in ratings. In August 2023, it was poised at 54, slightly decreasing to 53 in September 2023 and then slightly increasing back to 54 in October 2023. However, it made a significant leap in November 2023 to a rating of 83 and even further to 89, both in December 2023 and January 2024.

Secondly, Momentum is an area of focus, with a particular noteworthy upward trend. As of August 2023, it posted a rating of 61. This increased slightly to 65 in September 2023, steadied to 55 in October 2023, and made a substantial jump to 65 in November 2023. The real surge occurred in December 2023, where it hit 85, further spiking to a whopping 91 in January 2024.

Lastly, Quality has shown consistent stability with a persistent rating of 65 from August 2023 to January 2024. While no clear upward or downward trend is visible in this dimension, its consistent stability is significant and indicates the reliability of PayPal Holdings Inc. as an asset.

How does PayPal Holdings Inc. (PYPL) Stack Up Against its Peers?

Other stocks in the Consumer Financial Services sector that may be worth considering are Regional Management Corp. (RM), EZCORP Inc. (EZPW), and 360 Finance, Inc. (QFIN). These stocks are rated A (Strong Buy).

What To Do Next?

43 year investment veteran, Steve Reitmeister, has just released his 2024 market outlook along with trading plan and top 11 picks for the year ahead.

PYPL shares were trading at $63.27 per share on Tuesday afternoon, up $1.73 (+2.81%). Year-to-date, PYPL has gained 3.03%, versus a 3.66% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics.

The post PYPL Earnings Watch: Strategies for Smart Investors appeared first on StockNews.com