ITT trades at $144.30 per share and has stayed right on track with the overall market, gaining 12.2% over the last six months. At the same time, the S&P 500 has returned 10.4%.

Is now the time to buy ITT? Find out in our full research report, it’s free.

Why Does ITT Spark Debate?

Playing a crucial role in the development of the first transatlantic television transmission in 1956, ITT (NYSE:ITT) provides motion and fluid handling equipment for various industries

Two Positive Attributes:

1. Encouraging Short-Term Revenue Growth

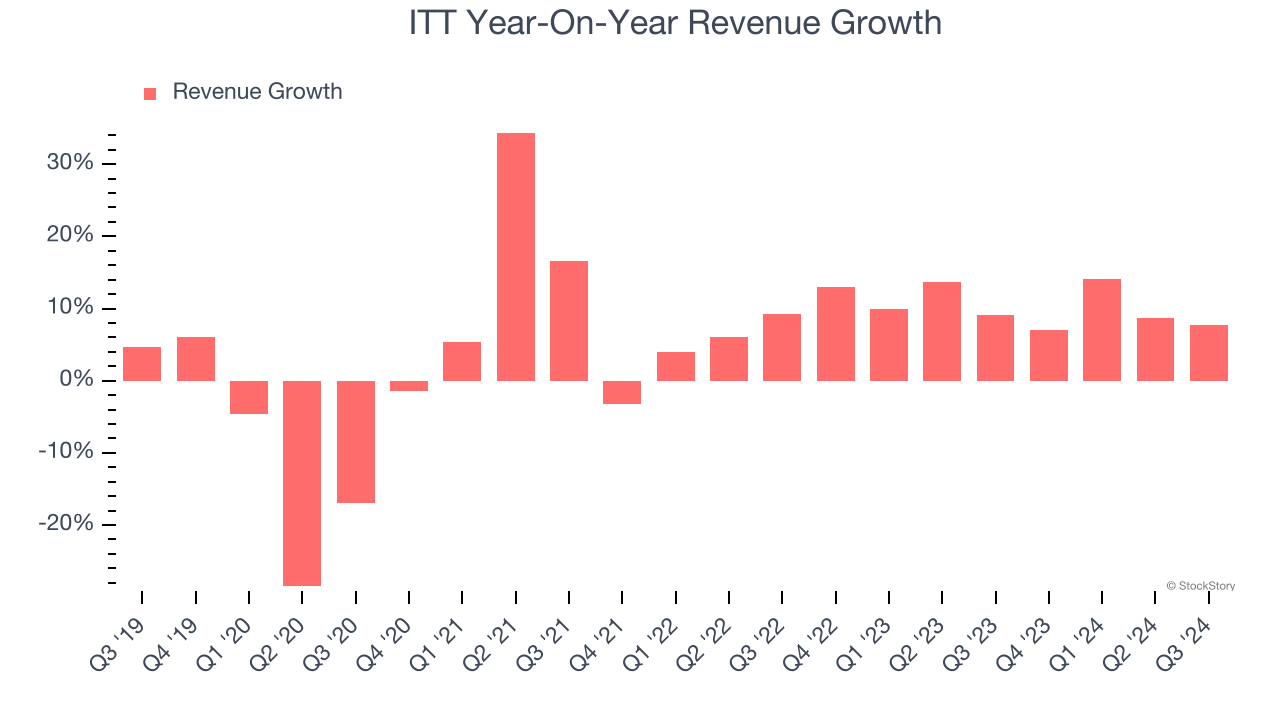

Long-term growth is the most important, but within industrials, a stretched historical view may miss new industry trends or demand cycles. ITT’s annualized revenue growth of 10.4% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

2. Operating Margin Rising, Profits Up

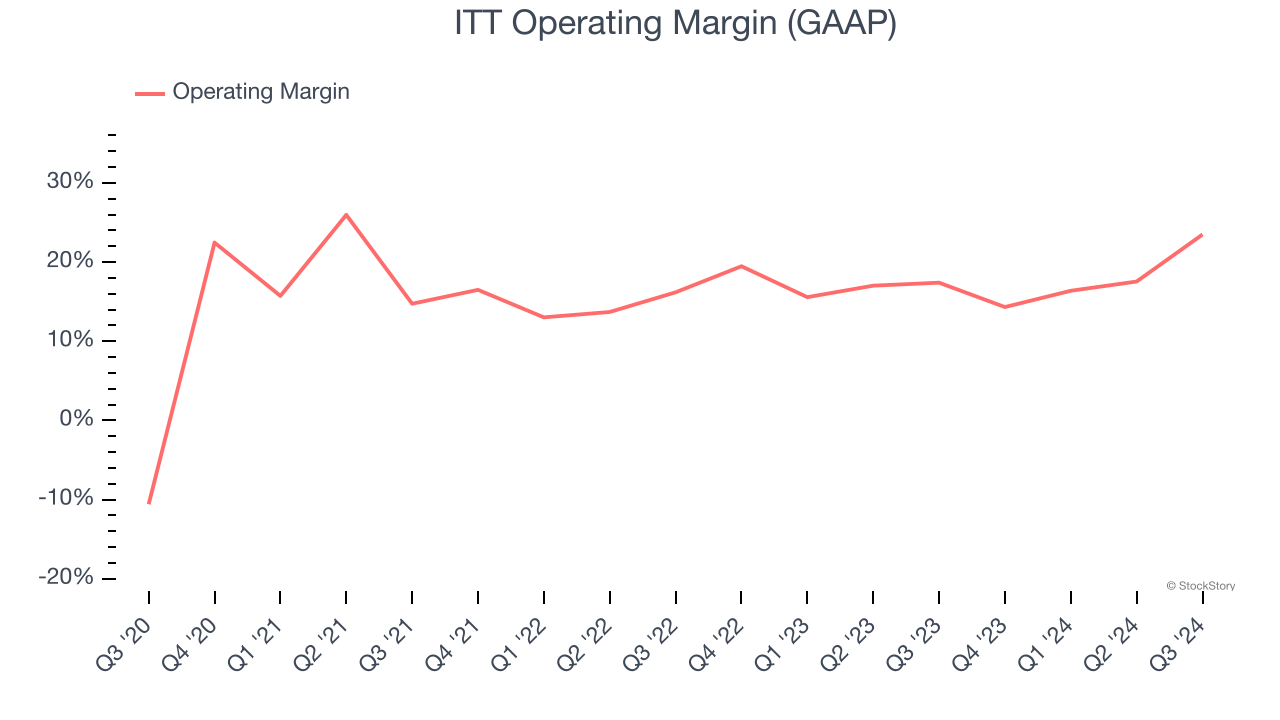

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Looking at the trend in its profitability, ITT’s operating margin rose by 12 percentage points over the last five years, showing its efficiency has meaningfully improved. . Its operating margin for the trailing 12 months was 18%.

One Reason to be Careful:

Free Cash Flow Margin Dropping

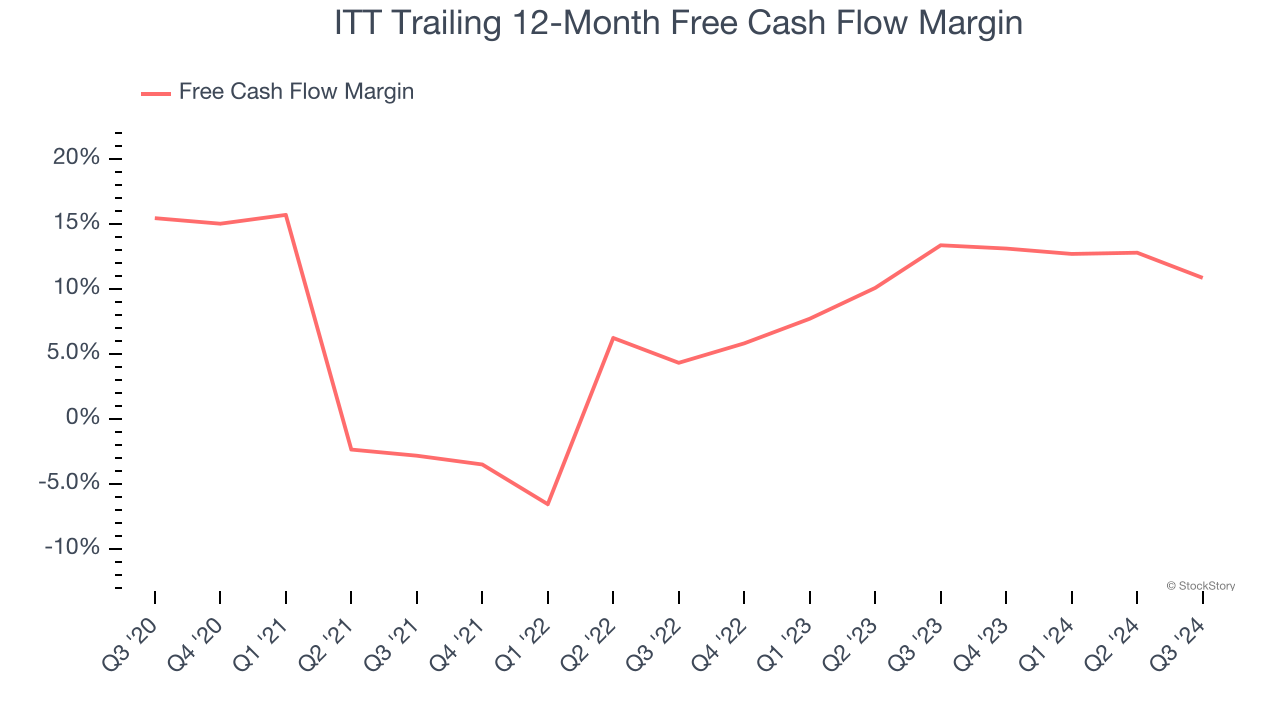

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, ITT’s margin dropped by 4.6 percentage points over the last five years. If its declines continue, it could signal higher capital intensity. ITT’s free cash flow margin for the trailing 12 months was 10.9%.

Final Judgment

ITT’s merits more than compensate for its flaws, but at $144.30 per share (or 22.8× forward price-to-earnings), is now the time to initiate a position? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than ITT

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.