Over the past six months, Analog Devices’s stock price fell to $214.73. Shareholders have lost 6% of their capital, which is disappointing considering the S&P 500 has climbed by 9.7%. This might have investors contemplating their next move.

Is there a buying opportunity in Analog Devices, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free.Even with the cheaper entry price, we're cautious about Analog Devices. Here are three reasons why you should be careful with ADI and a stock we'd rather own.

Why Is Analog Devices Not Exciting?

Founded by two MIT graduates, Ray Stata and Matthew Lorber in 1965, Analog Devices (NASDAQ:ADI) is one of the largest providers of high performance analog integrated circuits used mainly in industrial end markets, along with communications, autos, and consumer devices.

1. Revenue Tumbling Downwards

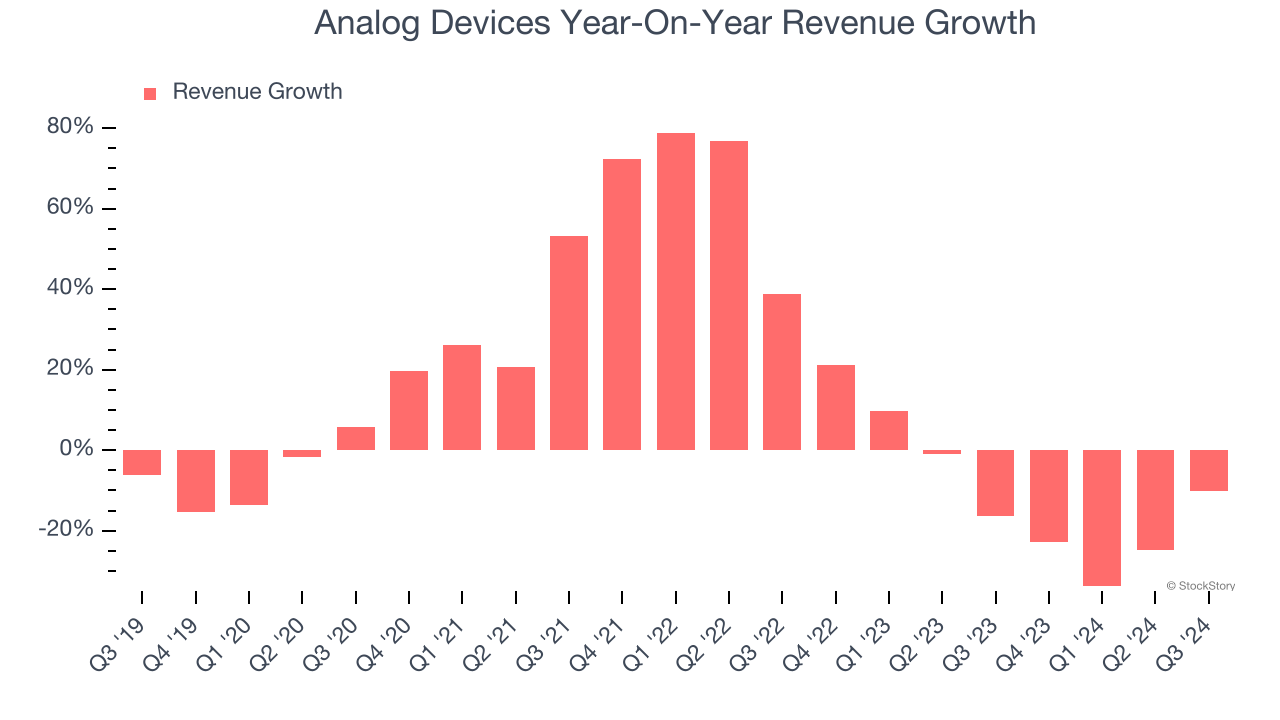

We at StockStory place the most emphasis on long-term growth, but within semiconductors, a stretched historical view may miss new demand cycles or industry trends like AI. Analog Devices’s recent history marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 11.4% over the last two years.

2. Operating Margin Falling

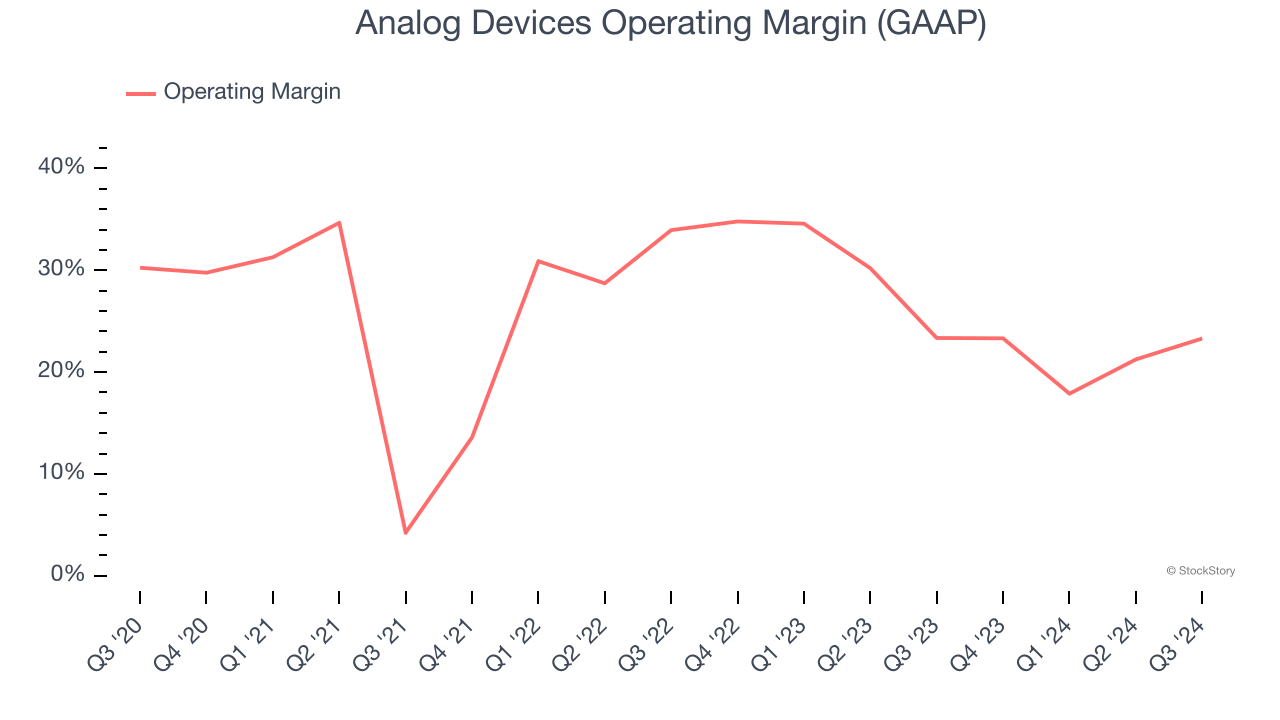

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

Looking at the trend in its profitability, Analog Devices’s operating margin decreased by 5.2 percentage points over the last five years. Even though its historical margin is high, shareholders will want to see Analog Devices become more profitable in the future. Its operating margin for the trailing 12 months was 21.6%.

3. Previous Growth Initiatives Haven’t Paid Off Yet

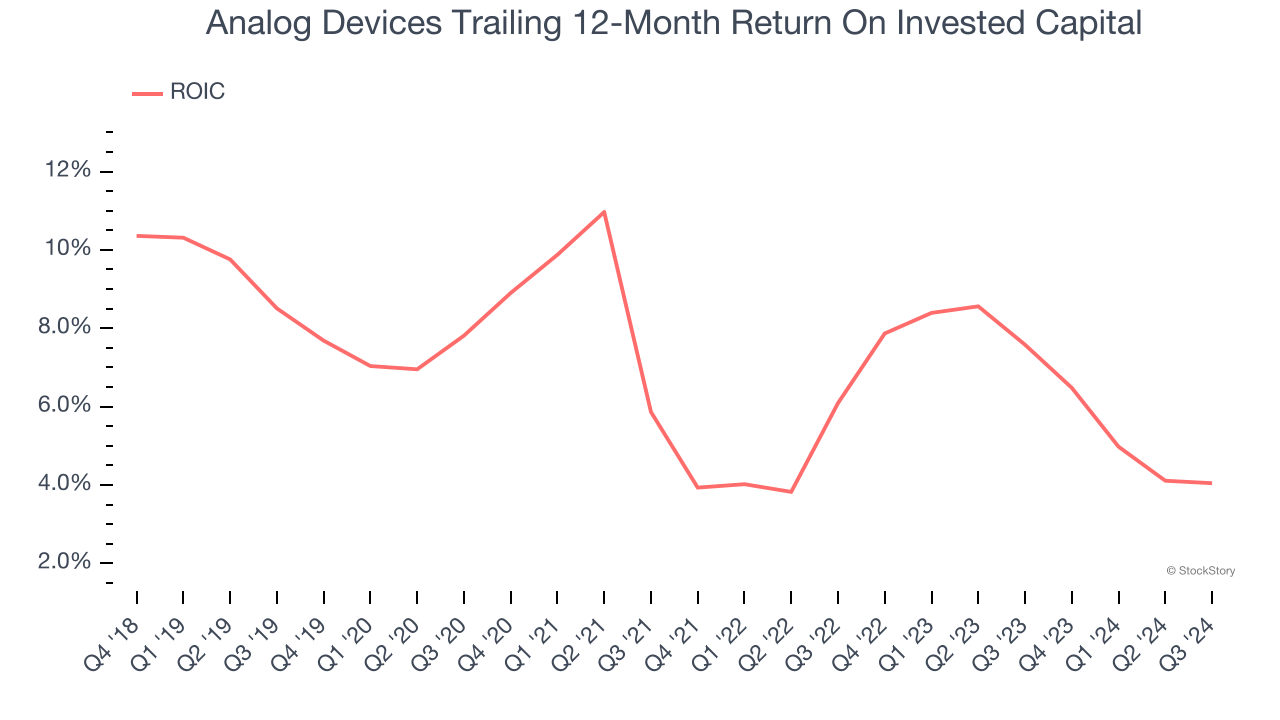

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Analog Devices historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 6.3%, somewhat low compared to the best semiconductor companies that consistently pump out 35%+.

Final Judgment

Analog Devices’s business quality ultimately falls short of our standards. Following the recent decline, the stock trades at 29× forward price-to-earnings (or $214.73 per share). This multiple tells us a lot of good news is priced in - you can find better investment opportunities elsewhere. We’d recommend looking at Cloudflare, one of our top software picks that could be a home run with edge computing.

Stocks We Would Buy Instead of Analog Devices

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.