Veralto currently trades at $103.49 per share and has shown little upside over the past six months, posting a middling return of 4.6%. The stock also fell short of the S&P 500’s 10.4% gain during that period.

Is there a buying opportunity in Veralto, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free.We don't have much confidence in Veralto. Here are three reasons why we avoid VLTO and a stock we'd rather own.

Why Is Veralto Not Exciting?

Spun off from Danaher in 2023, Veralto (NYSE:VLTO) provides water analytics and treatment solutions.

1. Long-Term Revenue Growth Disappoints

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Unfortunately, Veralto’s 3.5% annualized revenue growth over the last three years was sluggish. This fell short of our benchmark for the industrials sector.

2. Free Cash Flow Margin Dropping

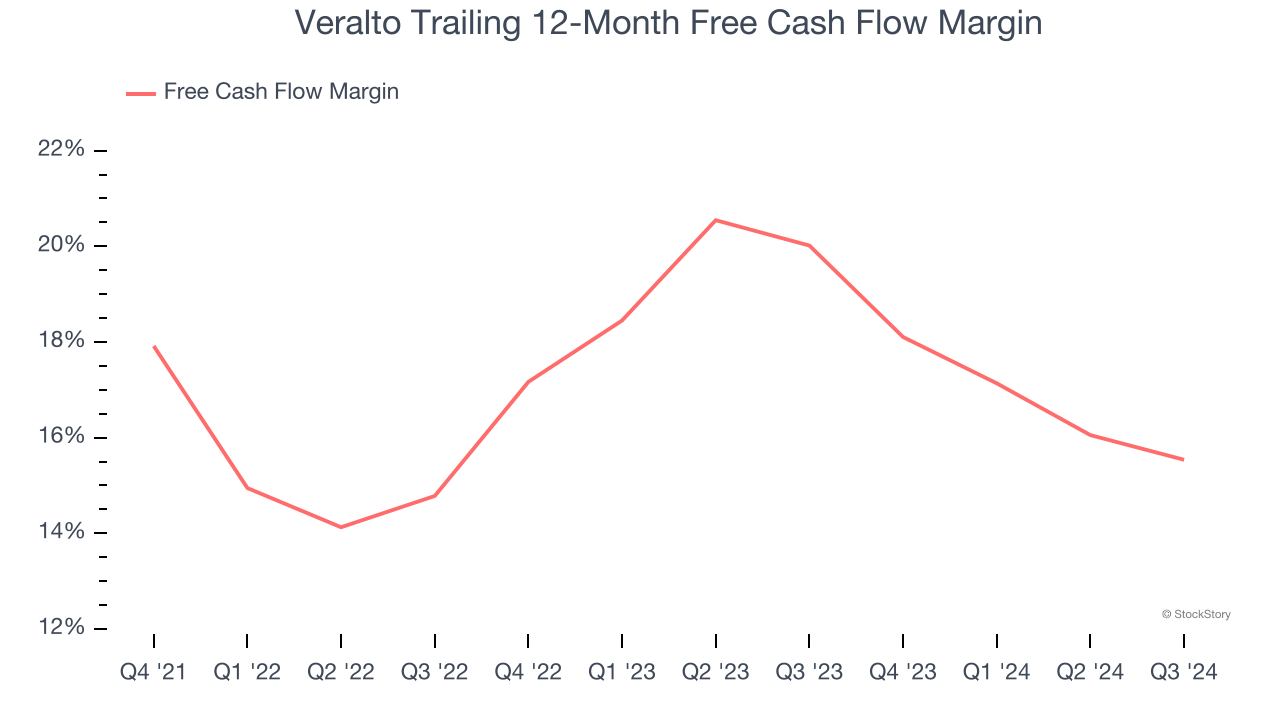

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Veralto’s margin dropped by 3.7 percentage points over the last four years. If its declines continue, it could signal higher capital intensity. Veralto’s free cash flow margin for the trailing 12 months was 15.5%.

3. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Veralto’s revenue to rise by 5.1%. Although this projection implies its newer products and services will fuel better top-line performance, it is still below the sector average.

Final Judgment

Veralto isn’t a terrible business, but it isn’t one of our picks. With its shares trailing the market in recent months, the stock trades at 28.3× forward price-to-earnings (or $103.49 per share). This valuation tells us it’s a bit of a market darling with a lot of good news priced in - you can find better investment opportunities elsewhere. We’d suggest looking at Wabtec, a leading provider of locomotive services benefiting from an upgrade cycle.

Stocks We Would Buy Instead of Veralto

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.