Acushnet trades at $71.09 per share and has stayed right on track with the overall market, gaining 9.8% over the last six months. At the same time, the S&P 500 has returned 7.7%.

Is now the time to buy Acushnet, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free.We're sitting this one out for now. Here are three reasons why GOLF doesn't excite us and a stock we'd rather own.

Why Is Acushnet Not Exciting?

Producer of the acclaimed Titleist Pro V1 golf ball, Acushnet (NYSE:GOLF) is a design and manufacturing company specializing in performance-driven golf products.

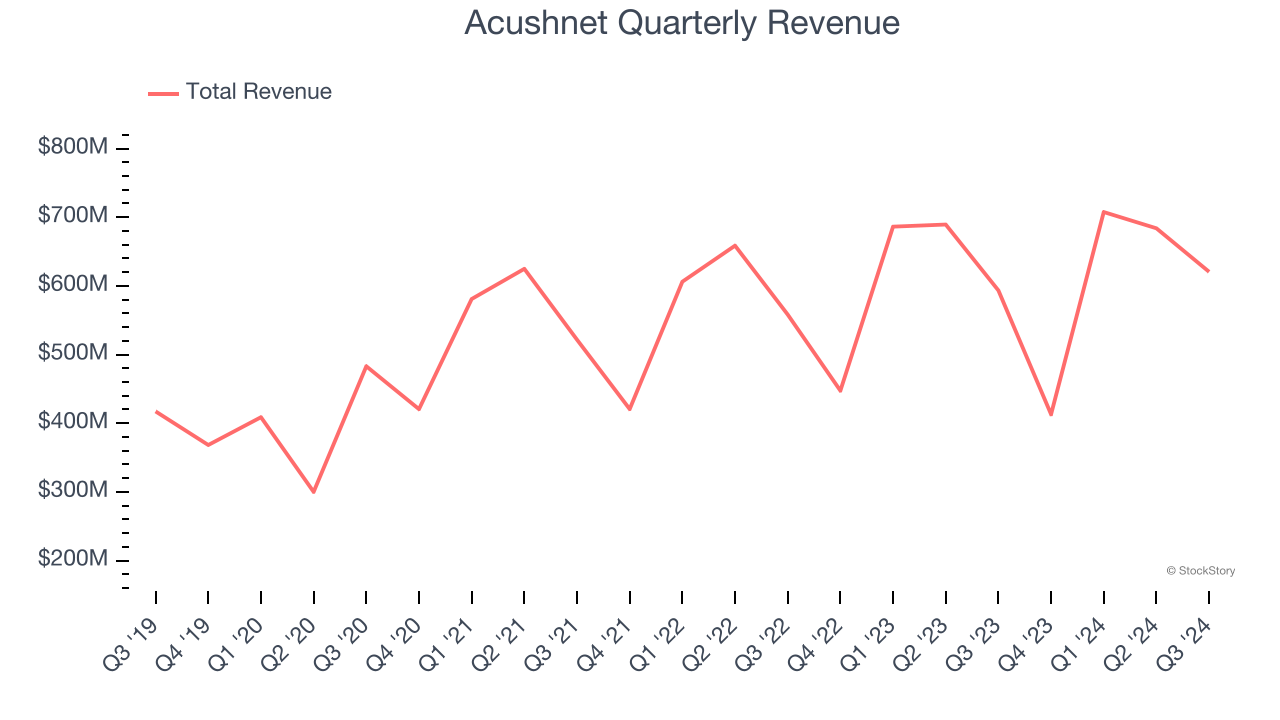

1. Long-Term Revenue Growth Disappoints

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Regrettably, Acushnet’s sales grew at a sluggish 7.9% compounded annual growth rate over the last five years. This fell short of our benchmark for the consumer discretionary sector.

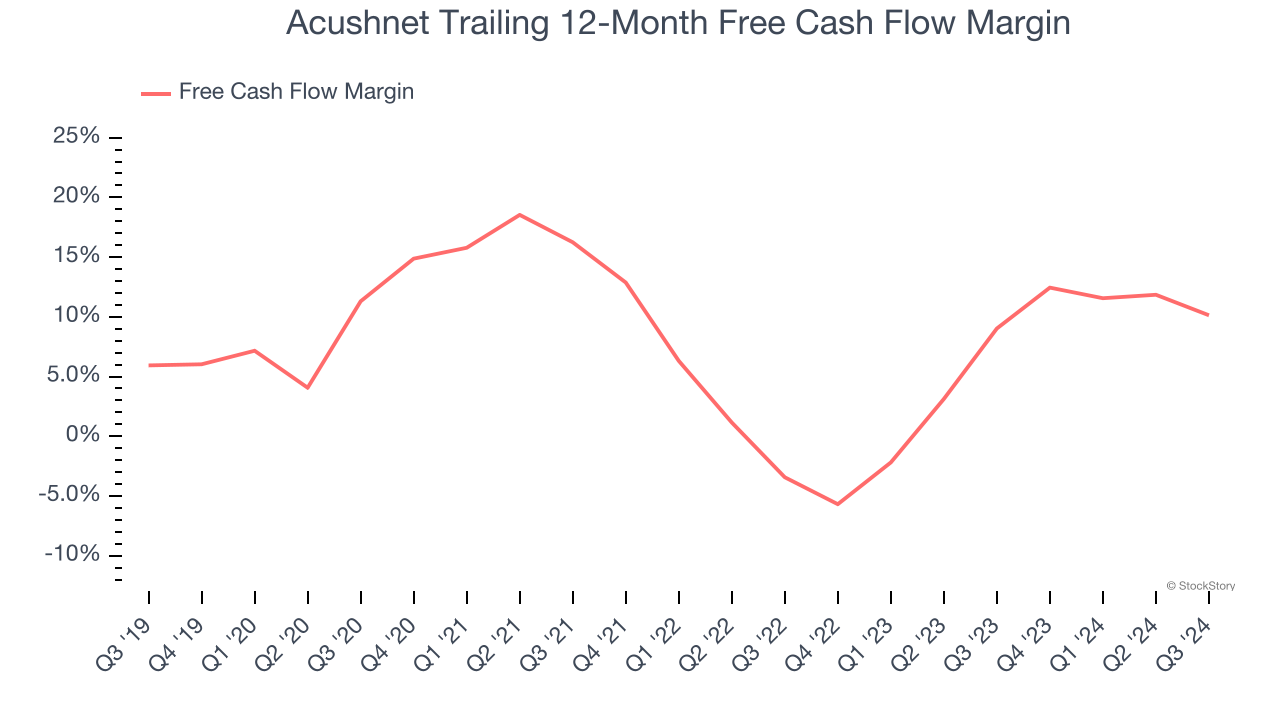

2. Mediocre Free Cash Flow Margin Limits Reinvestment Potential

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Acushnet has shown mediocre cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 9.6%, subpar for a consumer discretionary business.

3. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Acushnet’s revenue to rise by 5.2%, close to its 4% annualized growth for the past two years. This projection doesn't excite us and suggests its newer products and services will not accelerate its top-line performance yet.

Final Judgment

Acushnet isn’t a terrible business, but it doesn’t pass our quality test. That said, the stock currently trades at 17.6× forward price-to-earnings (or $71.09 per share). Investors with a higher risk tolerance might like the company, but we think the potential downside is too great. We're pretty confident there are superior stocks to buy right now. Let us point you toward CrowdStrike, the most entrenched endpoint security platform.

Stocks We Like More Than Acushnet

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.