The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Nordstrom (NYSE:JWN) and the rest of the general merchandise retail stocks fared in Q3.

General merchandise retailers–also called broadline retailers–know you’re busy and don’t want to drive around wasting time and gas, so they offer a one-stop shop. Convenience is the name of the game, so these stores may sell clothing in one section, toys in another, and home decor in a third. This concept has evolved over time from department stores to more niche concepts targeting bargain hunters or young adults, and e-commerce has forced these retailers to be extra sharp in their value propositions to consumers, whether that’s unique product or competitive prices.

The 6 general merchandise retail stocks we track reported a mixed Q3. As a group, revenues were in line with analysts’ consensus estimates.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

Best Q3: Nordstrom (NYSE:JWN)

Known for its exceptional customer service that features a ‘no questions asked’ return policy, Nordstrom (NYSE:JWN) is a high-end department store chain.

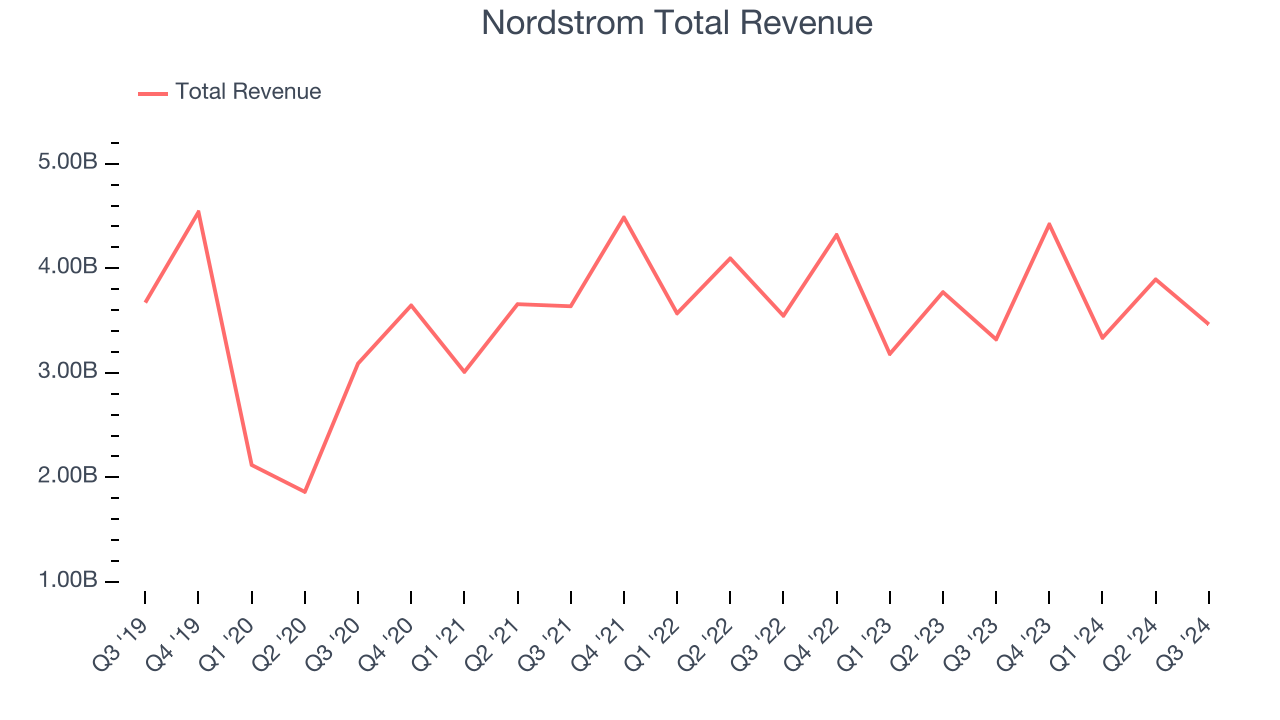

Nordstrom reported revenues of $3.46 billion, up 4.3% year on year. This print exceeded analysts’ expectations by 3.3%. Overall, it was an exceptional quarter for the company with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ gross margin estimates.

"The continued sales growth across the company and strong gross margin in the third quarter indicate our team's focus and efforts are working," said Erik Nordstrom, chief executive officer of Nordstrom,

Nordstrom pulled off the biggest analyst estimates beat of the whole group. Investor expectations, however, were likely higher than Wall Street’s published projections, leaving some wishing for even better results (analysts’ consensus estimates are those published by big banks and advisory firms, not the investors who make buy and sell decisions). The stock is down 7.9% since reporting and currently trades at $22.67.

Is now the time to buy Nordstrom? Access our full analysis of the earnings results here, it’s free.

Dillard's (NYSE:DDS)

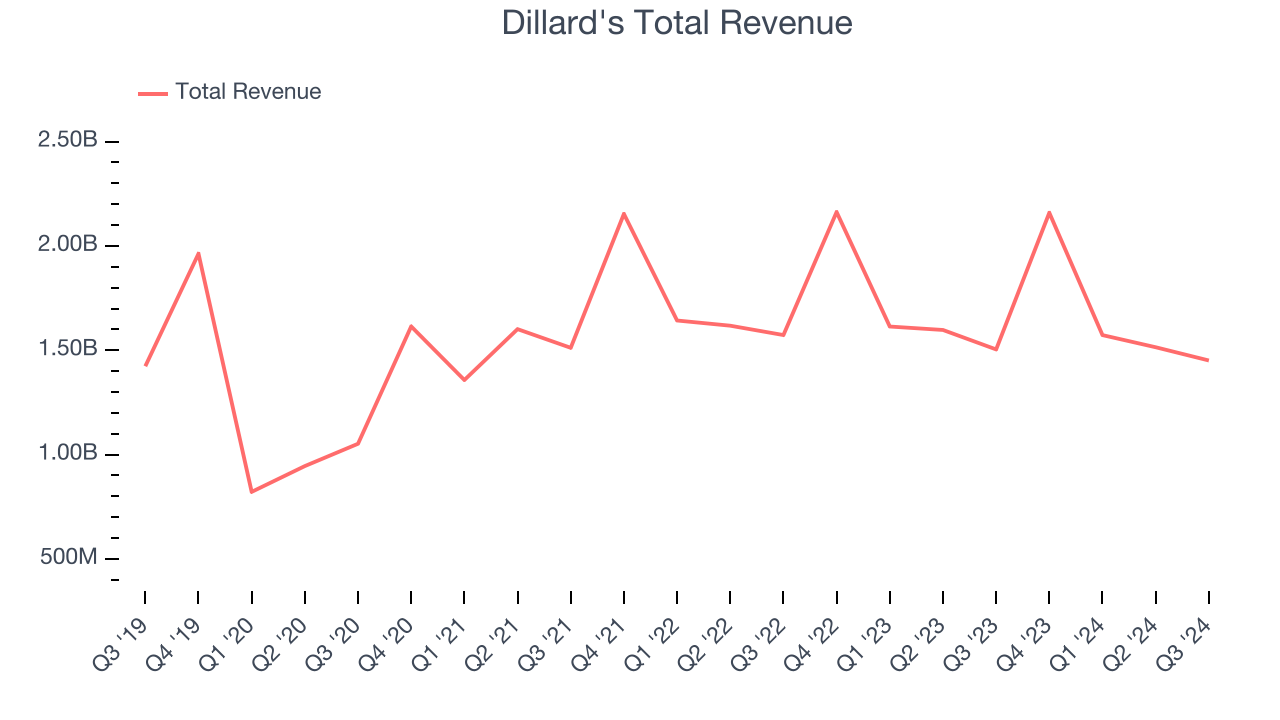

With stores located largely in the Southern and Western US, Dillard’s (NYSE:DDS) is a department store chain that sells clothing, cosmetics, accessories, and home goods.

Dillard's reported revenues of $1.45 billion, down 3.5% year on year, outperforming analysts’ expectations by 1.2%. The business had a very strong quarter with a solid beat of analysts’ EBITDA and EPS estimates.

The market seems happy with the results as the stock is up 16.9% since reporting. It currently trades at $454.

Is now the time to buy Dillard's? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Kohl's (NYSE:KSS)

Founded as a corner grocery store in Milwaukee, Wisconsin, Kohl’s (NYSE:KSS) is a department store chain that sells clothing, cosmetics, electronics, and home goods.

Kohl's reported revenues of $3.71 billion, down 8.5% year on year, in line with analysts’ expectations. It was a slower quarter as it posted full-year EPS guidance missing analysts’ expectations.

Kohl's delivered the slowest revenue growth in the group. As expected, the stock is down 19% since the results and currently trades at $14.85.

Read our full analysis of Kohl’s results here.

Burlington (NYSE:BURL)

Founded in 1972 as a discount coat and outerwear retailer, Burlington Stores (NYSE:BURL) is now an off-price retailer that has broadened into general apparel, footwear, and home goods.

Burlington reported revenues of $2.53 billion, up 10.5% year on year. This number lagged analysts' expectations by 1%. It was a slower quarter as it also logged EPS guidance for next quarter missing analysts’ expectations.

Burlington achieved the fastest revenue growth among its peers. The stock is down 1.2% since reporting and currently trades at $288.37.

Read our full, actionable report on Burlington here, it’s free.

TJX (NYSE:TJX)

Initially based on a strategy of buying excess inventory from manufacturers or other retailers, TJX (NYSE:TJX) is an off-price retailer that sells brand-name apparel and other goods at prices much lower than department stores.

TJX reported revenues of $14.06 billion, up 6% year on year. This print topped analysts’ expectations by 0.8%. Zooming out, it was a mixed quarter as it also recorded a solid beat of analysts’ EBITDA estimates but EPS guidance for next quarter missing analysts’ expectations.

The stock is up 5.7% since reporting and currently trades at $126.36.

Read our full, actionable report on TJX here, it’s free.

Market Update

Thanks to the Fed's series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market has thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.