As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q3. Today, we are looking at home construction materials stocks, starting with Gibraltar (NASDAQ:ROCK).

Traditionally, home construction materials companies have built economic moats with expertise in specialized areas, brand recognition, and strong relationships with contractors. More recently, advances to address labor availability and job site productivity have spurred innovation that is driving incremental demand. However, these companies are at the whim of residential construction volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates. Additionally, the costs of raw materials can be driven by a myriad of worldwide factors and greatly influence the profitability of home construction materials companies.

The 12 home construction materials stocks we track reported a mixed Q3. As a group, revenues missed analysts’ consensus estimates by 0.9%.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 7.7% since the latest earnings results.

Gibraltar (NASDAQ:ROCK)

Gibraltar (NASDAQ:ROCK) makes renewable energy, agriculture technology and infrastructure products. Its mission statement is to make everyday living more sustainable.

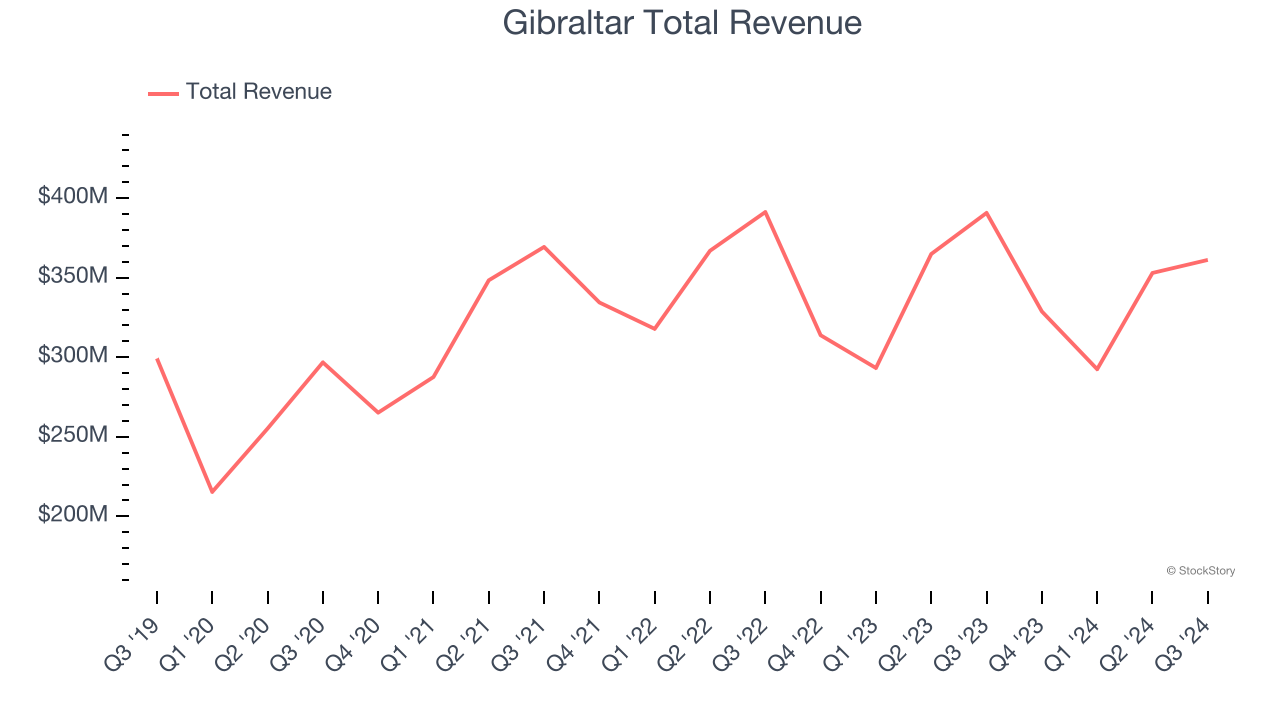

Gibraltar reported revenues of $361.2 million, down 7.6% year on year. This print was in line with analysts’ expectations, but overall, it was a mixed quarter for the company with full-year EPS guidance slightly topping analysts’ expectations but EBITDA in line with analysts’ estimates.

“Third quarter results were within our previously announced range, with the Renewables and Residential businesses coming in as we anticipated, Agtech sales growing over 30%, and three of our four segments delivering margin growth translating to $65 million in cash flow generation on solid execution and working capital management. We are managing well in a challenging sales environment and are well positioned to weather current market disruptions,” stated Chairman and CEO Bill Bosway.

Interestingly, the stock is up 9.1% since reporting and currently trades at $70.99.

Is now the time to buy Gibraltar? Access our full analysis of the earnings results here, it’s free.

Best Q3: Trex (NYSE:TREX)

Addressing the demand for aesthetically-pleasing and unique outdoor living spaces, Trex Company (NYSE:TREX) makes wood-alternative decking, railing, and patio furniture.

Trex reported revenues of $233.7 million, down 23.1% year on year, outperforming analysts’ expectations by 3.7%. The business had an exceptional quarter with an impressive beat of analysts’ EBITDA estimates.

Trex delivered the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 6.8% since reporting. It currently trades at $71.

Is now the time to buy Trex? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: JELD-WEN (NYSE:JELD)

Founded in the 1960s as a general wood-making company, JELD-WEN (NYSE:JELD) manufactures doors, windows, and other related building products.

JELD-WEN reported revenues of $934.7 million, down 13.2% year on year, falling short of analysts’ expectations by 5.6%. It was a disappointing quarter as it posted full-year revenue guidance missing analysts’ expectations.

JELD-WEN delivered the weakest full-year guidance update in the group. As expected, the stock is down 37.3% since the results and currently trades at $8.87.

Read our full analysis of JELD-WEN’s results here.

Fortune Brands (NYSE:FBIN)

Targeting a wide customer base of residential and commercial customers, Fortune Brands (NYSE:FBIN) makes plumbing, security, and outdoor living products.

Fortune Brands reported revenues of $1.16 billion, down 8.4% year on year. This print lagged analysts' expectations by 6.9%. It was a softer quarter as it also recorded a significant miss of analysts’ organic revenue estimates.

Fortune Brands had the weakest performance against analyst estimates among its peers. The stock is down 16.9% since reporting and currently trades at $69.98.

Read our full, actionable report on Fortune Brands here, it’s free.

Hayward (NYSE:HAYW)

Credited with introducing the first variable-speed pool pump, Hayward (NYSE:HAYW) makes residential and commercial pool equipment and accessories.

Hayward reported revenues of $227.6 million, up 3.3% year on year. This number beat analysts’ expectations by 2.1%. Overall, it was a very strong quarter as it also produced a solid beat of analysts’ EBITDA estimates and an impressive beat of analysts’ EPS estimates.

Hayward achieved the highest full-year guidance raise among its peers. The stock is up 4.9% since reporting and currently trades at $15.50.

Read our full, actionable report on Hayward here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.