Over the past six months, Packaging Corporation of America has been a great trade, beating the S&P 500 by 15.6%. Its stock price has climbed to $229.45, representing a healthy 25.3% increase. This was partly thanks to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is there a buying opportunity in Packaging Corporation of America, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free.Despite the momentum, we're swiping left on Packaging Corporation of America for now. Here are three reasons why we avoid PKG and a stock we'd rather own.

Why Do We Think Packaging Corporation of America Will Underperform?

Founded in 1959, Packaging Corporation of America (NYSE: PKG) produces containerboard and corrugated packaging products, also offering displays and protective packaging solutions.

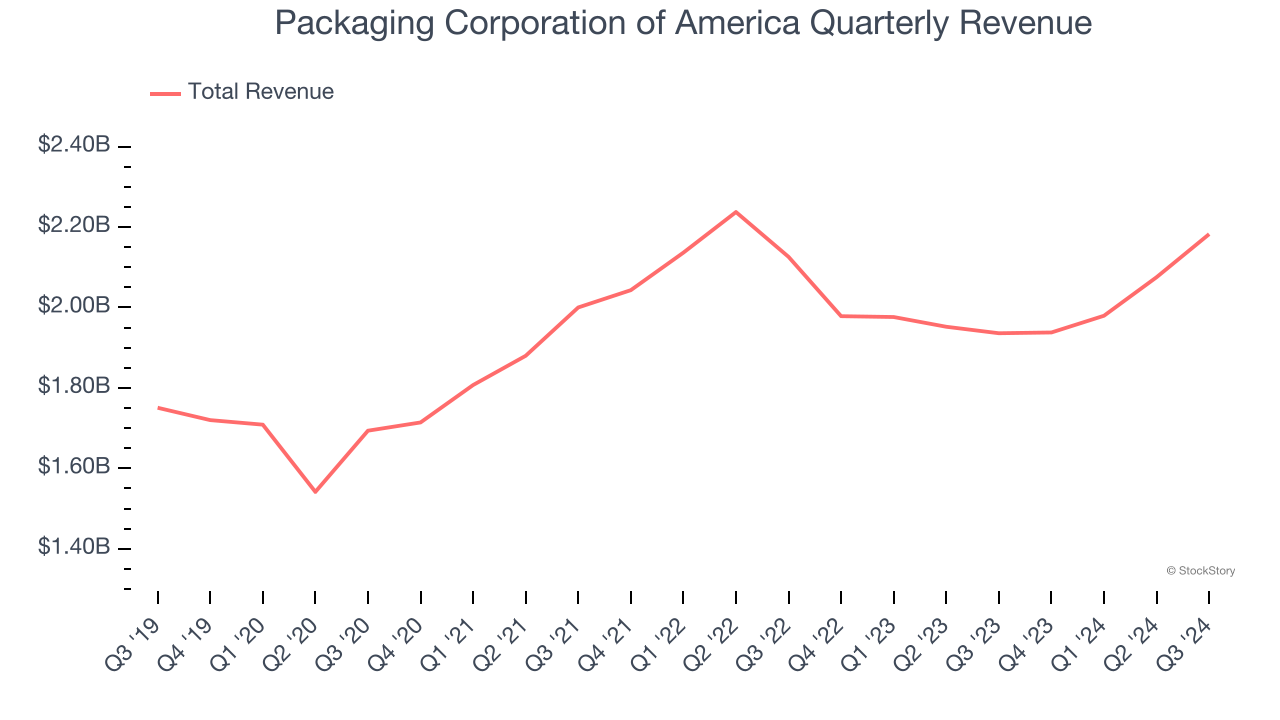

1. Long-Term Revenue Growth Disappoints

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, Packaging Corporation of America’s 3.2% annualized revenue growth over the last five years was sluggish. This fell short of our benchmark for the industrials sector.

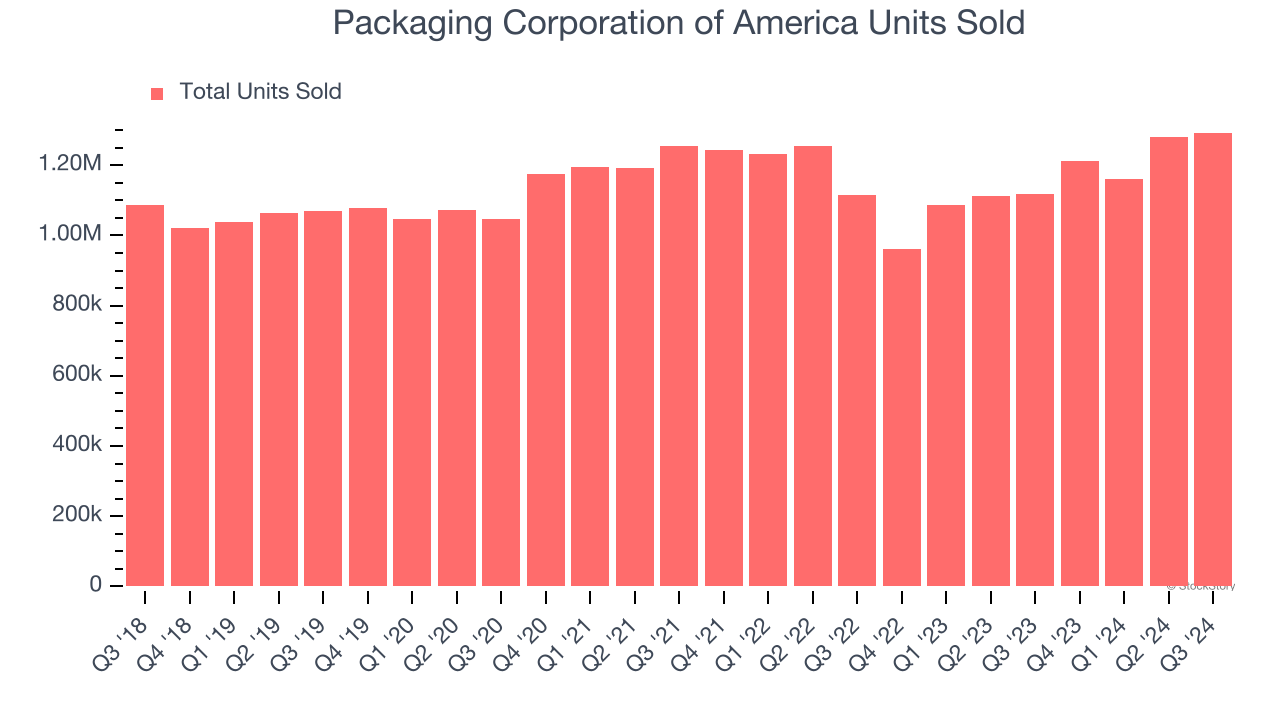

2. Weak Sales Volumes Indicate Waning Demand

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful Industrial Packaging company because there’s a ceiling to what customers will pay.

Packaging Corporation of America’s units sold came in at 1.29 million in the latest quarter, and over the last two years, averaged 2.3% year-on-year growth. This performance was underwhelming and suggests it might have to lower prices or invest in product improvements to accelerate growth, factors that can hinder near-term profitability.

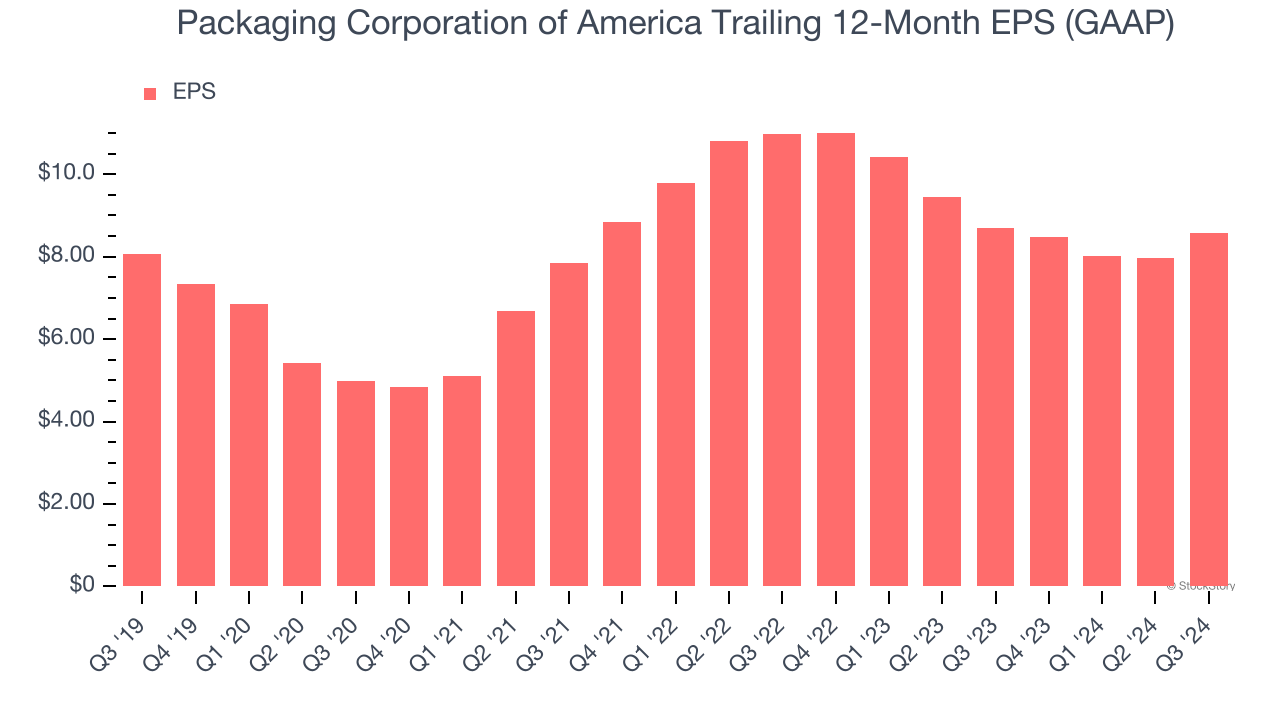

3. EPS Barely Growing

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Packaging Corporation of America’s EPS grew at a weak 1.2% compounded annual growth rate over the last five years, lower than its 3.2% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

Final Judgment

We cheer for all companies making their customers lives easier, but in the case of Packaging Corporation of America, we’ll be cheering from the sidelines. With its shares topping the market in recent months, the stock trades at 21.9× forward price-to-earnings (or $229.45 per share). This valuation tells us a lot of optimism is priced in - we think there are better investment opportunities out there. We’d suggest looking at Google, whose cloud computing and YouTube divisions are firing on all cylinders.

Stocks We Would Buy Instead of Packaging Corporation of America

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.