(Please enjoy this updated version of my weekly commentary from the Reitmeister Total Return newsletter).

The market is falling and the VIX (fear index) is rising.

Yet, there is really nothing new happening here. We have dealt with spikes in the Coronavirus. And faced inflation head on all the while the economy continues to trudge higher...and in time so too does the stock market.

So let’s review the facts before us to appreciate that “we have seen this act before”. That being where we discover the pullback is just a temporary detour before the bull market makes its next run higher.

Market Commentary

I thought a fun way to point out the fallacy of the recent downturn was to pick through articles I see on other investment websites for the supposed reasons that investors should be shaking in their boots right now.

Bearish Reason #1 = Higher Inflation & Higher Interest Rates

This question has been asked and answered in our commentary several times over. Most recently in last week’s commentary. No need to reinvent the wheel. Just read it again if you have not previously; Should Investors “Fear the Fed”?

However, it is good to know that we clearly foresaw these higher rates...and leaned into it aggressively with our ETF trades to short the bond market and play the regional bank stocks. That is working wonderfully of late as 10 year Treasury rates hit a 2 year high...and will only look better as the trend is most definitely our friend. (More on this topic further below).

Bearish Reason #2 = Omicron

Yes, it is very contagious. And yes, there is a spike in cases worldwide.

However, the good news is that symptoms are very mild and thus, it is having a very mild effect (or no effect) on the economy. Investors already made that determination a couple weeks back which led to ending the previous pullback with stocks surging above 4,700 once again.

Note that there are strong signs that the places that first saw the spikes in cases, like New York, are already seeing a serious decline in cases. This forward looking view of what should happen around the rest of the country bodes well for investors to push past this speed bump once again.

Bearish Reason #3 = Goldman Sachs Earnings

This is by far the most laughable and yet I see it as wide spread in investment articles today.

Yes, Goldman Sachs reported today. And yes, the stock market fell. But there is no more correlation in that as me saying I wore a purple shirt today and the stock market is down.

Meaning Goldman Sachs is NOT a bellwether for the economy. They are simply a bellwether for Goldman Sachs bonuses at the end of the year (which are still going to be obscenely high).

So....What is Really Happening?

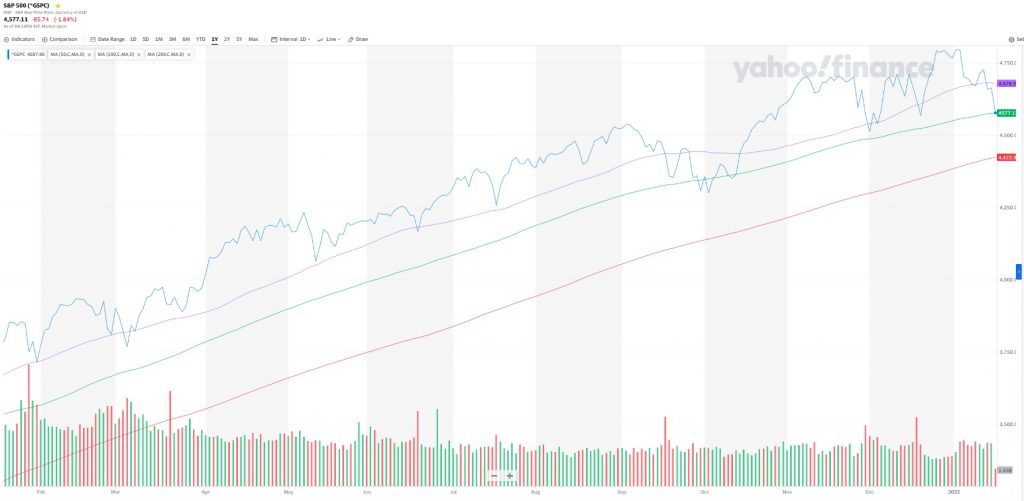

The market does not go straight up in a bull market. The 1 year chart below clearly shows the volatility dance...yet over time the march higher is evident.

What we really have is more of a “technical” situation. Where investors are once again exploring the short term downside potential of the market.

So for only the 4th time in the past year we are probing the 100 day moving average (green line above). Likely that is as far the market will need to go.

However, since it’s been over a year since the market tested the long term trend line (200 day moving average), then maybe it is finally time to do that once again. This would entail a move down to around 4,420 which would likely shake out any investor complacency making way for the next meaningful run higher.

I would say only 1/3rd chance we will make it down that low and thus why I am happy to stay 100% long at this time expecting a bounce off the 100 day back to the old highs...and maybe beyond. The results of earnings season, and what companies say for guidance will go a long way to setting the mood for the weeks ahead. Let’s hope that is positive like we have seen for the last several quarters.

What To Do Next?

Discover my top picks for the year ahead.

I am referring to the 12 stocks and 2 ETFs in my Reitmeister Total Return portfolio that firmly beat the market last year.

In fact, the 2 ETF trades are plays on the rising interest rate environment and dramatically outperforming the market of late.

All of these selections are based upon my 40 years of investing experience. Plus we rely heavily on the benefits of the POWR Ratings model with it’s impressive +30.72% annual returns since 1999.

All you have to do to see my current recommendations is to…

Wishing you a world of investment success!

Steve Reitmeister…but everyone calls me Reity (pronounced “Righty”)

CEO, Stock News Network and Editor, Reitmeister Total Return

SPY shares . Year-to-date, SPY has declined -4.89%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks.

The post 3 Bearish Myths Busted appeared first on StockNews.com