Data protection and security software company Varonis (NASDAQ:VRNS) fell short of the market’s revenue expectations in Q4 CY2024 as sales rose 2.9% year on year to $158.5 million. On the other hand, next quarter’s outlook exceeded expectations with revenue guided to $132.5 million at the midpoint, or 1.7% above analysts’ estimates. Its non-GAAP profit of $0.18 per share was 27.3% above analysts’ consensus estimates.

Is now the time to buy Varonis? Find out by accessing our full research report, it’s free.

Varonis (VRNS) Q4 CY2024 Highlights:

- Revenue: $158.5 million vs analyst estimates of $165.5 million (2.9% year-on-year growth, 4.2% miss)

- Adjusted EPS: $0.18 vs analyst estimates of $0.14 ($0.04 beat)

- Adjusted Operating Income: $15.34 million vs analyst estimates of $21.51 million (9.7% margin, $6.2 million miss)

- Management’s revenue guidance for the upcoming financial year 2025 is $617.5 million at the midpoint, missing analyst estimates by 1.6% and implying 12.1% growth (vs 10.8% in FY2024)

- Adjusted EPS guidance for the upcoming financial year 2025 is $0.15 at the midpoint, missing analyst estimates by 56.6%

- Operating Margin: -11.1%, down from -3.4% in the same quarter last year

- Free Cash Flow Margin: 68.4%, up from 14.4% in the previous quarter

- Annual Recurring Revenue: $641.9 million at quarter end, up 18.2% year on year

- Market Capitalization: $5.16 billion

Yaki Faitelson, Varonis CEO, said, "We are excited by the approximately 50% increase in ARR from new customers, which was driven by the simplicity of SaaS and MDDR as well as customer interest in utilizing Generative AI raising awareness for our solution. We look forward to continuing our momentum and completing our SaaS transition in 2025, which will unlock many more benefits as we capture our massive opportunity.”

Company Overview

Founded by a duo of former Israeli Defense Forces cyber warfare engineers, Varonis (NASDAQ:VRNS) offers software-as-service that helps customers protect data from cyber threats and gain visibility into how enterprise data is being used.

Endpoint Security

Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks. As the volume of internet enabled devices grows, every device that employees use to connect to business networks represents a potential risk. Endpoint security software enables businesses to protect devices (endpoints) that employees use for work purposes either on a network or in the cloud from cyber threats.

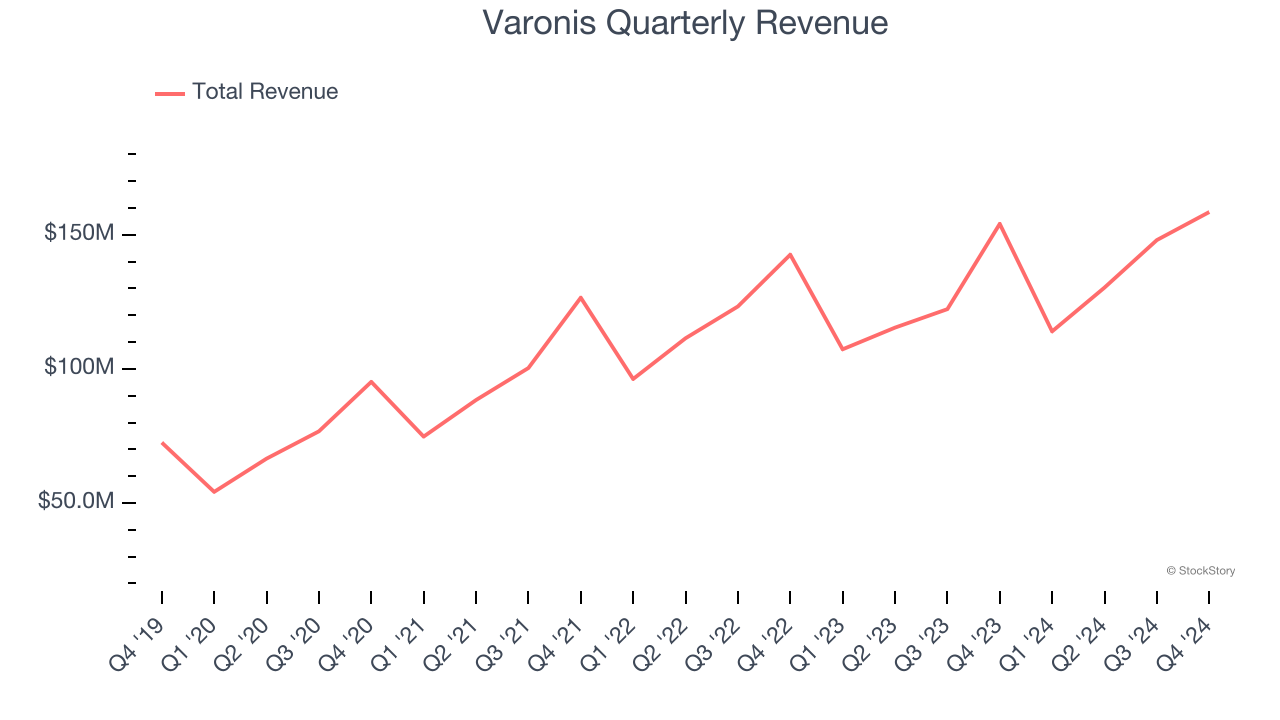

Sales Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Over the last three years, Varonis grew its sales at a 12.2% annual rate. Although this growth is acceptable on an absolute basis, it fell short of our benchmark for the software sector, which enjoys a number of secular tailwinds.

This quarter, Varonis’s revenue grew by 2.9% year on year to $158.5 million, falling short of Wall Street’s estimates. Company management is currently guiding for a 16.2% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 13.5% over the next 12 months, similar to its three-year rate. This projection is commendable and implies its newer products and services will fuel better top-line performance.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

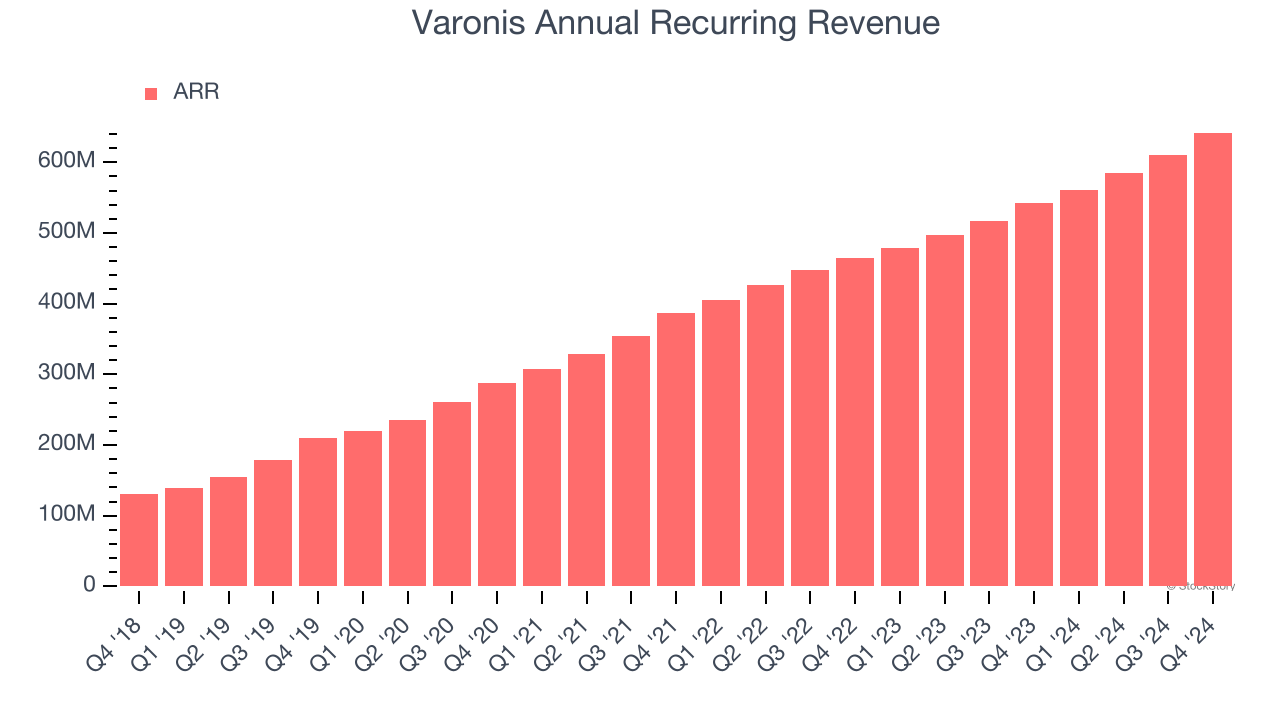

Annual Recurring Revenue

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

Varonis’s ARR punched in at $641.9 million in Q4, and over the last four quarters, its growth was solid as it averaged 17.7% year-on-year increases. This alternate topline metric grew faster than total sales, which likely means that the recurring portions of the business are growing faster than less predictable, choppier ones such as implementation fees. That could be a good sign for future revenue growth.

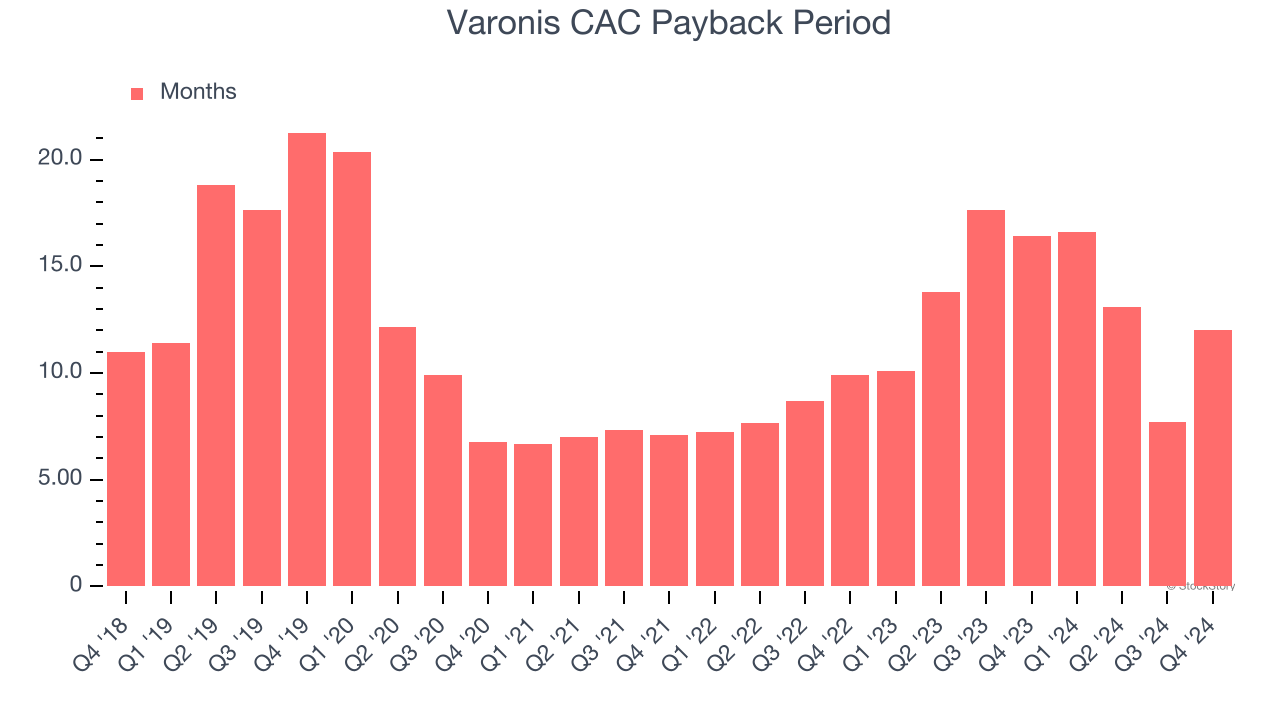

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Varonis is extremely efficient at acquiring new customers, and its CAC payback period checked in at 12 months this quarter. The company’s rapid recovery of its customer acquisition costs indicates it has a highly differentiated product offering and a strong brand reputation. These dynamics give Varonis more resources to pursue new product initiatives while maintaining the flexibility to increase its sales and marketing investments.

Key Takeaways from Varonis’s Q4 Results

It was great to see Varonis expecting revenue growth to accelerate next year. We were also glad its revenue guidance for next quarter came in higher than Wall Street’s estimates. On the other hand, its full-year revenue guidance missed significantly and its full-year EPS guidance fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock remained flat at $46.84 immediately after reporting.

Varonis underperformed this quarter, but does that create an opportunity to invest right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.