Dredging and coastal protection company Great Lakes Dredge & Dock (NASDAQ:GLDD) announced better-than-expected revenue in Q3 CY2024, with sales up 63.1% year on year to $191.2 million. Its GAAP profit of $0.13 per share was 29.1% below analysts’ consensus estimates.

Is now the time to buy Great Lakes Dredge & Dock? Find out by accessing our full research report, it’s free.

Great Lakes Dredge & Dock (GLDD) Q3 CY2024 Highlights:

- Revenue: $191.2 million vs analyst estimates of $184.6 million (3.5% beat)

- EPS: $0.13 vs analyst expectations of $0.18 (29.1% miss)

- EBITDA: $26.98 million vs analyst estimates of $33.07 million (18.4% miss)

- Gross Margin (GAAP): 19%, up from 7.7% in the same quarter last year

- Operating Margin: 8.7%, up from -4.4% in the same quarter last year

- EBITDA Margin: 14.1%, up from 6.1% in the same quarter last year

- Backlog: $1.21 billion at quarter end

- Market Capitalization: $780.1 million

Lasse Petterson, President and Chief Executive Officer, commented, “Great Lakes had a solid third quarter with strong project performance and substantial project wins in the bid market. During the quarter, Great Lakes was awarded $543.0 million of new work, including three port deepening projects capturing 81% of the third quarter capital market and six beach renourishment projects capturing 79% of the quarter’s coastal protection market. The largest project bid in the quarter was the Sabine-Neches Contract 6 Deepening project, won by Great Lakes, with awarded base and open options totaling $235 million. We ended the third quarter with a record backlog of $1.21 billion and an additional $465.0 million in low bids and options pending, which provides us utilization and revenue visibility well into 2026. Post quarter end, Great Lakes was awarded two projects for a total of $90 million, which were in low bids pending award at the end of the third quarter."

Company Overview

Founded as Lydon & Drews dredging company, Great Lakes Dredge & Dock (NASDAQ:GLDD) provides dredging services, land reclamation, and coastal protection projects in the United States and internationally.

Construction and Maintenance Services

Construction and maintenance services companies not only boast technical know-how in specialized areas but also may hold special licenses and permits. Those who work in more regulated areas can enjoy more predictable revenue streams - for example, fire escapes need to be inspected every five years–. More recently, services to address energy efficiency and labor availability are also creating incremental demand. But like the broader industrials sector, construction and maintenance services companies are at the whim of economic cycles as external factors like interest rates can greatly impact the new construction that drives incremental demand for these companies’ offerings.

Sales Growth

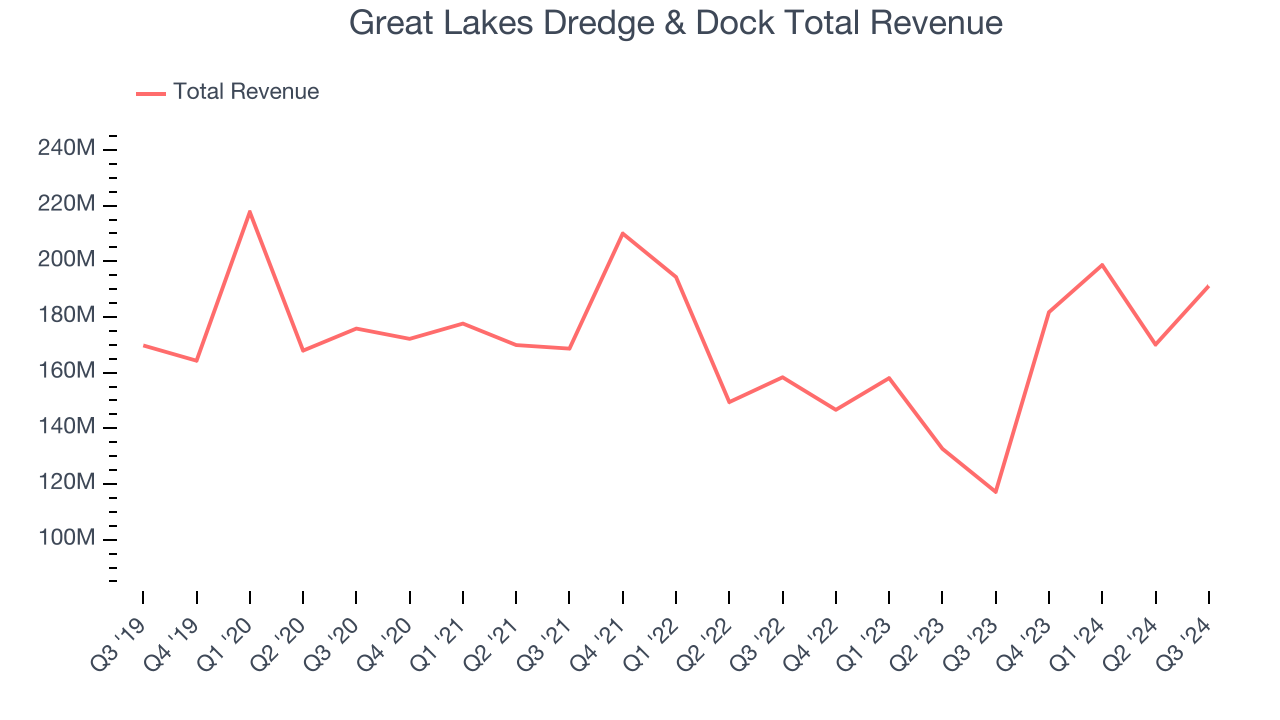

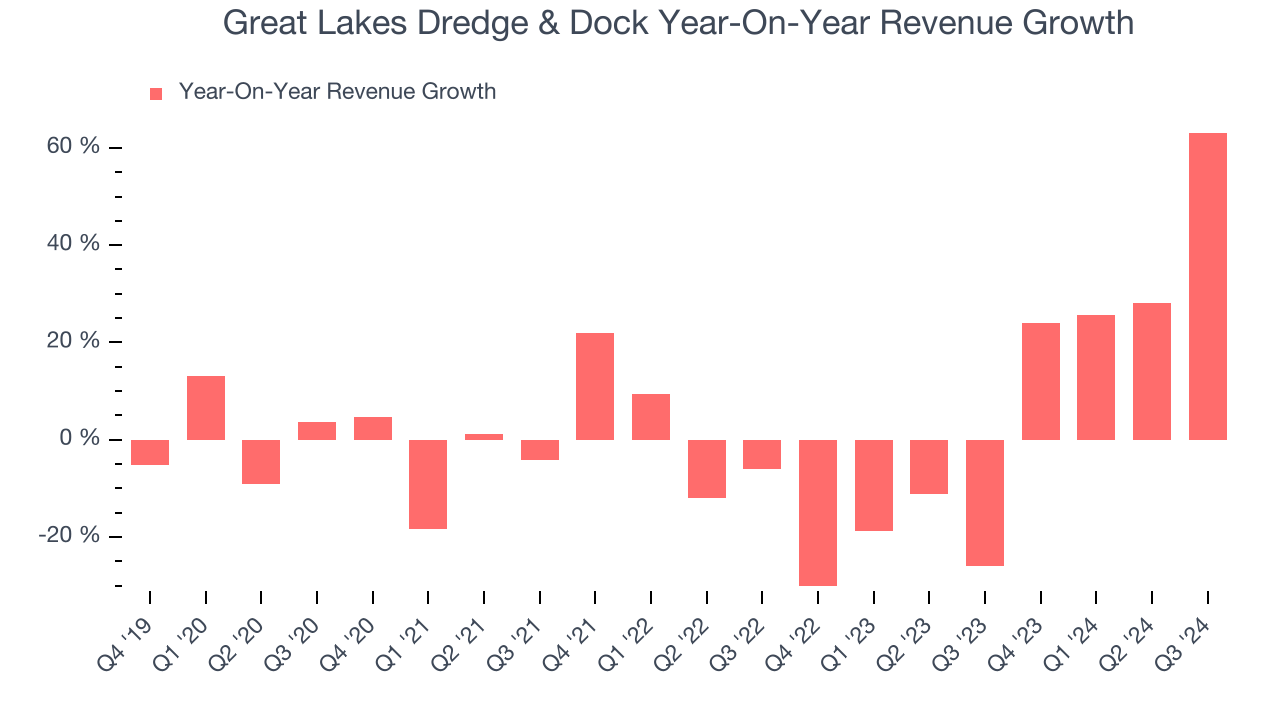

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Great Lakes Dredge & Dock’s sales were flat. This shows demand was soft and is a tough starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Great Lakes Dredge & Dock’s annualized revenue growth of 2.1% over the last two years is above its five-year trend, but we were still disappointed by the results.

This quarter, Great Lakes Dredge & Dock reported magnificent year-on-year revenue growth of 63.1%, and its $191.2 million of revenue beat Wall Street’s estimates by 3.5%.

Looking ahead, sell-side analysts expect revenue to grow 5.7% over the next 12 months, an improvement versus the last two years. Although this projection illustrates the market believes its newer products and services will catalyze better performance, it is still below the sector average.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling them, and, most importantly, keeping them relevant through research and development.

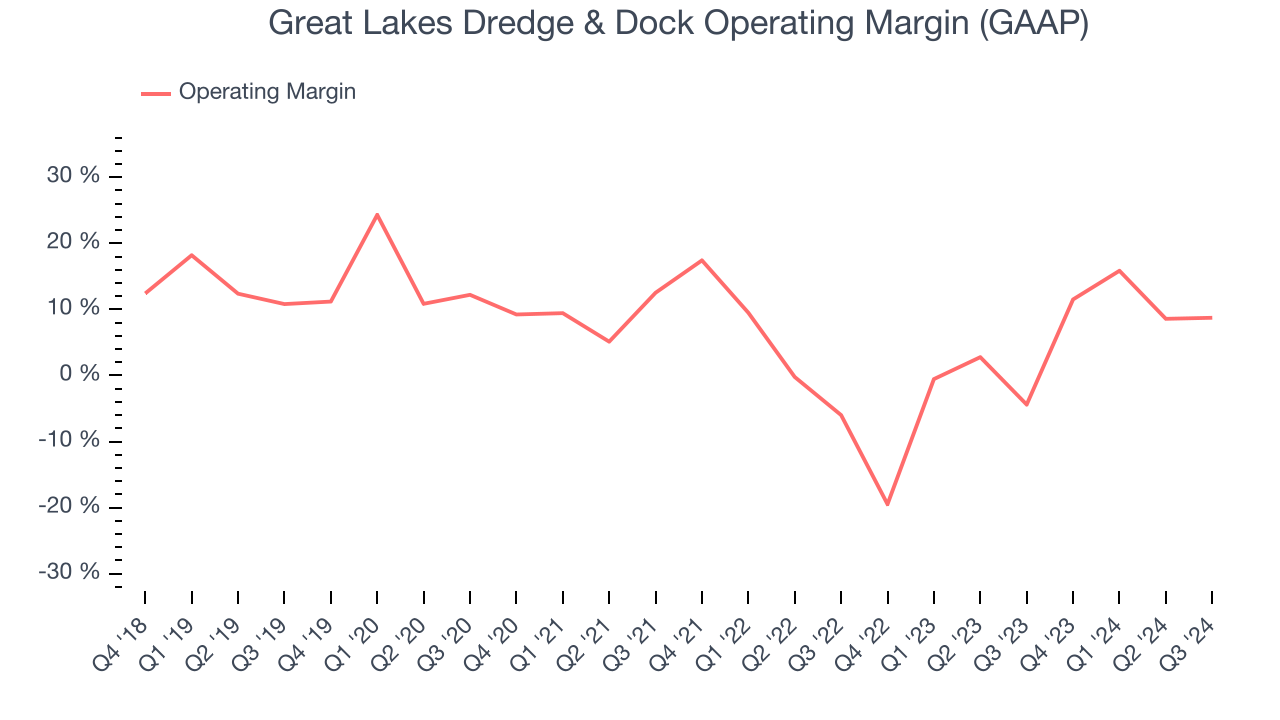

Great Lakes Dredge & Dock was profitable over the last five years but held back by its large cost base. Its average operating margin of 7.9% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

Looking at the trend in its profitability, Great Lakes Dredge & Dock’s annual operating margin decreased by 4 percentage points over the last five years. The company’s performance was poor no matter how you look at it. It shows operating expenses were rising and it couldn’t pass those costs onto its customers.

This quarter, Great Lakes Dredge & Dock generated an operating profit margin of 8.7%, up 13.1 percentage points year on year. The increase was solid, and since its operating margin rose more than its gross margin, we can infer it was recently more efficient with expenses such as marketing, R&D, and administrative overhead.

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth was profitable.

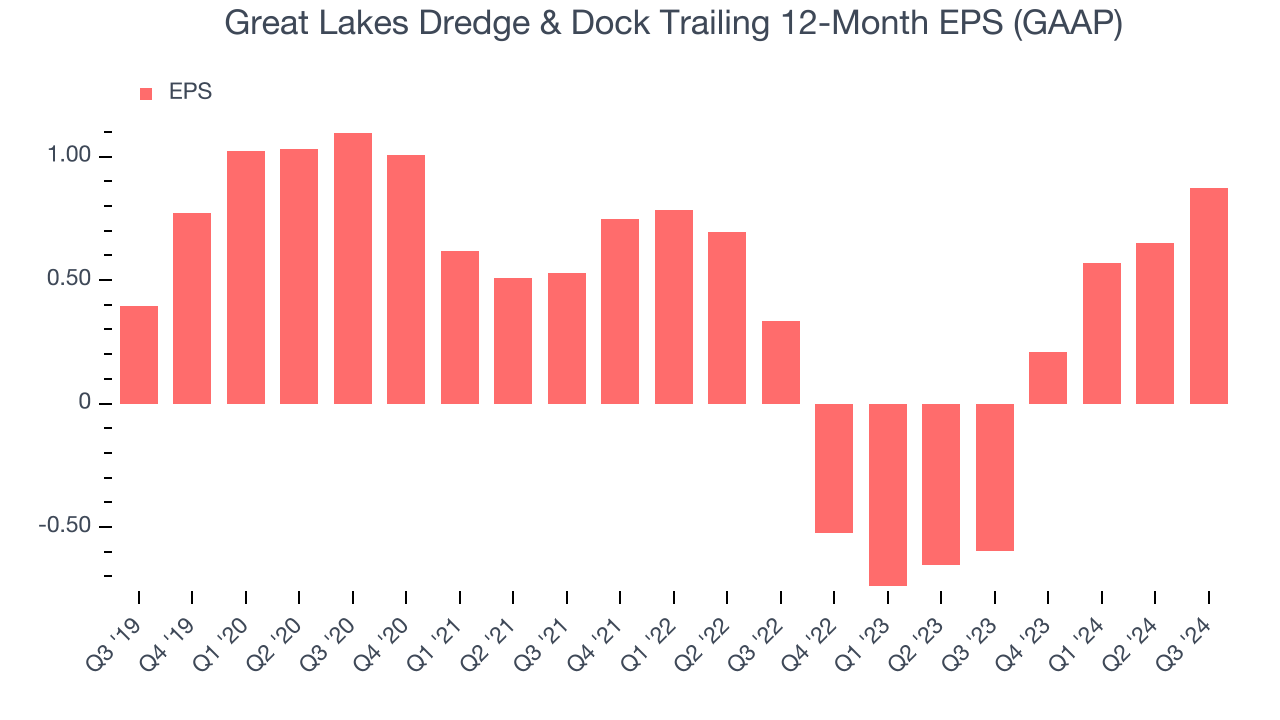

Great Lakes Dredge & Dock’s EPS grew at a spectacular 17.3% compounded annual growth rate over the last five years, higher than its flat revenue. However, this alone doesn’t tell us much about its business quality because its operating margin didn’t expand.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

Great Lakes Dredge & Dock’s two-year annual EPS growth of 62% was fantastic and topped its 2.1% two-year revenue growth.In Q3, Great Lakes Dredge & Dock reported EPS at $0.13, up from negative $0.09 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects Great Lakes Dredge & Dock’s full-year EPS of $0.87 to shrink by 10.1%.

Key Takeaways from Great Lakes Dredge & Dock’s Q3 Results

We were impressed by how significantly Great Lakes Dredge & Dock blew past analysts’ revenue expectations this quarter. On the other hand, its EBITDA and EPS fell short of Wall Street’s estimates. Overall, this quarter could have been better, but the stock traded up 5.9% to $12.30 following the sales outperformance.

So should you invest in Great Lakes Dredge & Dock right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.