What a time it’s been for Olo. In the past six months alone, the company’s stock price has increased by a massive 73.2%, reaching $7.55 per share. This was partly thanks to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is now the time to buy Olo, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.We’re glad investors have benefited from the price increase, but we're swiping left on Olo for now. Here are three reasons why there are better opportunities than OLO and a stock we'd rather own.

Why Is Olo Not Exciting?

Founded by Noah Glass, who wanted to get a cup of coffee faster on his way to work, Olo (NYSE:OLO) provides restaurants and food retailers with software to manage food orders and delivery.

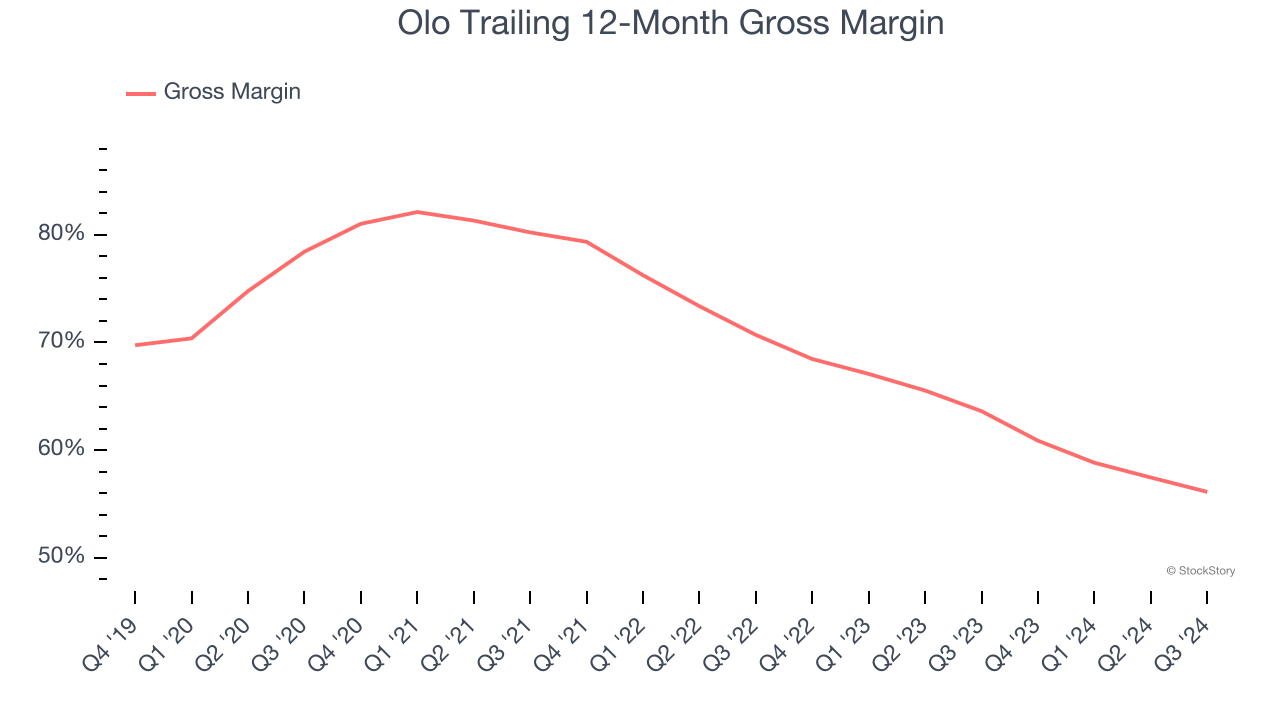

1. Low Gross Margin Reveals Weak Structural Profitability

For software companies like Olo, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

Olo’s gross margin is substantially worse than most software businesses, signaling it has relatively high infrastructure costs compared to asset-lite businesses like ServiceNow. As you can see below, it averaged a 56.1% gross margin over the last year. That means Olo paid its providers a lot of money ($43.89 for every $100 in revenue) to run its business.

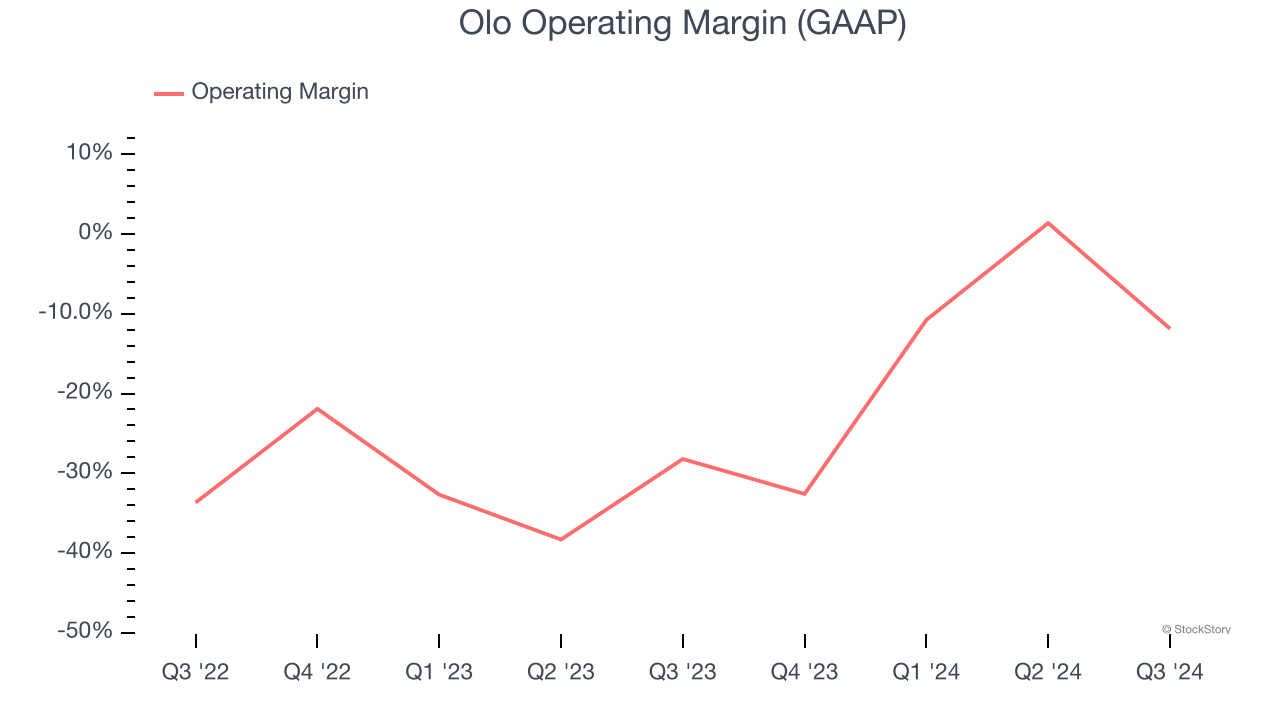

2. Operating Losses Sound the Alarms

While many software businesses point investors to their adjusted profits, which exclude stock-based compensation (SBC), we prefer GAAP operating margin because SBC is a legitimate expense used to attract and retain talent. This is one of the best measures of profitability because it shows how much money a company takes home after developing, marketing, and selling its products.

Olo’s expensive cost structure has contributed to an average operating margin of negative 13% over the last year. Unprofitable, high-growth software companies require extra attention because they spend heaps of money to capture market share. As seen in its fast historical revenue growth, this strategy seems to have worked so far, but it’s unclear what would happen if Olo reeled back its investments. Wall Street seems to be optimistic about its growth, but we have some doubts.

3. Cash Flow Margin Set to Decline

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Over the next year, analysts predict Olo’s cash conversion will slightly fall. Their consensus estimates imply its free cash flow margin of 8.4% for the last 12 months will decrease to 6.8%.

Final Judgment

Olo’s business quality ultimately falls short of our standards. After the recent surge, the stock trades at 4× forward price-to-sales (or $7.55 per share). While this valuation is fair, the upside isn’t great compared to the potential downside. We're pretty confident there are superior stocks to buy right now. We’d recommend looking at MercadoLibre, the Amazon and PayPal of Latin America.

Stocks We Would Buy Instead of Olo

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.