Sally Beauty has followed the market’s trajectory closely, rising in tandem with the S&P 500 over the past six months. The stock has climbed by 8.3% to $11.25 per share while the index has gained 10.4%.

Is there a buying opportunity in Sally Beauty, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free.We're swiping left on Sally Beauty for now. Here are three reasons why SBH doesn't excite us and a stock we'd rather own.

Why Do We Think Sally Beauty Will Underperform?

Catering to both everyday consumers as well as salon professionals, Sally Beauty (NYSE:SBH) is a retailer that sells salon-quality beauty products such as makeup and haircare products.

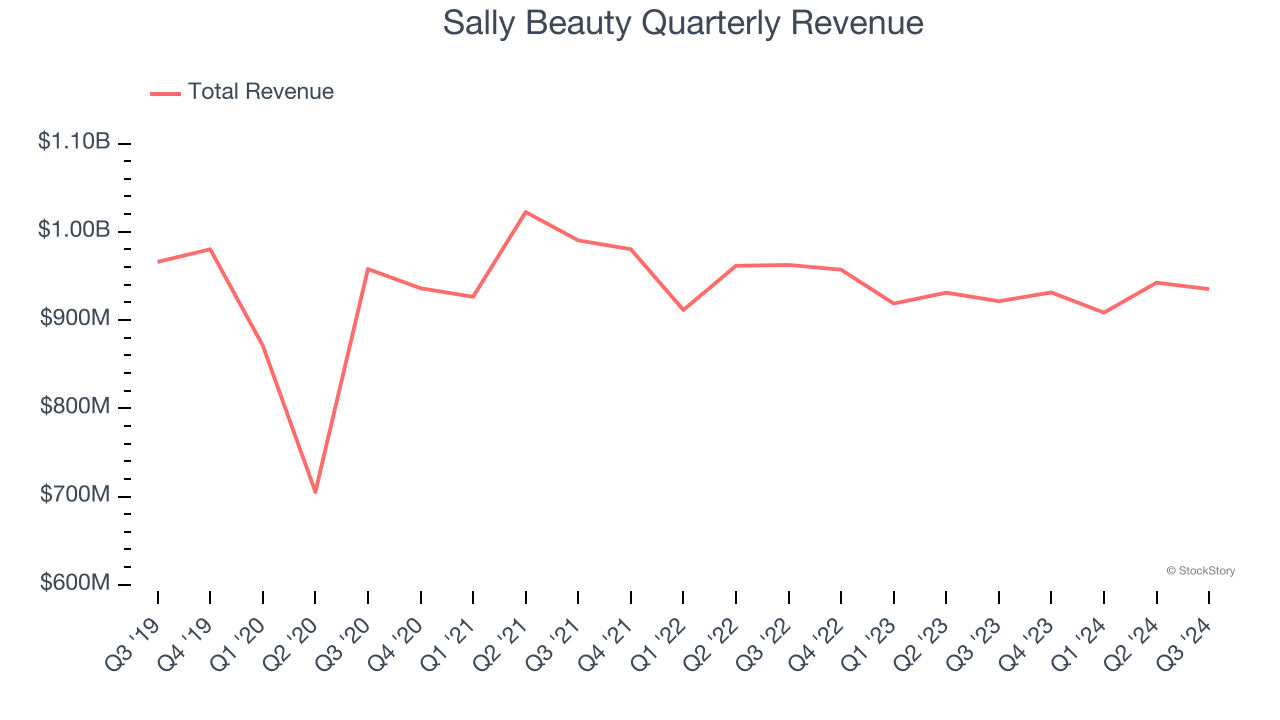

1. Long-Term Revenue Growth Flatter Than a Pancake

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Unfortunately, Sally Beauty struggled to consistently increase demand as its $3.72 billion of sales for the trailing 12 months was close to its revenue five years ago. This was below our standards and signals it’s a low quality business.

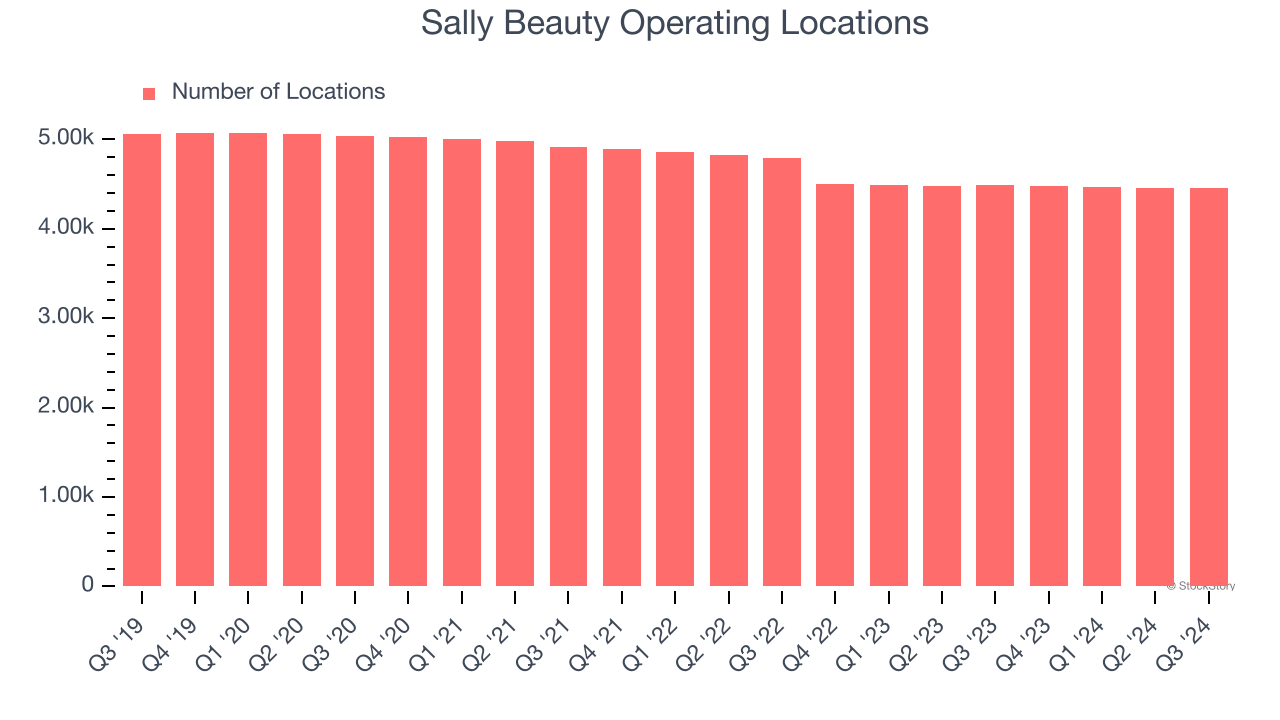

2. Stores Are Closing, a Headwind for Revenue

A retailer’s store count influences how much it can sell and how quickly revenue can grow.

Sally Beauty operated 4,460 locations in the latest quarter. Over the last two years, the company has generally closed its stores, averaging 3.9% annual declines.

When a retailer shutters stores, it usually means that brick-and-mortar demand is less than supply, and it is responding by closing underperforming locations to improve profitability.

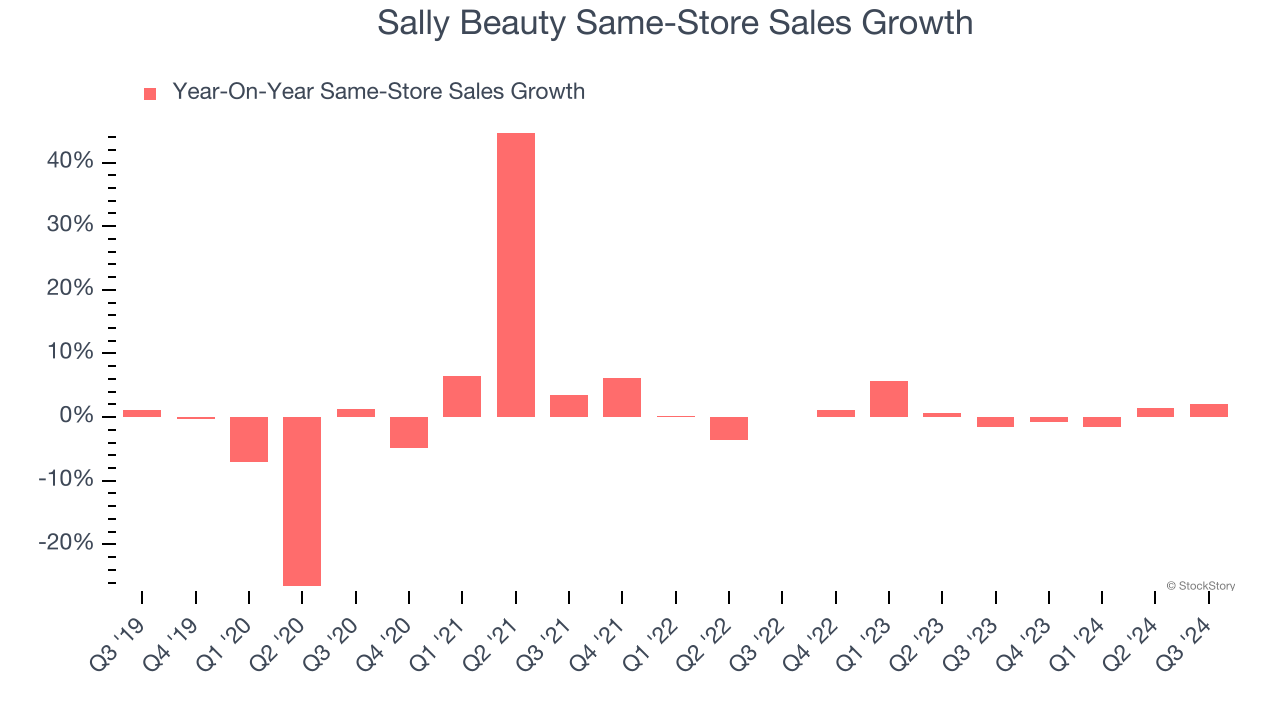

3. Flat Same-Store Sales Indicate Weak Demand

Same-store sales is a key performance indicator used to measure organic growth at brick-and-mortar shops for at least a year.

Sally Beauty’s demand within its existing locations has barely increased over the last two years as its same-store sales were flat.

Final Judgment

Sally Beauty falls short of our quality standards. That said, the stock currently trades at 6.4× forward price-to-earnings (or $11.25 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are more exciting stocks to buy at the moment. We’d recommend looking at Wingstop, a fast-growing restaurant franchise with an A+ ranch dressing sauce.

Stocks We Like More Than Sally Beauty

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.