Enterprise workflow software maker ServiceNow (NYSE:NOW) met Wall Street’s revenue expectations in Q4 CY2024, with sales up 21.3% year on year to $2.96 billion. Its non-GAAP profit of $3.67 per share was in line with analysts’ consensus estimates.

Is now the time to buy ServiceNow? Find out by accessing our full research report, it’s free.

ServiceNow (NOW) Q4 CY2024 Highlights:

- Revenue: $2.96 billion vs analyst estimates of $2.96 billion (21.3% year-on-year growth, in line)

- Subscription Revenue: $2.87 billion vs analyst estimates of $2.89 billion (21% year-on-year growth, in line)

- Adjusted EPS: $3.67 vs analyst expectations of $3.66 (in line)

- Management’s subscription revenue guidance for the upcoming Q1 2025 is $3.0 billion at the midpoint (implying 19% growth, in line)

- Management’s adjusted operating margin guidance for the upcoming Q1 2025 is 30% (in line)

- Operating Margin (GAAP): 12.6%, up from 11.1% in the same quarter last year

- Free Cash Flow Margin: 47.3%, up from 16.8% in the previous quarter

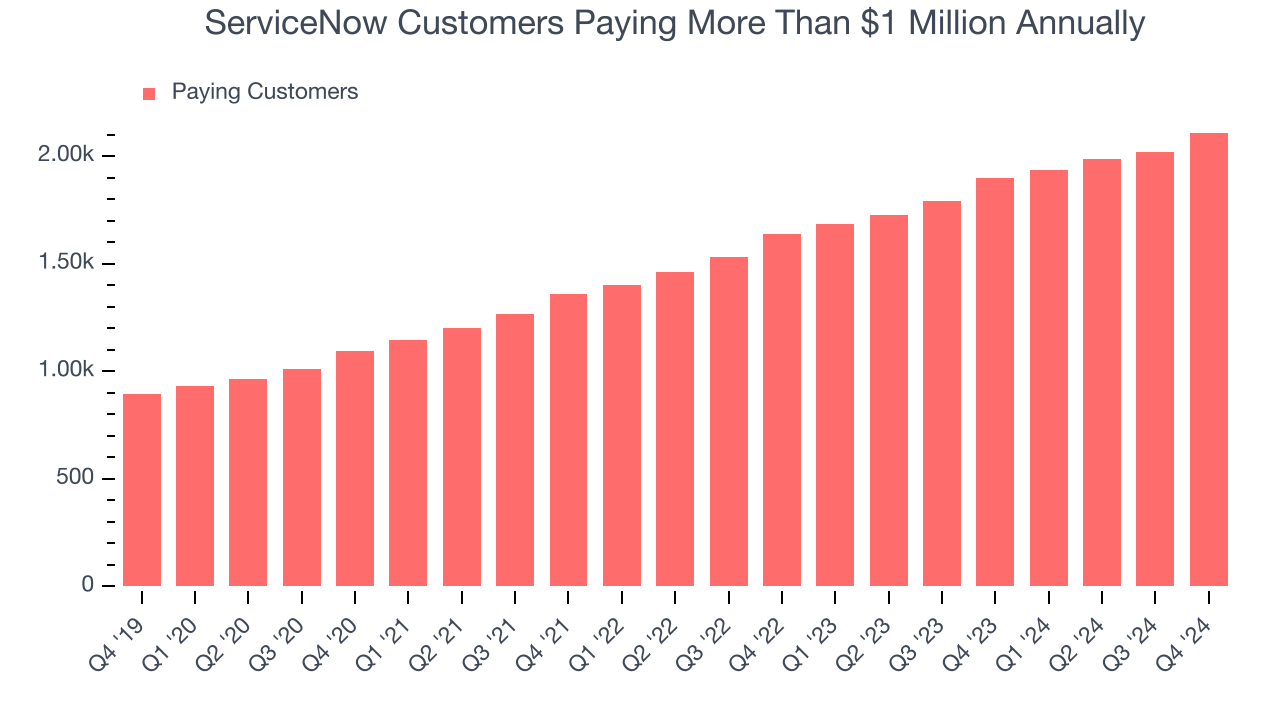

- Customers: 2,109 customers paying more than $1 million annually (12% year on year growth)

- Market Capitalization: $241.5 billion

“ServiceNow closed out the year exceeding Q4 expectations on top of our ‘beat and raise’ track record,” said ServiceNow Chairman and CEO Bill McDermott.

Company Overview

Founded by Fred Luddy, who coded the company's initial prototype on a flight from San Francisco to London, ServiceNow (NYSE:NOW) is a software provider helping companies automate workflows across IT, HR, and customer service.

Automation Software

The whole purpose of software is to automate tasks to increase productivity. Today, innovative new software techniques, often involving AI and machine learning, are finally allowing automation that has graduated from simple one- or two-step workflows to more complex processes integral to enterprises. The result is surging demand for modern automation software.

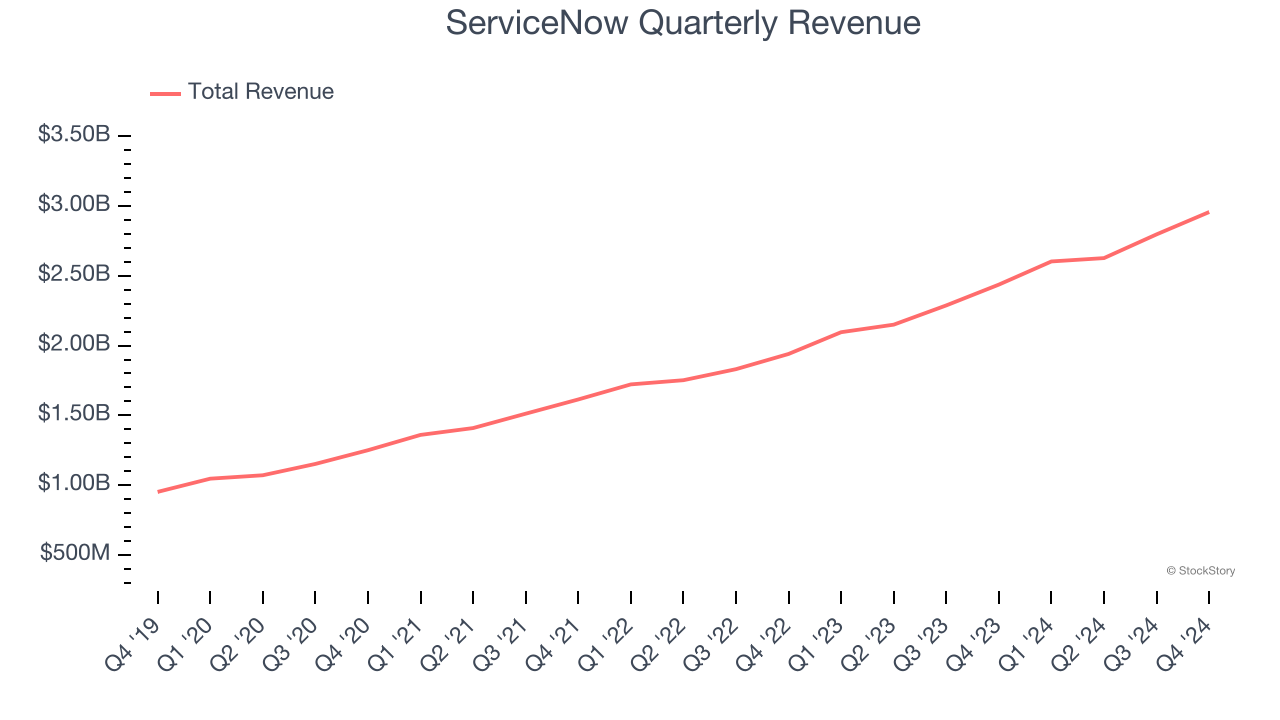

Sales Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Over the last three years, ServiceNow grew its sales at a decent 23.1% compounded annual growth rate. Its growth was slightly above the average software company and shows its offerings resonate with customers.

This quarter, ServiceNow’s year-on-year revenue growth of 21.3% was excellent, and its $2.96 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 20.3% over the next 12 months, a slight deceleration versus the last three years. We still think its growth trajectory is attractive given its scale and suggests the market sees success for its products and services.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Enterprise Customer Base

This quarter, ServiceNow reported 2,109 enterprise customers paying more than $1 million annually, an increase of 89 from the previous quarter. That’s quite a bit more contract wins than last quarter and quite a bit above what we’ve observed over the previous year. Shareholders should take this as an indication that ServiceNow’s go-to-market strategy is working well.

Key Takeaways from ServiceNow’s Q4 Results

With shares up roughly 20% in the last three months (before this print) and the stock making a 52-week high just earlier this week, the market was pricing in good news for ServiceNow. With that said, roughly in line subscription revenue and total revenue this quarter did not meet heightened expectations. Additionally, RPO (remaining performance obligations, a key leading indicator of revenue), missed Wall Street’s expectations by roughly 2%, although the 23% year on year growth was certainly healthy for a company of this scale. Moving down the income statement, adjusted operating margin of 29.5% beat expectations very slightly.

Looking ahead, ServiceNow guided to Q1 subscription revenue of roughly $3.0 billion, in line with Wall Street’s expectations. Adjusted operating margin of 30% is expected in Q1, again in line with expectations.

A top priority for ServiceNow continues to be AI. Recent developments include AI Agent Orchestrator, which connects teams of AI agents working across tasks, systems, and departments to maximize efficiency. AI Agent Studio is a low code/no-code tool allowing businesses to build fully-customized AI agents. AI Agents is a product featuring ready-to-deploy agents designed for every workflow across IT, customer service, HR, and more.

Overall ServiceNow reported Q4 2024 results and gave Q1 2025 guidance that was largely in line with expectations. Said differently, the business is tracking, with healthy, profitable growth. However, the valuation and recent run-up in the stock tells us that expectations were high heading into the print. It is therefore no surprise that the stock traded down 10.6% to $1,023 immediately following the results.

Big picture, is ServiceNow a buy here and now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.