Federal Signal has followed the market’s trajectory closely, rising in tandem with the S&P 500 over the past six months. The stock has climbed by 12% to $94.29 per share while the index has gained 7.7%.

Is now the time to buy FSS? Find out in our full research report, it’s free.

Why Is FSS a Good Business?

Developing sirens that warned of air raid attacks or fallout during the Cold War, Federal Signal (NYSE:FSS) provides safety and emergency equipment for government agencies, municipalities, and industrial companies.

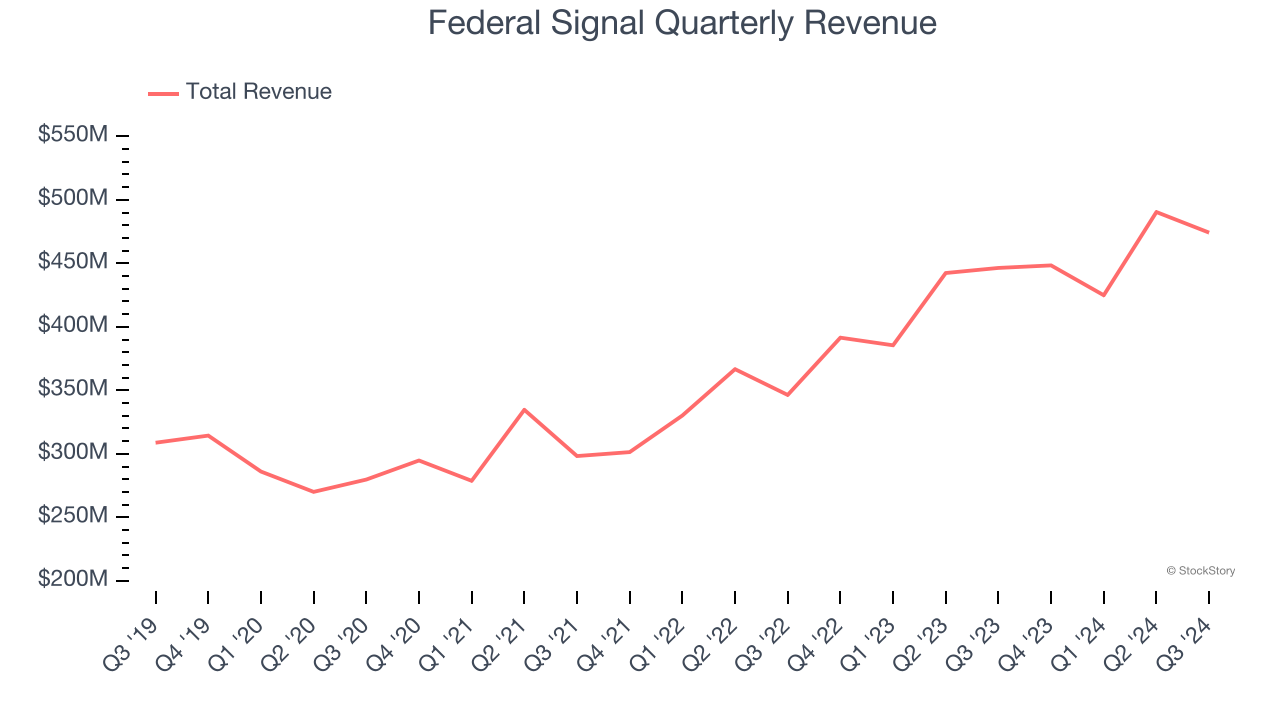

1. Long-Term Revenue Growth Shows Momentum

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Federal Signal grew its sales at a decent 8.9% compounded annual growth rate. Its growth was slightly above the average industrials company and shows its offerings resonate with customers.

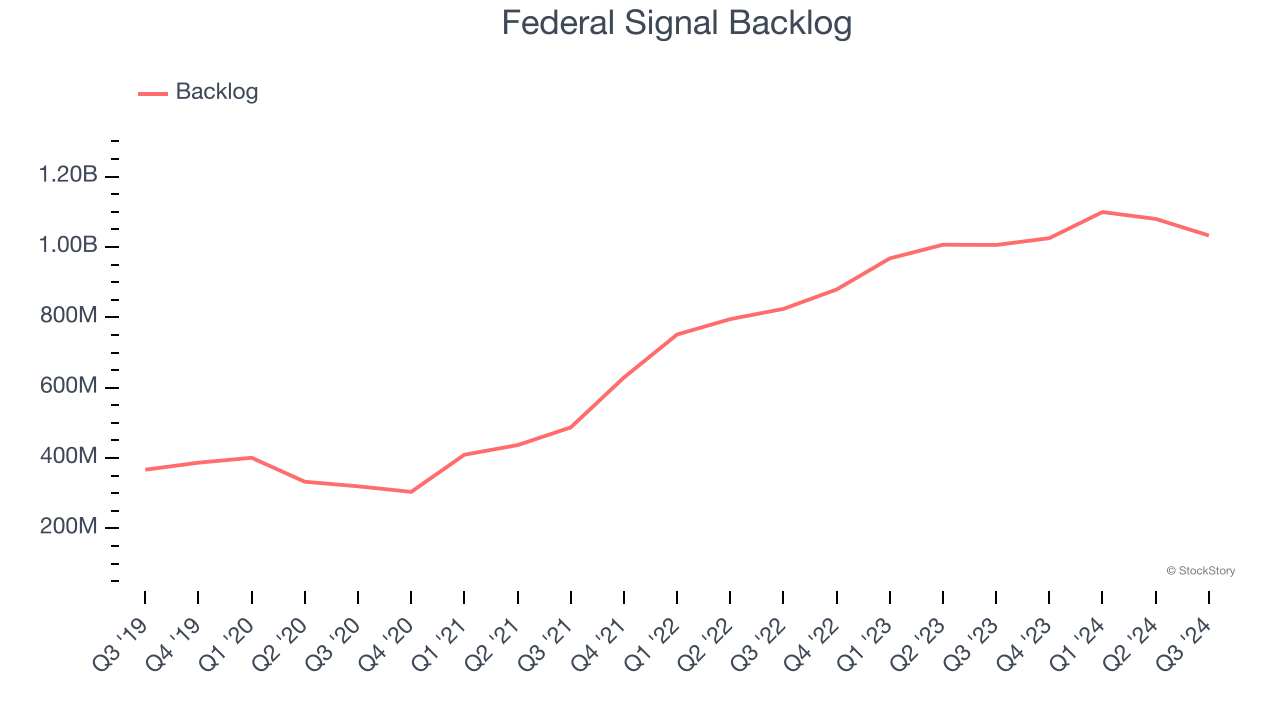

2. Skyrocketing Backlog Locks In Future Sales

We can better understand Heavy Transportation Equipment companies by analyzing their backlog. This metric shows the value of outstanding orders that have not yet been executed or delivered, giving visibility into Federal Signal’s future revenue streams.

Federal Signal’s backlog punched in at $1.03 billion in the latest quarter, and over the last two years, its year-on-year growth averaged 19.7%. This performance was fantastic and shows the company has a robust sales pipeline because it is accumulating more orders than it can fulfill. Its growth also suggests that customers are committing to Federal Signal for the long term, enhancing the business’s predictability.

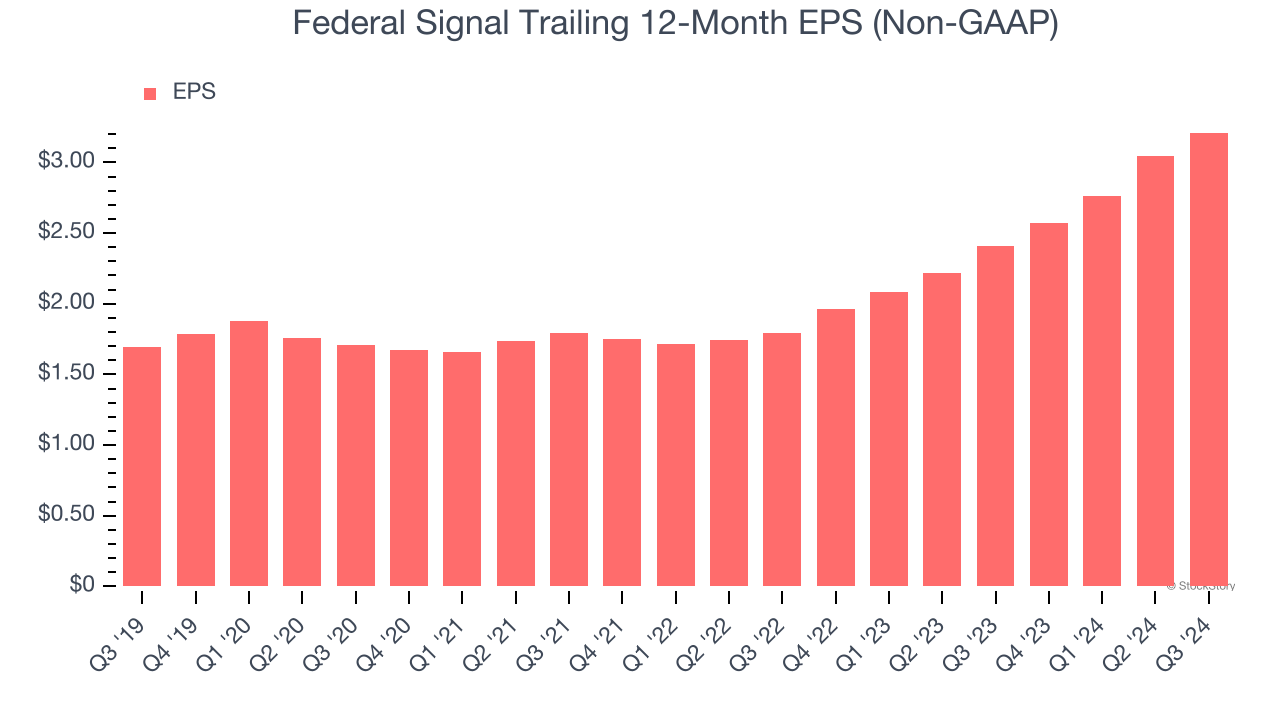

3. Outstanding Long-Term EPS Growth

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Federal Signal’s EPS grew at a remarkable 13.6% compounded annual growth rate over the last five years, higher than its 8.9% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Final Judgment

These are just a few reasons why we think Federal Signal is a high-quality business, but at $94.29 per share (or 26.2× forward price-to-earnings), is now the right time to buy the stock? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than Federal Signal

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.