Healthcare software provider Veeva Systems (NASDAQ:VEEV) reported Q3 CY2024 results topping the market’s revenue expectations, with sales up 13.4% year on year to $699.2 million. The company expects next quarter’s revenue to be around $697.5 million, close to analysts’ estimates. Its non-GAAP profit of $1.75 per share was 10.7% above analysts’ consensus estimates.

Is now the time to buy Veeva Systems? Find out by accessing our full research report, it’s free.

Veeva Systems (VEEV) Q3 CY2024 Highlights:

- Revenue: $699.2 million vs analyst estimates of $684.3 million (13.4% year-on-year growth, 2.2% beat)

- Adjusted EPS: $1.75 vs analyst estimates of $1.58 (10.7% beat)

- Adjusted Operating Income: $304 million vs analyst estimates of $274.3 million (43.5% margin, 10.8% beat)

- Revenue Guidance for Q4 CY2024 is $697.5 million at the midpoint, roughly in line with what analysts were expecting

- Management raised its full-year Adjusted EPS guidance to $6.44 at the midpoint, a 3.5% increase

- Operating Margin: 25.9%, up from 20.8% in the same quarter last year

- Free Cash Flow Margin: 22.9%, up from 13.3% in the previous quarter

- Market Capitalization: $38.5 billion

"It was a great quarter of innovation and excellent execution across the board," said CEO Peter Gassner.

Company Overview

Built on top of Salesforce as one of the first vertical-focused cloud platforms, Veeva (NYSE:VEEV) provides data and customer relationship management (CRM) software for organizations in the life sciences industry.

Healthcare And Life Sciences Software

The coronavirus pandemic has underscored the importance of high-quality health infrastructure in times of crisis. Coupled with intense competition between drugmakers and the growing volume of data in the health care sector, demand for data management solutions in the healthcare space is expected to remain strong in the years ahead.

Sales Growth

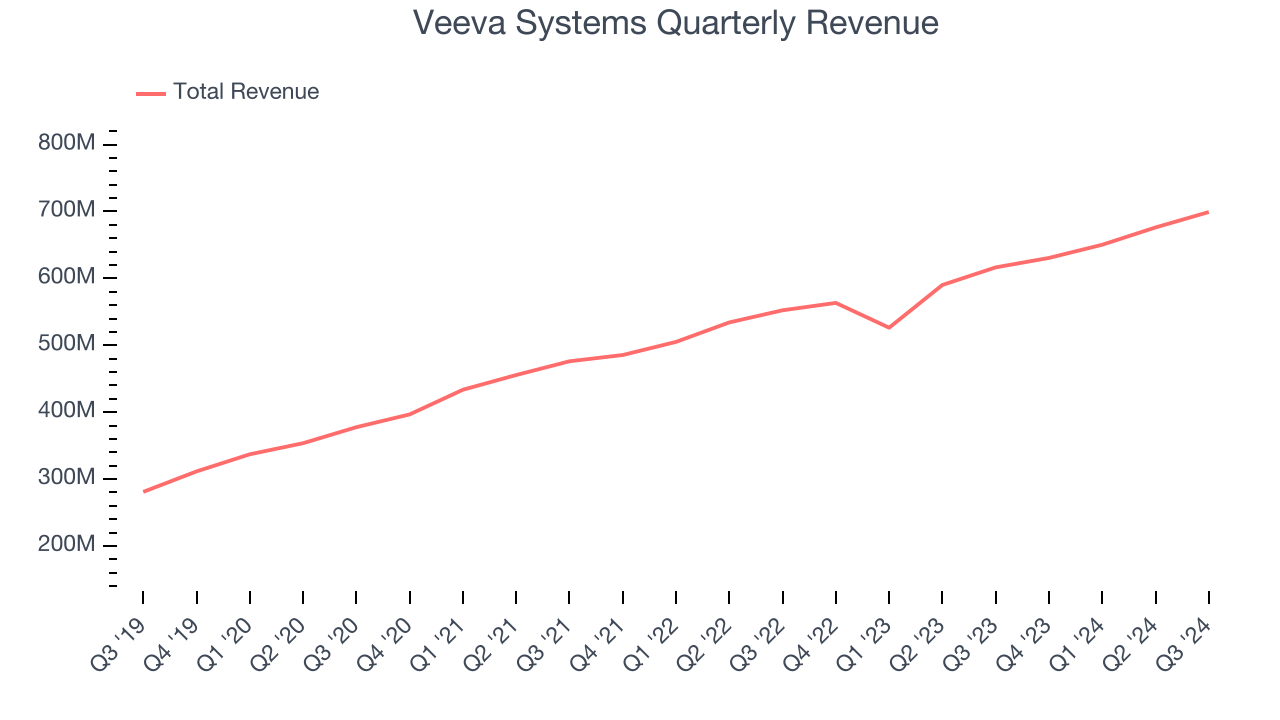

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last three years, Veeva Systems grew its sales at a 14.7% annual rate. Although this growth is solid on an absolute basis, it fell short of our benchmark for the software sector. Luckily, there are other things to like about Veeva Systems.

This quarter, Veeva Systems reported year-on-year revenue growth of 13.4%, and its $699.2 million of revenue exceeded Wall Street’s estimates by 2.2%. Company management is currently guiding for a 10.6% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 11% over the next 12 months, a deceleration versus the last three years. Despite the slowdown, this projection is above the sector average and suggests the market sees some success for its newer products and services.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Customer Acquisition Efficiency

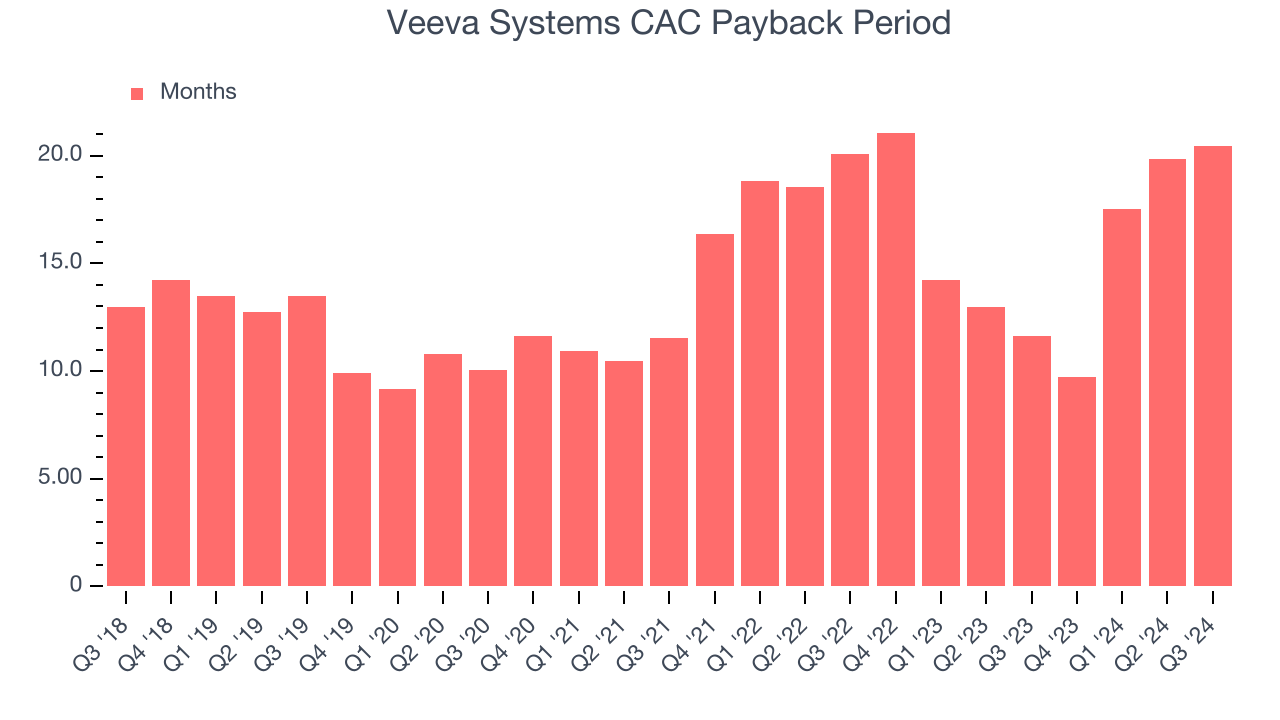

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

Veeva Systems is extremely efficient at acquiring new customers, and its CAC payback period checked in at 20.4 months this quarter. The company’s performance gives it the freedom to invest its resources into new product initiatives while maintaining optionality.

Key Takeaways from Veeva Systems’s Q3 Results

It was great to see Veeva Systems raise its full-year EPS guidance. We were also glad this quarter's revenue, adjusted operating income, and EPS beat Wall Street’s estimates. Overall, these results were solid. The stock traded up 5.9% to $245.24 immediately after reporting.

Indeed, Veeva Systems had a rock-solid quarterly earnings result, but is this stock a good investment here? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.