Mark Makela/Reuters

- Business Insider spoke with 13 pilots who work or have worked for Air Transport Services Group and Atlas Air Worldwide, where they fly or have flown planes for Amazon Air.

- Those pilots and transportation analysts said the rapid growth of Amazon Air, coupled with low pay, has led to inexperienced pilots in the cockpit and a lack of qualified applicants.

- But, analysts said that the low pay at Amazon Air's contractors is a key reason Jeff Bezos' air venture can stay profitable.

- ABX Air, one contractor, lost more pilots than it hired in 2018, according to union labor numbers. Atlas Air, another contractor, said hired 57 fewer pilots than it needed to keep up with business demands.

- Meanwhile, Amazon is looking to operate 10 more planes by the end of 2020. Pilots who fly for them say their contract airlines might not have the staffing for that.

Jeff Bezos is a master at cutting costs.

He's also looking to launch a third-party logistics service that many analysts say is poised to edge out FedEx and UPS. Earlier this year, Amazon declared itself a transportation company in its most recent SEC filing and is rolling out a third-party shipping service for merchants on its site.

"Amazon will only enter a category or acquire a business that they know they can scale," former Amazon executive Brittain Ladd, now an independent supply chain consultant, told Business Insider. "When it comes to residential delivery, when it comes to contract commercial logistics, Amazon not only knows it can enter those categories, but they scale those categories and do a better job than UPS and FedEx can."

But Jim Hall, who led the National Transportation Safety Board (NTSB) from 1994 to 2001, said Bezos's classic model of keeping it cheap and scaling doesn't quite work for the air industry.

"I am concerned anytime that new entrants into aviation particularly carrying packages or goods enter a market where their background has been essentially trying to cut costs to make money," Jim Hall, who led the National Transportation Safety Board (NTSB) from 1994 to 2001, told Business Insider, referring specifically to Amazon. "Cutting costs in aviation causes deaths and accidents."

Still, cutting costs is exactly what Amazon Air is setting out to do, according to supply chain analysts and interviews with more than a dozen pilots who work with Amazon Air. Rather than directly employing pilots and buying planes, Amazon is contracting pilots and leasing cargo planes. Their two contract airlines, ATSG and Atlas Air Worldwide Holdings, pay pilots a third less than FedEx or UPS.

That's poised to be a problem down the road for Amazon and its two-day Prime delivery promise — and its plan to edge out UPS and FedEx as a logistics provider. Amazon has plans to add 10 planes to its fleet by the end of 2020, but veteran pilots told Business Insider that the contract airlines Amazon works with can't attract enough talent.

"Atlas and ATSG are having a hard time finding experienced pilots," CEO of AeroConsulting Experts Ross Aimer, an aviation consulting expert with 53 years in the industry, told Business Insider. "They're not getting the right talent as fast as they’re expanding."

Amazon and Atlas did not respond to repeated requests for a response to this series of articles on Amazon Air. ATSG sent a statement on behalf of ABX and ATI.

"Regarding staffing, ATSG has had no issues in finding qualified candidates to support its growth," an ATSG spokesperson told Business Insider on questions of attracting new talent. "Contract negotiations continue to be conducted under the auspices of the National Mediation Board, and we look forward to their satisfactory conclusion."

A push to launch and quickly scaleFor much of its existence since the e-commerce "everything store" launched in 1996, Amazon has moved its cargo through air cargo services from UPS, USPS, and FedEx.

Then, Christmas 2013 happened. UPS failed to deliver the 7.75 million Amazon packages in its network in time for December 25th. Amazon had to sheepishly issue $20 gift cards and apologies to customers.

Around that time, both delivery giants told Amazon they were not interested in scaling their operations to keep up with Amazon's skyrocketing delivery demands, Seaport Global Securities managing director Kevin Sterling said.

Amazon, determined not to let down its customers again, lessened its reliance on third-party delivery companies. In 2013, UPS delivered nearly half of Amazon's US orders, according to Wolfe Research. That dropped to 22% in 2018.

The retailer has shifted to an in-house delivery network, including trucks, trains, ocean freighters, and, of course, planes. ATSG told Motherboard in 2015 that they were leasing four cargo jets to Amazon, who was building an air hub at Wilmington Air Park. ATI and ABX pilots were evenly splitting those planes.

Four years since it launched its in-house delivery network, Amazon has 40 767s, with plans for 10 more courtesy of ATSG. Morgan Stanley analysts said Amazon could scale to 100 planes by 2025. It services 20 domestic locations, and three more Amazon Air gateways are underway in Ohio, Illinois, and Texas.

Amazon has 760 cargo flights per week, according to Marc Wulfraat, president and founder of supply chain consultancy MWPVL International Inc.

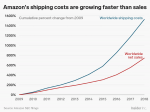

"Amazon is doing everything possible to keep their shipping expense low because it's ballooning," Wulfraat said.

Observers ranging from ex-Amazon executives to the Stamps.com CEO say this massive logistics network isn't just so Amazon can cut its delivery expense. The e-commerce company is reportedly considering opening its own third-party logistics network that will challenge UPS and FedEx.

"Even Amazon, as big as they are and growing as fast as they are, will not be able to fill up this network on day one," Morgan Stanley analyst Ravi Shanker told Business Insider. "So, similar to what they did with AWS, we think it's very logical for them to improve the utilization of their network and lower their own costs by opening up to third parties."

And even while those planes are painted with Amazon's name, Amazon has been careful to not actually employ those pilots. One key reason is that pilots are almost universally unionized; even pilots at FedEx, whose labor force is otherwise completely not unionized, are unionized.

"This is another headache that Amazon just doesn't want and why they don't want to get into the airline business," Sterling told Business Insider. "There's no way around unions in airlines, which is why Amazon will continue to outsource this function."

Despite poor pilot pay, Amazon still spends more on flights than FedEx and UPSIn order to keep Amazon, which has recently gained a reputation for ditching third-party logistics companies as a customer, the pressure is high on Atlas and ATSG to keep labor costs minimal.

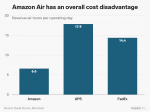

David Vernon, Bernstein senior analyst and vice president, wrote in a December note that Amazon pilots' low wages were keeping the air venture cheaper to carry goods airport-to-airport. Still, because of "crew inefficiencies," Amazon Air is still costlier than UPS or FedEx to move goods door-to-door.

"While we are certain Amazon is getting a better deal chartering flights with ATSG and Atlas than it would at UPS or FedEx (which explains why they chose them), this does not mean they can undercut UPS and FedEx on price for deferred deliveries," Vernon wrote.

In other words, a key reason Amazon is able to move goods at a cost that's competitive with FedEx or UPS is because pilots are paid so low — not because of any efficiencies on Amazon's part.

Boeing 767 captains with the maximum years of company tenure at ATSG and Atlas earn up to $246 an hour, according to their labor contracts and information posted on the salary-report website Airline Pilot Central.

But serving as a captain on the same plane with the maximum years of company tenure is much more lucrative at other cargo airlines.

Pilots with the maximum years of experience earn $313 an hour at FedEx and $309 at UPS. (Maximum experience at UPS and FedEx is 15 years, while it's capped at 12 years at Atlas, ABX, and ATI.)

Even smaller cargo airlines, such as Kalitta Air, pay better than ATSG and Atlas. Kalitta 767 captains earn $273 an hour. No other airlines flying 767s had salary information publicly available.

Elsewhere in logistics, trucking companies have struggled with servicing Amazon, even big names like XPO Logistics, which will lose $600 million in revenue in 2019 because of Amazon shifting its delivery strategy.

Trucking company New England Motor Freight filed for bankruptcy in Feb. Amazon was one of its five biggest customers, and analysts said the company's demands for quickly scaling put pressure on the company. Helane Becker, Cowen's managing director, previously told Business Insider that servicing consumer delivery clients such as Amazon is "very cost intensive" for trucking companies.

"Amazon contracts are pretty demanding," Satish Jindel, a supply-chain expert and SJ Consulting Group's principal consultant, previously told Business Insider. "Because they're growing so rapidly, they can suck up a lot more of your capacity that you planned to make available to them."

'Free' two-day deliveries may be at risk — along with Amazon's third-party logistics aspirations and 10 additional cargo aircraftPilots who work at Amazon Air said they think service disruptions are likely as pilots quit, retire, and are reluctant to interview at Amazon's contract airlines.

Because of the low pay and labor issues surrounding ATSG and Atlas, pilots told Business Insider that only those with shoddy qualifications are applying to work at Amazon Air's contract airlines. There are fewer and fewer applicants to those airlines, too.

Delays on Atlas Air flights have jumped by 70% since Dec. 2016, according to company data. (Atlas and Amazon began operating cargo flights in the second half of 2016.)

"Right now, they're barely keeping it together," one anonymous Atlas Air pilot told Business Insider. "And when I say 'barely,' it's right there. They're going to run out of people."

Atlas also said at the beginning of 2018 that it needed to add 200 pilots to its pilot pool as business expanded — but, according to its pilots' union, Atlas only hired a net 143 pilots last year. It hired 288 pilots but 145 quit. ABX Air lost more pilots than it hired — 37 joined, but 42 quit.

"This could potentially have big disruptive impacts on Amazon's ability to deliver product to customers unless they figure out how to deal with this issue," Wulfraat said.

NOW WATCH: This Mercedes-Benz stretch van feels like a private jet

See Also:

- Pilots who fly for Amazon Air earn 33% less than their colleagues at UPS and FedEx for flying the exact same planes

- An Amazon Air plane crashed in February, killing all 3 people on board. Weeks earlier, several pilots said they thought an accident was inevitable.

- Lyft will be the first ride-hailing company to go public. Here's how its numbers compare to Uber.