The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how auto parts retailer stocks fared in Q3, starting with O'Reilly (NASDAQ:ORLY).

Cars are complex machines that need maintenance and occasional repairs, and auto parts retailers cater to the professional mechanic as well as the do-it-yourself (DIY) fixer. Work on cars may entail replacing fluids, parts, or accessories, and these stores have the parts and accessories or these jobs. While e-commerce competition presents a risk, these stores have a leg up due to the combination of broad and deep selection as well as expertise provided by sales associates. Another change on the horizon could be the increasing penetration of electric vehicles.

The 5 auto parts retailer stocks we track reported a softer Q3. As a group, revenues were in line with analysts’ consensus estimates.

In light of this news, share prices of the companies have held steady as they are up 1.2% on average since the latest earnings results.

Best Q3: O'Reilly (NASDAQ:ORLY)

Serving both the DIY customer and professional mechanic, O’Reilly Automotive (NASDAQ:ORLY) is an auto parts and accessories retailer that sells everything from fuel pumps to car air fresheners to mufflers.

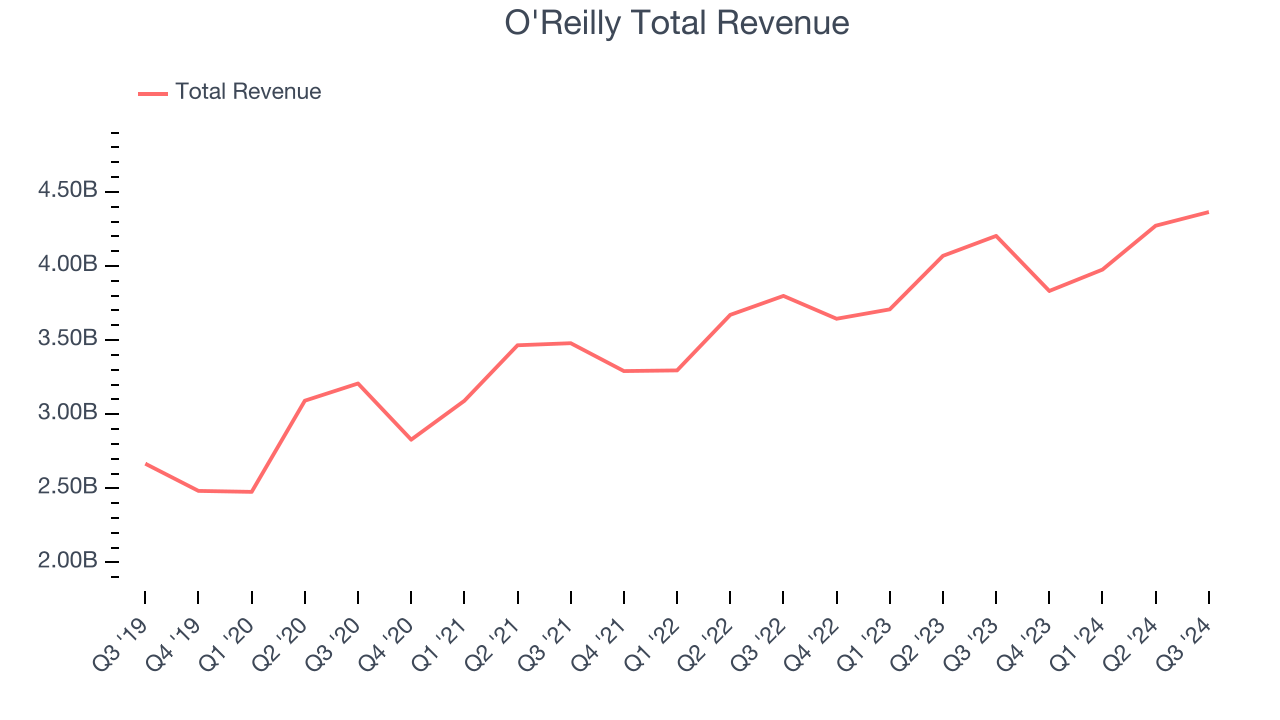

O'Reilly reported revenues of $4.36 billion, up 3.8% year on year. This print fell short of analysts’ expectations by 1.3%. Overall, it was a mixed quarter for the company with a solid beat of analysts’ EBITDA estimates but full-year EPS guidance slightly missing analysts’ expectations.

O'Reilly achieved the highest full-year guidance raise but had the weakest performance against analyst estimates of the whole group. Unsurprisingly, the stock is up 2.9% since reporting and currently trades at $1,234.

Is now the time to buy O'Reilly? Access our full analysis of the earnings results here, it’s free.

AutoZone (NYSE:AZO)

Aiming to be a one-stop shop for the DIY customer, AutoZone (NYSE:AZO) is an auto parts and accessories retailer that sells everything from car batteries to windshield wiper fluid to brake pads.

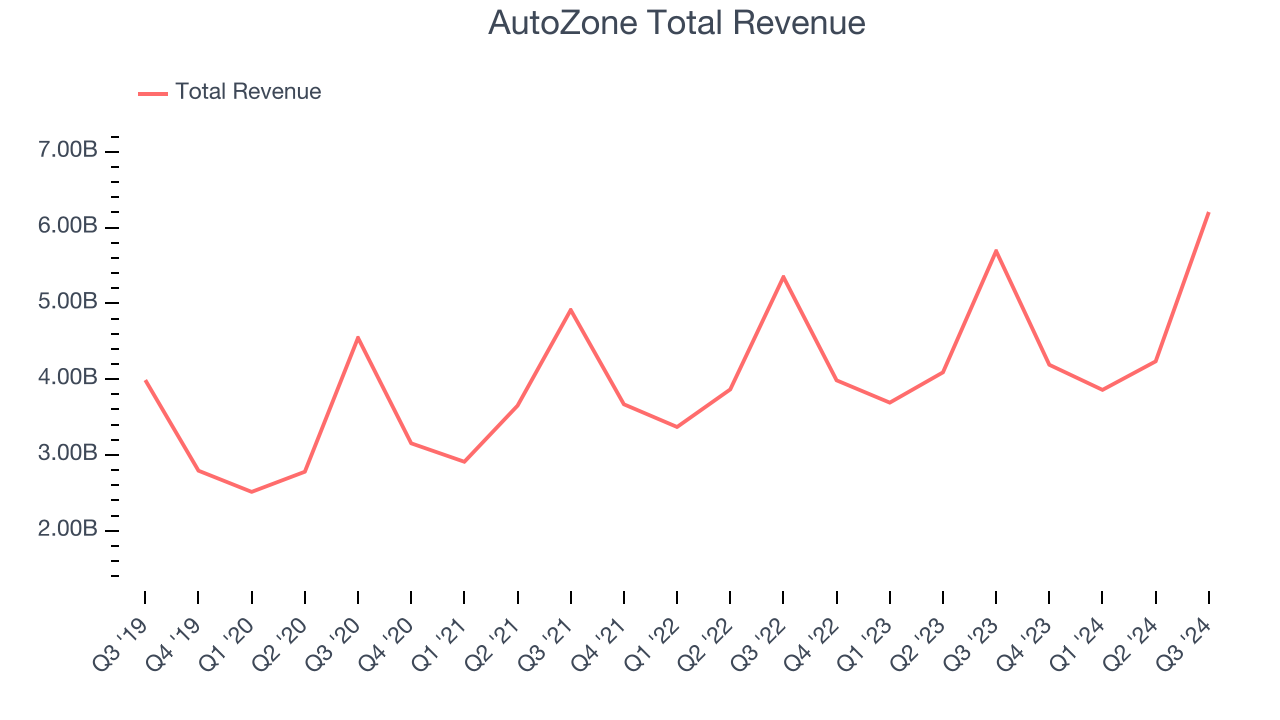

AutoZone reported revenues of $6.21 billion, up 9% year on year, in line with analysts’ expectations. The business performed better than its peers, but it was unfortunately a slower quarter with a miss of analysts’ EBITDA and EPS estimates.

AutoZone scored the fastest revenue growth among its peers. The market seems content with the results as the stock is up 2% since reporting. It currently trades at $3,111.

Is now the time to buy AutoZone? Access our full analysis of the earnings results here, it’s free.

Slowest Q3: Monro (NASDAQ:MNRO)

Started as a single location in Rochester, New York, Monro (NASDAQ:MNRO) provides common auto services such as brake repairs, tire replacements, and oil changes.

Monro reported revenues of $301.4 million, down 6.4% year on year, in line with analysts’ expectations. It was a disappointing quarter as it posted a significant miss of analysts’ EBITDA estimates.

Monro delivered the biggest analyst estimates beat but had the slowest revenue growth in the group. Interestingly, the stock is up 5.6% since the results and currently trades at $28.27.

Read our full analysis of Monro’s results here.

Advance Auto Parts (NYSE:AAP)

Founded in Virginia in 1932, Advance Auto Parts (NYSE:AAP) is an auto parts and accessories retailer that sells everything from carburetors to motor oil to car floor mats.

Advance Auto Parts reported revenues of $2.15 billion, down 3.2% year on year. This number lagged analysts' expectations by 1.1%. Overall, it was a disappointing quarter as it also logged full-year revenue guidance missing analysts’ expectations significantly.

Advance Auto Parts had the weakest full-year guidance update among its peers. The stock is up 5.1% since reporting and currently trades at $43.

Read our full, actionable report on Advance Auto Parts here, it’s free.

Genuine Parts (NYSE:GPC)

Largely targeting the professional customer, Genuine Parts (NYSE:GPC) sells auto and industrial parts such as batteries, belts, bearings, and machine fluids.

Genuine Parts reported revenues of $5.97 billion, up 2.5% year on year. This result was in line with analysts’ expectations. More broadly, it was a softer quarter as it recorded full-year EPS guidance missing analysts’ expectations significantly and a significant miss of analysts’ EBITDA estimates.

The stock is down 9.5% since reporting and currently trades at $129.47.

Read our full, actionable report on Genuine Parts here, it’s free.

Market Update

Thanks to the Fed's series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market has thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.