Aircraft leasing company Air Lease Corporation (NYSE:AL) reported Q3 CY2024 results exceeding the market’s revenue expectations, with sales up 4.7% year on year to $690.2 million. Its non-GAAP profit of $1.25 per share was also 57.2% above analysts’ consensus estimates.

Is now the time to buy Air Lease? Find out by accessing our full research report, it’s free.

Air Lease (AL) Q3 CY2024 Highlights:

- Revenue: $690.2 million vs analyst estimates of $676 million (2.1% beat)

- Adjusted EPS: $1.25 vs analyst estimates of $0.80 (57.2% beat)

- Free Cash Flow was $44.42 million, up from -$44.32 million in the same quarter last year

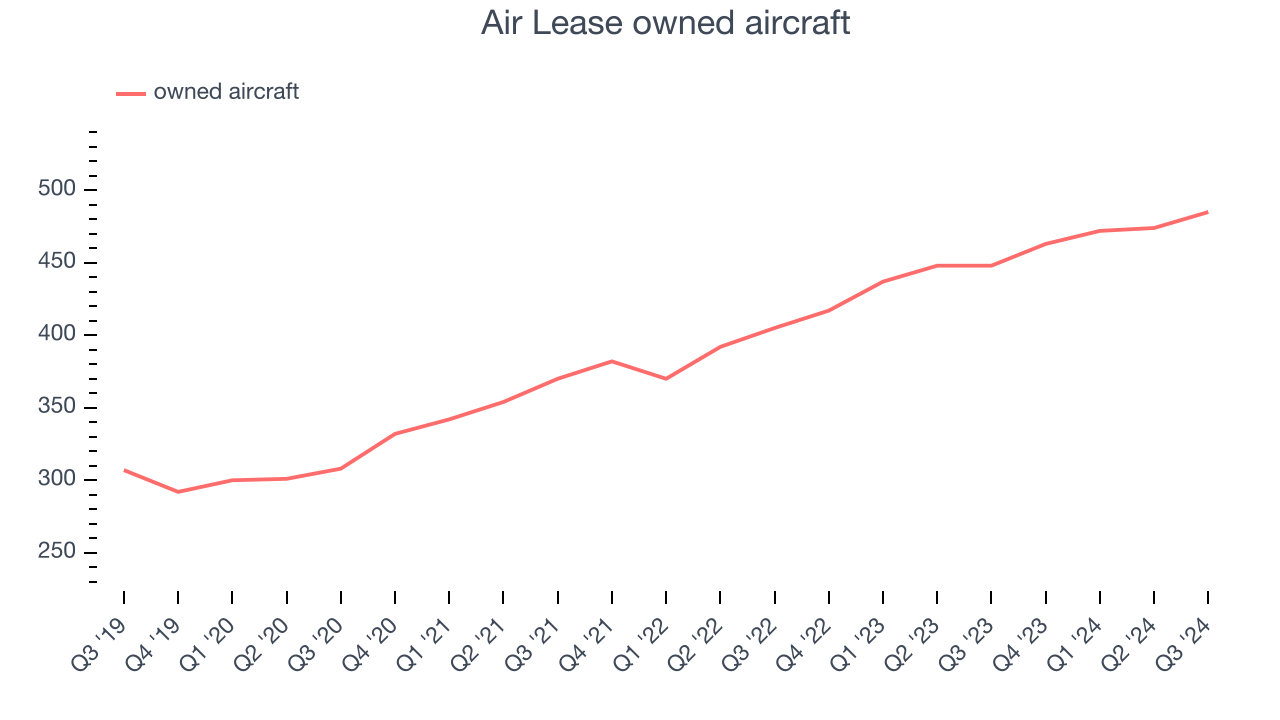

- owned aircraft: 485, up 37 year on year

- Market Capitalization: $5.27 billion

Company Overview

Established by a founder of Century City in Los Angeles, Air Lease Corporation (NYSE:AL) provides aircraft leasing and financing solutions to airlines worldwide.

Vehicle Parts Distributors

Supply chain and inventory management are themes that grew in focus after COVID wreaked havoc on the global movement of raw materials and components. Transportation parts distributors that boast reliable selection in sometimes specialized areas combined and quickly deliver products to customers can benefit from this theme. Additionally, distributors who earn meaningful revenue streams from aftermarket products can enjoy more steady top-line trends and higher margins. But like the broader industrials sector, transportation parts distributors are also at the whim of economic cycles that impact capital spending, transportation volumes, and demand for discretionary parts and components.

Sales Growth

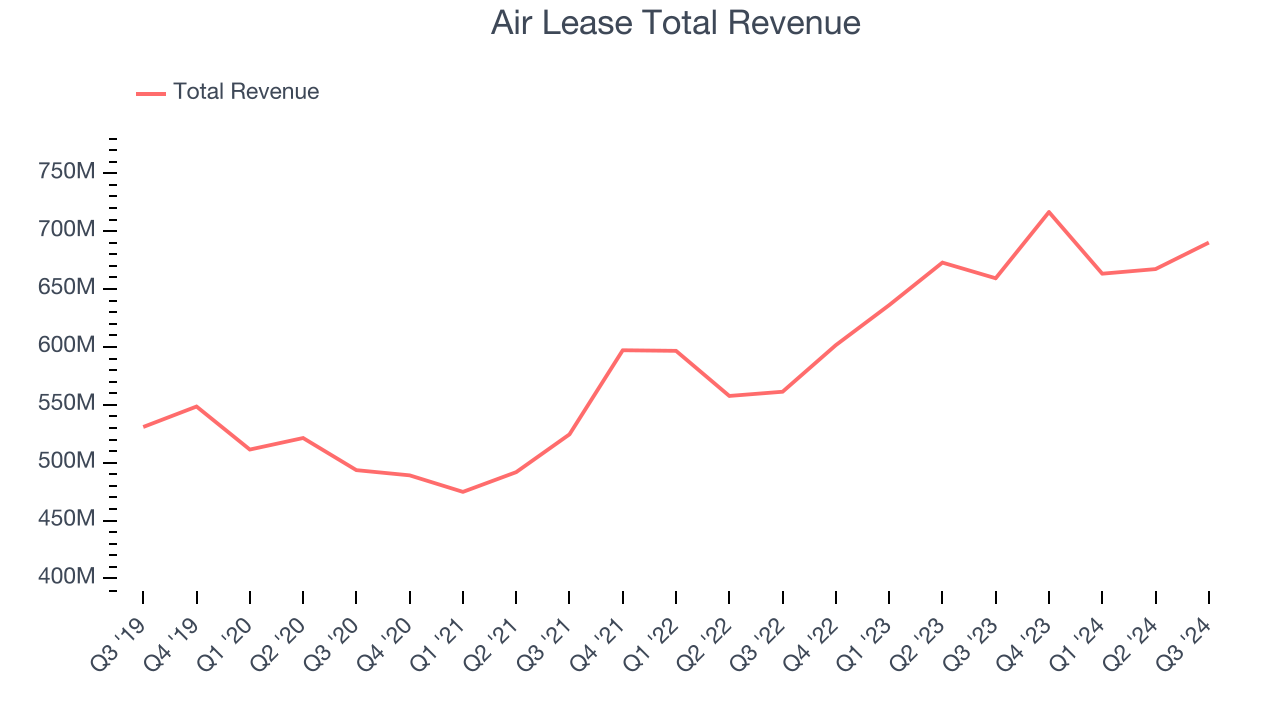

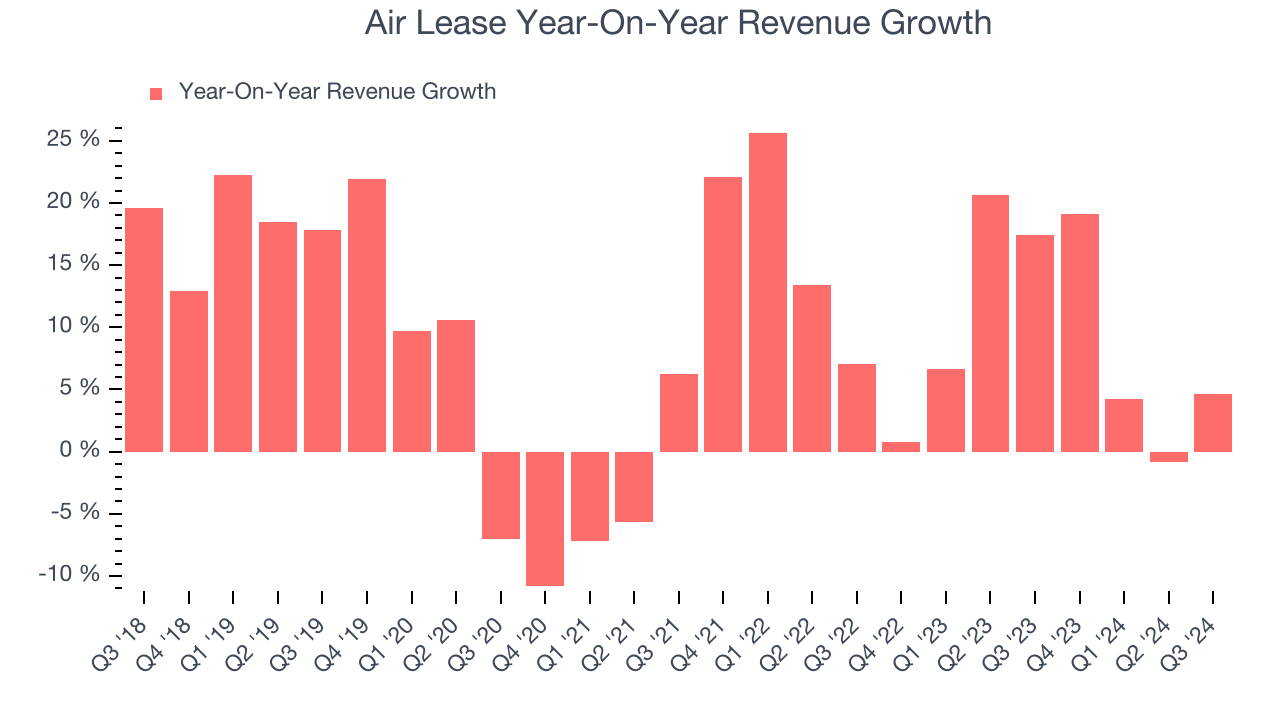

A company’s long-term performance is an indicator of its overall business quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for multiple years. Regrettably, Air Lease’s sales grew at a mediocre 7.4% compounded annual growth rate over the last five years. This shows it couldn’t expand in any major way, a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Air Lease’s annualized revenue growth of 8.8% over the last two years is above its five-year trend, suggesting some bright spots.

We can better understand the company’s revenue dynamics by analyzing its number of owned aircraft, which reached 485 in the latest quarter. Over the last two years, Air Lease’s owned aircraft averaged 10.7% year-on-year growth. Because this number is higher than its revenue growth during the same period, we can see the company’s monetization has fallen.

This quarter, Air Lease reported modest year-on-year revenue growth of 4.7% but beat Wall Street’s estimates by 2.1%.

We also like to judge companies based on their projected revenue growth, but not enough Wall Street analysts cover the company for it to have reliable consensus estimates.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

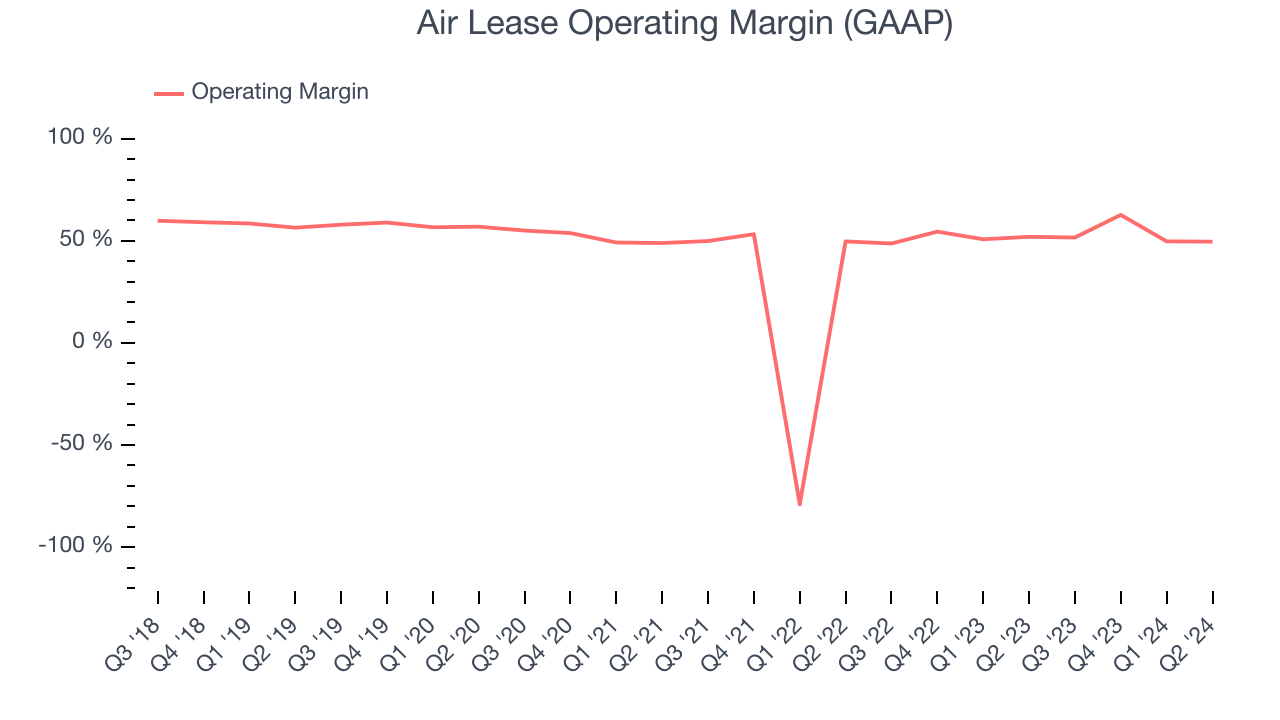

Air Lease has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 45.8%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Air Lease’s annual operating margin decreased by 3.3 percentage points over the last five years. Even though its margin is still high, shareholders will want to see Air Lease become more profitable in the future.

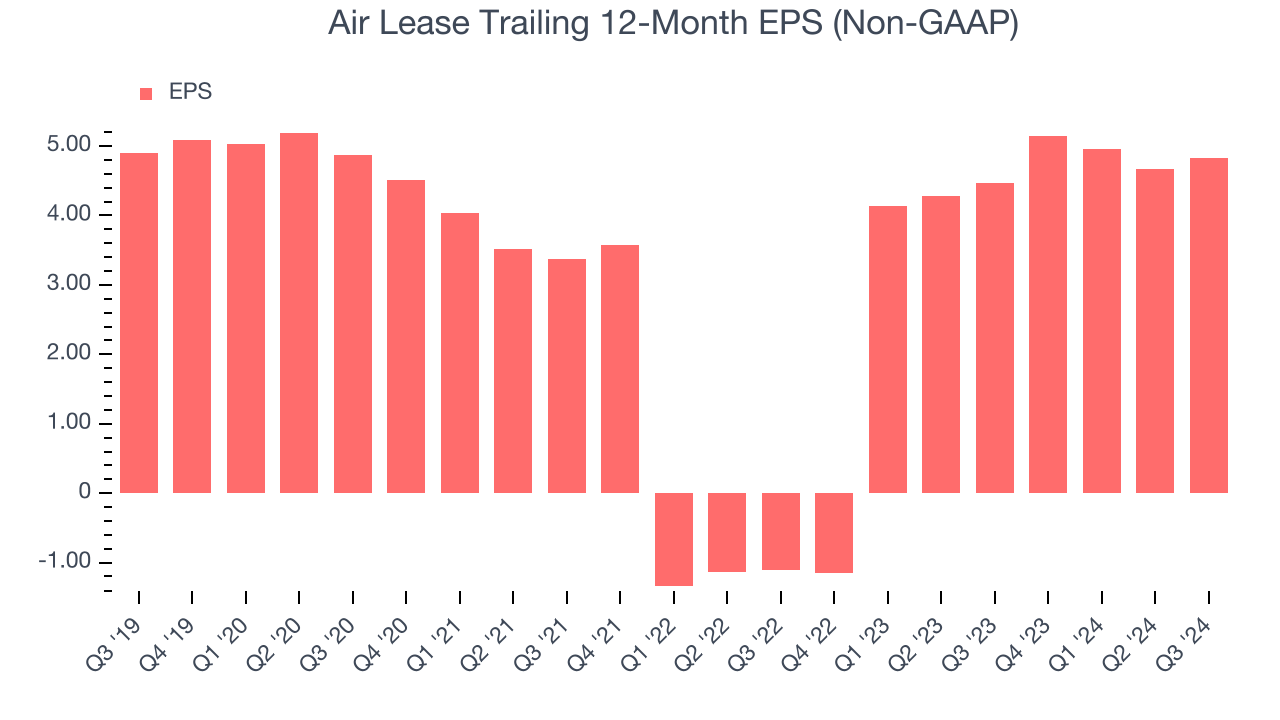

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth was profitable.

Air Lease’s flat EPS over the last five years was below its 7.4% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

Diving into the nuances of Air Lease’s earnings can give us a better understanding of its performance. As we mentioned earlier, Air Lease’s operating margin declined by 3.3 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can give insight into an emerging theme or development for the business.

For Air Lease, its two-year annual EPS growth of 152% was higher than its five-year trend. This acceleration made it one of the faster-growing industrials companies in recent history.In Q3, Air Lease reported EPS at $1.25, up from $1.10 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data.

Key Takeaways from Air Lease’s Q3 Results

We were impressed by how significantly Air Lease blew past analysts’ EPS expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates. Zooming out, we think this quarter featured some important positives. The stock remained flat at $47.32 immediately following the results.

So should you invest in Air Lease right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.