Chewy has had an impressive run over the past six months as its shares have beaten the S&P 500 by 16.8%. The stock now trades at $31.75, marking a 24.5% gain. This was partly due to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is now the time to buy Chewy, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.Despite the momentum, we're swiping left on Chewy for now. Here are three reasons why CHWY doesn't excite us and a stock we'd rather own.

Why Is Chewy Not Exciting?

Founded by Ryan Cohen who later became known for his involvement in GameStop, Chewy (NYSE: CHWY) is an online retailer specializing in pet food, supplies, and healthcare services.

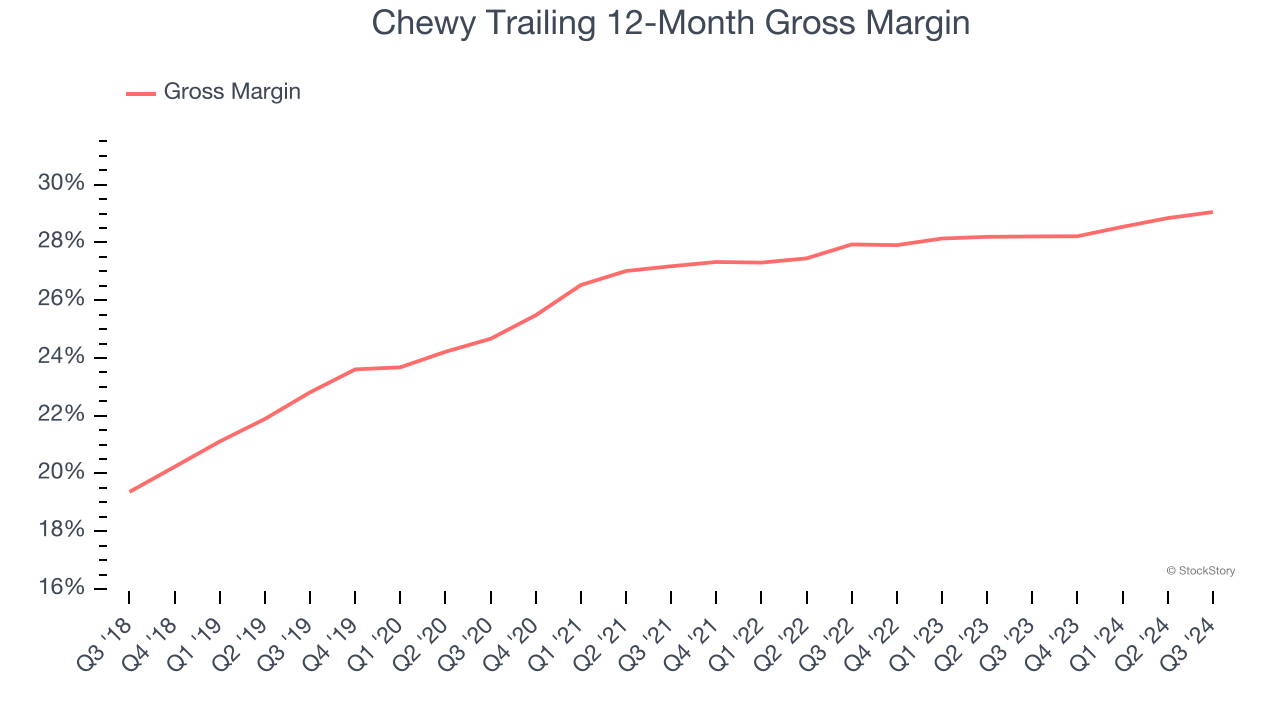

1. Low Gross Margin Reveals Weak Structural Profitability

For online retail (separate from online marketplaces) businesses like Chewy, gross profit tells us how much money the company gets to keep after covering the base cost of its products and services, which typically include the cost of acquiring the products sold, shipping and fulfillment, customer service, and digital infrastructure.

Chewy’s unit economics are far below other consumer internet companies because it must carry inventories as an online retailer. This means it has relatively higher capital intensity than a pure software business like Meta or Airbnb and signals it operates in a competitive market. As you can see below, it averaged a 28.6% gross margin over the last two years. Said differently, Chewy had to pay a chunky $71.36 to its service providers for every $100 in revenue.

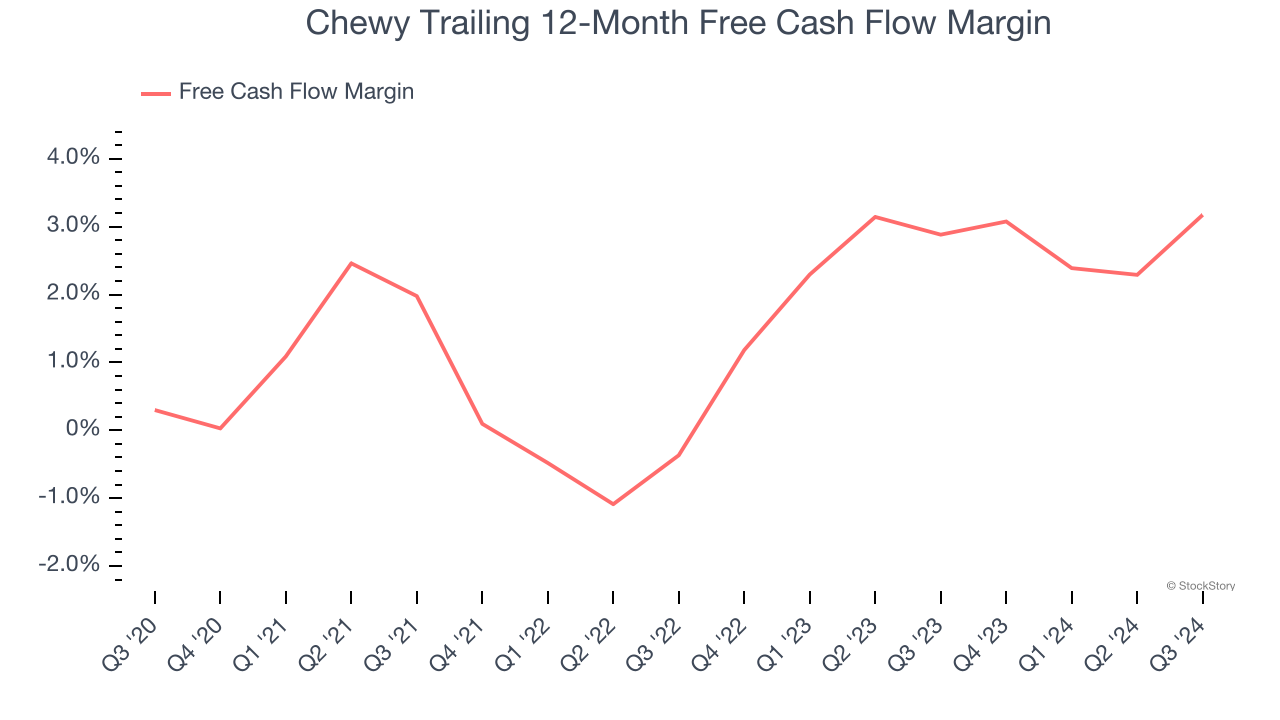

2. Mediocre Free Cash Flow Margin Limits Reinvestment Potential

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Chewy has shown mediocre cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 3%, subpar for a consumer internet business.

3. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Chewy’s revenue to rise by 7.4%, a slight deceleration versus its 10.2% annualized growth for the past three years. This projection doesn't excite us and indicates its products and services will face some demand challenges.

Final Judgment

Chewy isn’t a terrible business, but it isn’t one of our picks. With its shares beating the market recently, the stock trades at 21.6× forward EV-to-EBITDA (or $31.75 per share). Beauty is in the eye of the beholder, but our analysis shows the upside isn’t great compared to the potential downside. We're pretty confident there are superior stocks to buy right now. We’d recommend looking at Wabtec, a leading provider of locomotive services benefiting from an upgrade cycle.

Stocks We Like More Than Chewy

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.