Fastenal’s 15.9% return over the past six months has outpaced the S&P 500 by 5.6%, and its stock price has climbed to $74.70 per share. This performance may have investors wondering how to approach the situation.

Is now the time to buy Fastenal, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.Despite the momentum, we're sitting this one out for now. Here are three reasons why there are better opportunities than FAST and a stock we'd rather own.

Why Is Fastenal Not Exciting?

Founded in 1967, Fastenal (NASDAQ:FAST) provides industrial and construction supplies, including fasteners, tools, safety products, and many other product categories to businesses globally.

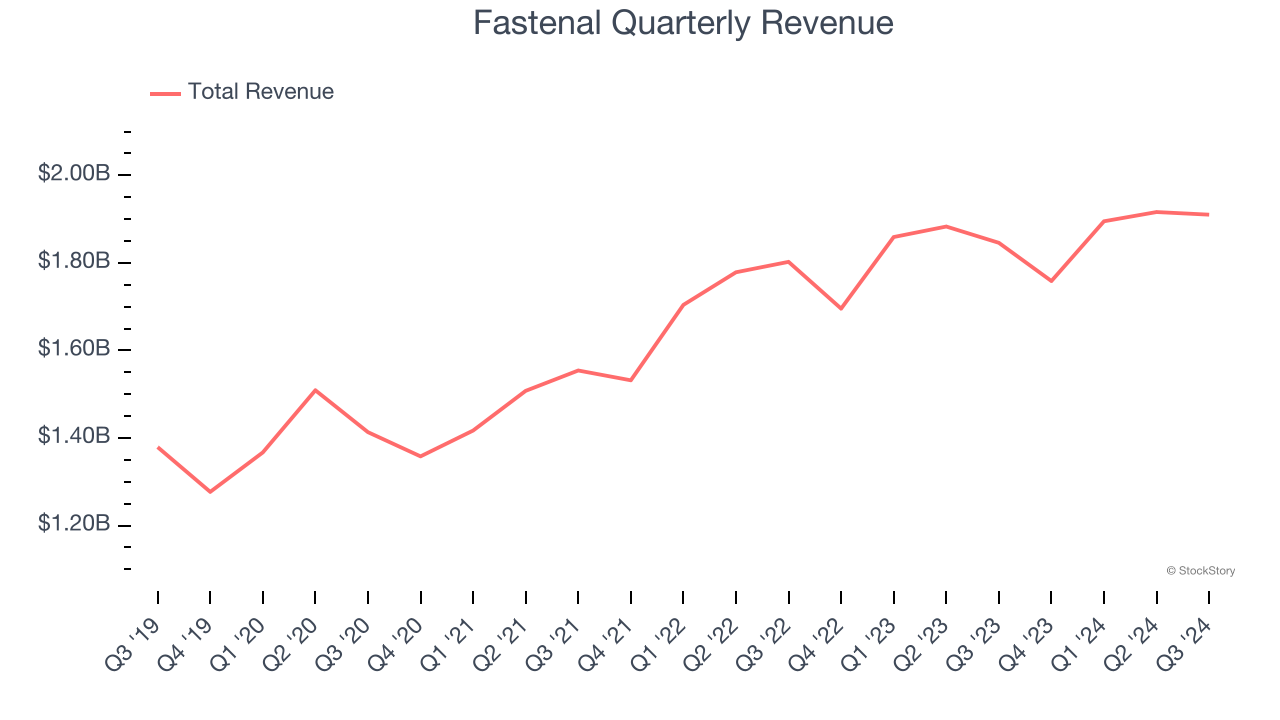

1. Long-Term Revenue Growth Disappoints

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Regrettably, Fastenal’s sales grew at a mediocre 7.2% compounded annual growth rate over the last five years. This fell short of our benchmark for the industrials sector.

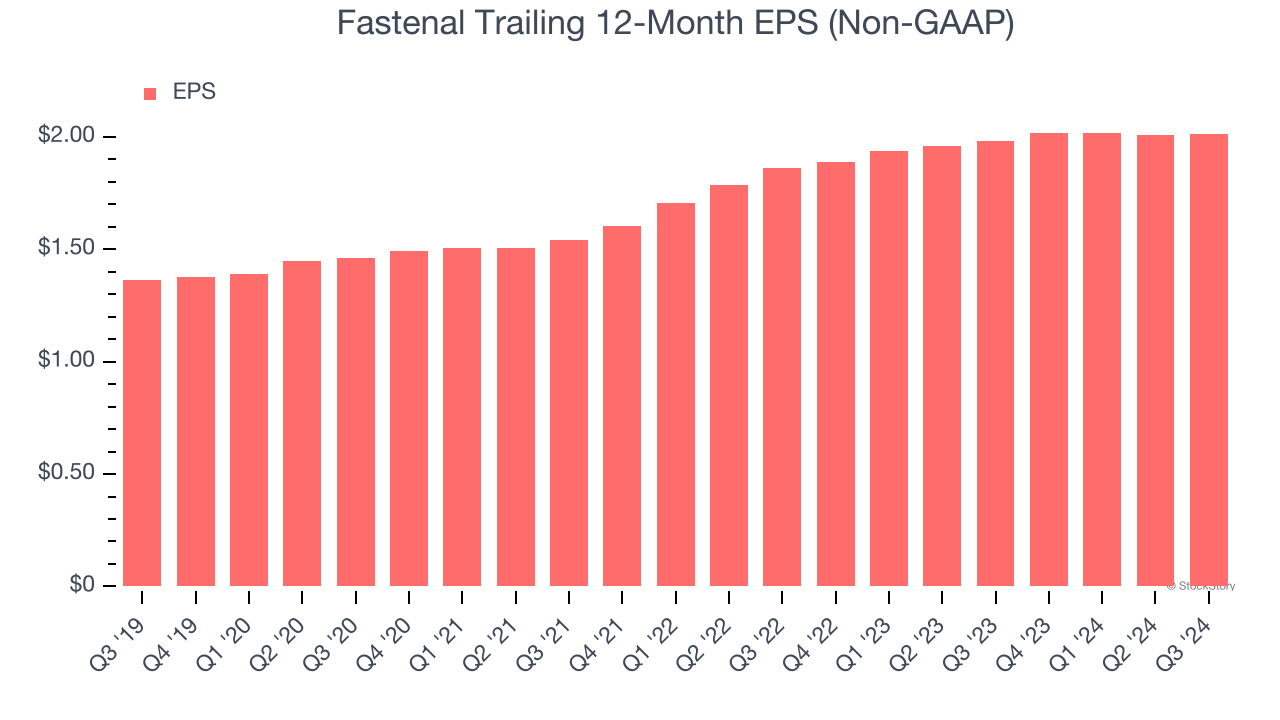

2. Recent EPS Growth Below Our Standards

Although long-term earnings trends give us the big picture, we like to analyze EPS over a shorter period to see if we are missing a change in the business.

Fastenal’s unimpressive 4% annual EPS growth over the last two years aligns with its revenue trend. This tells us it maintained its per-share profitability as it expanded.

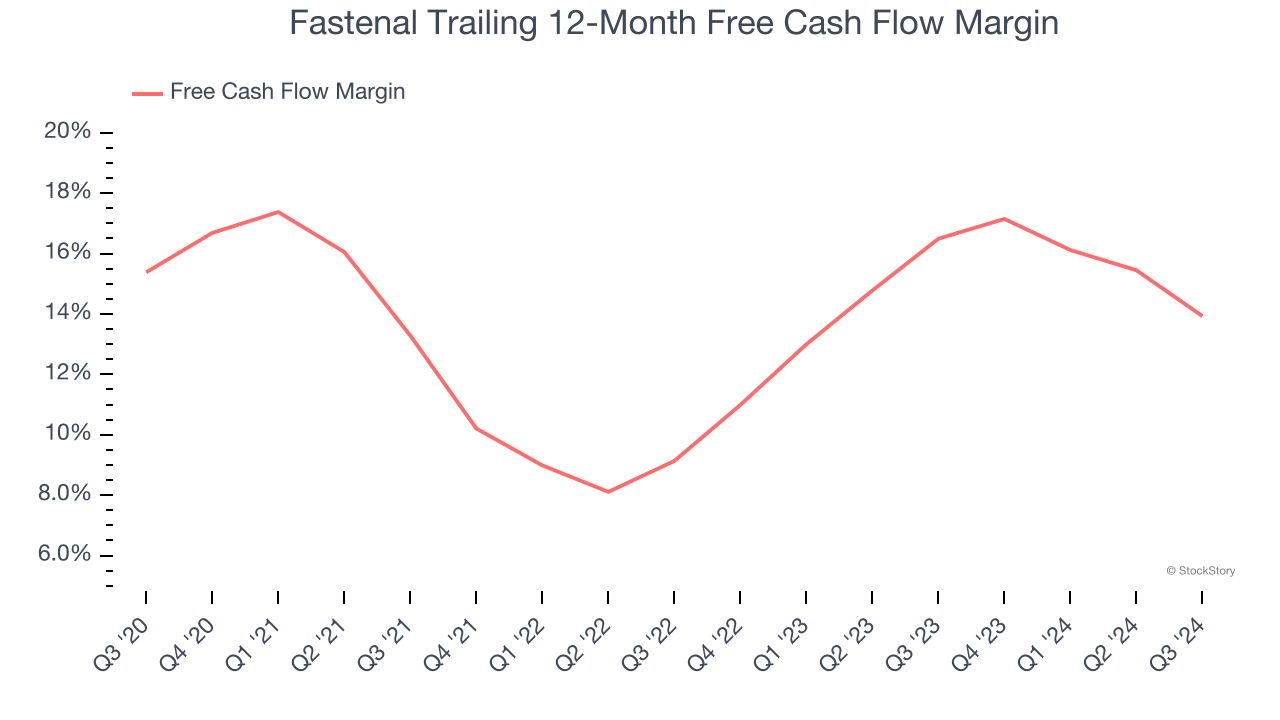

3. Free Cash Flow Margin Dropping

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Fastenal’s margin dropped by 1.5 percentage points over the last five years. If its declines continue, it could signal higher capital intensity. Fastenal’s free cash flow margin for the trailing 12 months was 13.9%.

Final Judgment

Fastenal isn’t a terrible business, but it doesn’t pass our quality test. With its shares outperforming the market lately, the stock trades at 35.4× forward price-to-earnings (or $74.70 per share). This multiple tells us a lot of good news is priced in - we think there are better opportunities elsewhere. Let us point you toward Wabtec, a leading provider of locomotive services benefiting from an upgrade cycle.

Stocks We Like More Than Fastenal

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.