Caterpillar trades at $369.94 and has moved in lockstep with the market. Its shares have returned 12.1% over the last six months while the S&P 500 has gained 9.7%.

Is now the time to buy CAT? Find out in our full research report, it’s free.

Why Does CAT Stock Spark Debate?

With its iconic yellow machinery working on construction sites, Caterpillar (NYSE:CAT) manufactures construction equipment like bulldozers, excavators, and parts and maintenance services.

Two Things to Like:

1. Operating Margin Rising, Profits Up

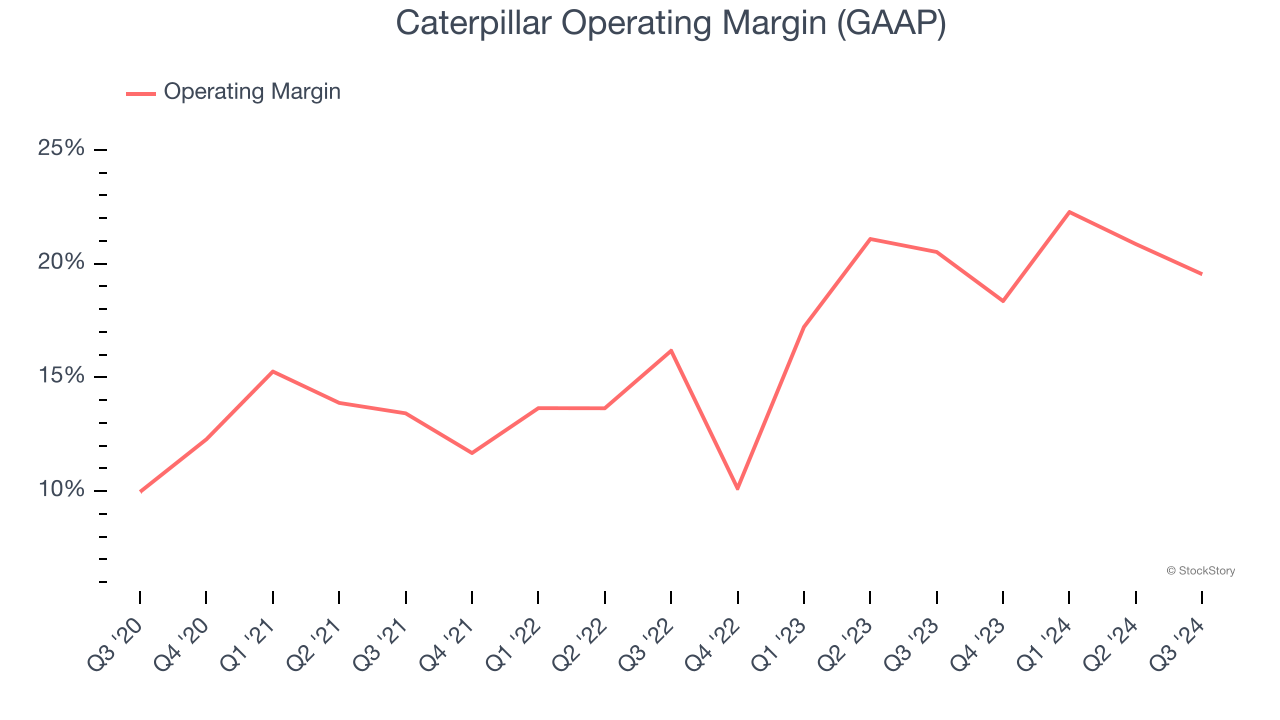

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

Analyzing the trend in its profitability, Caterpillar’s operating margin rose by 8.7 percentage points over the last five years, showing its efficiency has meaningfully improved. . Its operating margin for the trailing 12 months was 20.2%.

2. Outstanding Long-Term EPS Growth

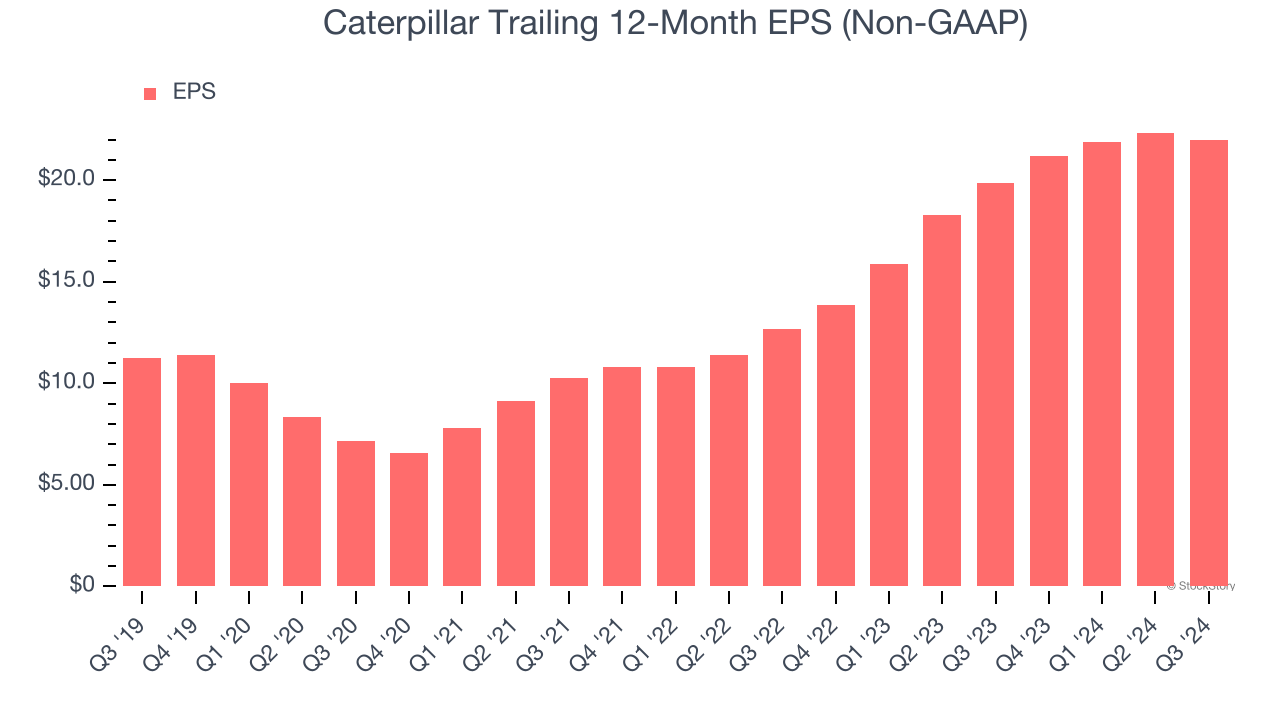

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Caterpillar’s EPS grew at a remarkable 14.4% compounded annual growth rate over the last five years, higher than its 3.6% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

One Reason to be Careful:

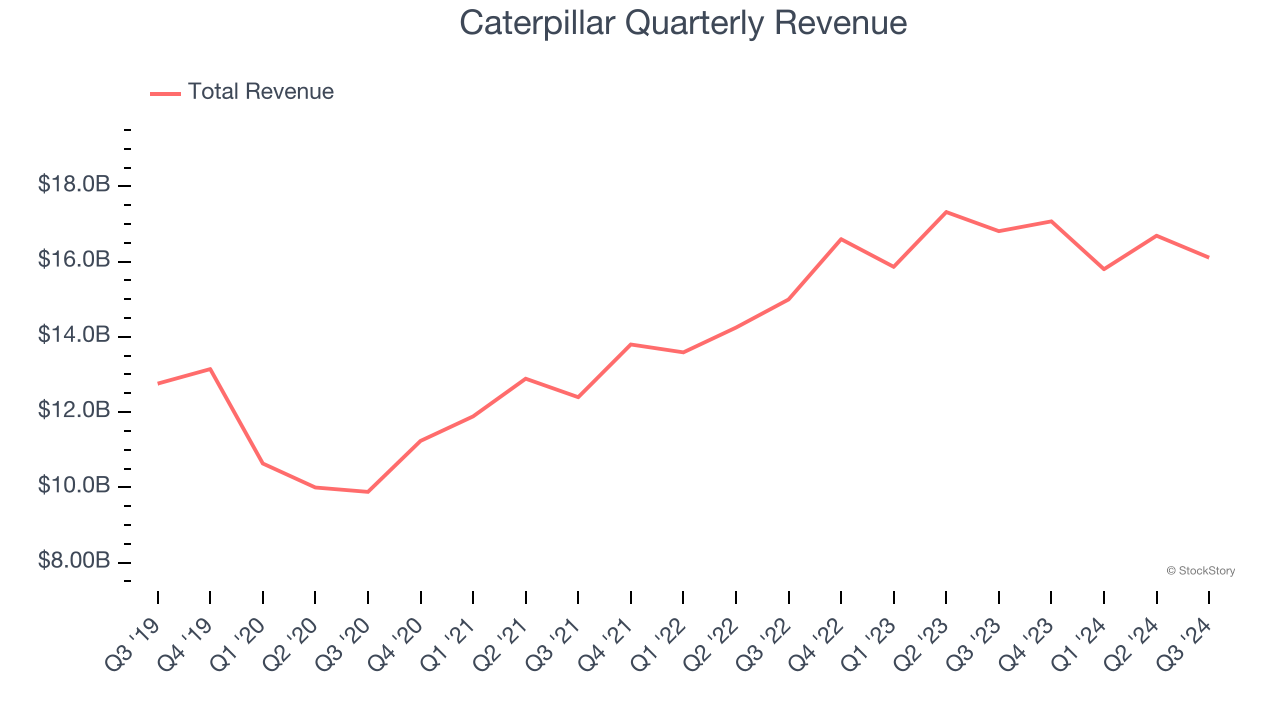

Long-Term Revenue Growth Disappoints

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Caterpillar grew its sales at a sluggish 3.6% compounded annual growth rate. This was below our standard for the industrials sector.

Final Judgment

Caterpillar’s positive characteristics outweigh the negatives, but at $369.94 per share (or 17× forward price-to-earnings), is now the time to initiate a position? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than Caterpillar

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.