As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q3. Today, we are looking at vertical software stocks, starting with Q2 Holdings (NYSE:QTWO).

Software is eating the world, and while a large number of solutions such as project management or video conferencing software can be useful to a wide array of industries, some have very specific needs. As a result, vertical software, which addresses industry-specific workflows, is growing and fueled by the pressures to improve productivity, whether it be for a life sciences, education, or banking company.

The 15 vertical software stocks we track reported a strong Q3. As a group, revenues beat analysts’ consensus estimates by 3.4% while next quarter’s revenue guidance was 0.7% above.

Luckily, vertical software stocks have performed well with share prices up 12.4% on average since the latest earnings results.

Q2 Holdings (NYSE:QTWO)

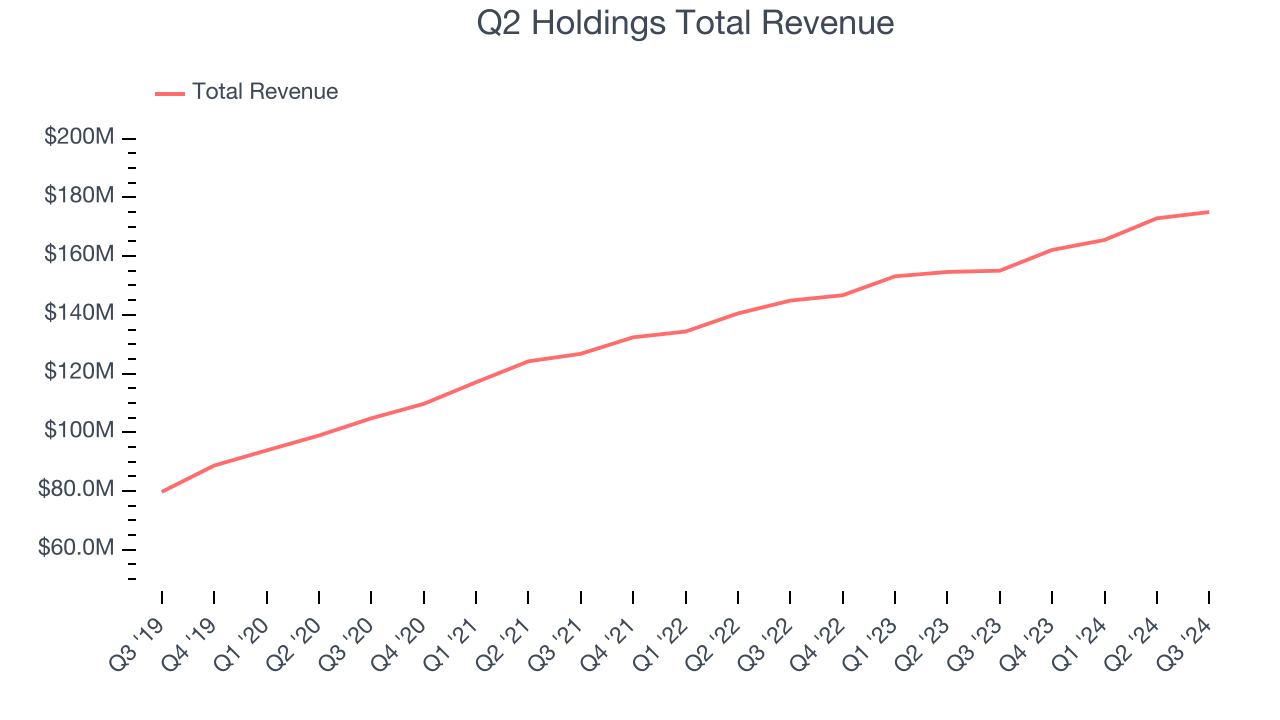

Founded in 2004 by Hank Seale, Q2 (NYSE:QTWO) offers software-as-a-service that enables small banks to provide online banking and consumer lending services to their clients.

Q2 Holdings reported revenues of $175 million, up 12.9% year on year. This print exceeded analysts’ expectations by 0.9%. Overall, it was a very strong quarter for the company with an impressive beat of analysts’ billings estimates and a solid beat of analysts’ EBITDA estimates.

“We achieved solid bookings success across our business lines in the third quarter, highlighted by six Enterprise and Tier 1 deals, including three with Top 50 U.S. banks,” said Q2 Chairman and CEO Matt Flake.

Interestingly, the stock is up 14.8% since reporting and currently trades at $103.82.

Is now the time to buy Q2 Holdings? Access our full analysis of the earnings results here, it’s free.

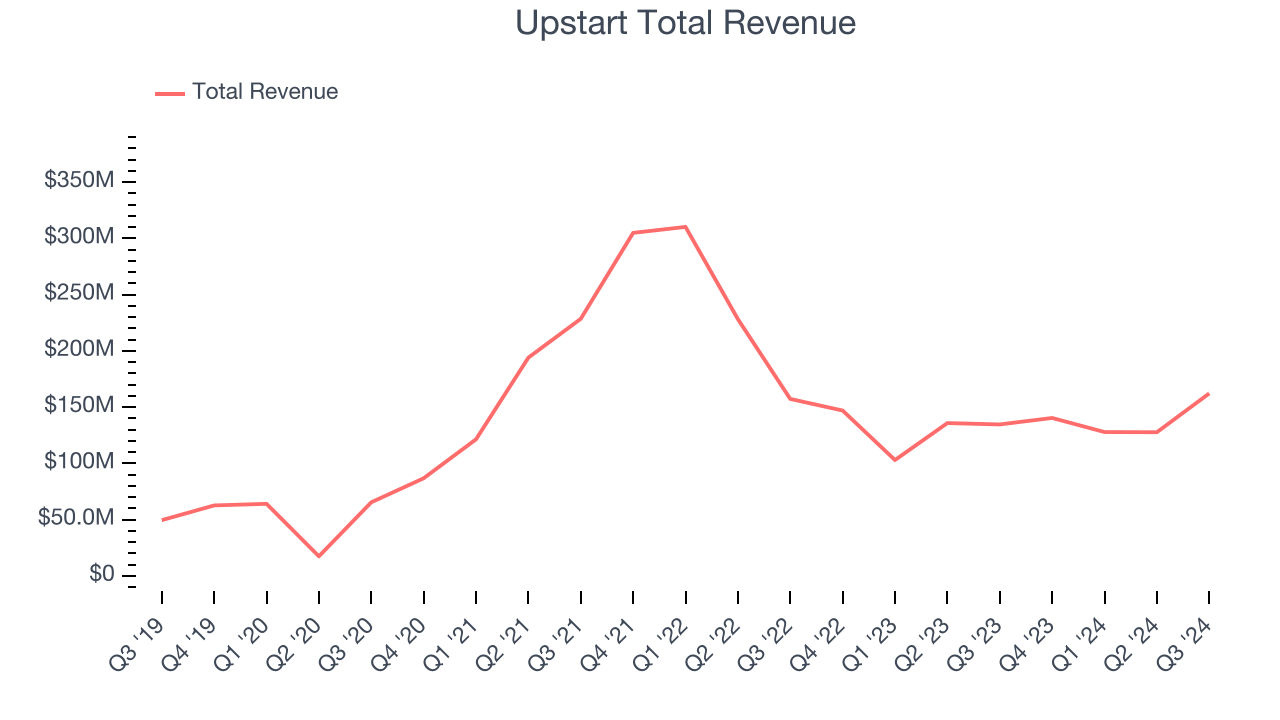

Best Q3: Upstart (NASDAQ:UPST)

Founded by the former head of Google's enterprise business, Upstart (NASDAQ:UPST) is an AI-powered lending platform facilitating loans for banks and consumers.

Upstart reported revenues of $162.1 million, up 20.5% year on year, outperforming analysts’ expectations by 7.9%. The business had a stunning quarter with an impressive beat of analysts’ EBITDA estimates and revenue guidance for next quarter exceeding analysts’ expectations.

The market seems happy with the results as the stock is up 53.1% since reporting. It currently trades at $84.90.

Is now the time to buy Upstart? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Adobe (NASDAQ:ADBE)

One of the most well-known Silicon Valley software companies around, Adobe (NASDAQ:ADBE) is a leading provider of software as service in the digital design and document management space.

Adobe reported revenues of $5.61 billion, up 11.1% year on year, exceeding analysts’ expectations by 1.2%. Still, it was a slower quarter as it posted revenue guidance for next quarter slightly missing analysts’ expectations and a miss of analysts’ billings estimates.

As expected, the stock is down 15.5% since the results and currently trades at $464.45.

Read our full analysis of Adobe’s results here.

Veeva Systems (NYSE:VEEV)

Built on top of Salesforce as one of the first vertical-focused cloud platforms, Veeva (NYSE:VEEV) provides data and customer relationship management (CRM) software for organizations in the life sciences industry.

Veeva Systems reported revenues of $699.2 million, up 13.4% year on year. This print beat analysts’ expectations by 2.2%. It was a very strong quarter as it also produced an impressive beat of analysts’ EBITDA estimates and full-year EPS guidance exceeding analysts’ expectations.

The stock is down 1.2% since reporting and currently trades at $228.78.

Read our full, actionable report on Veeva Systems here, it’s free.

Cadence (NASDAQ:CDNS)

With the name chosen to reflect the idea of a repeating pattern or rhythm in electronic design, Cadence Design Systems (NASDAQ:CDNS) offers a software-as-a-service platform for semiconductor engineering and design.

Cadence reported revenues of $1.22 billion, up 18.8% year on year. This number topped analysts’ expectations by 2.9%. Overall, it was a very strong quarter as it also recorded a solid beat of analysts’ billings and EBITDA estimates.

The stock is up 20.8% since reporting and currently trades at $305.55.

Read our full, actionable report on Cadence here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), has fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty heading into 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.