Restaurant company Darden (NYSE:DRI) reported Q4 CY2024 results beating Wall Street’s revenue expectations, with sales up 6% year on year to $2.89 billion. The company’s full-year revenue guidance of $12.1 billion at the midpoint came in 1.2% above analysts’ estimates. Its non-GAAP profit of $2.03 per share was in line with analysts’ consensus estimates.

Is now the time to buy Darden? Find out by accessing our full research report, it’s free.

Darden (DRI) Q4 CY2024 Highlights:

- Revenue: $2.89 billion vs analyst estimates of $2.87 billion (6% year-on-year growth, 0.7% beat)

- Adjusted EPS: $2.03 vs analyst estimates of $2.02 (in line)

- Adjusted EBITDA: $434 million vs analyst estimates of $439.2 million (15% margin, 1.2% miss)

- Adjusted EPS guidance for the full year is $9.50 at the midpoint, roughly in line with what analysts were expecting

- Operating Margin: 10.1%, in line with the same quarter last year

- Free Cash Flow Margin: 7.2%, similar to the same quarter last year

- Locations: 2,152 at quarter end, up from 2,010 in the same quarter last year

- Same-Store Sales rose 2.4% year on year, in line with the same quarter last year

- Market Capitalization: $18.78 billion

"We had a strong quarter and I am pleased that our four largest brands – Olive Garden, LongHorn Steakhouse, Yard House and Cheddar's Scratch Kitchen – generated positive same-restaurant sales, as did three of our four business segments," said Darden President & CEO Rick Cardenas.

Company Overview

Started in 1968 as the famous seafood joint, Red Lobster, Darden (NYSE:DRI) is a leading American restaurant company that owns and operates a portfolio of popular restaurant brands.

Sit-Down Dining

Sit-down restaurants offer a complete dining experience with table service. These establishments span various cuisines and are renowned for their warm hospitality and welcoming ambiance, making them perfect for family gatherings, special occasions, or simply unwinding. Their extensive menus range from appetizers to indulgent desserts and wines and cocktails. This space is extremely fragmented and competition includes everything from publicly-traded companies owning multiple chains to single-location mom-and-pop restaurants.

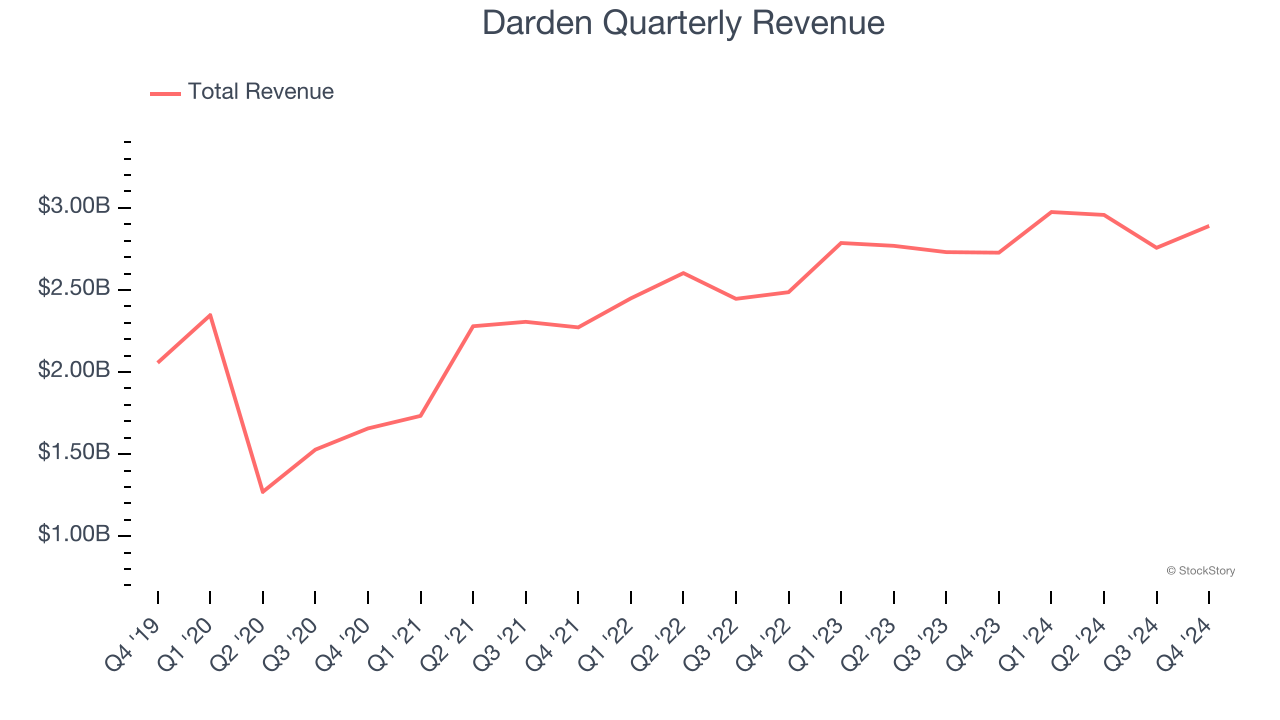

Sales Growth

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

Darden is one of the most widely recognized restaurant chains and benefits from customer loyalty, a luxury many don’t have. Its scale also gives it negotiating leverage with suppliers, enabling it to source its ingredients at a lower cost. However, its scale is a double-edged sword because it's harder to find incremental growth when your existing restaurant banners have penetrated most of the market. To accelerate system-wide sales, Darden must lean into newer chains.

As you can see below, Darden’s 6% annualized revenue growth over the last five years (we compare to 2019 to normalize for COVID-19 impacts) was tepid, but to its credit, it opened new restaurants and increased sales at existing, established dining locations.

This quarter, Darden reported year-on-year revenue growth of 6%, and its $2.89 billion of revenue exceeded Wall Street’s estimates by 0.7%.

Looking ahead, sell-side analysts expect revenue to grow 6.5% over the next 12 months, similar to its five-year rate. This projection doesn't excite us and indicates its newer offerings will not catalyze better top-line performance yet.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Restaurant Performance

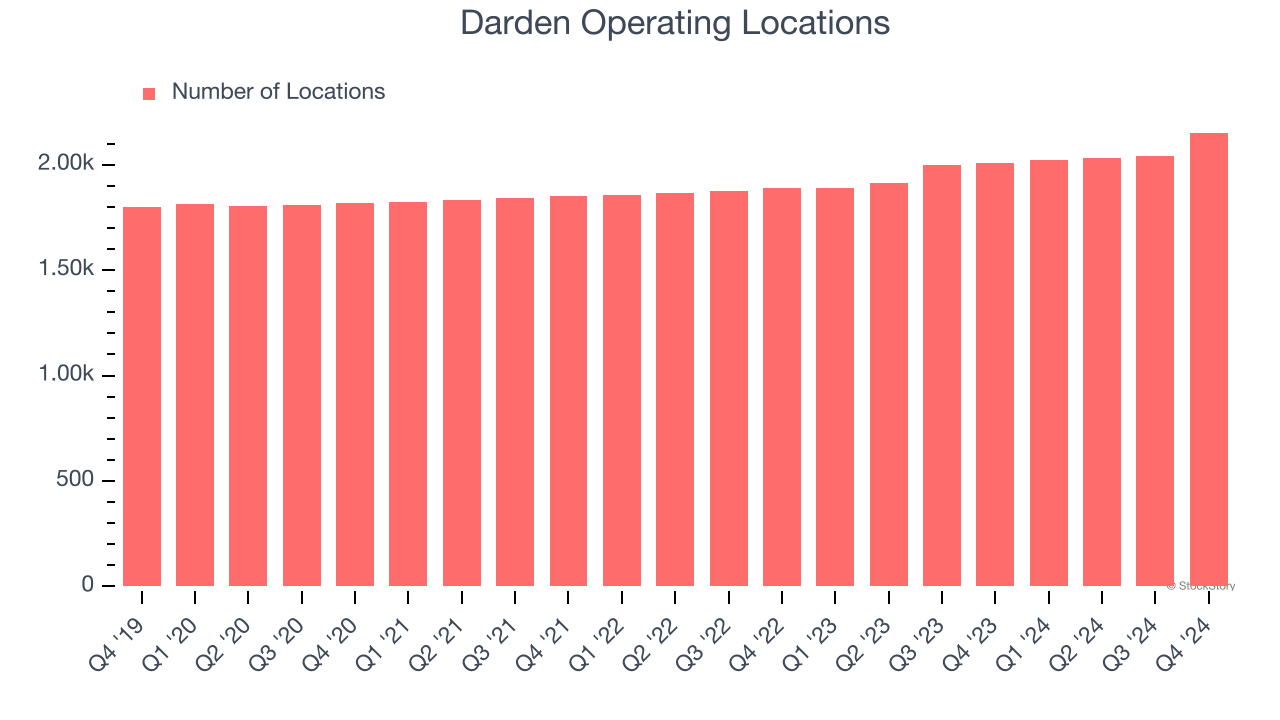

Number of Restaurants

The number of dining locations a restaurant chain operates is a critical driver of how quickly company-level sales can grow.

Darden sported 2,152 locations in the latest quarter. Over the last two years, it has opened new restaurants at a rapid clip by averaging 5% annual growth, among the fastest in the restaurant sector.

When a chain opens new restaurants, it usually means it’s investing for growth because there’s healthy demand for its meals and there are markets where its concepts have few or no locations.

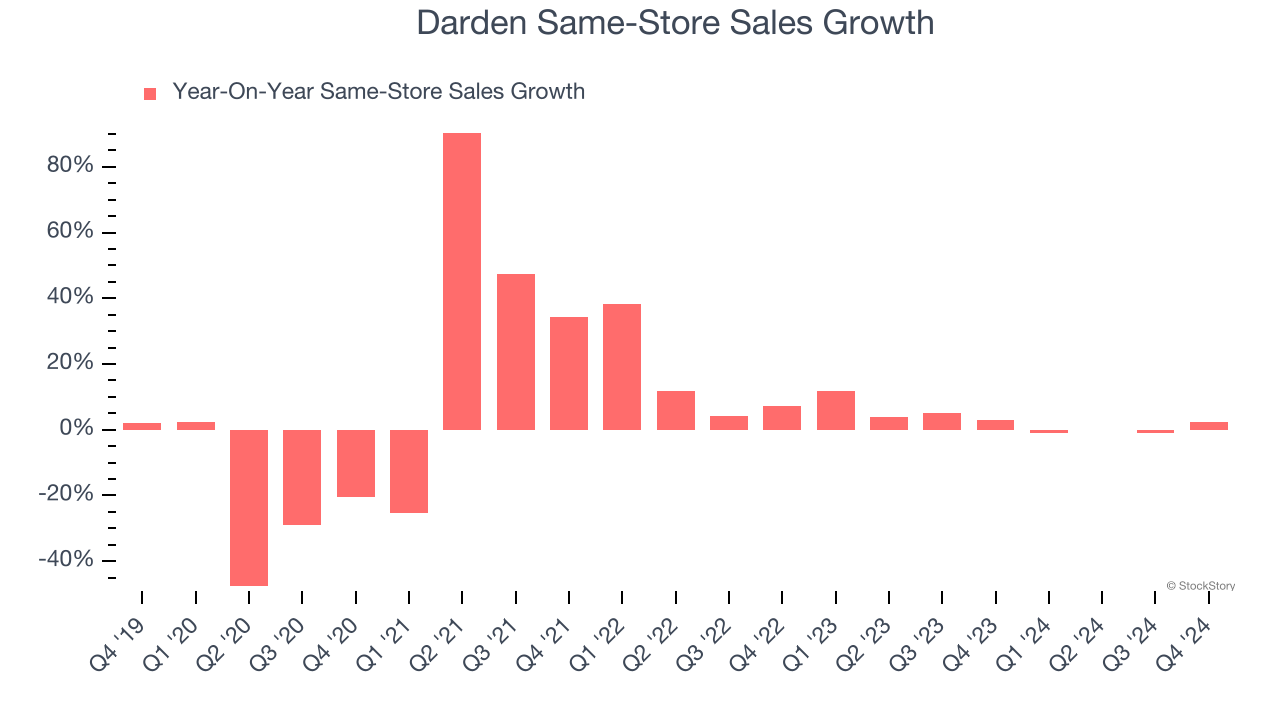

Same-Store Sales

The change in a company's restaurant base only tells one side of the story. The other is the performance of its existing locations, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales is an industry measure of whether revenue is growing at those existing restaurants and is driven by customer visits (often called traffic) and the average spending per customer (ticket).

Darden’s demand has been healthy for a restaurant chain over the last two years. On average, the company has grown its same-store sales by a robust 3% per year. This performance suggests its rollout of new restaurants could be beneficial for shareholders. When a chain has demand, more locations should help it reach more customers and boost revenue growth.

In the latest quarter, Darden’s same-store sales rose 2.4% year on year. This performance was more or less in line with its historical levels.

Key Takeaways from Darden’s Q4 Results

We enjoyed seeing Darden exceed analysts’ same-store sales expectations this quarter. We were also glad its full-year revenue guidance came in slightly higher than Wall Street’s estimates. Overall, this quarter had some key positives. The stock traded up 8.3% to $173.01 immediately after reporting.

Is Darden an attractive investment opportunity at the current price? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.