Over the past six months, Altice has been a great trade, beating the S&P 500 by 13.4%. Its stock price has climbed to $2.50, representing a healthy 23.8% increase. This run-up might have investors contemplating their next move.

Is there a buying opportunity in Altice, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free.Despite the momentum, we're cautious about Altice. Here are three reasons why ATUS doesn't excite us and a stock we'd rather own.

Why Do We Think Altice Will Underperform?

Based in Long Island City, Altice USA (NYSE:ATUS) is a telecommunications company offering cable, internet, telephone, and television services across the United States.

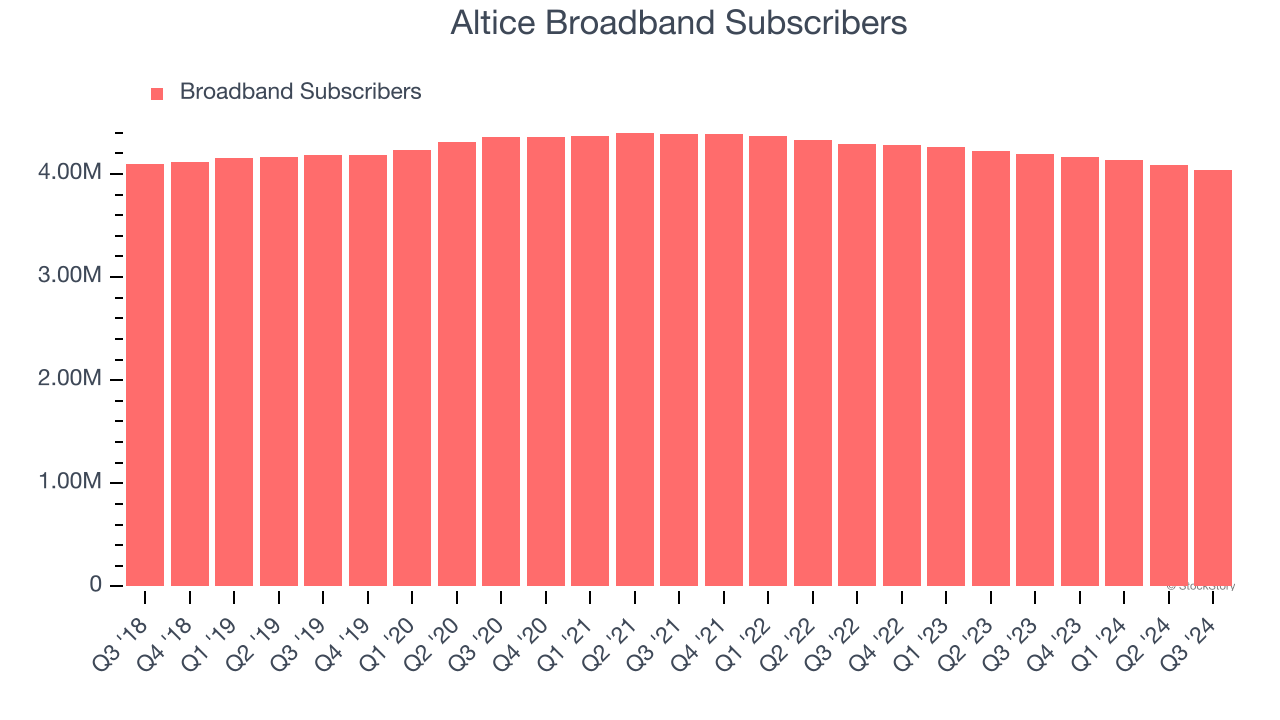

1. Decline in Broadband Subscribers Points to Weak Demand

Revenue growth can be broken down into changes in price and volume (for companies like Altice, our preferred volume metric is broadband subscribers). While both are important, the latter is the most critical to analyze because prices have a ceiling.

Altice’s broadband subscribers came in at 4.04 million in the latest quarter, and over the last two years, averaged 2.8% year-on-year declines. This performance was underwhelming and implies there may be increasing competition or market saturation. It also suggests Altice might have to lower prices or invest in product improvements to grow, factors that can hinder near-term profitability.

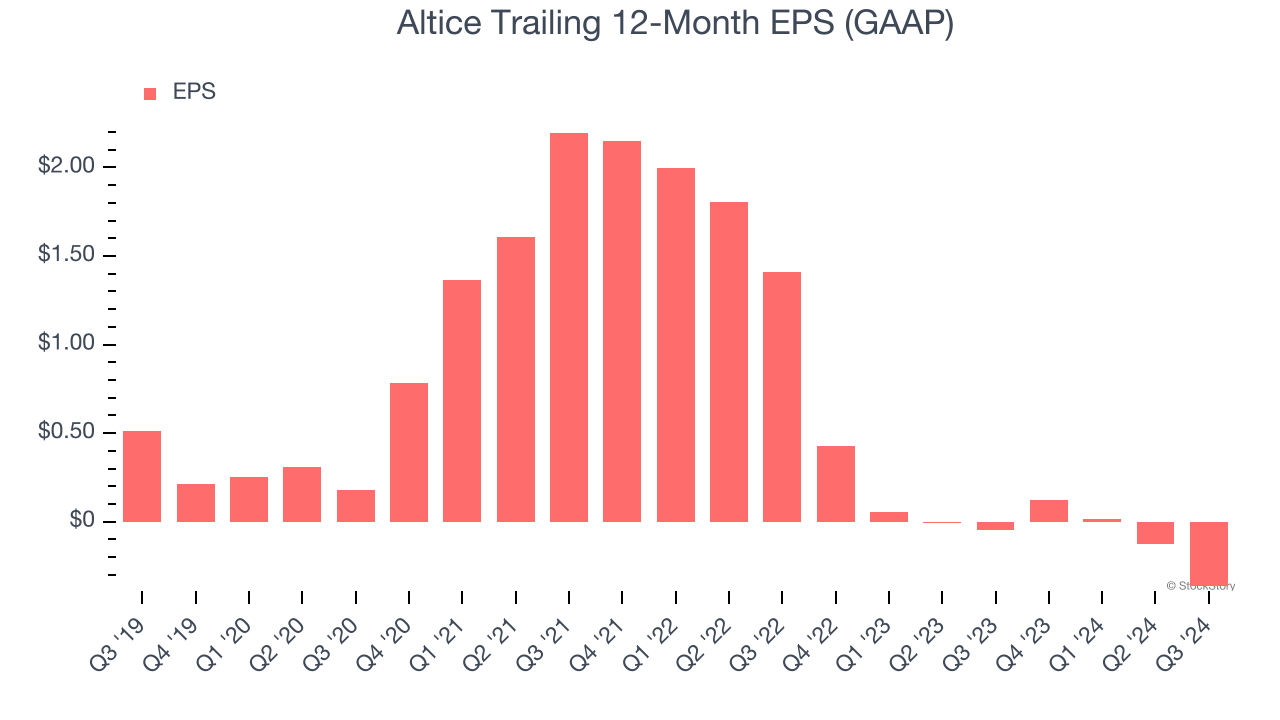

2. EPS Trending Down

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for Altice, its EPS declined by more than its revenue over the last five years, dropping 22.1% annually. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

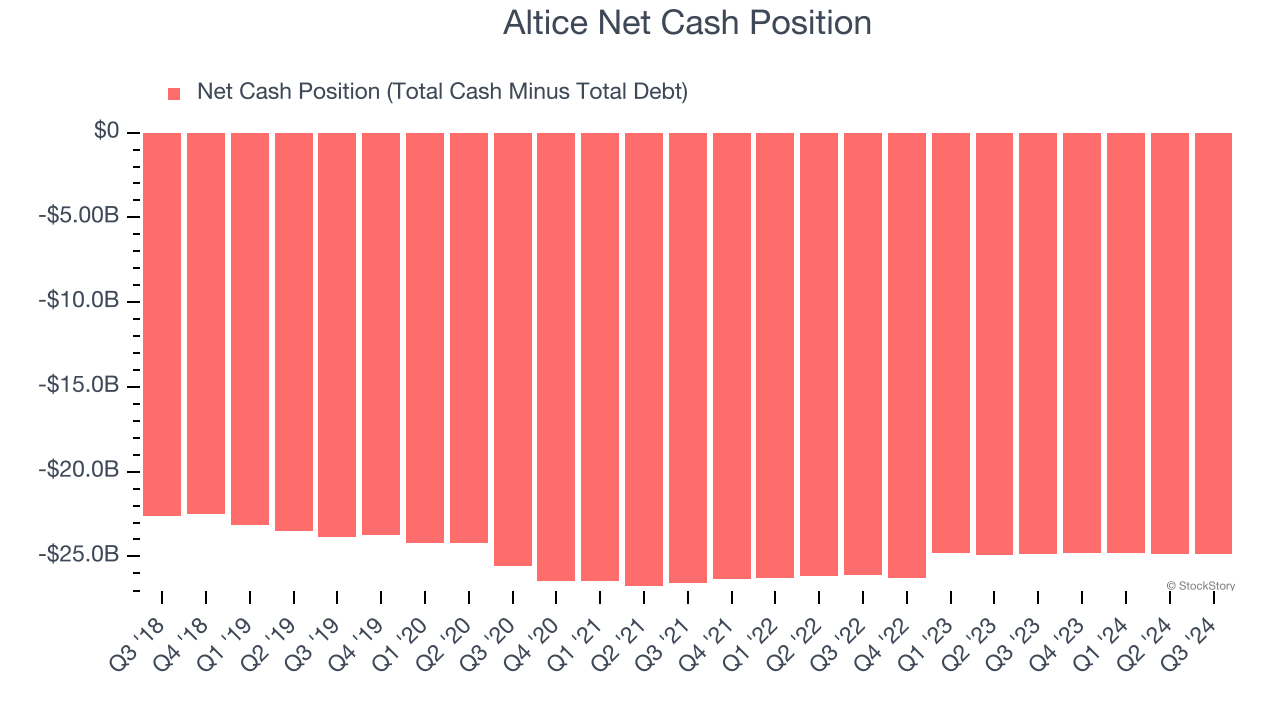

3. High Debt Levels Increase Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly. As long-term investors, we aim to avoid companies taking excessive advantage of this instrument because it could lead to insolvency.

Altice’s $25.1 billion of debt exceeds the $250 million of cash on its balance sheet. Furthermore, its 7× net-debt-to-EBITDA ratio (based on its EBITDA of $3.48 billion over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. Altice could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope Altice can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

Final Judgment

We cheer for all companies serving everyday consumers, but in the case of Altice, we’ll be cheering from the sidelines. With its shares outperforming the market lately, the stock trades at 0.3× forward EV-to-EBITDA (or $2.50 per share). This valuation is reasonable, but the company’s shaky fundamentals present too much downside risk. There are better stocks to buy right now. Let us point you toward The Trade Desk, the nucleus of digital advertising.

Stocks We Would Buy Instead of Altice

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.