Prominent software industry player Oracle Corporation (ORCL) is set to release its fiscal 2024 second-quarter results next week. In the last reported quarter, the company’s total revenues increased about 9% year-over-year to $12.45 billion. However, the topline figure missed the analyst estimate of $12.47 billion. Non-GAAP EPS came in at $1.19 per share, compared with estimates of $1.15.

Despite the topline miss, the rise in Artificial Intelligence (AI) adoption could boost ORCL’s cloud infrastructure business. Larry Ellison, Chairman and CTO, stated that AI development companies have signed contracts to purchase more than $4 billion of capacity in ORCL’s Gen2 Cloud, twice as much as the bookings at the end of the fourth quarter.

Given this scenario, let’s look at the trends of ORCL’s key financial metrics to understand why it could be wise to invest in the stock now.

Fluctuating Financial Fortunes: Tracking Trends in Oracle's Key Metrics from 2020 to 2023

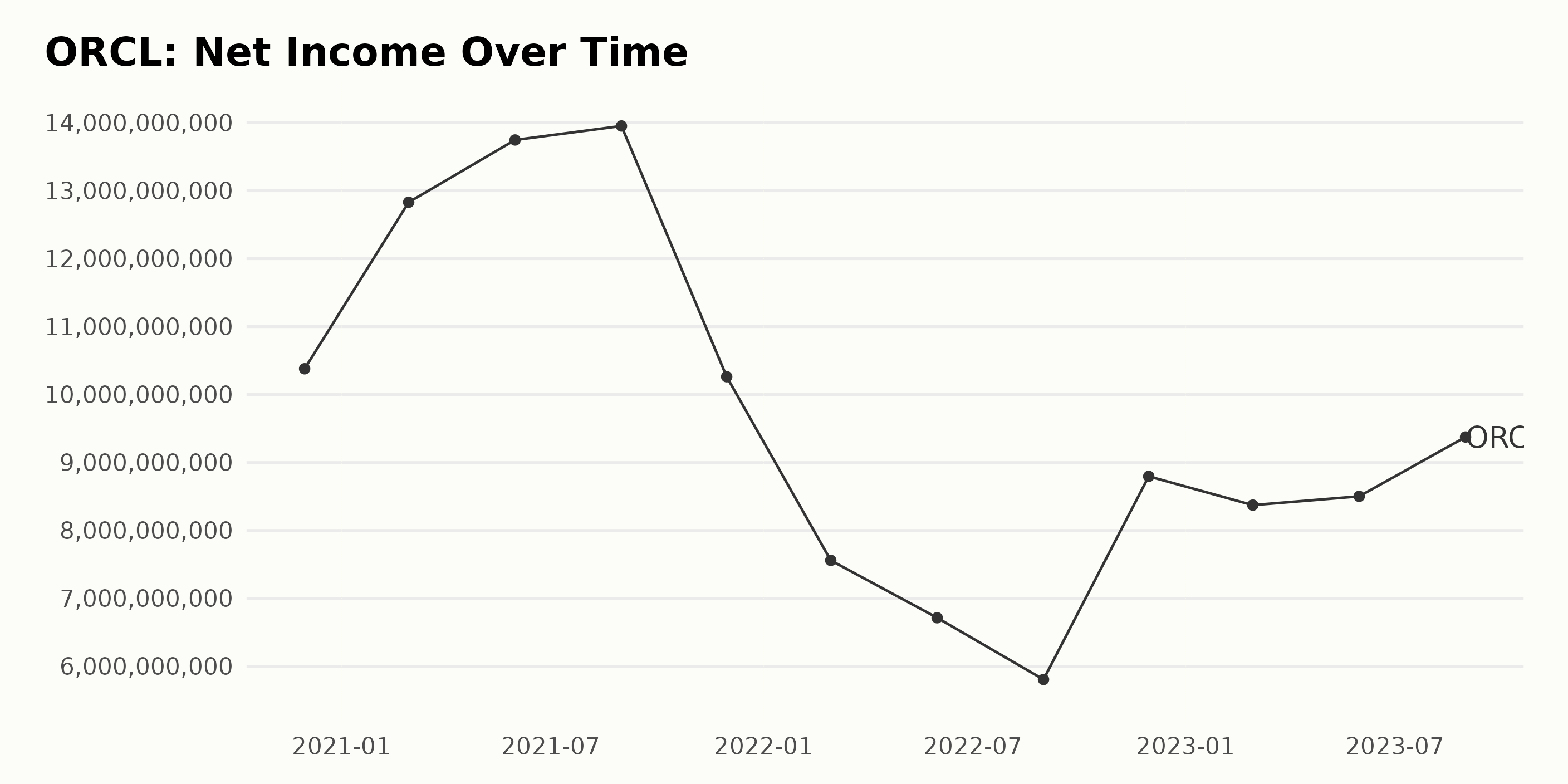

The trailing-12-month net income of ORCL exhibits a fluctuating trend from November 2020 to August 2023. Key highlights are as follows:

- The net income started at $10.38 billion in November 2020.

- A steady increase was observed until its peak value of $13.95 billion in August 2021, reflecting relative growth.

- However, a decline in net income showed from November 2021, reaching its lowest point of $5.81 billion by August 2022.

- From November 2022, a rebound trend was noticed, climbing back to $8.50 billion in May 2023 and then up to $9.38 billion in August 2023.

The most recent data from August 2023 shows an increase in ORCL's net income to $9.38 billion, compared to the drop one year prior in August 2022 ($5.81 billion).

Overall, Oracle's net income revealed significant fluctuations over the time analyzed, with periods of both growth and decline. While recent trends suggest a rebound, the net income remains lower than initial measurements.

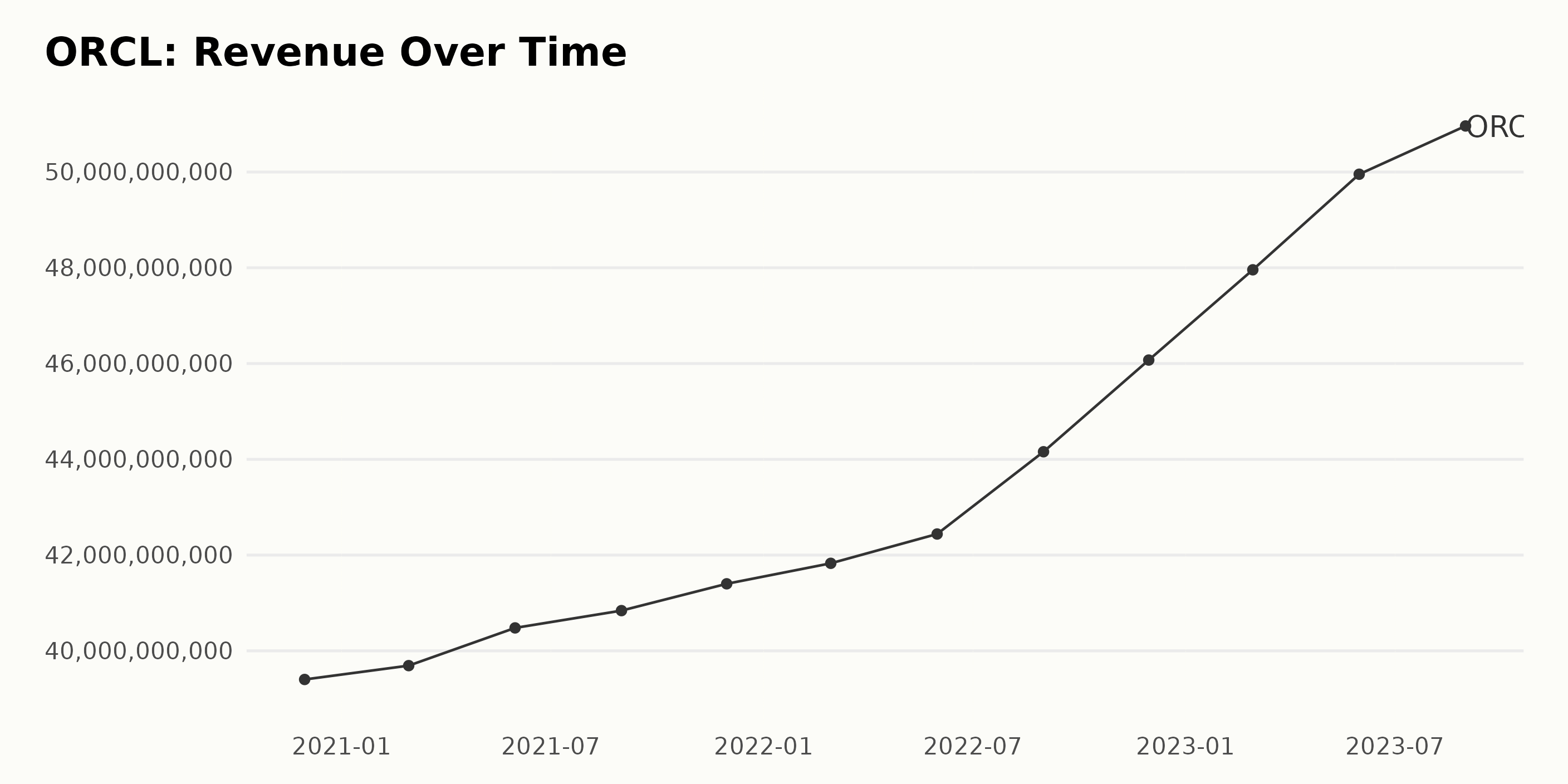

The data series provides a detailed account of the fluctuations in the trailing-12-month revenue of ORCL over roughly three years, from November 2020 to August 2023. Here are some key points to take note:

- In November 2020, the reported revenue for ORCL was $39.40 billion.

- Over the course of the following year, we saw a consistent increase, peaking at $41.83 billion in February 2022 and reaching $42.44 billion by May 2022.

- A significant surge was seen afterward, as by August 2022, the revenue stood at $44.16 billion, followed by an even steeper rise to $46.07 billion in November 2022.

- As we moved into 2023, this positive trend persisted, with revenue escalating to $48.96 billion in February, hitting $49.95 billion in May, and finally reaching $50.96 billion in August 2023.

From the first recorded value in November 2020 to the last reported number in August 2023, the revenue growth of ORCL is quite noticeable. The increase from $39.40 billion to $50.96 billion signifies a growth rate of almost 29.34%.

It's important to emphasize the remarkably steady upward trend in ORCL's revenue throughout these years, particularly remarkable in the last trailing year, where the growth seems to be accelerating, shifting from a growth pace of around $2.4 billion per quarter to a faster climb of about $10 billion in the trailing year from August 2022 to August 2023.

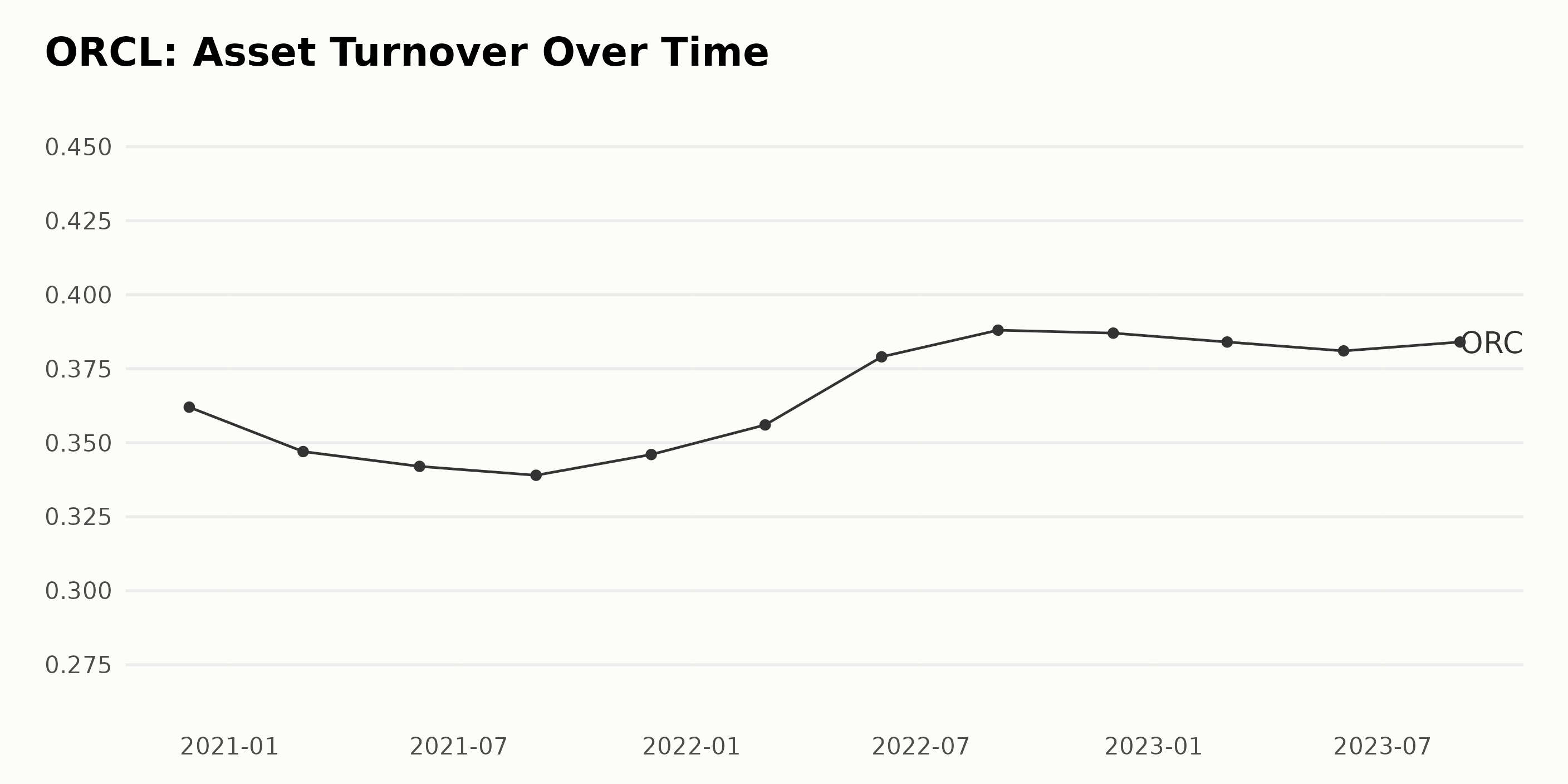

From this dataset, the following key points can be identified about ORCL asset turnover:

- Its asset turnover has generally shown a fluctuating trend over the given period, beginning from November 2020 to August 2023.

- Initially, ORCL experienced a slight decrease in asset turnover, recording a dip from 0.362 on November 30, 2020, to 0.339 on August 31, 2021.

- However, starting September 2021, ORCL witnessed an upward trend in asset turnover, reaching 0.388 by August 31, 2022. This represents a growth rate of approximately 7% over that year.

- The asset turnover witnessed a marginal decrease afterward, arriving at 0.384 by February 28, 2023, and sustaining that value until August 31, 2023.

- The last recorded asset turnover for ORCL is 0.384 as of August 31, 2023, representing a 6.1% growth from the first recorded value of 0.362 in November 2020.

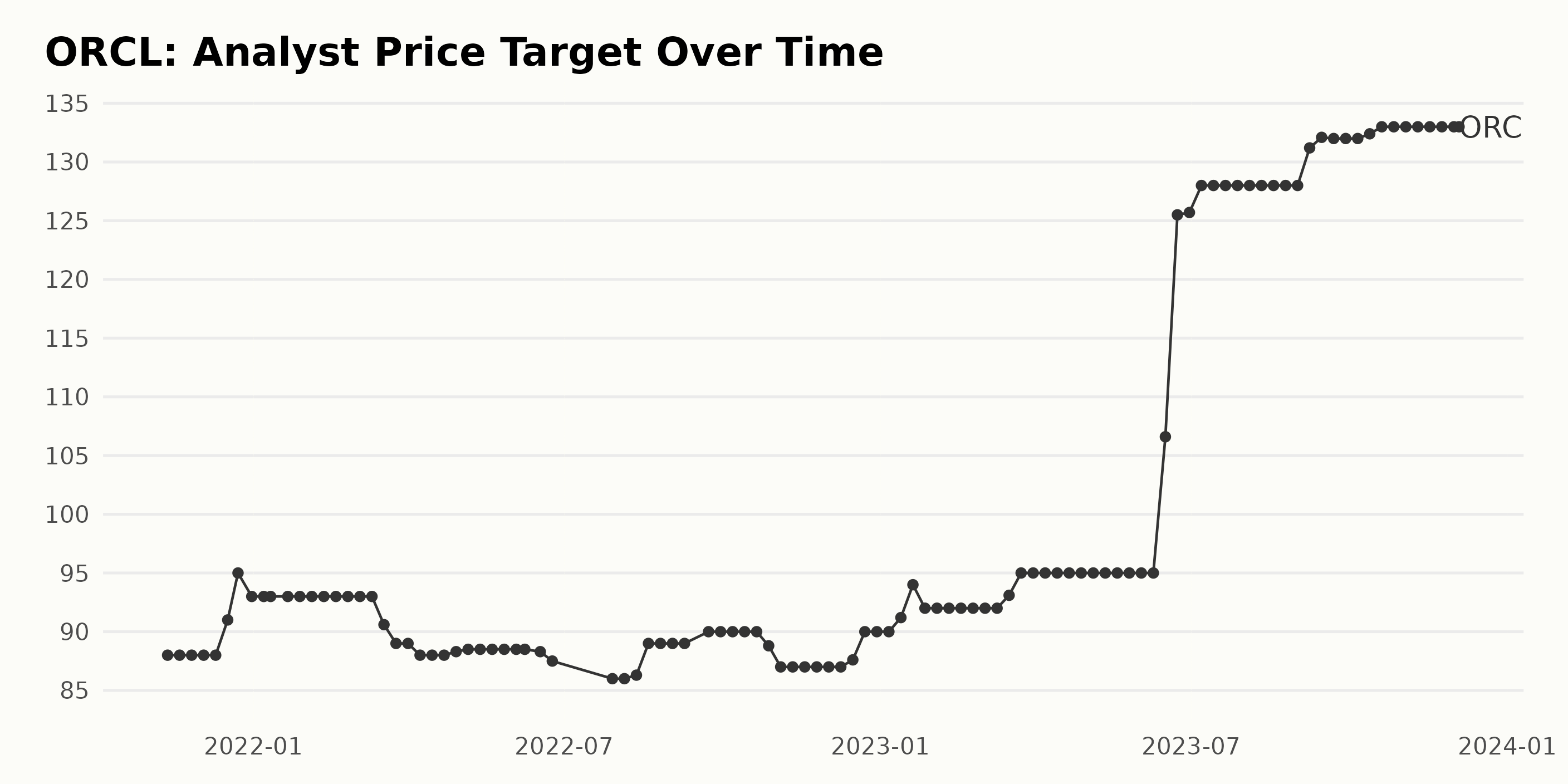

The analyst price target for ORCL has shown an overall increasing trend from November 2021 to December 2023. In Particular, it rose from $88 in November 2021 to reach a peak of $133 in December 2023, demonstrating a growth rate of about 51.14%. Some fluctuation is noticeable within the series of given data:

- The target price remained constant at $88 from November 12, 2021, until December 10, 2021.

- There was a surge to $95 by December 23, 2021, and then it dropped to $90.6 in March 2022, fell further to $86 by July 2022, and then made a recovery back to $90 by September 2022.

- However, it showed a gradual decrease to $87 until November 2022 and then increased to $90 in December of the same year.

- There was another surge, reaching $95 until May 2023, and maintained this value until June 2023.

- A steep increase occurred in mid-June 2023, reaching a high of $125.5 by the end of June, even later flaring up to $128 in July 2023 and keeping its place until September 2023.

- The final months of the data set, from September to December 2023, saw a modest increase in the analyst price target, peaking at $133 in October 2023 which held steady through to December 2023.

Recent trends show stability with the analyst price target remaining consistent at $133 from October to early December 2023. The mentioned data suggest analysts are increasingly positive about ORCL, and the general expectation is that the company's share price will rise over time.

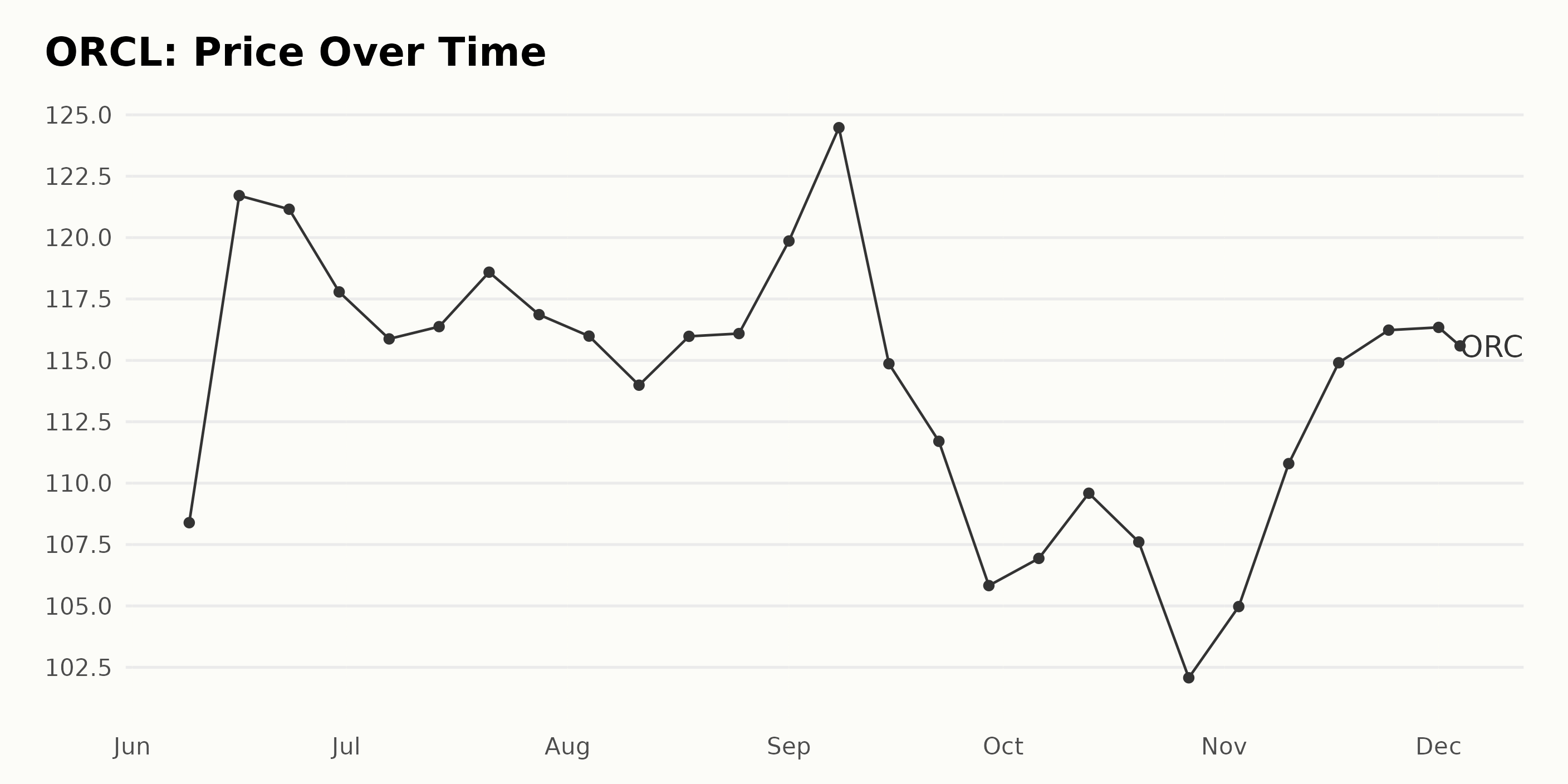

Highlights from Oracle Corporation's Share Price Fluctuations: June-December 2023

Analyzing the given data of ORCL share prices from June to December 2023, some trends can be observed:

- The price of ORCL began at $108.39 on June 9, 2023, peaked at $121.71 on June 16, 2023, and then experienced a slight dip to $121.15 by June 23, 2023.

- Starting from late June, there was a general decelerating trend in prices with occasional minor increases such as on July 14, 2023 ($116.37), July 21, 2023 ($118.59), and August 18, 2023 ($115.98).

- In September 2023, the share price peaked mid-month at $124.47 on September 8, 2023, but fell sharply to $111.70 by September 22, 2023. Thereafter, it declined further to its lowest point at $105.82 by the end of the month on September 29, 2023.

- October marked the beginning of a slight accelerating trend, with the lowest point hitting $102.07 on October 27, 2023.

- Following this low, however, there was a consistent upswing in prices through November, finally reaching $116.34 on December 1, 2023, and maintaining around the same rate by December 4, 2023 ($115.78).

Overall, the growth rate of ORCL share prices was not steady throughout the six-month period, marked by fluctuations, both accelerations and decelerations at varying points. Here is a chart of ORCL's price over the past 180 days.

Oracle Corporation POWR Ratings: An Analysis of Sentiment, Quality, and Momentum

Based on the provided data, ORCL has shown a fluctuating POWR Ratings Grade throughout the period from June 2023 to December 2023. The company is part of the Software - Application category, comprising 133 total stocks. Here are some key highlights:

- In the week of June 10, 2023, ORCL had a POWR Grade of C (Neutral), and it was ranked #54 in the category.

- The ranking improved gradually over the weeks to reach #41 by July 1, 2023, maintaining the POWR grade at C (Neutral).

- By mid-July, the POWR grade had improved to B (Buy), with the rank in the category further improving to #37. However, this position varied slightly, dropping again to #40 by July 29, 2023, with its POWR grade slipping back down to C (Neutral).

- Throughout August and most of September 2023, the POWR grade continued to remain at C (Neutral), with the rank in the category hovering around the 40s range.

- Thereafter, starting from the week of October 28, 2023, ORCL saw improvement in its POWR grade again to B (Buy). Its position also improved and hovered between the #36 and #38 rank till the end of the year.

Lastly, as of December 5, 2023, ORCL holds a POWR Grade of B (Buy) and is ranked #35 in its category. Please note that lower ranks are better and denote a superior rank in its category. The fluctuating POWR Grade and rank in the category suggest ORCL's performance has varied within this timeframe. The company has, however, demonstrated a slight improvement in the final months of 2023.

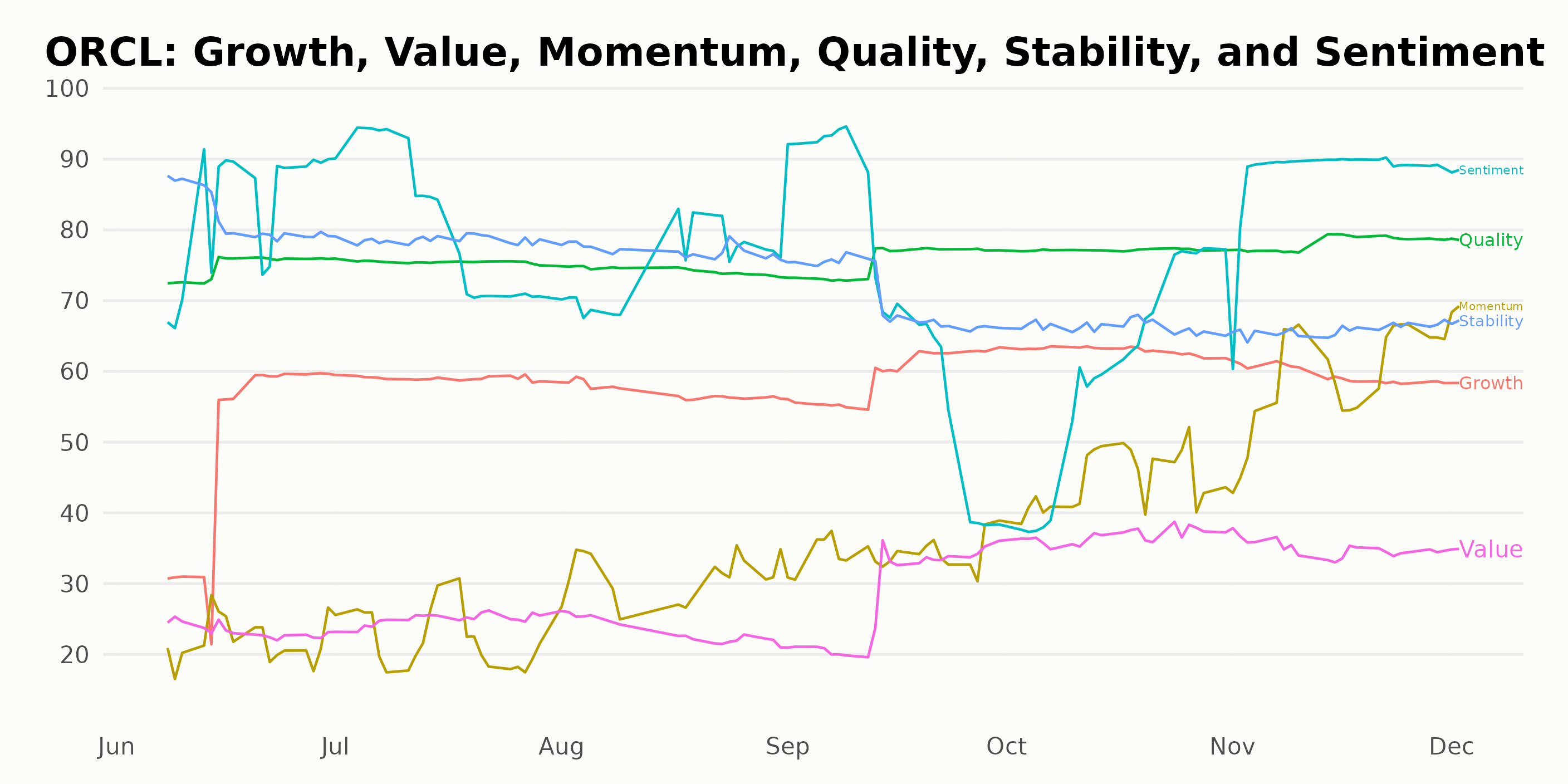

Analyzing the POWR Ratings for ORCL, here's a brief discussion on the three most noteworthy dimensions: Sentiment, Quality, and Momentum.

Sentiment

- In June 2023, Sentiment had a high score of 83. Despite a slight dip to 81 in July and further declines in August and September to 75 and 71, respectively, the rating rebounded significantly, with a tally of 88 by November and December 2023.

Quality

- The Quality dimension maintained fairly high ratings over the six months. Starting from 75 in June, it generally remained stable until August before noticing a positive trend from 74 in August to 79 in December 2023.

Momentum

- Although the Momentum dimension had a lower start in June 2023 at 22, it showed a remarkable upward trend, scoring 69 in December of the same year. The rise was particularly significant during the October to December period.

In conclusion, while the Sentiment and Quality dimensions started at fairly strong positions and remained consistently high, the Momentum dimension demonstrated an impressive uptick despite a weaker initial position.

How does Oracle Corporation (ORCL) Stack Up Against its Peers?

Other stocks in the Software - Application sector that may be worth considering are eGain Corporation (EGAN), Commvault Systems, Inc. (CVLT), and Rimini Street, Inc. (RMNI) - they have better POWR Ratings. Click here to explore more Software - Application stocks.

What To Do Next?

Get your hands on this special report with 3 low priced companies with tremendous upside potential even in today’s volatile markets:

3 Stocks to DOUBLE This Year >

ORCL shares were trading at $114.33 per share on Tuesday morning, down $1.45 (-1.25%). Year-to-date, ORCL has gained 42.00%, versus a 20.74% rise in the benchmark S&P 500 index during the same period.

About the Author: Anushka Dutta

Anushka is an analyst whose interest in understanding the impact of broader economic changes on financial markets motivated her to pursue a career in investment research.

The post Oracle (ORCL) Earnings Anticipation: Software Stock Buy or Sell? appeared first on StockNews.com