Shareholders of Herbalife would probably like to forget the past six months even happened. The stock dropped 28.7% and now trades at $8.15. This may have investors wondering how to approach the situation.

Is there a buying opportunity in Herbalife, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free.Despite the more favorable entry price, we're sitting this one out for now. Here are three reasons why there are better opportunities than HLF and a stock we'd rather own.

Why Is Herbalife Not Exciting?

With the first products sold out of the trunk of the founder’s car, Herbalife (NYSE:HLF) today offers a portfolio of shakes, supplements, personal care products, and weight management programs to help customers reach their nutritional and fitness goals.

1. Demand Slipping as Sales Volumes Decline

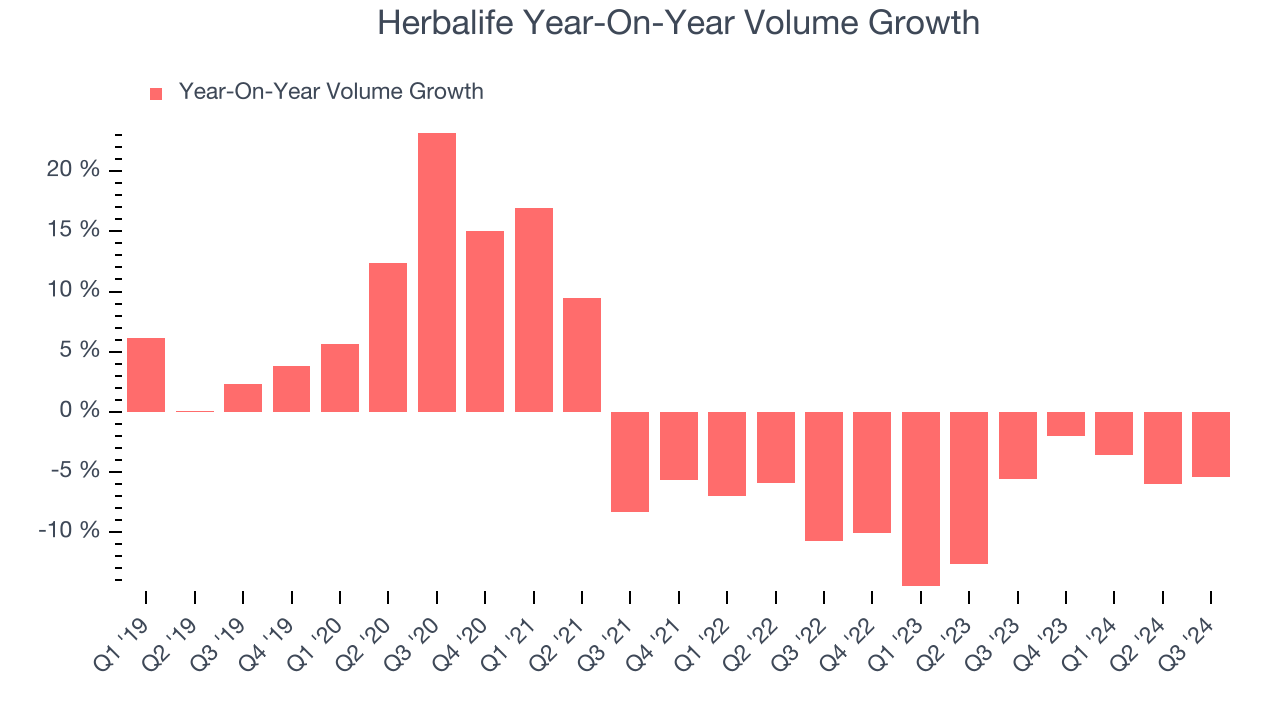

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

Herbalife’s average quarterly sales volumes have shrunk by 7.5% over the last two years. This decrease isn’t ideal because the quantity demanded for consumer staples products is typically stable.

2. Core Business Falling Behind as Demand Plateaus

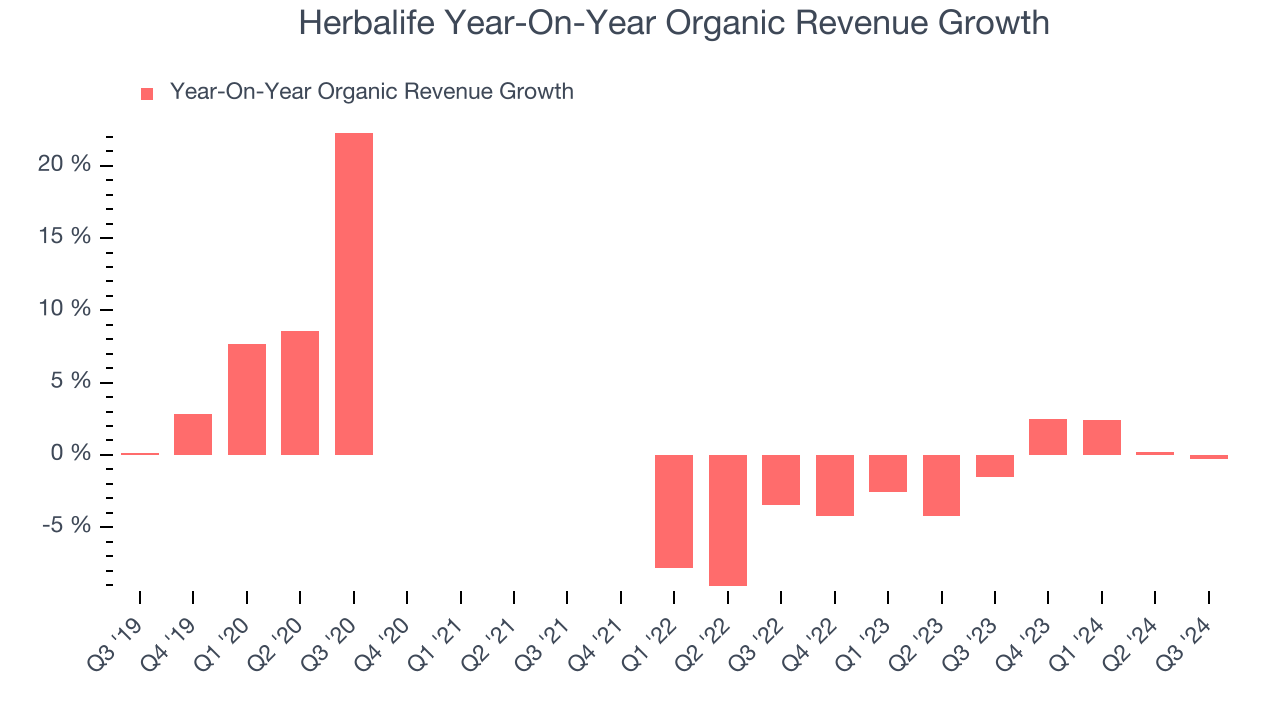

When analyzing revenue growth, we care most about organic revenue growth. This metric captures a business’s performance excluding one-time events such as mergers, acquisitions, and divestitures as well as foreign currency fluctuations.

The demand for Herbalife’s products has barely risen over the last eight quarters. On average, the company’s organic sales have been flat.

3. EPS Trending Down

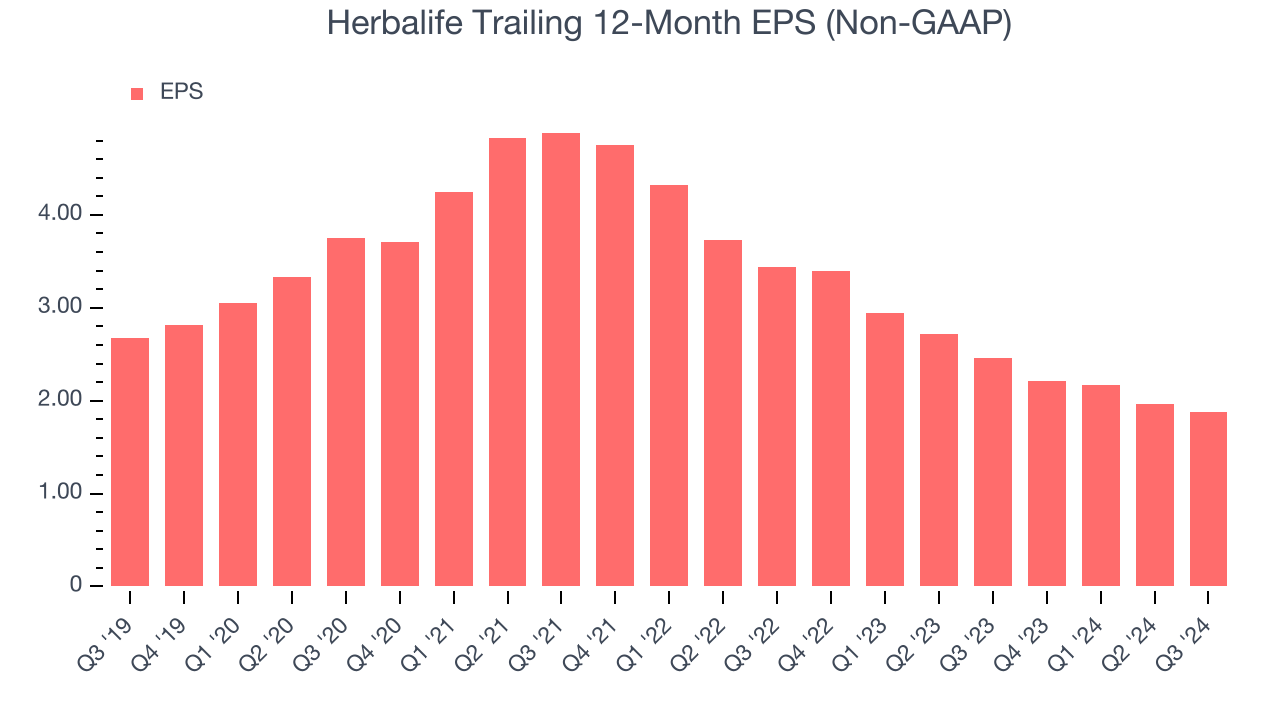

We track the change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for Herbalife, its EPS declined by more than its revenue over the last three years, dropping 27.2% annually. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

Final Judgment

Herbalife isn’t a terrible business, but it doesn’t pass our bar. Following the recent decline, the stock trades at 4.4× forward price-to-earnings (or $8.15 per share). While this valuation is optically cheap, the potential downside is big given its shaky fundamentals. We're pretty confident there are superior stocks to buy right now. Let us point you toward Yum! Brands, an all-weather company that owns household favorite Taco Bell.

Stocks We Like More Than Herbalife

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.