Stocks are once again flirting with the highs of the year at 4,600 on the S&P 500 (SPY). And yes, will likely crack above given the positive seasonal effects that comes with typical Santa Claus rally.

Even better than that is that FINALLY investors are taking profits on bloated technology and mega cap positions. This money is being rotated to deserving small and mid cap stocks that have woefully underperformed to this point in 2023.

This is the best news for investors going into 2024. More on why that is the case in this week’s edition of the Reitmeister Total Return commentary below...

Market Commentary

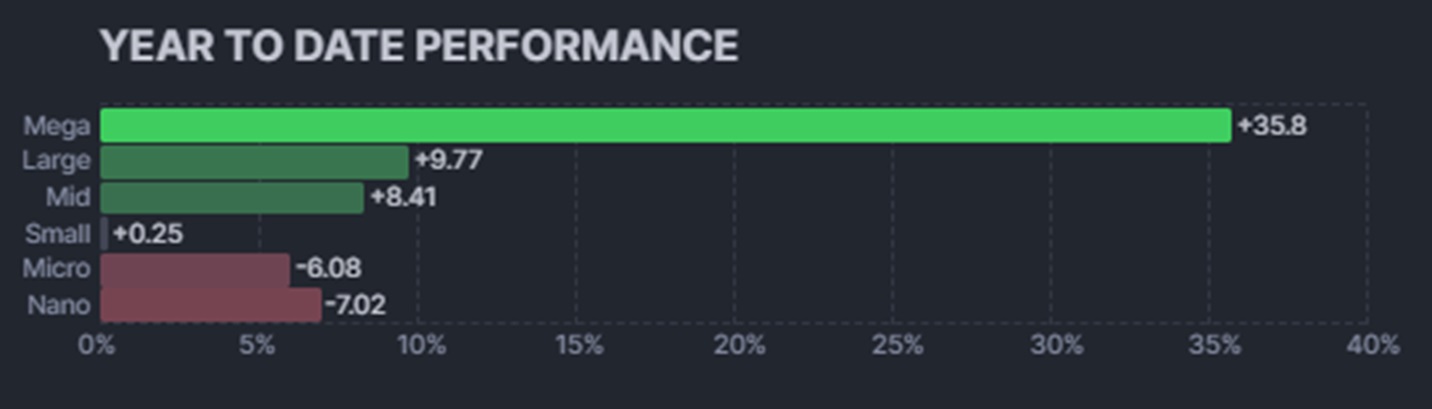

If a picture is worth a thousand words...then let this chart speak loudly about what was wrong with the 2023 stock market:

As noted by myself and many other market commentators, the 2023 bull market was a bit of smoke and mirrors. That’s because almost all the gains really accrued to the mega cap technology stocks like Tesla, Nvidia, Apple, Microsoft etc. That explains the extreme gains for that mega cap bar above versus tepid gains and even losses for the broader market.

It’s one thing for mega caps to lead and others modestly lag. But the nearly non-existent gains for small caps is quite troubling. That’s because history shows that small caps outperform over time because they grow earnings faster and that is rewarded with higher share prices. Heck, that hasn’t been true for 4 years.

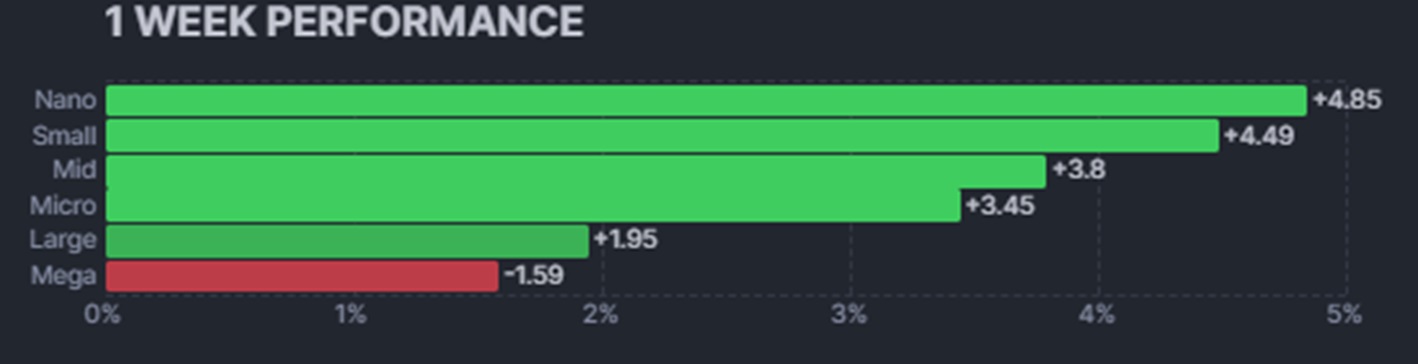

Thus, the chart below for the past week is a VERY welcome relief:

Not only are smaller stocks leading the way, but profits are actually being trimmed from these bloated mega cap positions. This is the rotation we have all been waiting for which signals that this bull market is for real...and has legs to run further ahead in the coming year.

But to be clear, it won’t be the S&P 500 having a banner year in 2024. I suspect that 5,000 will be the year end target which calls for modest single digit returns.

Instead, it will be the overlooked small and mid caps leading the way. Where those market indices may show 2-3X the gains of their large cap peers as they play catch up.

The good news is that the POWR Ratings is exceptionally good at uncovering the best of those smaller stocks that typically fly under the radar. And that will be a big part of our advantage in the coming year.

The only thing that could derail that is, of course, growing signs of a recession. Meaning what if the Fed overstays their welcome and creates a recession before rates start heading lower?

This was the fear that led to the bear market of 2022 because history showed that recession was the most likely outcome from such an aggressive rate hiking regime. Oddly, but gladly, this time was different. That being the millions of workers who chose early retirement during Covid which made the employment market incredibly resilient.

Basically anyone who really wanted a job could find one with a record breaking 10,000,000 job openings posted. And as history shows, as long as consumers have jobs and money in their pocket...they will spend it.

This is what propped up the economy in 2023...leading to no recession and return of the bull market. As long as that picture of economic health remains...so too does bullish stock market conditions. But again, the 2024 playbook calls for a different group of stocks to lead the way unlike 2023.

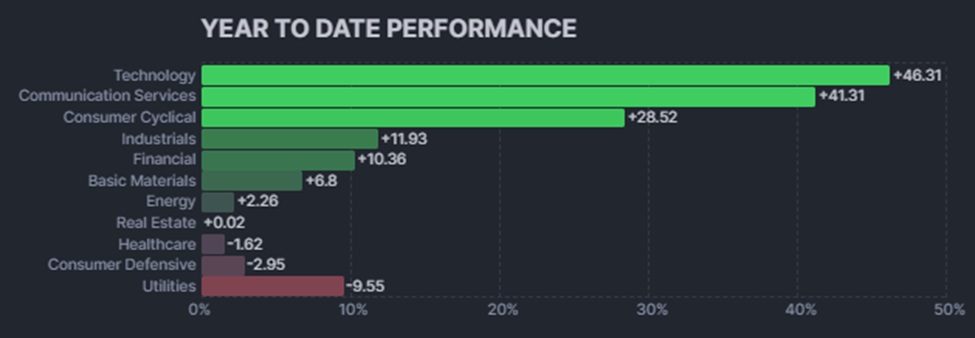

That also includes a rotation in the sectors that investors will be attracted to. Here is the year to date 2023 sector performance breakdown:

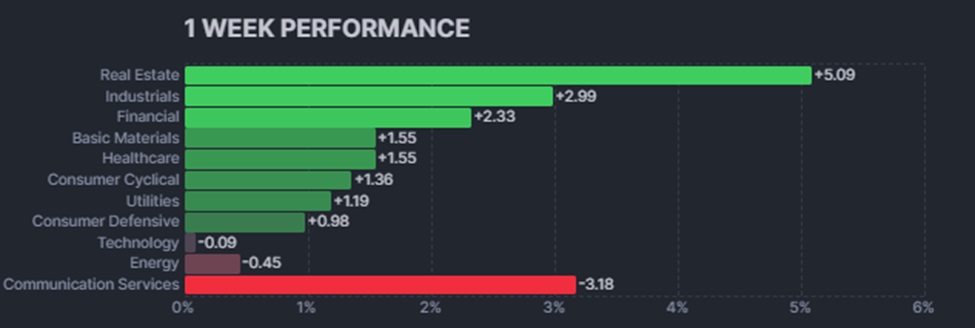

And here is just the past week further showing the rotation that is taking place:

Real estate is leading the way because rates are going lower making loans less expensive. There probably is more upside there, but I think it’s the next 3 groups that should see continued upside: Industrials, Financials, Basic Materials and probably at some point Energy will join that party.

Putting it altogether, 2023 was a good year for investors...but an odd one given the extreme underperformance from small caps. This sets up 2024 as a superior investment year for the average individual investor if you look in the right spots.

Hopefully the information above helps you focus in on those right spots going forward. Also the top picks discussed in the next section should help you outperform in the year ahead.

What To Do Next?

Discover my current portfolio of 7 stocks packed to the brim with the outperforming benefits found in our exclusive POWR Ratings model.

Plus I have added 4 ETFs that are all in sectors well positioned to outpace the market in the weeks and months ahead.

This is all based on my 43 years of investing experience seeing bull markets...bear markets...and everything between.

If you are curious to learn more, and want to see these 11 hand selected trades, then please click the link below to get started now.

Steve Reitmeister’s Trading Plan & Top Picks >

Wishing you a world of investment success!

Steve Reitmeister…but everyone calls me Reity (pronounced “Righty”)

CEO, StockNews.com and Editor, Reitmeister Total Return

SPY shares were trading at $456.73 per share on Tuesday afternoon, up $0.04 (+0.01%). Year-to-date, SPY has gained 20.75%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks.

The post VERY Healthy Stock Rotation Underway appeared first on StockNews.com