As the Q3 earnings season wraps, let’s dig into this quarter’s best and worst performers in the data infrastructure industry, including Elastic (NYSE:ESTC) and its peers.

Generating insights from system level data is an increasing priority for most businesses, but to do so requires connecting and analyzing piles of data stored and siloed in separate databases. This is the demand driver for cloud based data infrastructure software providers, who can more readily integrate, distribute and process information vs. legacy on-premise software providers.

The 4 data infrastructure stocks we track reported a strong Q3. As a group, revenues beat analysts’ consensus estimates by 3.6% while next quarter’s revenue guidance was in line.

Thankfully, share prices of the companies have been resilient as they are up 5.9% on average since the latest earnings results.

Best Q3: Elastic (NYSE:ESTC)

Started by Shay Banon as a search engine for his wife's growing list of recipes at Le Cordon Bleu cooking school in Paris, Elastic (NYSE:ESTC) helps companies integrate search into their products and monitor their cloud infrastructure.

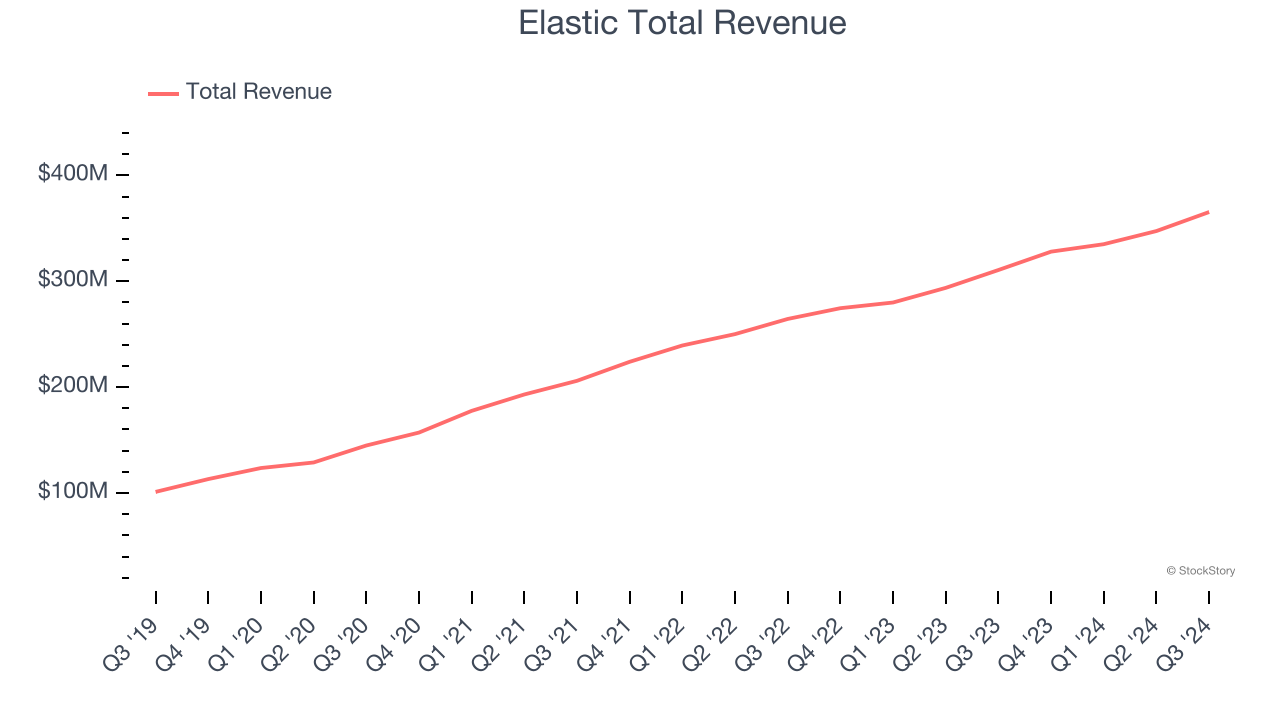

Elastic reported revenues of $365.4 million, up 17.6% year on year. This print exceeded analysts’ expectations by 3.1%. Overall, it was a very strong quarter for the company with an impressive beat of analysts’ billings estimates and EPS guidance for next quarter exceeding analysts’ expectations.

“Elastic delivered a strong second quarter supported by solid sales execution, exceeding our guidance across all revenue and profitability metrics,” said Ash Kulkarni, Chief Executive Officer, Elastic.

Elastic delivered the weakest full-year guidance update of the whole group. The company added 50 enterprise customers paying more than $100,000 annually to reach a total of 1,420. Interestingly, the stock is up 9.3% since reporting and currently trades at $102.99.

Is now the time to buy Elastic? Access our full analysis of the earnings results here, it’s free.

Confluent (NASDAQ:CFLT)

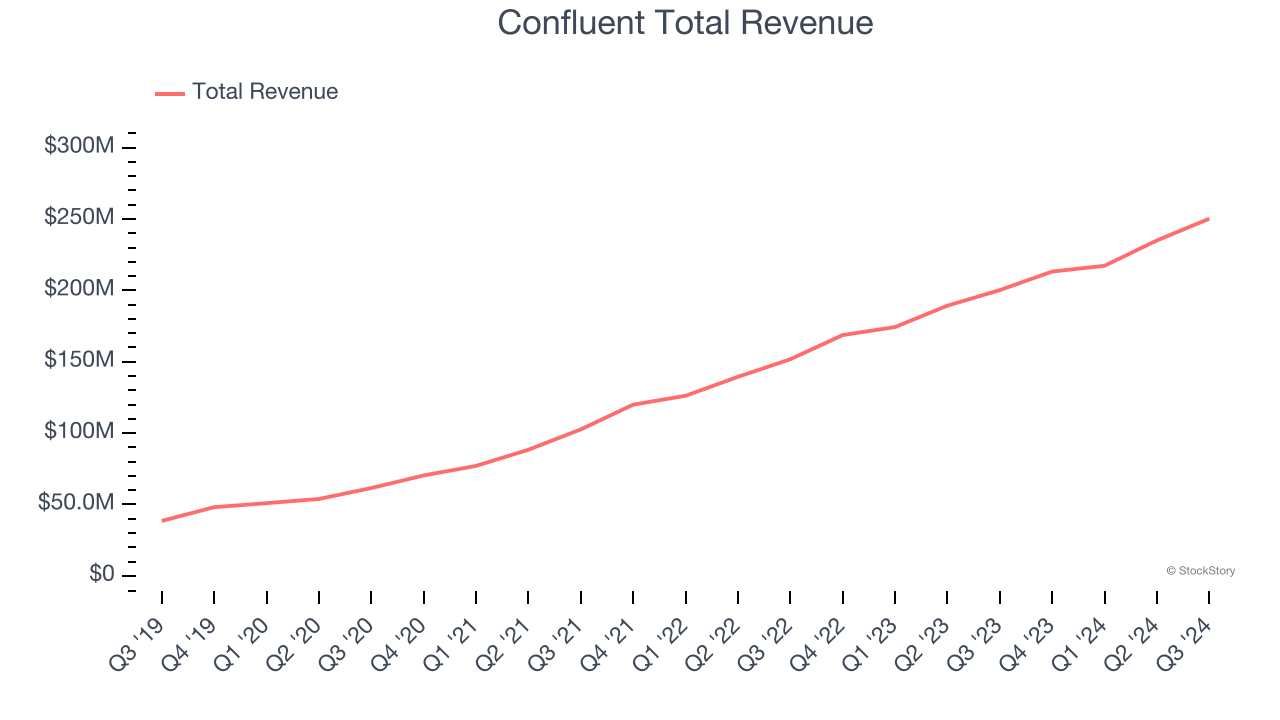

Started in 2014 by the team of engineers at LinkedIn who originally built it as an internal tool, Confluent (NASDAQ:CFLT) provides infrastructure software for organizations that makes it easy and fast to collect and move large amounts of data between different systems.

Confluent reported revenues of $250.2 million, up 25% year on year, outperforming analysts’ expectations by 2.1%. The business had a strong quarter with a solid beat of analysts’ billings and EBITDA estimates.

The market seems happy with the results as the stock is up 28.7% since reporting. It currently trades at $29.70.

Is now the time to buy Confluent? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Teradata (NYSE:TDC)

Part of point-of-sale and ATM company NCR from 1991 to 2007, Teradata (NYSE:TDC) offers a software-as-service platform that helps organizations manage their data across multiple storages and analyze it.

Teradata reported revenues of $440 million, flat year on year, exceeding analysts’ expectations by 5.3%. It may have had the worst quarter among its peers, but its results were still good as it also locked in full-year EPS guidance exceeding analysts’ expectations and an impressive beat of analysts’ EBITDA estimates.

Teradata delivered the biggest analyst estimates beat but had the slowest revenue growth in the group. As expected, the stock is down 3.6% since the results and currently trades at $32.18.

Read our full analysis of Teradata’s results here.

C3.ai (NYSE:AI)

Founded in 2009 by enterprise software veteran Tom Seibel, C3.ai (NYSE:AI) provides software that makes it easy for organizations to add artificial intelligence technology to their applications.

C3.ai reported revenues of $94.34 million, up 28.8% year on year. This print beat analysts’ expectations by 3.6%. Overall, it was a strong quarter as it also recorded a solid beat of analysts’ EBITDA estimates and full-year revenue guidance slightly topping analysts’ expectations.

C3.ai scored the fastest revenue growth and highest full-year guidance raise among its peers. The stock is down 10.7% since reporting and currently trades at $37.33.

Read our full, actionable report on C3.ai here, it’s free.

Market Update

Thanks to the Fed's series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market has thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% each in November and December), and a notable surge followed Donald Trump's presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by the pace and magnitude of future rate cuts as well as potential changes in trade policy and corporate taxes once the Trump administration takes over. The path forward is marked by uncertainty.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.