Heating and cooling solutions company AAON (NASDAQ:AAON) reported Q3 CY2024 results topping the market’s revenue expectations, with sales up 4.9% year on year to $327.3 million. Its GAAP profit of $0.63 per share was also 10% above analysts’ consensus estimates.

Is now the time to buy AAON? Find out by accessing our full research report, it’s free.

AAON (AAON) Q3 CY2024 Highlights:

- Revenue: $327.3 million vs analyst estimates of $315.8 million (3.6% beat)

- EPS: $0.63 vs analyst estimates of $0.57 (10% beat)

- EBITDA: $82.86 million vs analyst estimates of $78.11 million (6.1% beat)

- Gross Margin (GAAP): 34.9%, down from 37.2% in the same quarter last year

- Operating Margin: 20%, down from 23.2% in the same quarter last year

- EBITDA Margin: 25.3%, down from 28.2% in the same quarter last year

- Free Cash Flow Margin: 9.1%, up from 8% in the same quarter last year

- Backlog: $647.7 million at quarter end

- Market Capitalization: $9.74 billion

Gary Fields, CEO, stated, "The third quarter marked another quarter of strong results. Net sales for the quarter were a Company record, driven by robust growth at the BASX and AAON Coil Products segments. Demand at these two segments was largely spurred by the data center market as we continue to opportunistically leverage this high-growth market with our highly-engineered solutions-based product offerings. At the AAON Oklahoma segment, sales and profitability were in line with our expectations. Operationally, this segment continued to perform at a high level. The BASX segment still has some room for margin improvement, which we expect will occur over the next six months as disruptions related to the capacity expansion project, including outsourcing of parts manufacturing, dissipates and its shop reaches optimal efficiency. Overall, we were pleased with the third quarter results."

Company Overview

Backed by two million square feet of lab testing space, AAON (NASDAQ:AAON) makes heating, ventilation, and air conditioning equipment for different types of buildings.

HVAC and Water Systems

Many HVAC and water systems companies sell essential, non-discretionary infrastructure for buildings. Since the useful lives of these water heaters and vents are fairly standard, these companies have a portion of predictable replacement revenue. In the last decade, trends in energy efficiency and clean water are driving innovation that is leading to incremental demand. On the other hand, new installations for these companies are at the whim of residential and commercial construction volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates.

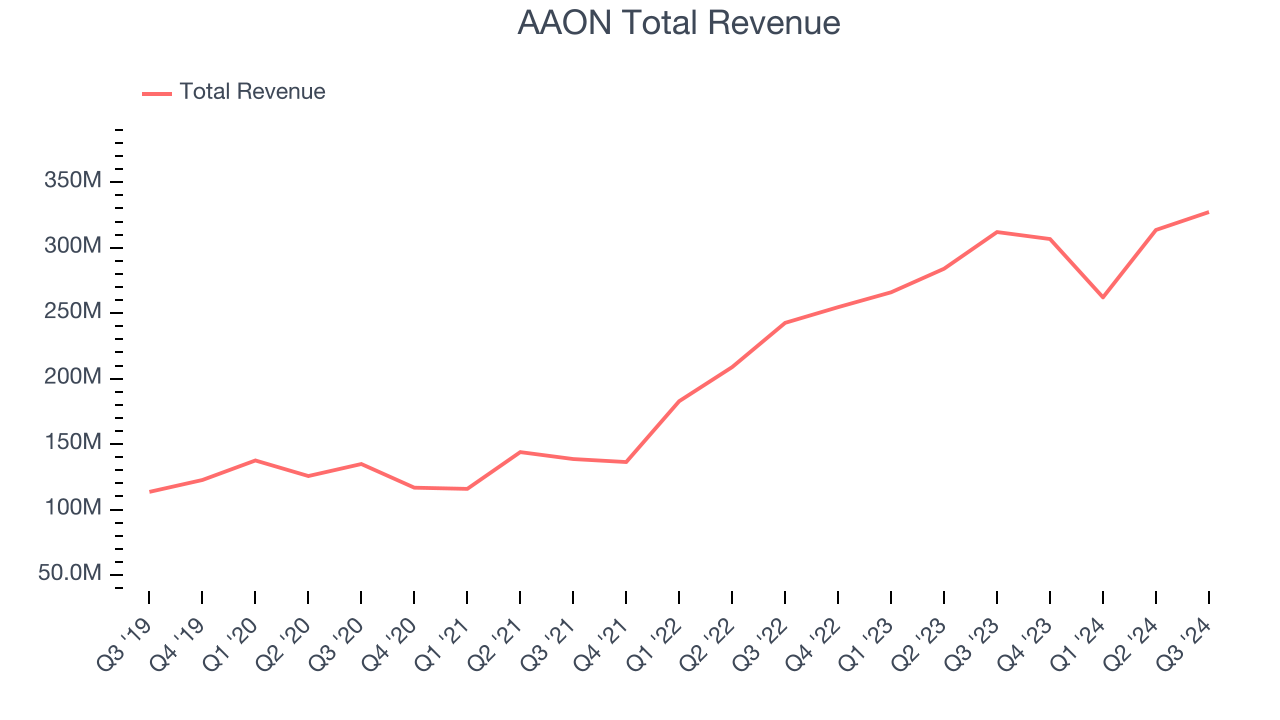

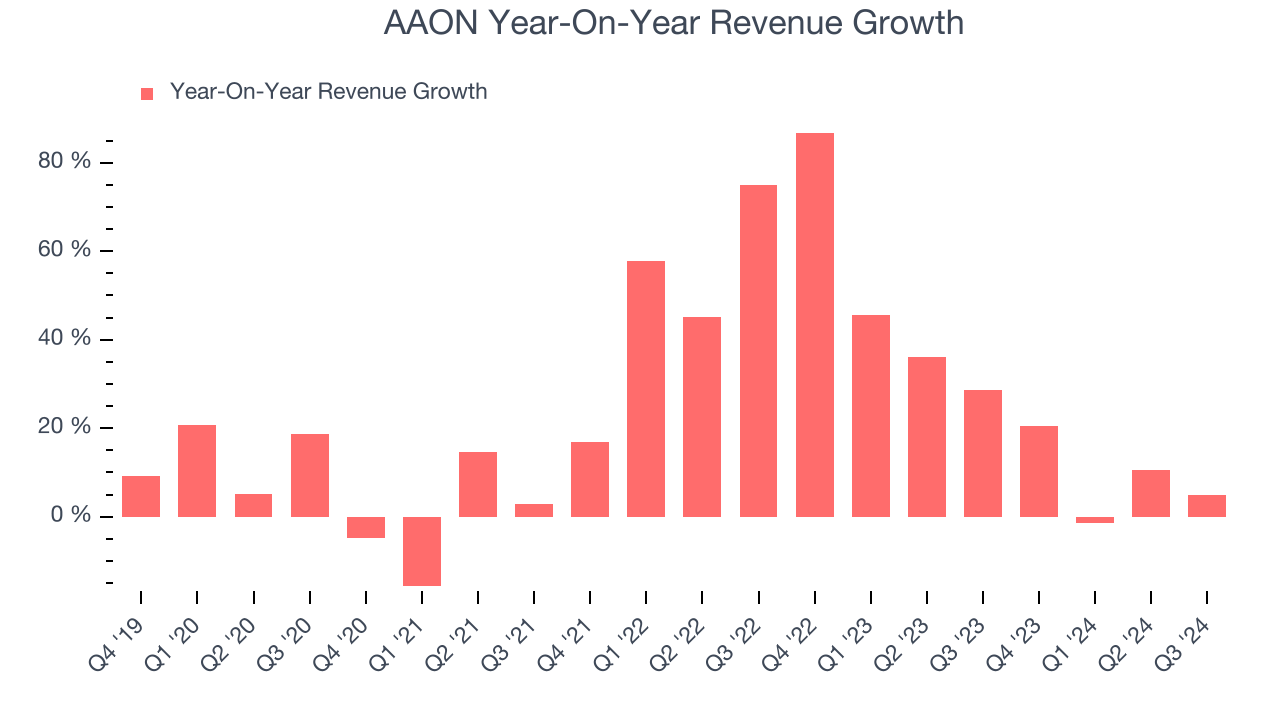

Sales Growth

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, AAON grew its sales at an incredible 21.4% compounded annual growth rate. This is a great starting point for our analysis because it shows AAON’s offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. AAON’s annualized revenue growth of 25.3% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

This quarter, AAON reported modest year-on-year revenue growth of 4.9% but beat Wall Street’s estimates by 3.6%.

Looking ahead, sell-side analysts expect revenue to grow 14.3% over the next 12 months, a deceleration versus the last two years. This projection is still admirable and shows the market sees success for its products and services.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

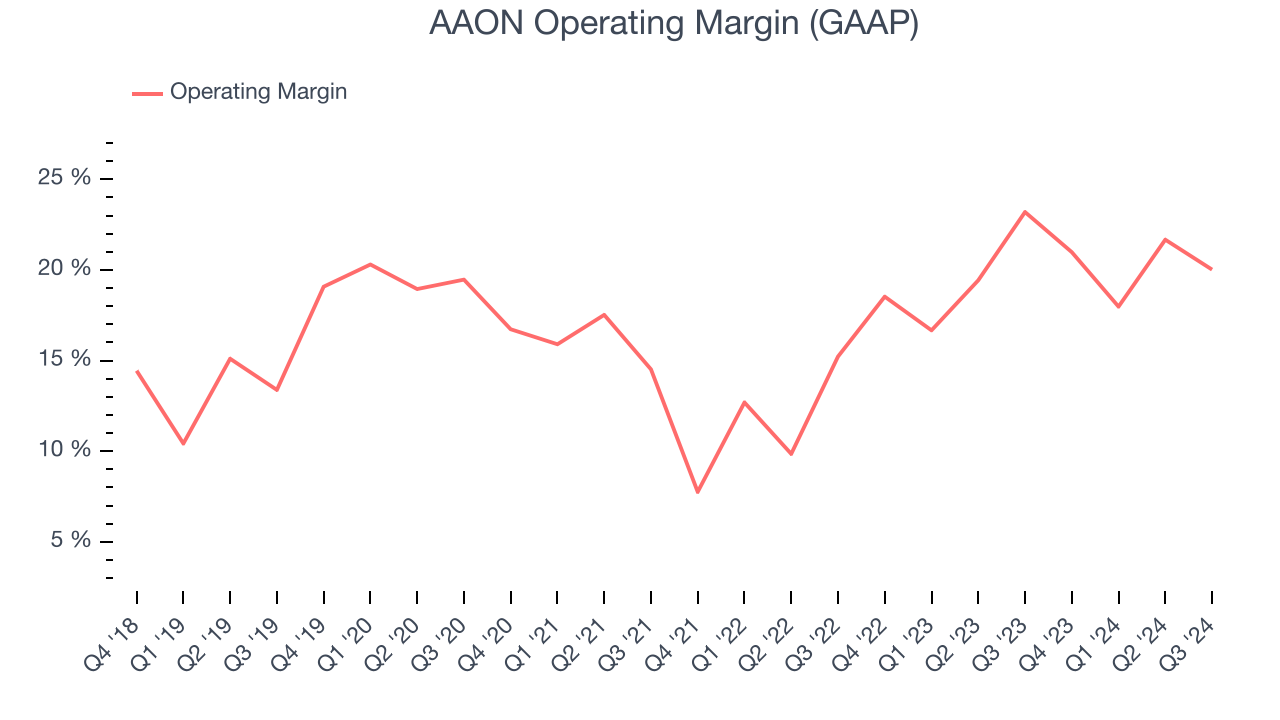

Operating Margin

AAON has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 17.9%.

Analyzing the trend in its profitability, AAON’s annual operating margin might have seen some fluctuations but has generally stayed the same over the last five years, highlighting the long-term consistency of its business.

This quarter, AAON generated an operating profit margin of 20%, down 3.2 percentage points year on year. Since AAON’s operating margin decreased more than its gross margin, we can assume it was recently less efficient because expenses such as marketing, R&D, and administrative overhead increased.

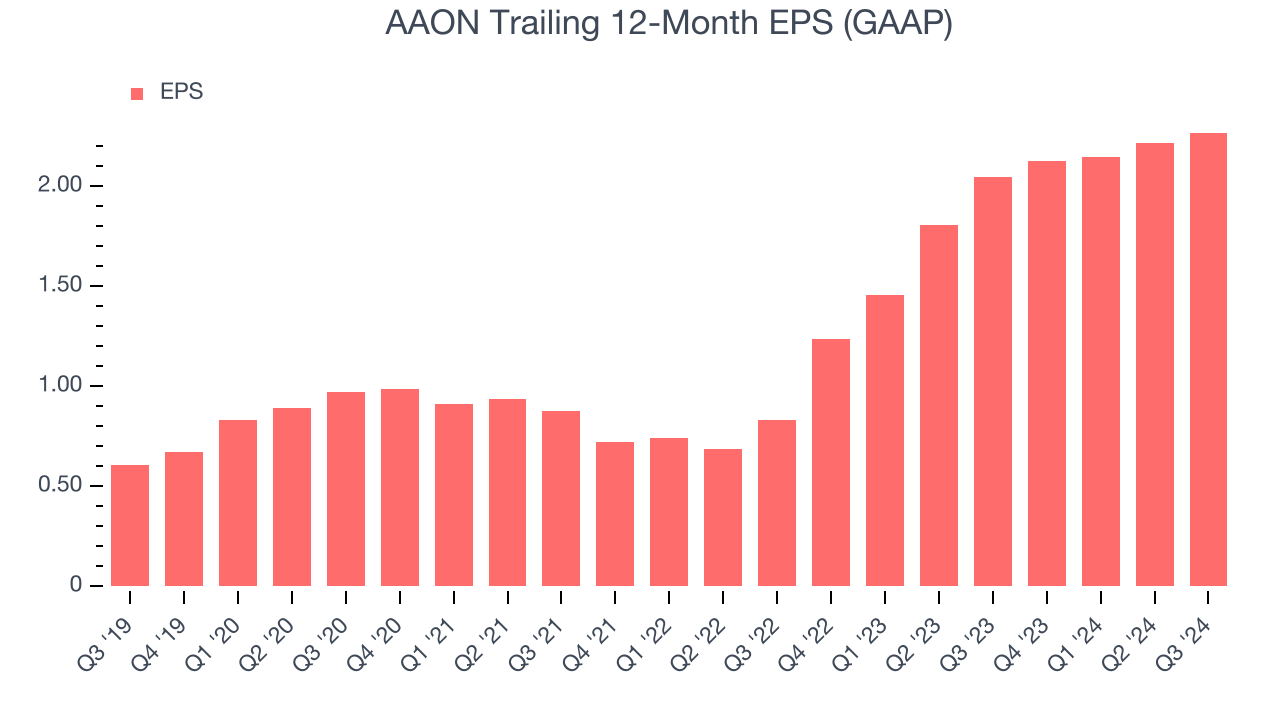

Earnings Per Share

Analyzing revenue trends tells us about a company’s historical growth, but the long-term change in its earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

AAON’s EPS grew at an astounding 30.2% compounded annual growth rate over the last five years, higher than its 21.4% annualized revenue growth. However, this alone doesn’t tell us much about its business quality because its operating margin didn’t expand.

Like with revenue, we analyze EPS over a more recent period because it can give insight into an emerging theme or development for the business.

AAON’s two-year annual EPS growth of 65% was fantastic and topped its 25.3% two-year revenue growth.In Q3, AAON reported EPS at $0.63, up from $0.58 in the same quarter last year. This print beat analysts’ estimates by 10%. Over the next 12 months, Wall Street expects AAON’s full-year EPS of $2.27 to grow by 20.9%.

Key Takeaways from AAON’s Q3 Results

We were impressed by how significantly AAON blew past analysts’ revenue expectations this quarter. We were also excited its EPS outperformed Wall Street’s estimates. Zooming out, we think this was a good quarter with some key areas of upside. The stock remained flat at $119.10 immediately following the results.

So should you invest in AAON right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.