As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q3. Today, we are looking at vehicle retailer stocks, starting with Lithia (NYSE:LAD).

Buying a vehicle is a big decision and usually the second-largest purchase behind a home for many people, so retailers that sell new and used cars try to offer selection, convenience, and customer service to shoppers. While there is online competition, especially for research and discovery, the vehicle sales market is still very fragmented and localized given the magnitude of the purchase and the logistical costs associated with moving cars over long distances. At the end of the day, a large swath of the population relies on cars to get from point A to point B, and vehicle sellers are acutely aware of this need.

The 4 vehicle retailer stocks we track reported a very strong Q3. As a group, revenues beat analysts’ consensus estimates by 1.6%.

Luckily, vehicle retailer stocks have performed well with share prices up 18.7% on average since the latest earnings results.

Lithia (NYSE:LAD)

With a strong presence in the Western US, Lithia Motors (NYSE:LAD) sells a wide range of vehicles, including new and used cars, trucks, SUVs, and luxury vehicles from various manufacturers.

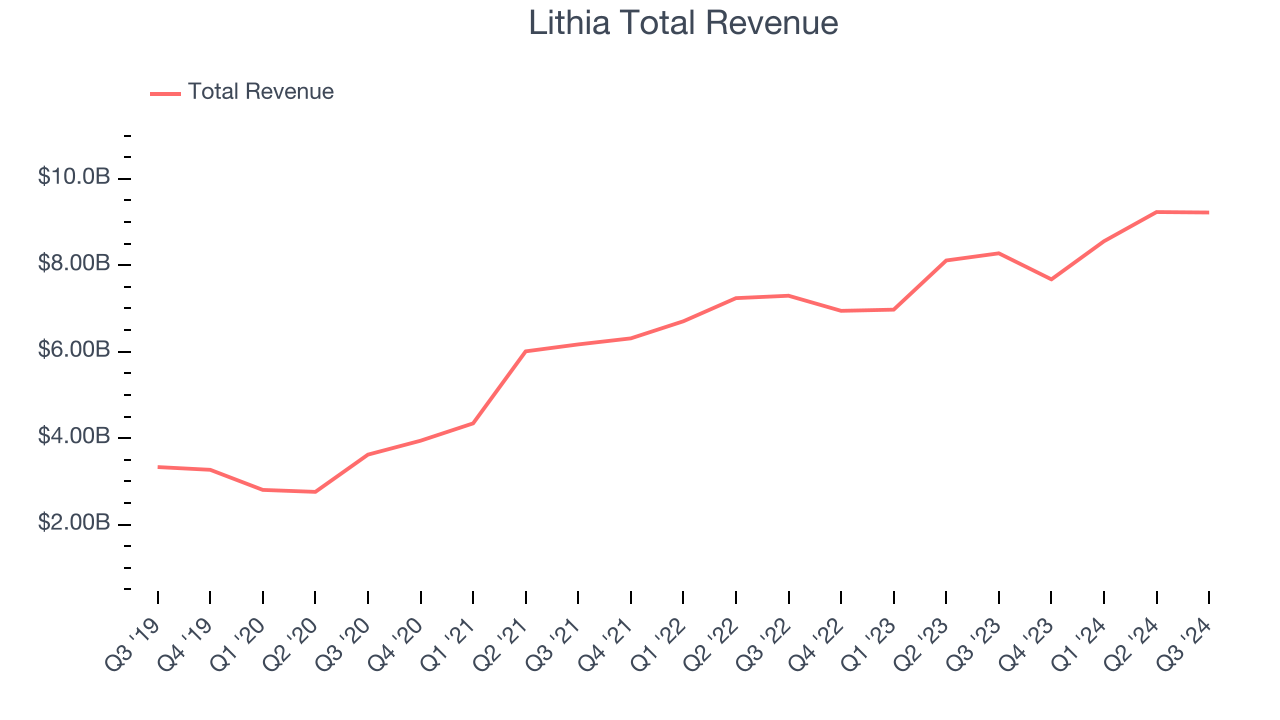

Lithia reported revenues of $9.22 billion, up 11.4% year on year. This print fell short of analysts’ expectations by 2.5%, but it was still a strong quarter for the company with an impressive beat of analysts’ EBITDA estimates and a decent beat of analysts’ EPS estimates.

"Our third quarter performance was strong and demonstrated the team's ability to grow our business, leveraging size and scale and seizing new opportunities while focusing on operational efficiency. Our core businesses showed consistent growth while delivering substantial cost savings, and our adjacent operations continued building momentum, positioning us well for the future," said Bryan DeBoer, President and CEO.

Lithia achieved the fastest revenue growth but had the weakest performance against analyst estimates of the whole group. Unsurprisingly, the stock is up 24.9% since reporting and currently trades at $380.62.

Is now the time to buy Lithia? Access our full analysis of the earnings results here, it’s free.

Best Q3: Camping World (NYSE:CWH)

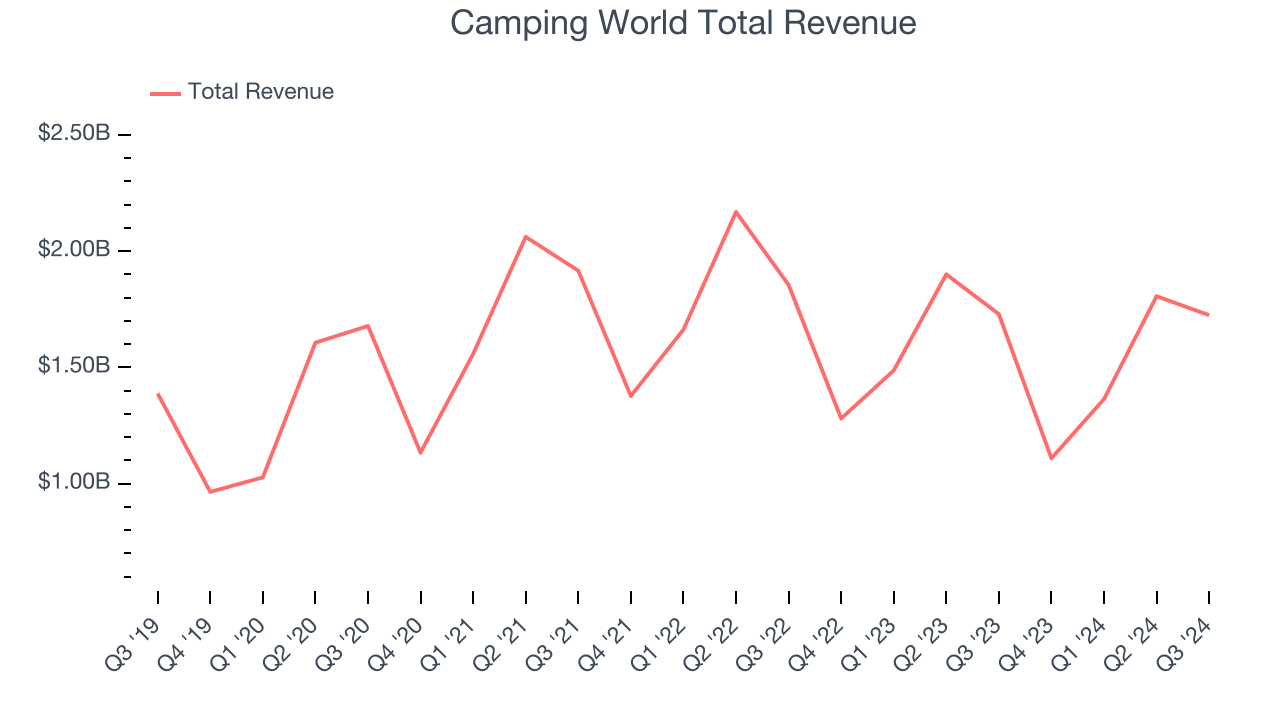

Founded in 1966 as a single recreational vehicle (RV) dealership, Camping World (NYSE:CWH) still sells RVs along with boats and general merchandise for outdoor activities.

Camping World reported revenues of $1.72 billion, flat year on year, outperforming analysts’ expectations by 5.4%. The business had a stunning quarter with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

Camping World pulled off the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 12.9% since reporting. It currently trades at $24.15.

Is now the time to buy Camping World? Access our full analysis of the earnings results here, it’s free.

Slowest Q3: America's Car-Mart (NASDAQ:CRMT)

With a strong presence in the Southern and Central US, America’s Car-Mart (NASDAQ:CRMT) sells used cars to budget-conscious consumers.

America's Car-Mart reported revenues of $347.3 million, down 3.6% year on year, exceeding analysts’ expectations by 0.8%. It was a satisfactory quarter as it also posted a solid beat of analysts’ gross margin estimates but a significant miss of analysts’ EPS estimates.

America's Car-Mart delivered the slowest revenue growth in the group. Interestingly, the stock is up 21.4% since the results and currently trades at $55.49.

Read our full analysis of America's Car-Mart’s results here.

CarMax (NYSE:KMX)

Known for its transparent, customer-centric approach and wide selection of vehicles, Carmax (NYSE:KMX) is the largest automotive retailer in the United States.

CarMax reported revenues of $7.01 billion, flat year on year. This print topped analysts’ expectations by 2.7%. It was a very strong quarter as it also logged a solid beat of analysts’ EBITDA estimates and a decent beat of analysts’ gross margin estimates.

The stock is up 15.8% since reporting and currently trades at $86.27.

Read our full, actionable report on CarMax here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September, a quarter in November) have kept 2024 stock markets frothy, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there's still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.