Over the last six months, KBR’s shares have sunk to $57.64, producing a disappointing 10.2% loss - a stark contrast to the S&P 500’s 9.7% gain. This might have investors contemplating their next move.

Is now the time to buy KBR, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.Even with the cheaper entry price, we're swiping left on KBR for now. Here are three reasons why we avoid KBR and a stock we'd rather own.

Why Is KBR Not Exciting?

Known for projects like the construction of Guantanamo Bay, KBR provides professional services and technologies, specializing in engineering, construction, and government services sectors.

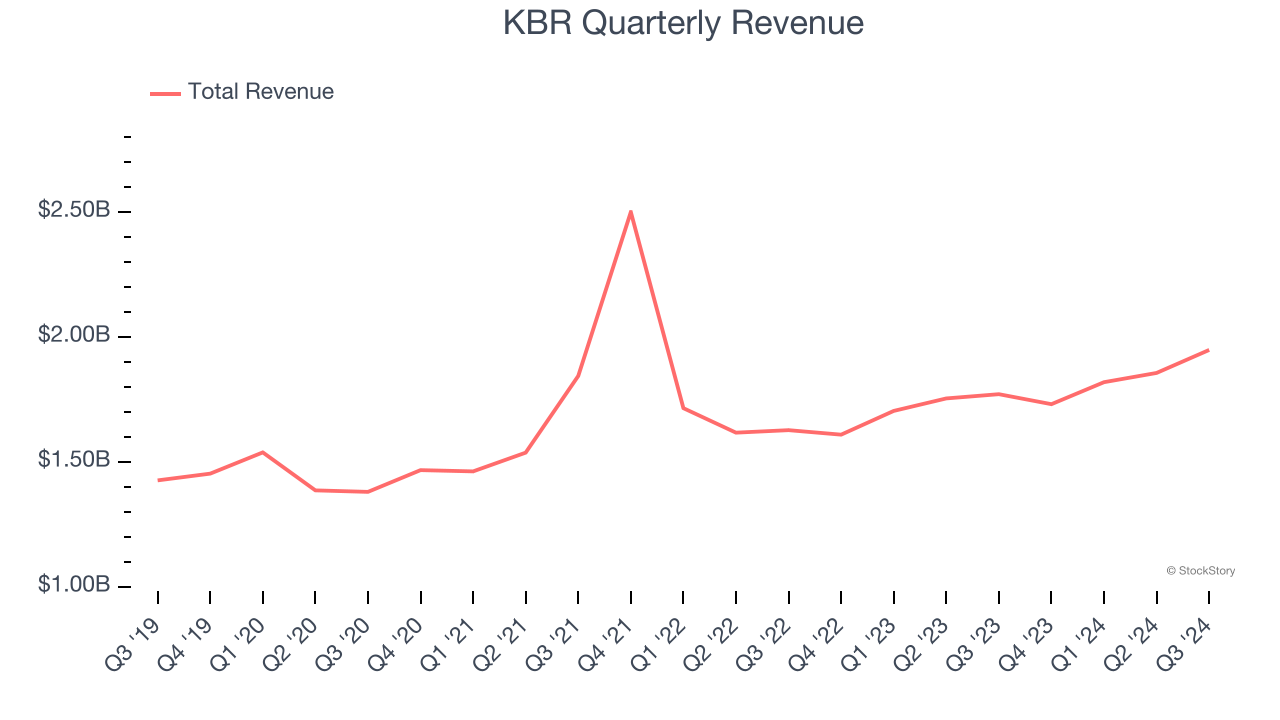

1. Long-Term Revenue Growth Disappoints

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, KBR grew its sales at a tepid 5.9% compounded annual growth rate. This fell short of our benchmark for the industrials sector.

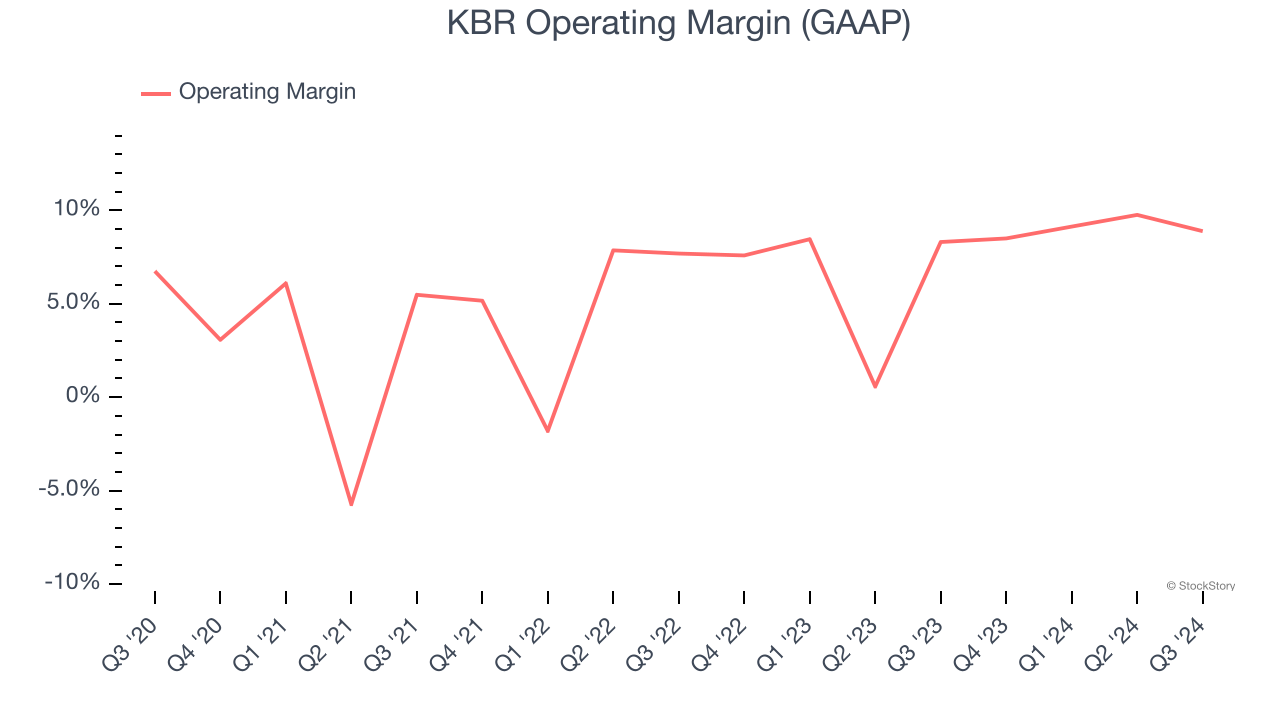

2. Weak Operating Margin Could Cause Trouble

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

KBR was profitable over the last five years but held back by its large cost base. Its average operating margin of 5% was weak for an industrials business.

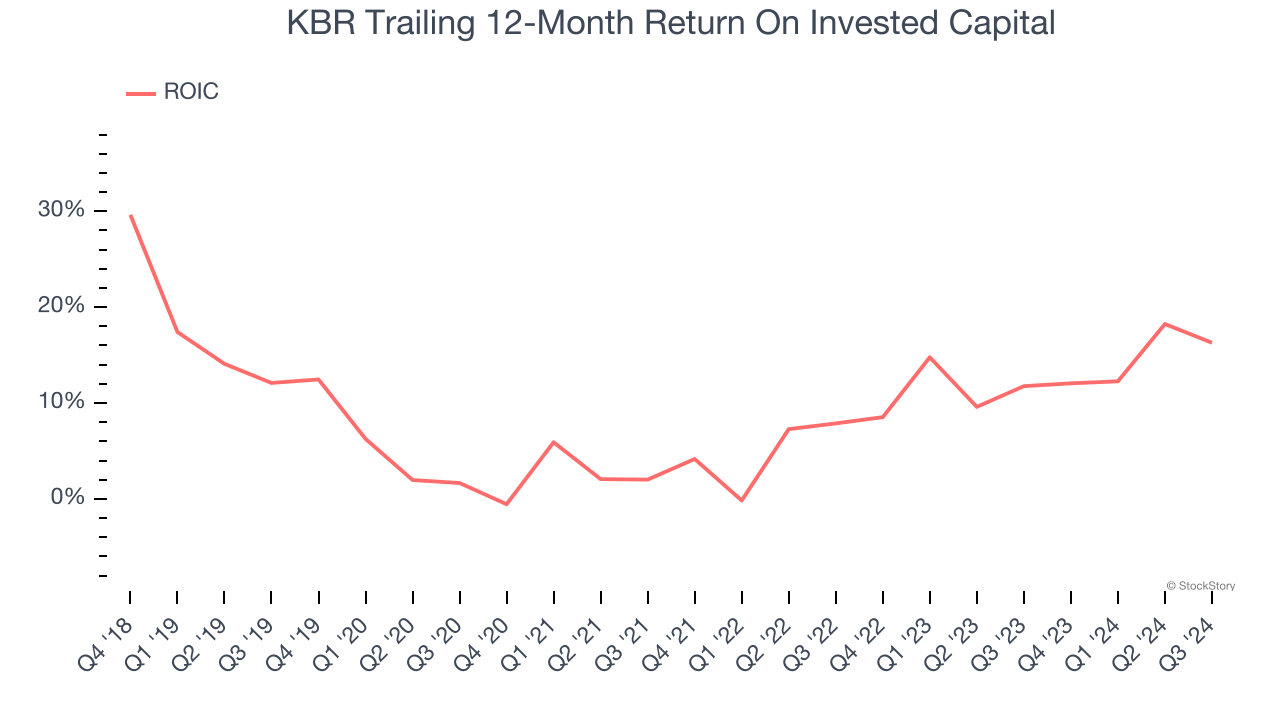

3. Previous Growth Initiatives Haven’t Paid Off Yet

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

KBR historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 7.9%, somewhat low compared to the best industrials companies that consistently pump out 20%+.

Final Judgment

KBR isn’t a terrible business, but it doesn’t pass our quality test. Following the recent decline, the stock trades at 15.1× forward price-to-earnings (or $57.64 per share). This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're pretty confident there are more exciting stocks to buy at the moment. Let us point you toward Uber, whose profitability just reached an inflection point.

Stocks We Like More Than KBR

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.