Freight transportation intermediary C.H. Robinson (NASDAQ:CHRW) fell short of the market’s revenue expectations in Q4 CY2024, with sales flat year on year at $4.18 billion. Its non-GAAP profit of $1.21 per share was 9.3% above analysts’ consensus estimates.

Is now the time to buy C.H. Robinson Worldwide? Find out by accessing our full research report, it’s free.

C.H. Robinson Worldwide (CHRW) Q4 CY2024 Highlights:

- Revenue: $4.18 billion vs analyst estimates of $4.44 billion (flat year on year, 5.7% miss)

- Adjusted EPS: $1.21 vs analyst estimates of $1.11 (9.3% beat)

- Adjusted EBITDA: $208.1 million vs analyst estimates of $210.3 million (5% margin, 1.1% miss)

- Operating Margin: 4.4%, up from 2.5% in the same quarter last year

- Free Cash Flow Margin: 6%, up from 0.9% in the same quarter last year

- Market Capitalization: $12.98 billion

"We’ve talked extensively over the past year about our new Robinson operating model and the disciplined execution that the model is enabling, as well as how we’re leveraging our industry leading talent and technology to raise the bar in logistics," said President and Chief Executive Officer, Dave Bozeman.

Company Overview

Engaging in contracts with tens of thousands of transportation companies, C.H. Robinson (NASDAQ:CHRW) offers freight transportation and logistics services.

Air Freight and Logistics

The growth of e-commerce and global trade continues to drive demand for expedited shipping services, presenting opportunities for air freight companies. The industry continues to invest in advanced technologies such as automated sorting systems and real-time tracking solutions to enhance operational efficiency. Despite the advantages of speed and global reach, air freight and logistics companies are still at the whim of economic cycles. Consumer spending, for example, can greatly impact the demand for these companies’ offerings while fuel costs can influence profit margins.

Sales Growth

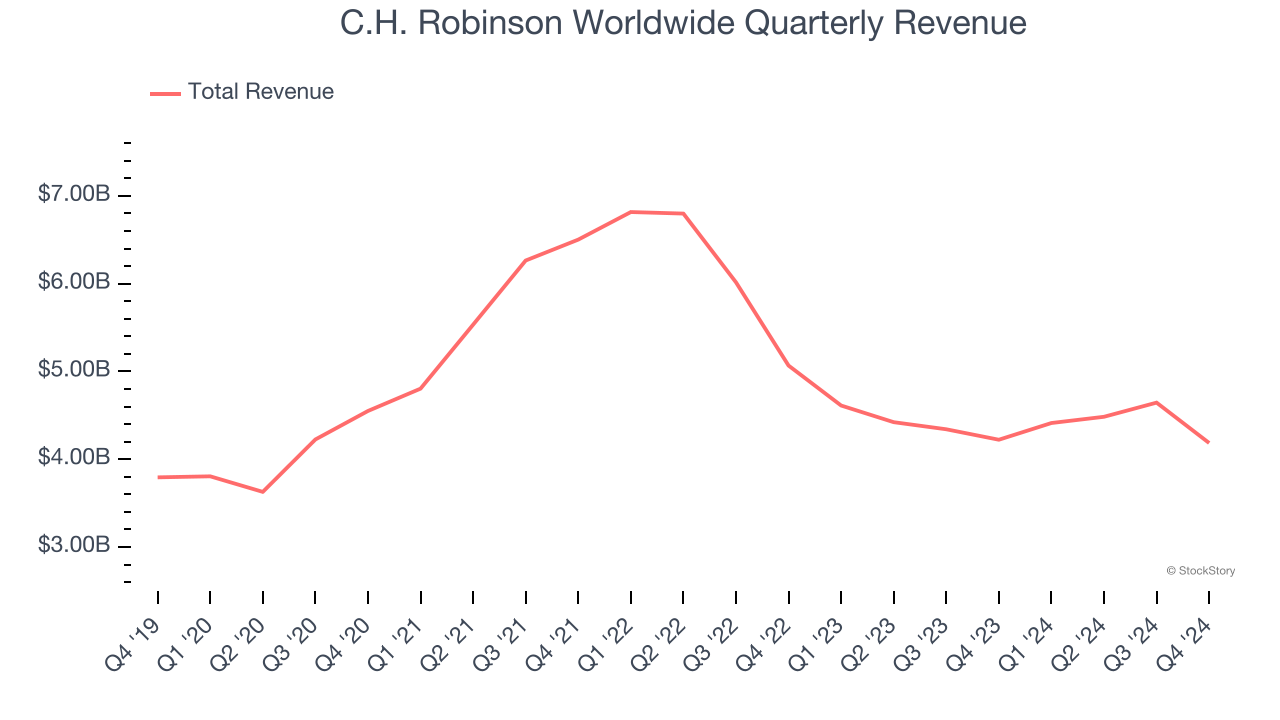

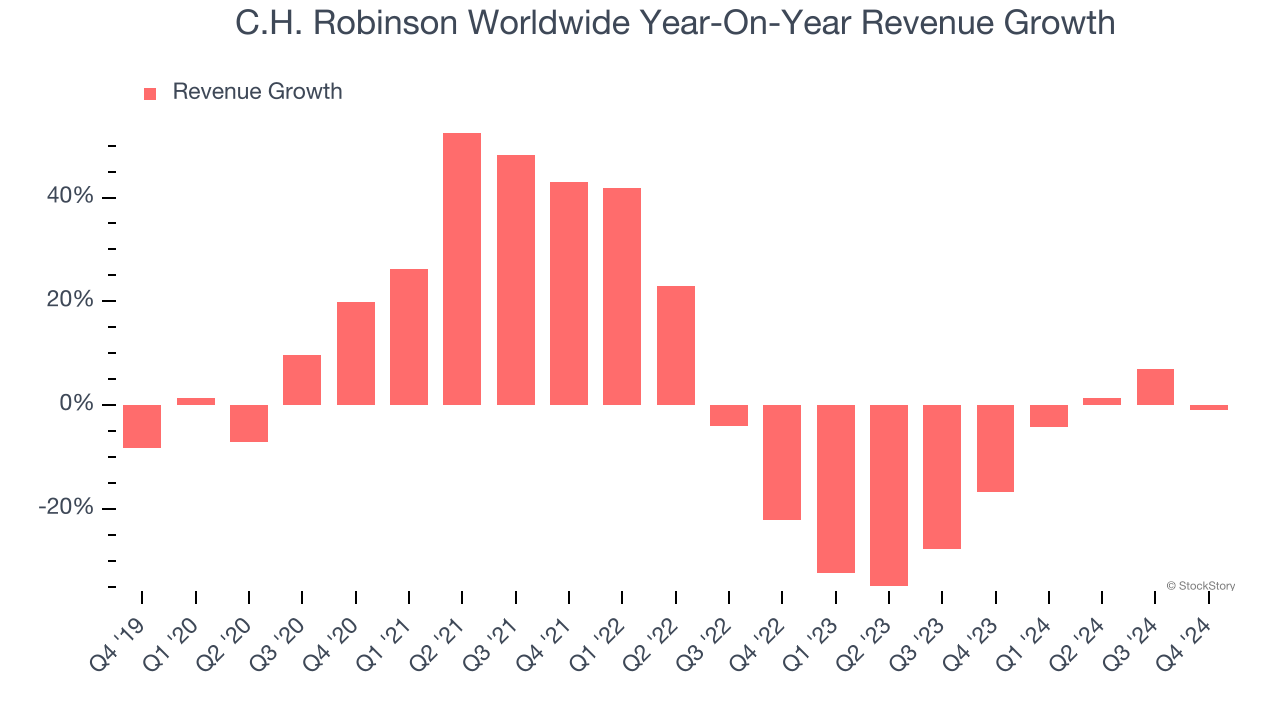

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, C.H. Robinson Worldwide’s 3% annualized revenue growth over the last five years was sluggish. This fell short of our benchmarks and is a rough starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. C.H. Robinson Worldwide’s history shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 15.3% annually. C.H. Robinson Worldwide isn’t alone in its struggles as the Air Freight and Logistics industry experienced a cyclical downturn, with many similar businesses observing lower sales at this time.

C.H. Robinson Worldwide also breaks out the revenue for its most important segments, North American surface transportation and Global Forwarding, which are 67% and 21.1% of revenue. Over the last two years, C.H. Robinson Worldwide’s North American surface transportation revenue (transportation brokerage) averaged 13.5% year-on-year declines while its Global Forwarding revenue (worldwide ocean, air, customers ) averaged 12.4% declines.

This quarter, C.H. Robinson Worldwide missed Wall Street’s estimates and reported a rather uninspiring 0.9% year-on-year revenue decline, generating $4.18 billion of revenue.

Looking ahead, sell-side analysts expect revenue to grow 3.3% over the next 12 months. Although this projection implies its newer products and services will catalyze better top-line performance, it is still below average for the sector.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

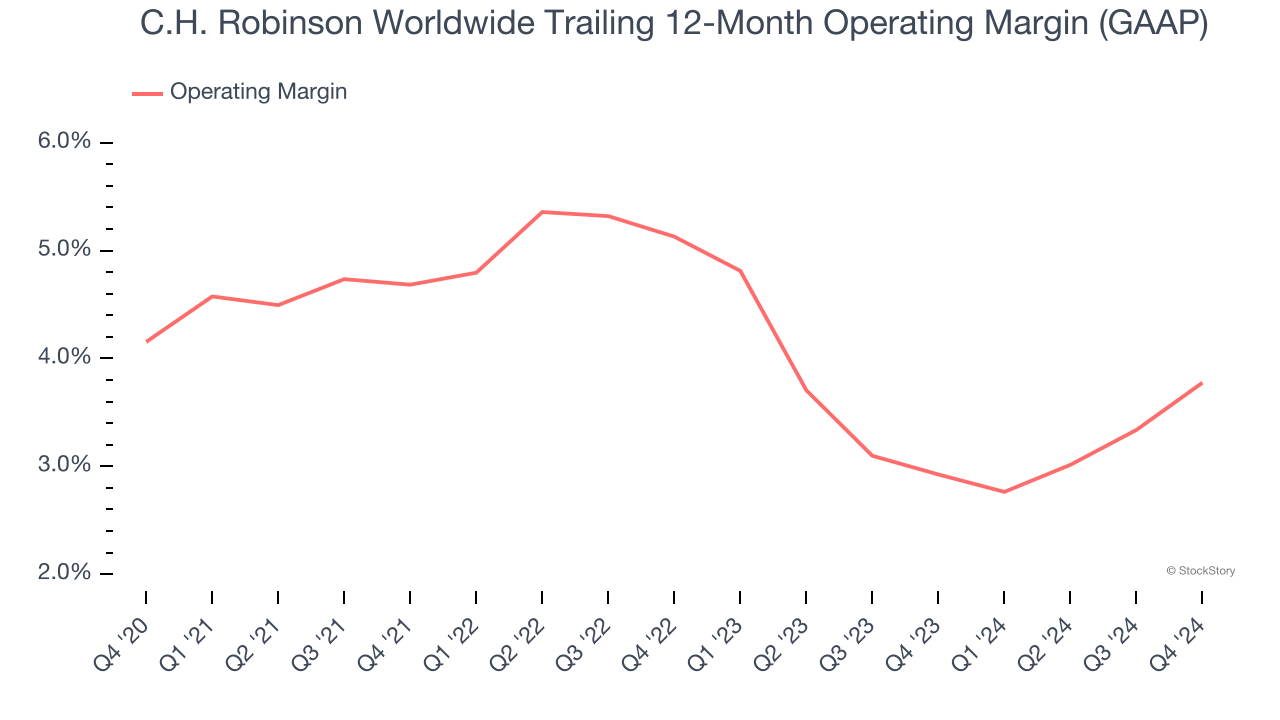

C.H. Robinson Worldwide was profitable over the last five years but held back by its large cost base. Its average operating margin of 4.2% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

Analyzing the trend in its profitability, C.H. Robinson Worldwide’s operating margin might have seen some fluctuations but has generally stayed the same over the last five years, meaning it will take a fundamental shift in the business to change.

This quarter, C.H. Robinson Worldwide generated an operating profit margin of 4.4%, up 1.8 percentage points year on year. Since its gross margin expanded more than its operating margin, we can infer that leverage on its cost of sales was the primary driver behind the recently higher efficiency.

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

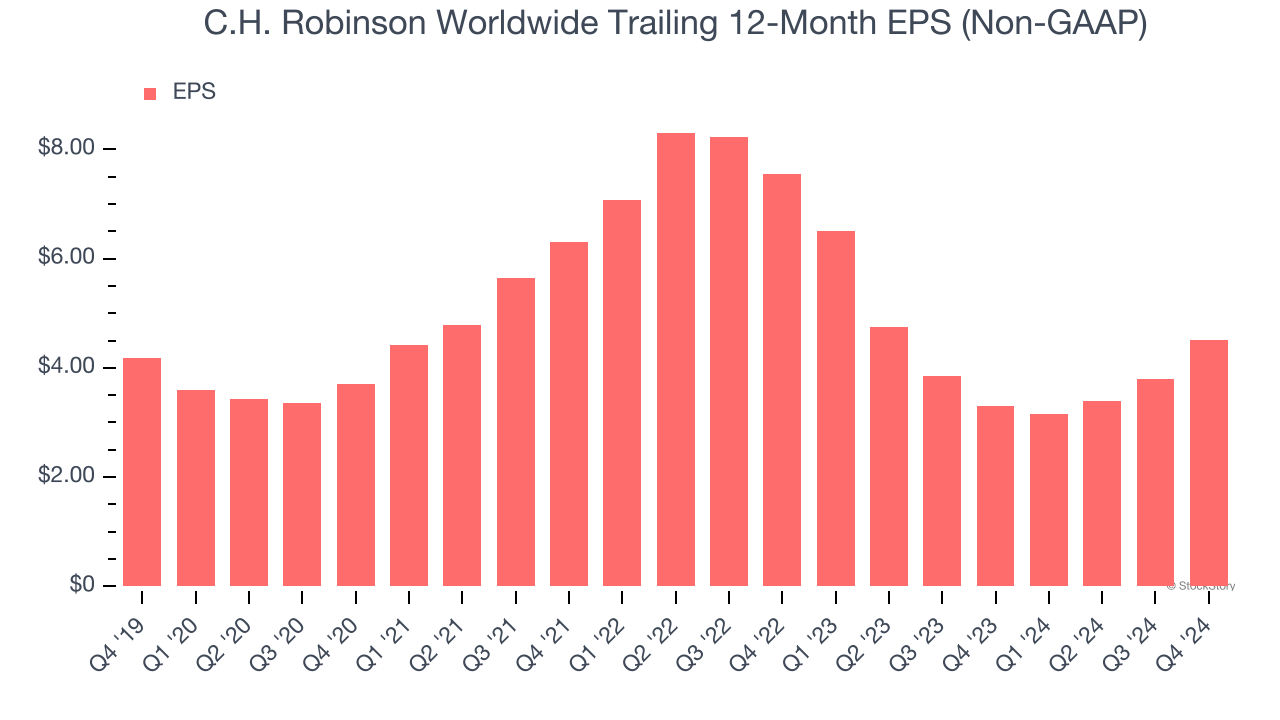

C.H. Robinson Worldwide’s EPS grew at a weak 1.5% compounded annual growth rate over the last five years, lower than its 3% annualized revenue growth. However, its operating margin didn’t change during this timeframe, telling us that non-fundamental factors such as interest and taxes affected its ultimate earnings.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

C.H. Robinson Worldwide’s two-year annual EPS declines of 22.8% were bad and lower than its two-year revenue performance.

In Q4, C.H. Robinson Worldwide reported EPS at $1.21, up from $0.50 in the same quarter last year. This print beat analysts’ estimates by 9.3%. Over the next 12 months, Wall Street expects C.H. Robinson Worldwide’s full-year EPS of $4.50 to grow 8.2%.

Key Takeaways from C.H. Robinson Worldwide’s Q4 Results

It was encouraging to see C.H. Robinson Worldwide beat analysts’ EPS expectations this quarter. On the other hand, its revenue and EBITDA missed as its North American surface transportation segment underwhelmed. Overall, this was a weaker quarter. The stock traded down 2.8% to $105 immediately following the results.

The latest quarter from C.H. Robinson Worldwide’s wasn’t that good. One earnings report doesn’t define a company’s quality, though, so let’s explore whether the stock is a buy at the current price. When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.