Google’s parent company, Alphabet Inc. (GOOGL), celebrated its 25th anniversary this year with solid momentum across its verticals, especially its cloud business. In its third-quarter results, GOOGL reported a $266 million Google Cloud operating revenue, compared to a loss of $440 million in the year-ago quarter.

The company is focused on making Artificial Intelligence (AI) accessible and helpful for its customers. This month, GOOGL introduced Gemini, its most capable and general AI model. Moreover, JPMorgan is bullish on Gemini and projects the technology to bridge the AI gap. Furthermore, the bank expects the company’s gross revenue to grow by 11% in 2024.

Given such conductive prospects, let’s look at the trends of GOOGL’s key financial metrics to understand why it could be wise to invest in the stock now.

Alphabet Inc.'s Financial Trend Analysis: Observations and Insights (2020 - 2023)

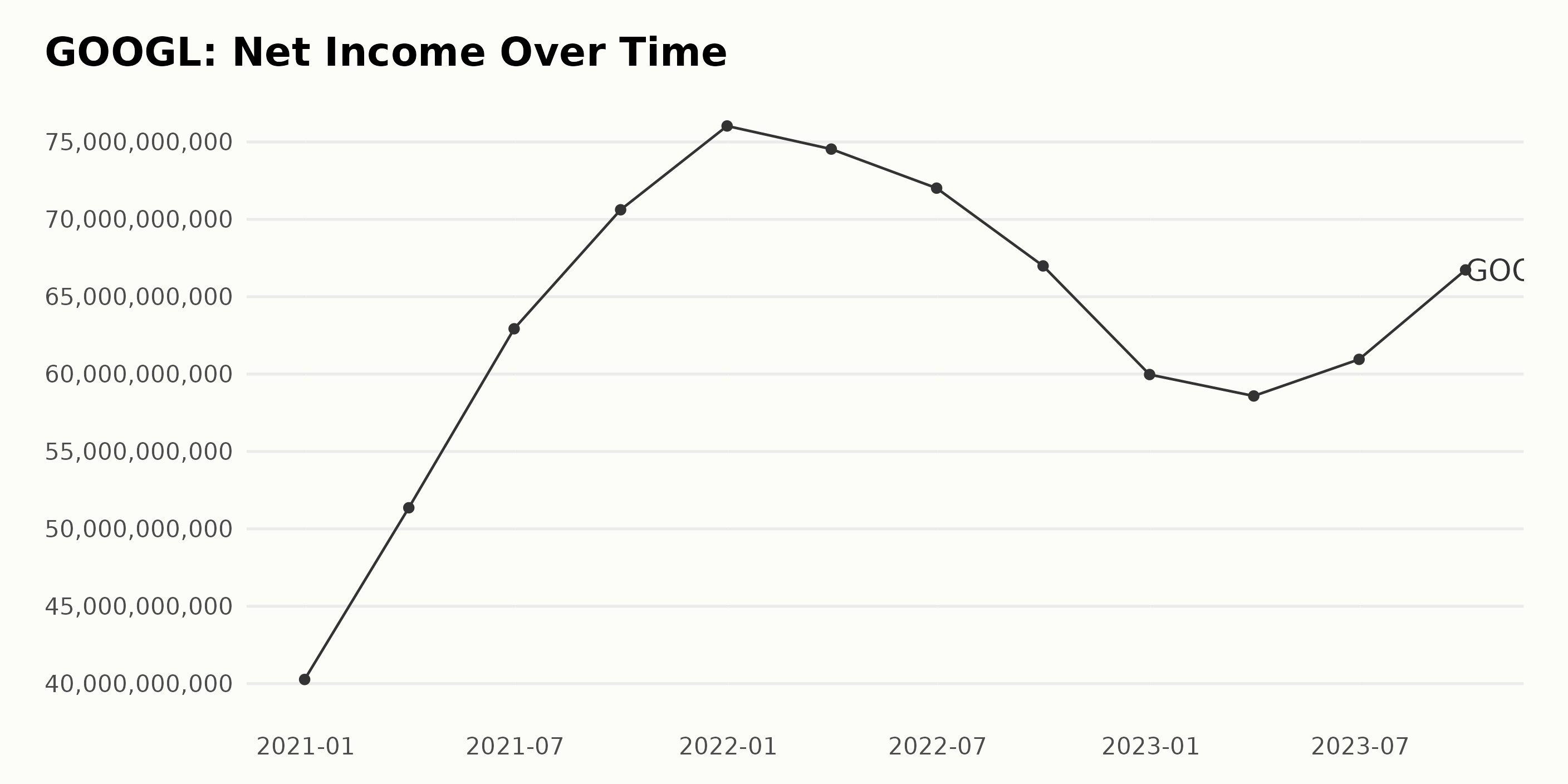

The data series presents the trailing-12-month net income trend and fluctuations of GOOGL over the span of 2020 to 2023. Here's a summarized trend analysis:

- On December 31, 2020, GOOGL recorded a net income of $40.27 billion.

- A steady increment is observed through September 2021, peaking at $70.62 billion, representing a growth of approximately 75% from the initial value.

- The net income then experienced a minor dip to $76.03 billion by the end of 2021 but still showcased an overall upward trajectory.

- However, a moderate downward trend was observed in 2022, with the net income falling to $59.97 billion on December 31, thereby indicating some business cyclicality.

- In the first half of 2023, the net income slightly recovered to $60.95 billion by the end of June 2023.

- By the end of the third quarter of 2023, a noticeable rebound occurred, with the net income rising to $66.73 billion, demonstrating the resilient income-generating capacity of GOOGL.

Overall, despite short-term fluctuations, GOOGL showed considerable growth in net income from 2020 to 2023. The significant drop in 2022 was addressed effectively in 2023, signaling the strength and flexibility of the company’s earnings.

Calculating the growth rate from December 31, 2020 ($40.27 billion) to September 30, 2023 ($66.73 billion), there is roughly a 66% increase in net income.

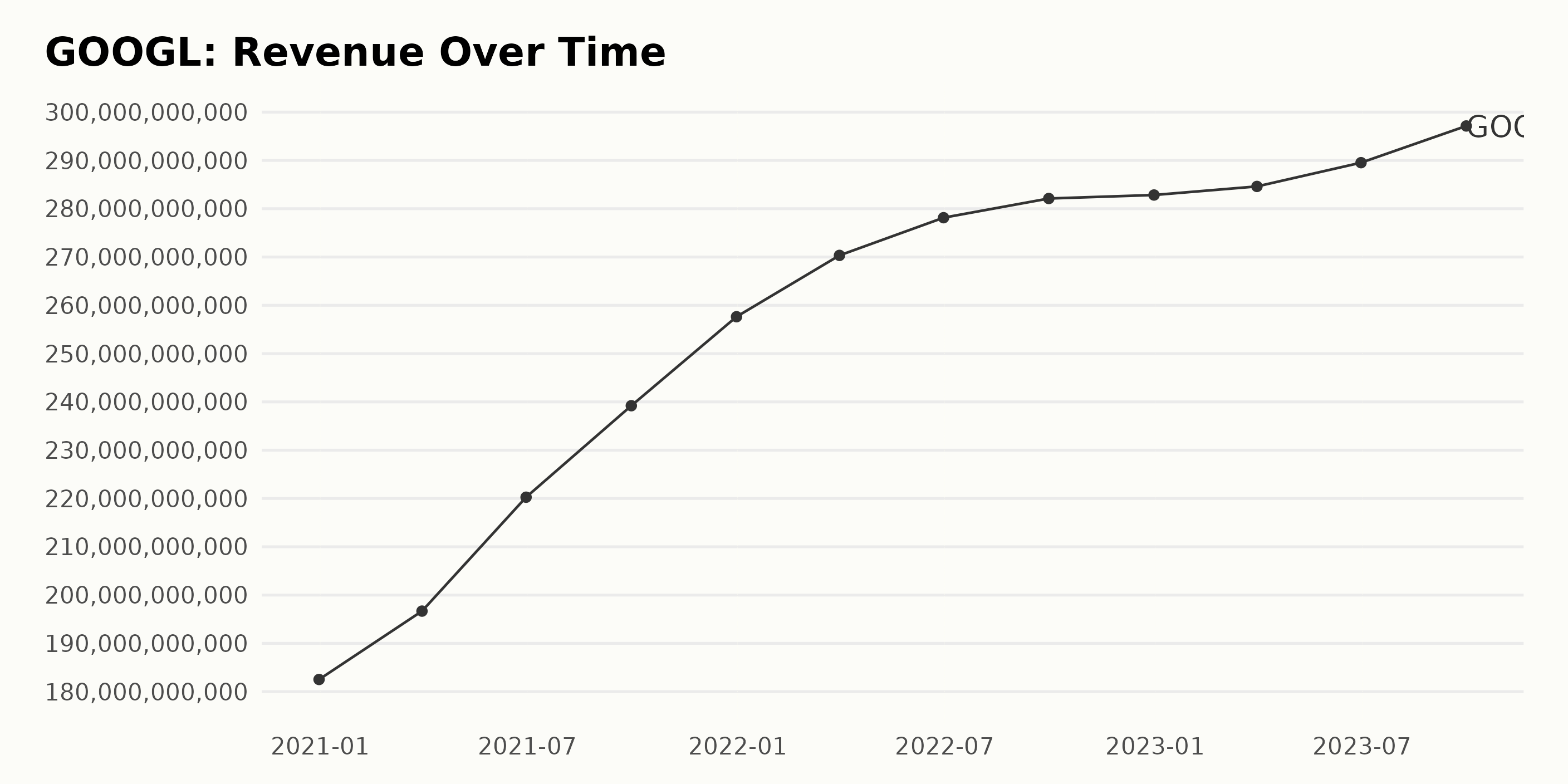

Analyzing the trailing-12-month revenue data of GOOGL, the following trends and fluctuations are observed: There is a consistent upward trend in GOOGL's revenues over the past few years. Starting at $182.53 billion in December 2020, revenues grew to $297.13 billion as of September 2023. Revenue growth highlights:

- In the first quarter of 2021, revenue reported was $196.68 billion, a remarkable growth from $182.53 billion at the end of 2020.

- By the end of the second quarter of 2021, revenue increased significantly to $220.26 billion.

- A notable hike was observed by the third quarter of 2021, with revenue reaching $239.21 billion.

- The revenue maintained its increasing trend in the fourth quarter of 2021, reporting $257.64 billion.

- The first and second quarters of 2022 saw revenue figures expand to $270.33 billion and $278.14 billion, respectively.

- Despite a slight slowdown in growth in the third quarter of 2022 ($282.11 billion), there was only a minimal increase in the fourth quarter of 2022($282.84 billion).

- In the first three quarters of 2023, there was a steady rise in revenue to $284.61 billion (first quarter), $289.53 billion (second quarter) and $297.13 billion (third quarter).

While the data series indicates minor fluctuations within individual quarters, the overall long-term trend points toward substantial growth. Based on this trend, GOOGL seems to be in a healthy financial position with sustained revenue growth. From the initial revenue in December 2020 to the last reported revenue in September 2023, the growth rate is approximately 63%.

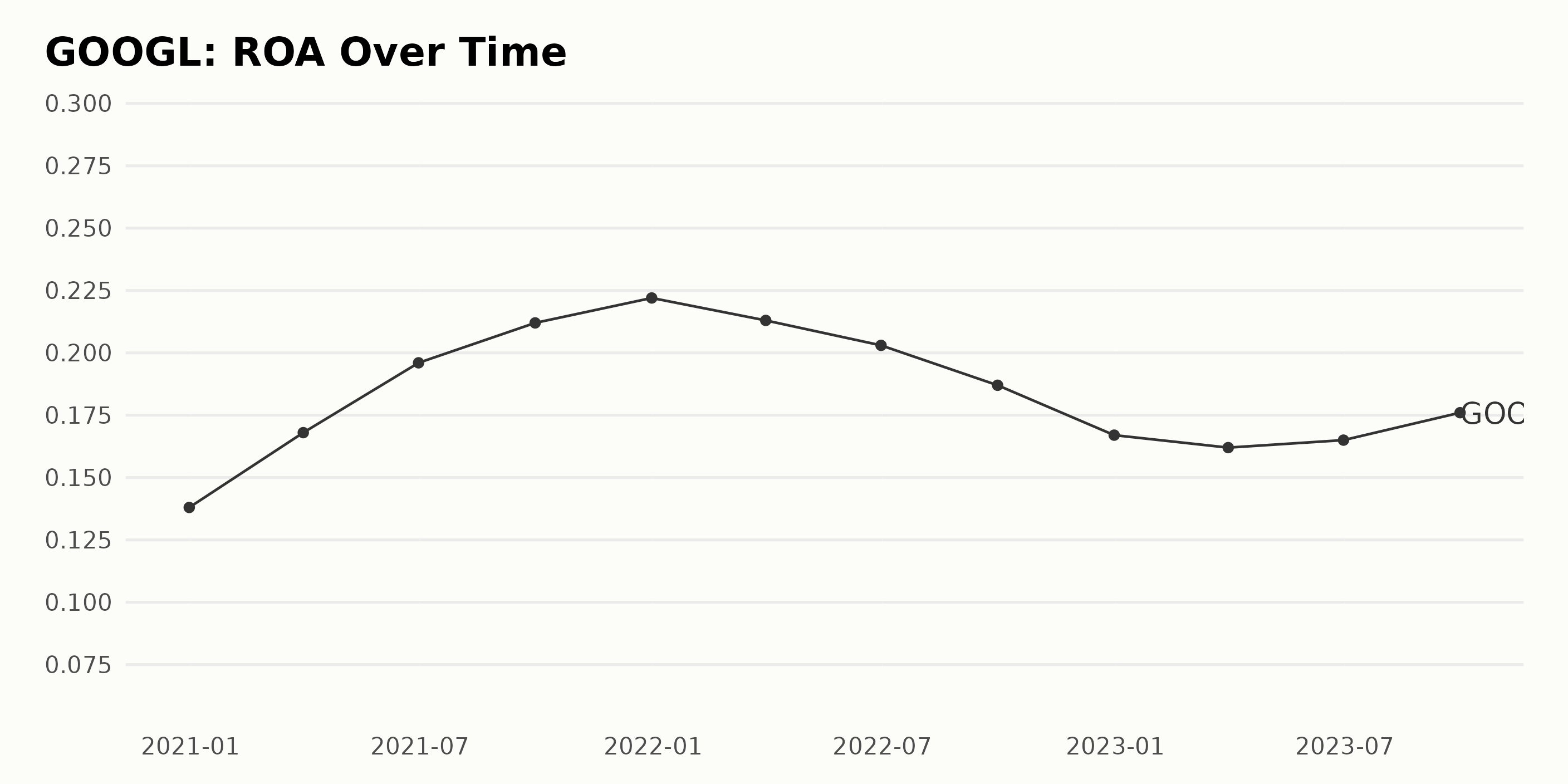

The data provided shows the trend and fluctuations in the Return On Assets (ROA) performance of GOOGL over a span of approximately three years, from December 2020 to September 2023. Key observations from the data include:

- In December 2020, GOOGL's ROA stood at 13.8%, which continued to rise over the following quarters, hitting a peak of 22.2% in December 2021.

- This upward trend implies a steady growth in efficiency, with GOOGL using its assets to generate profits during this period.

- However, post-December 2021, there has been a consistent decline in ROA, falling to a low of 16.2% by March 2023.

- From March 2023 onwards, GOOGL's ROA has seen a slight revival, reaching 17.6% as of September 2023.

To calculate the growth rate, comparing the last value of Alphabet's ROA (17.6% in September 2023) with its first value (13.8% in December 2020), we see an increase of approximately 28%. This indicates an overall positive growth during this period, despite some intermediate fluctuations.

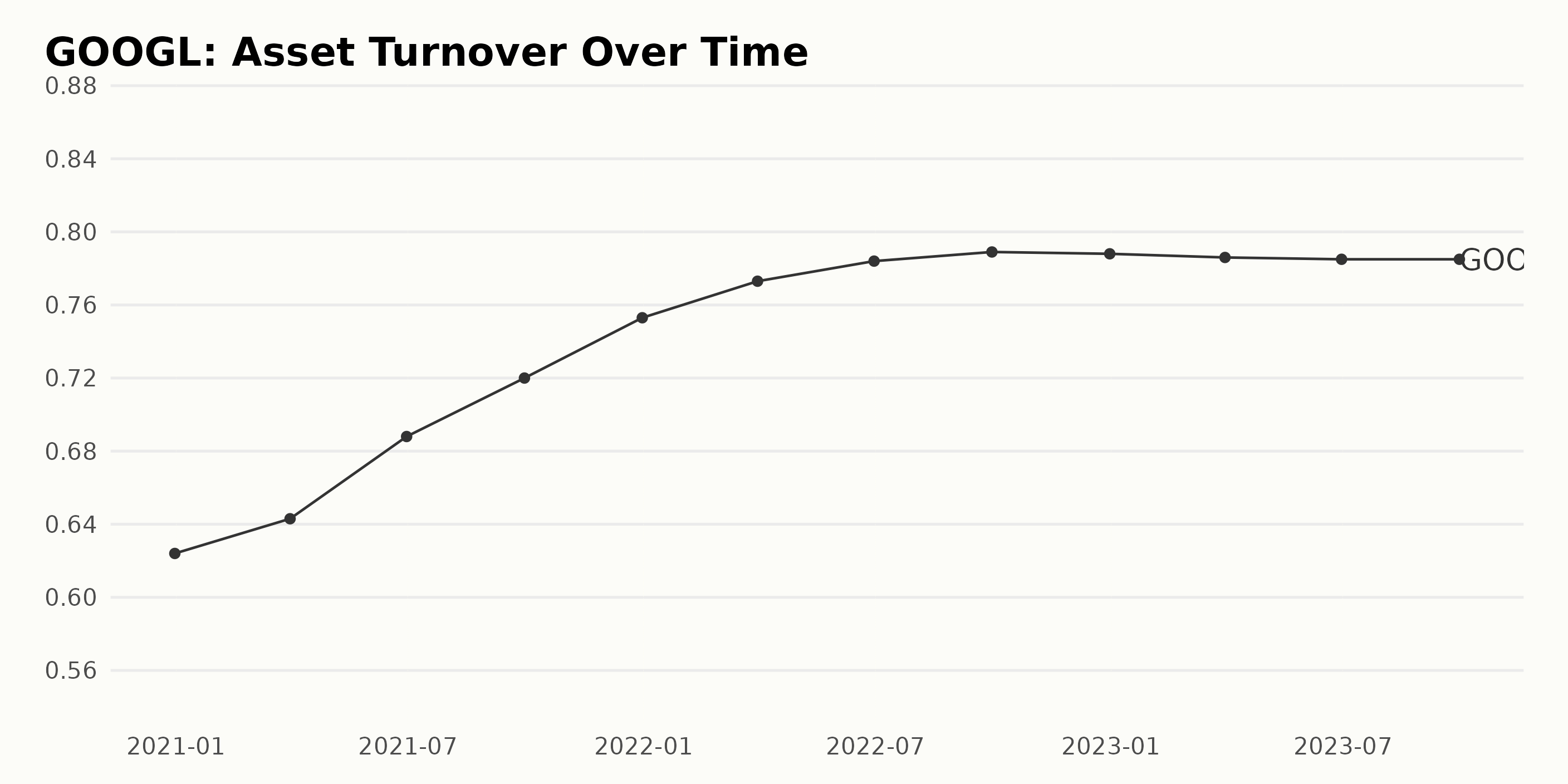

Based on the series of data provided:

- GOOGL's asset turnover showed a steady upward trend from the end of 2020 to the end of 2022.

- From December 31, 2020, with an asset turnover of 0.624, the value consistently increased, reaching 0.789 by September 30, 2022. This corresponds to a growth of approximately 26.44% over this period, reflecting improved efficiency in using its assets to generate revenue.

- However, the last quarter of 2022 saw a minor dip to 0.788. Further, the first three quarters of 2023 demonstrated a slight but consistent decrease in asset turnover, ending at 0.785 on September 30, 2023.

- The overall growth rate from December 31, 2020 to September 30, 2023 was approximately 25.80%.

While there's been significant growth in GOOGL's asset turnover since late 2020, the recent trend suggests a marginal slowdown in this growth. It will be necessary to monitor the following periods to determine if this becomes a consistent pattern.

Alphabet Inc.'s Upward Trend Amid Volatility: An Analysis of 2023 Performance

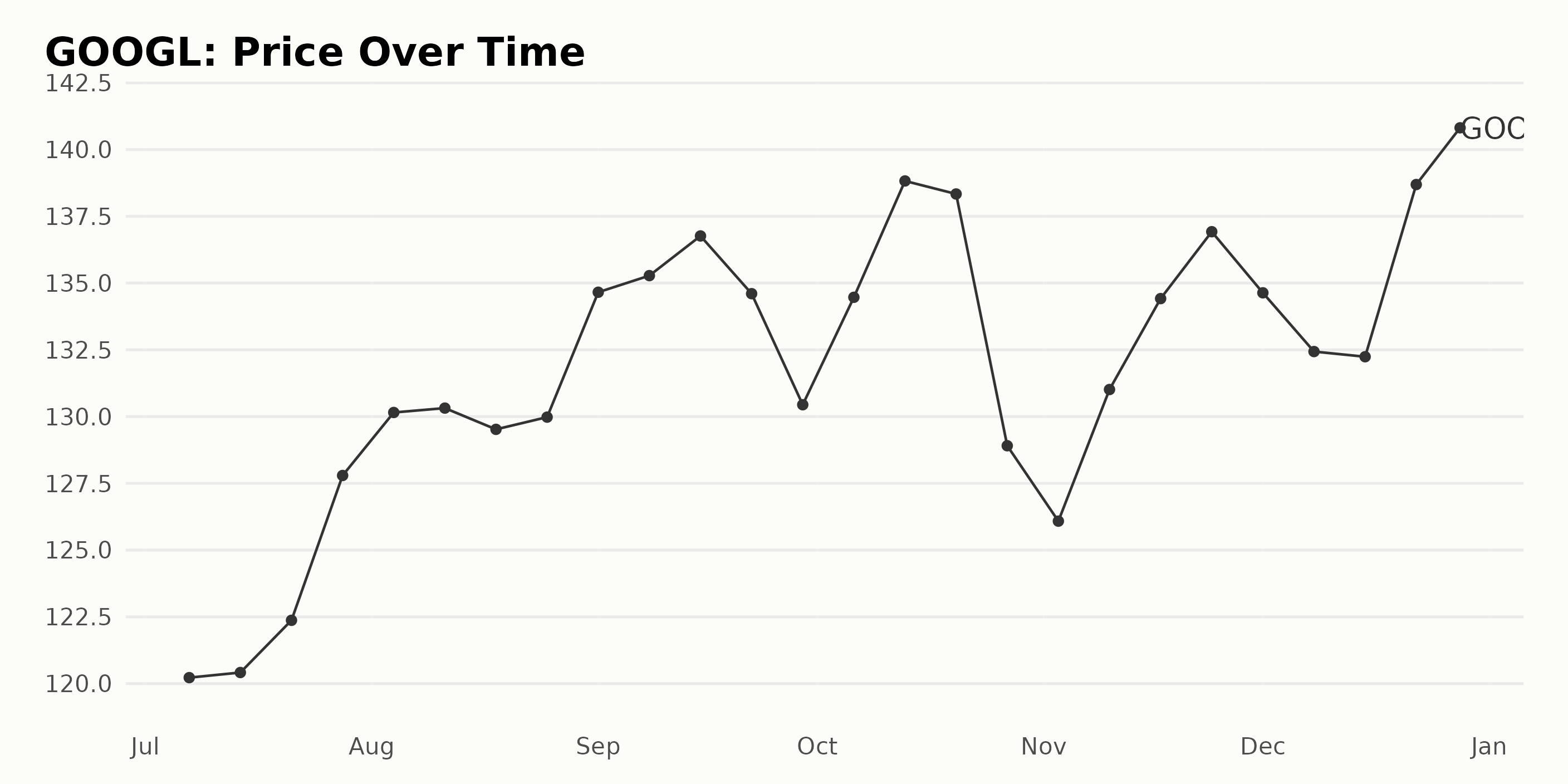

Analyzing the data provided, an overall upward trend in GOOGL share prices can be observed from July 2023 to December 2023, with some slight fluctuations during the period:

- The share price began at $120.22 on July 7, 2023.

- After a series of minuscule increases, the price reached $130.15 on the week ending August 4, 2023, resulting in an almost steady growth rate for July 2023.

- An unusual drop was experienced on the week ending August 18, 2023, with the price dropping to $129.52. However, it quickly recovered and climbed to $134.66 by September 1, 2023.

- The highest share price for September occurred on September 15, with a value of $136.77. Soon after, the share price took a hit on September 29, when it dropped to $130.44, but rebounded back to $134.47 on October 6, 2023.

- Another leap in price was observed on October 13, 2023, with the share price reaching $138.83. This was followed by a somewhat significant drop toward the end of October, falling to $128.91 on October 27, 2023.

- November 2023 showed a recovery period as GOOGL's share price rose consistently to close the month at $136.93.

- Although there was a slight downward trend at the start of December 2023, GOOGL bounced back to end the year at its highest value in the period studied, $140.23, on December 28, 2023.

In summary, this portrays a moderately volatile journey for GOOGL. The overall trend is upward, although the increases and decreases in share price are not uniform week to week. This indicates periods of accelerated and decelerating trends in the growth rate. The general trajectory, however, is clearly upwards. Here is a chart of GOOGL's price over the past 180 days.

Alphabet Inc.'s Noteworthy Performance: Quality, Sentiment, and Momentum Analysis (July-December 2023)

The POWR Ratings grade of GOOGL in the 56-stock Internet category has generally been consistent throughout the period from July to December 2023 based on the provided data. Here is a detailed breakdown:

From July to October 2023, the POWR grade remained steady at B (Buy). The rank within the Internet stock category was fluctuating. However, it showed positive progress in the ranks, improving slowly from #11 to #4 as we approached the end of October 2023.

At the beginning of November 2023, GOOGL's POWR grade experienced a brief increase to A (Strong Buy) but moved back down to B (Buy) within the week. Again, on November 25, 2023, GOOGL's POWR grade shifted up to A (Strong Buy), which lasted until mid-December with a consistent position of #3 in the category.

However, by the end of December 2023 (December 29), the POWR grade was reassessed back to B (Buy), and its ranking slipped slightly to #4 in the Internet category out of a total of 56 stocks. Key points are:

- GOOGL's highest ranking within the category was #3, which it achieved for the first time in November 2023 when its POWR grade was A (Strong Buy).

- Despite some variations, GOOGL's grade remained stable at B (Buy) and A (Strong Buy) and never fell below these grades.

- The company's latest POWR Grade as of December 29, 2023, is B (Buy), with its current position being #4 in the Internet category.

Overall, GOOGL demonstrated a strong performance within the Internet category throughout the second half of 2023.

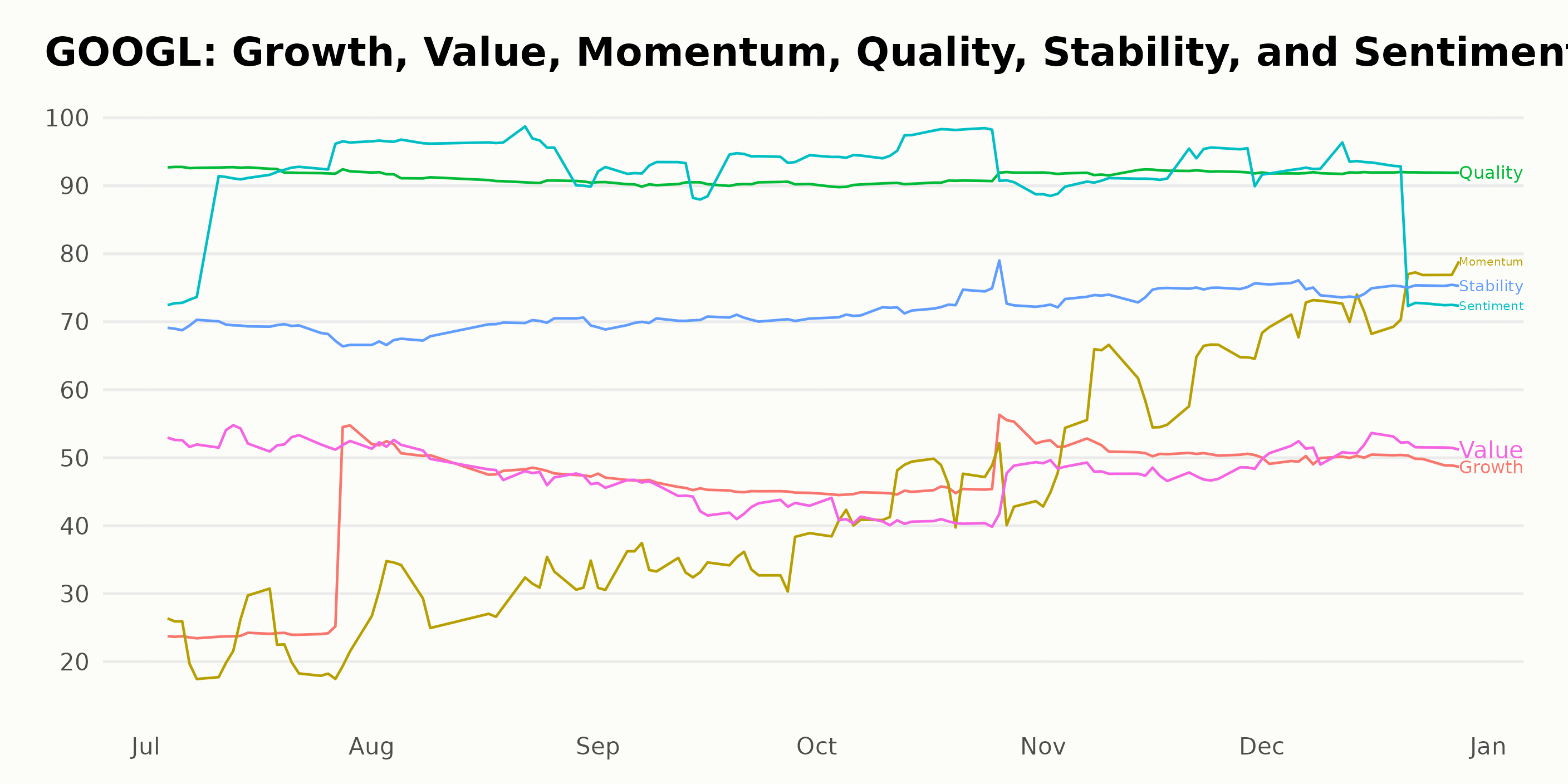

Based on the POWR Ratings data, GOOGL has shown varying dynamics across multiple dimensions from July to December 2023. After careful analysis, the three most noteworthy dimensions are Quality, Sentiment, and Momentum.

Quality: The Quality dimension consistently received the highest rating across the entire period. It started with a score of 92 in July 2023 and slightly fluctuated between 90-92 over the next five months. Despite the slight variation, the Quality score remained in the 90s range, indicating that GOOGL consistently shows strong operation capacity and robust profitability.

Sentiment: Following closely behind Quality, the Sentiment dimension also demonstrated high ratings. This dimension presented an upward trend, peaking at 95 in August and October 2023 before ending at 87 in December 2023. These strong sentiments suggest a positive market perception toward GOOGL.

Momentum: Although not as high as the previous two dimensions, Momentum showed an increasing trend, which is particularly noteworthy. Starting at a moderate rating of 22 in July 2023, the Momentum score improved significantly over the months, reaching 73 by December 2023. This steady increase hints at an ongoing positive trend in GOOGL’s share price performance during this period.

From these trends, it appears that GOOGL is performing well in terms of Quality, Sentiment, and Momentum, according to the POWR Ratings.

How does Alphabet Inc. (GOOGL) Stack Up Against its Peers?

Other stocks in the Internet sector that may be worth considering are Yelp Inc. (YELP), Meta Platforms, Inc. (META), and Travelzoo (TZOO) - they have an A (Strong Buy) or B (Buy) grades. Click here to explore more stocks in the Internet sector.

What To Do Next?

Discover 10 widely held stocks that our proprietary model shows have tremendous downside potential. Please make sure none of these “death trap” stocks are lurking in your portfolio:

GOOGL shares were trading at $139.20 per share on Friday afternoon, down $1.03 (-0.73%). Year-to-date, GOOGL has gained 57.77%, versus a 25.88% rise in the benchmark S&P 500 index during the same period.

About the Author: Anushka Dutta

Anushka is an analyst whose interest in understanding the impact of broader economic changes on financial markets motivated her to pursue a career in investment research.

The post Alphabet (GOOGL) 2024 Stock Analysis: What Should Investors Expect? appeared first on StockNews.com