Electric vehicle manufacturer Rivian (NASDAQ:RIVN) missed Wall Street’s revenue expectations in Q3 CY2024, with sales falling 34.6% year on year to $874 million. Its GAAP loss of $1.08 per share was in line with analysts’ consensus estimates.

Is now the time to buy Rivian? Find out by accessing our full research report, it’s free.

Rivian (RIVN) Q3 CY2024 Highlights:

- Revenue: $874 million vs analyst estimates of $976.6 million (10.5% miss)

- EPS (GAAP): -$1.08 vs analyst expectations of -$1.09 (in line)

- EBITDA: -$757 million vs analyst estimates of -$665.4 million (13.8% miss)

- Gross Margin (GAAP): -44.9%, down from -35.7% in the same quarter last year

- Operating Margin: -134%, down from -108% in the same quarter last year

- EBITDA Margin: -86.6%, down from -67.5% in the same quarter last year

- Sales Volumes fell 35.6% year on year (136% in the same quarter last year)

- Market Capitalization: $9.79 billion

Company Overview

The manufacturer of Amazon’s delivery trucks, Rivian (NASDAQ:RIVN) designs, manufactures, and sells electric adventure vehicles and commercial delivery vans.

Automobile Manufacturers

Much capital investment and technical know-how are needed to manufacture functional, safe, and aesthetically pleasing automobiles for the mass market. Barriers to entry are therefore high, and auto manufacturers with economies of scale can boast strong economic moats. However, this doesn’t insulate them from new entrants, as electric vehicles (EVs) have entered the market and are upending it. This has forced established manufacturers to not only contend with emerging EV-first competitors but also decide how much they want to invest in these disruptive technologies, which will likely cannibalize their legacy offerings.

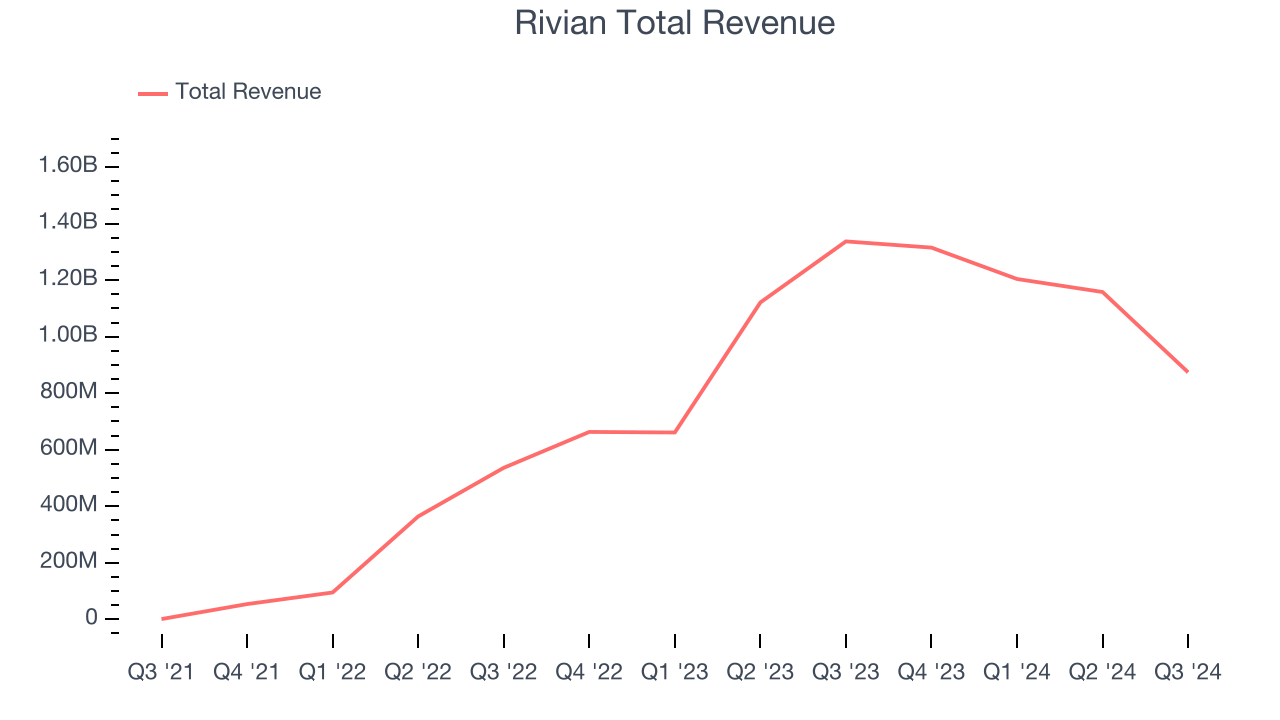

Sales Growth

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Thankfully, Rivian’s 108% annualized revenue growth over the last two years was incredible. This is encouraging because it shows Rivian’s offerings resonate with customers, a helpful starting point.

This quarter, Rivian missed Wall Street’s estimates and reported a rather uninspiring 34.6% year-on-year revenue decline, generating $874 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 13.1% over the next 12 months, a deceleration versus the last two years. This projection is still noteworthy and indicates the market is baking in success for its products and services.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

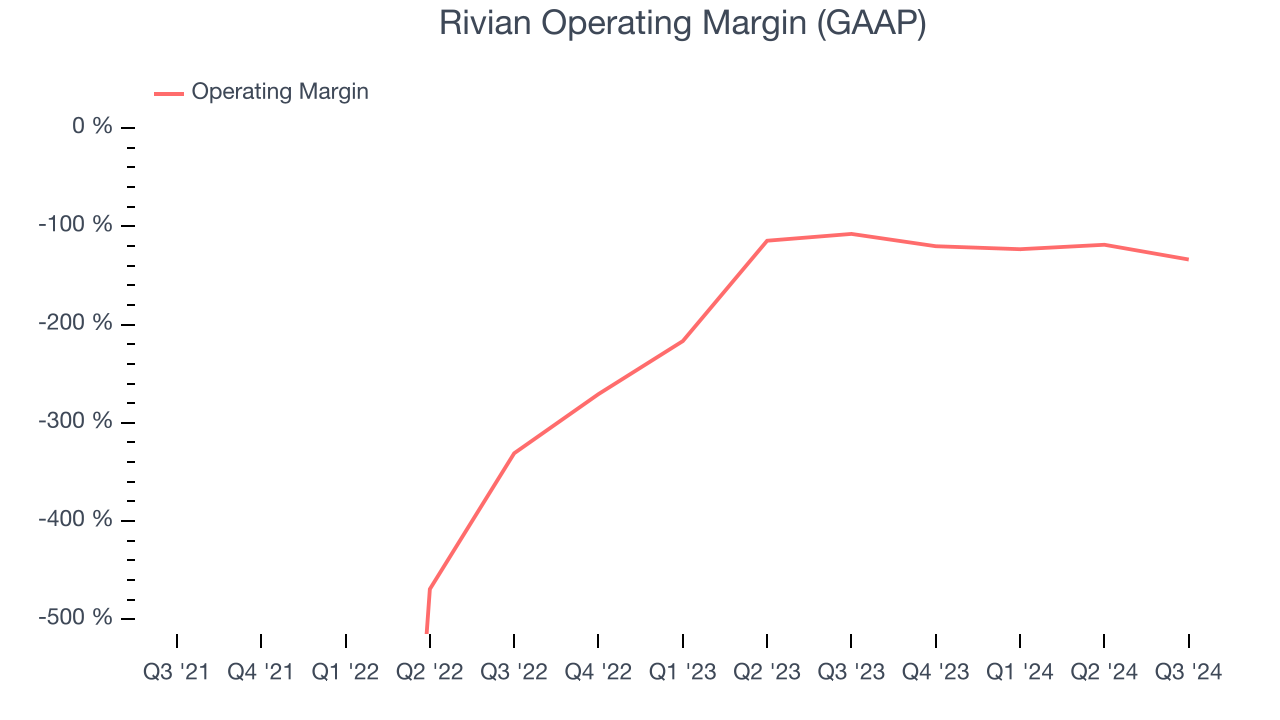

Operating Margin

Rivian’s operating margin has been trending up over the last year, but it still averaged negative 212%. This is due to its large expense base and inefficient cost structure. It might have a shot at long-term profitability if it can scale quickly and gain operating leverage.

This quarter, Rivian generated a negative 134% operating margin. The company's lack of profits raise a flag.

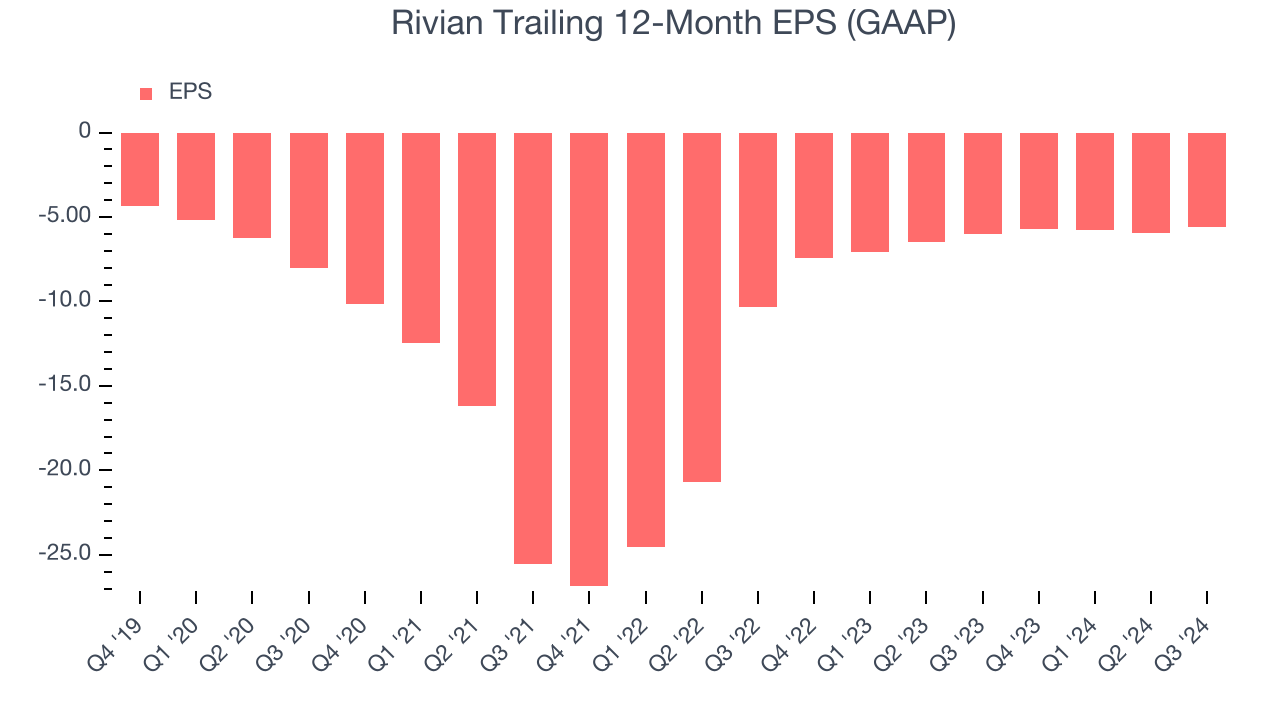

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth was profitable.

Rivian’s earnings losses deepened over the last five years as its EPS dropped 6.2% annually. However, it’s bucked its trend as of late, increasing its EPS over the last three years. We’ll see if it can maintain its growth.

Like with revenue, we analyze EPS over a more recent period because it can give insight into an emerging theme or development for the business.

For Rivian, its two-year annual EPS growth of 26.5% was higher than its five-year trend. This acceleration made it one of the faster-growing industrials companies in recent history.In Q3, Rivian reported EPS at negative $1.08, up from negative $1.44 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects Rivian to improve its earnings losses. Analysts forecast its full-year EPS of negative $5.59 will advance to negative $3.79.

Key Takeaways from Rivian’s Q3 Results

We struggled to find many strong positives in these results as its vehicles sold, revenue, and EBITDA fell short of Wall Street’s estimates. Overall, this was a weaker quarter, but management promised investors a positive gross margin next quarter. This is a huge development as Rivian has long struggled with negative unit economics, meaning it lost money on every sale. The stock traded up 2.7% to $10.31 immediately after reporting.

So should you invest in Rivian right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.