Originally posted on https://financhill.com/blog/investing/top-gene-editing-stocks

Cystic Fibrosis. Hemophilia. Sickle Cell Disease. These diagnoses strike fear in the hearts of patients and their families. Treatments are limited, and they often come with serious side effects.

Though medical researchers are always working towards better protocols, recent medical advances have primarily focused on refining existing treatments rather than creating new, more effective options.

Until now.

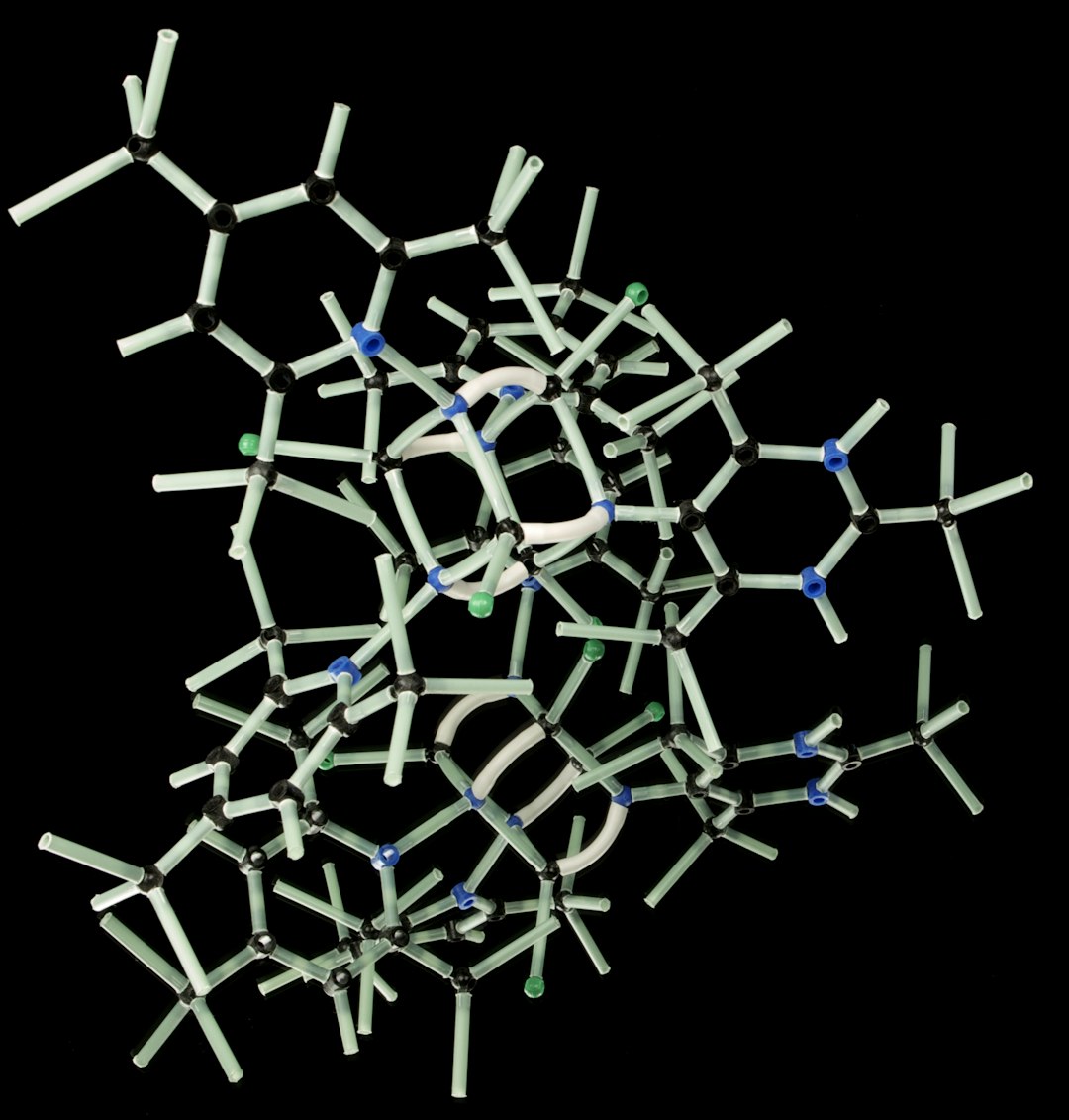

Gene editing presents a dramatic breakthrough in medical science.

Instead of simply treating disease, new technology is capable of changing DNA to remove the portions responsible for disease.

While there is still a long way to go before gene editing becomes standard practice, many physicians believe this technology is the future of medicine – particularly for diseases that develop as a result of genetic mutations.

If gene editing is indeed the solution for improving treatments and curing diseases that have so far been incurable, the biotech companies on the cutting edge of gene editing present a unique opportunity for investors. After all, such cures would certainly bring tremendous profit.

The questions are: which companies are most likely to succeed and what are the best gene-editing stock to invest in?

How To Spot The Top Gene Editing StocksAs with any investment, companies involved in gene editing have the same challenges and opportunities that any company faces.

- Product-market fit

- Customer Satisfaction

- Cost of growth vs revenues

- Quality of management and leadership

These can destroy innovation, no matter how good the technology is. Before investing in gene editing businesses, carefully examine the companies’ financials.

Assuming the company you are considering meets your standards from a financial management perspective, these are other elements that should be reviewed:

How far along is the technology from a development perspective?Some companies are just starting to experiment with new medical technology, while others are in pre-clinical testing.

The next step is approval from the US Food and Drug Administration and/or the European Medicines Agency to begin clinical testing, then Phase 1, Phase 2, and Phase 3 clinical testing, and finally regulatory approval.

The closer a therapy is to regulatory approval the more likely it is to succeed.

What partnerships does the company have?Biotech advances come with a massive price tag, and most small research companies can’t succeed alone. They partner with major pharmaceutical companies or other large organizations with an interest in the project to obtain the necessary resources.

Before forming such partnerships, partner organizations put substantial time and energy into vetting the proposed therapies.

If the company you are considering has big-name partners, you can be confident the gene editing technology has promise.

What disease is the company targeting?There are pros and cons to consider when it comes to which disease your chosen company is targeting.

Those focused on a rare disease may have less competition, but there is limited commercial potential – and of course, the converse is also true.

It’s important to find a balance between number and type of diseases targeting, potential number of patients who will benefit, and number of companies focused on gene editing techniques for the same condition.

These criteria may help reduce the risk of losing your investment, but you have to go into gene editing ventures with your eyes open to the potential risk.

As always, investing in stock with huge opportunities for reward is a risky bet. No matter how solid the company is, or how innovative the technology, there is the possibility it will fail at some point during the testing process for any one of a million reasons.

With that said, these are three of the companies currently leading the way in gene editing:

Is CRISPR Therapeutics a Buy?CRISPR Therapeutics [NASDAQ:CRSP] is currently focused on gene editing solutions for Beta Thalassemia and Sickle Cell Disease.

It has a market cap of around $2 billion, and technology is currently in Phase 1 clinical testing.

CRISPR partners include Bayer and Vertex Pharmaceuticals.

CRISPR Therapeutics [CRSP] is using the most recent – and most effective – gene editing technology to selectively edit DNA.

This technology is also called CRISPR (Clustered Regularly Interspaced Short Palindromic Repeats), and it was discovered in 2012.

Today, it is the least expensive and most widely use gene editing technology in the industry.

Should You Invest in Editas Medicine?Editas Medicine [NASDAQ:EDIT] is a smaller biotech company with a market cap of $994 million.

It plans to begin Phase 1 trials in 2019 for gene editing therapies that treat Leber Congenital Amaurosis Type 10 (LCA10). Editas boasts partnerships with Allergan [NYSE: AGN] and Celgene [NASDAQ: CELG].

Editas is also using CRISPR gene editing technology in its therapies, and it may be the first company to test CRISPR editing in humans.

Patients are in the process of being screened now, and they will receive the first treatments in the second half of 2019.

Is Cellectics A Buy Or A Sell?

Cellectis [NASDAQ:CLLS] is even smaller still, with a market cap of $741 million.

However, it has a list of big-name partners that include Pfizer [NYSE: PFE], Allogene [NASDAQ: ALLO] and Servier.

Gene editing technology developed by Cellectis is currently in Phase I trials for the treatment of Acute Lymphoblastic Leukemia (ALL), Acute Myeloid Leukemia (AML), and Blastic Plasmacytoid Dendritic Cell Neoplasm (BPDCN).

Cellectis is using the TALEN (Transcription Activator-Like Effector Nuclease) gene editing technique to edit the body’s own immune cells (T-cells) to attack cancer cells.

TALEN was the second gene editing technology to be developed. In 2009, scientists determined that this method makes it possible to edit DNA sequences in a more targeted manner than the previous technology was capable of doing.

Best Gene Editing Stocks: The Bottom Line

When gene editing eventually becomes the standard of care for a variety of human diseases, industry growth could be significant.

However, it is hard to predict when the technology will enter the mainstream, so this industry may not be right for investors with short-term financial goals.

On the other hand, investors who can wait it out may wish to put this industry on the top of their buy list.