E*TRADE Advisor Services, a provider of integrated technology, custody, and practice management support for registered investment advisors (RIAs), today announced results from the most recent wave of its Independent Advisor Sentiment survey:

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20190809005211/en/

Advisors also note recession fears have increased among the client population (Graphic: Business Wire)

- Recession fears take the lead. The number one concern among clients, according to RIAs, is a recession (33%), up seven percentage points from last quarter and replacing volatility for the top spot.

- Emotions loom large. Advisors said the biggest mistake clients make is trying to time the market (43%), consistent with last quarter’s findings.

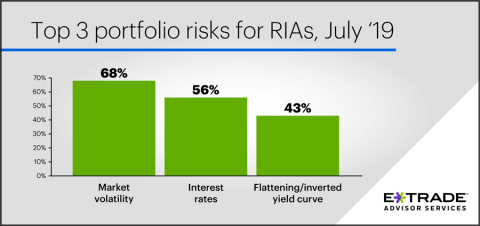

- While clients appear less concerned about volatility, advisors remain focused. Volatility is the number one risk that RIAs are actively managing in client portfolios, followed by interest rates (56%), and a flattening/inverted yield curve (43%).

- Advisors are eyeing IT above all other sectors. Advisors noted that sectors with the most opportunity for their clients in the next few months are information technology (53%), health care (43%), and financials (34%), consistent with last quarter.

“Advisors are focusing on the fundamentals of our economy, which are on relatively solid footing despite how late we are in the bull market run,” said Matt Wilson, head of E*TRADE Advisor Services. “Amid the recent market volatility, advisors can really demonstrate their value to clients—shoring up defenses in client portfolios, helping them understand the bigger picture, and encouraging them to stay focused on their long-term goals. Advisors play a critical role in helping clients navigate not only the immediate challenges the market can present but also what the market could bring in the months to come.”

About the Survey

This survey was conducted in-house from July 16 to July 29, 2019, among a convenience sample of 305 independent RIAs.

About E*TRADE Financial and Important Notices

E*TRADE Financial and its subsidiaries provide financial services including brokerage and banking products and services to retail customers. Securities products and services are offered by E*TRADE Securities LLC (Member FINRA/SIPC). Commodity futures and options on futures products and services are offered by E*TRADE Futures LLC (Member NFA). Managed Account Solutions are offered through E*TRADE Capital Management, LLC, a Registered Investment Adviser. Bank products and services are offered by E*TRADE Bank, and RIA custody solutions are offered by E*TRADE Savings Bank doing business as “E*TRADE Advisor Services,” both of which are national federal savings banks (Members FDIC). More information is available at www.etrade.com.

E*TRADE Financial, E*TRADE, and the E*TRADE logo are trademarks or registered trademarks of E*TRADE Financial Corporation. ETFC-G

© 2019 E*TRADE Financial Corporation. All rights reserved.

When it comes to the market, what are your clients contacting you most about? | ||

Q3 2019 | Q2 2019 | |

Fears of a recession | 33% | 26% |

Market volatility | 24% | 47% |

China and US trade tensions | 22% | 11% |

Gridlock in Washington | 7% | 5% |

Economic weakness abroad | 3% | 0% |

Federal reserve monetary policy | 2% | 1% |

Flattening/inverted yield curve | 2% | 1% |

Other | 3% | 4% |

None of these | 4% | 5% |

What is the biggest mistake you see your clients making? | ||

Q3 2019 | Q2 2019 | |

Trying to time the market | 43% | 43% |

Not saving enough for retirement | 22% | 27% |

Prioritizing their dependent’s financial needs over their own | 14% | 11% |

Acting on stock tips that don’t align with long-term goals | 10% | 8% |

Asking for early withdraws from retirement accounts | 7% | 5% |

Other | 3% | 4% |

None | 1% | 2% |

What risks are you actively managing right now when it comes to client portfolios? Select all that apply. | ||

Q3 2019 | Q2 2019 | |

Market volatility | 68% | 75% |

Interest rates | 56% | 53% |

Flattening/inverted yield curve | 43% | 39% |

Recession | 40% | 41% |

Political instability | 34% | 33% |

Inflation | 22% | 30% |

Armed conflict, war, or terrorism | 5% | 7% |

None of these | 4% | 5% |

Other | 2% | 2% |

What industries do you think offer the most potential for your clients this quarter? (Please choose your top three) | ||

Q3 2019 | Q2 2019 | |

Information technology | 53% | 51% |

Health care | 43% | 34% |

Financials | 34% | 34% |

Consumer discretionary | 26% | 11% |

Consumer staples | 22% | 23% |

Energy | 21% | 26% |

Communication services | 12% | 8% |

Utilities | 10% | 8% |

Industrials | 9% | 12% |

Materials | 6% | 5% |

View source version on businesswire.com: https://www.businesswire.com/news/home/20190809005211/en/

Contacts:

646-521-4418

mediainq@etrade.com