Over the past six months, Semrush’s shares (currently trading at $14.30) have posted a disappointing 8.2% loss, well below the S&P 500’s 13% gain. This might have investors contemplating their next move.

Following the pullback, is this a buying opportunity for SEMR? Find out in our full research report, it’s free.

Why Is SEMR a Good Business?

Started by Oleg Shchegolev while still in university, Semrush (NYSE:SEMR) is a software as a service platform that helps companies optimize their search engine and content marketing efforts.

1. Projected Revenue Growth Is Remarkable

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite, though some deceleration is natural as businesses scale.

Semrush’s management team is currently guiding for a 21.5% year-on-year increase in sales next quarter. Looking further ahead, sell-side analysts expect Semrush’s revenue to grow by 20% over the next 12 months, a deceleration versus its 28% annualized growth rate for the last three years. This projection is still commendable and suggests the market is factoring in success for its products and services.

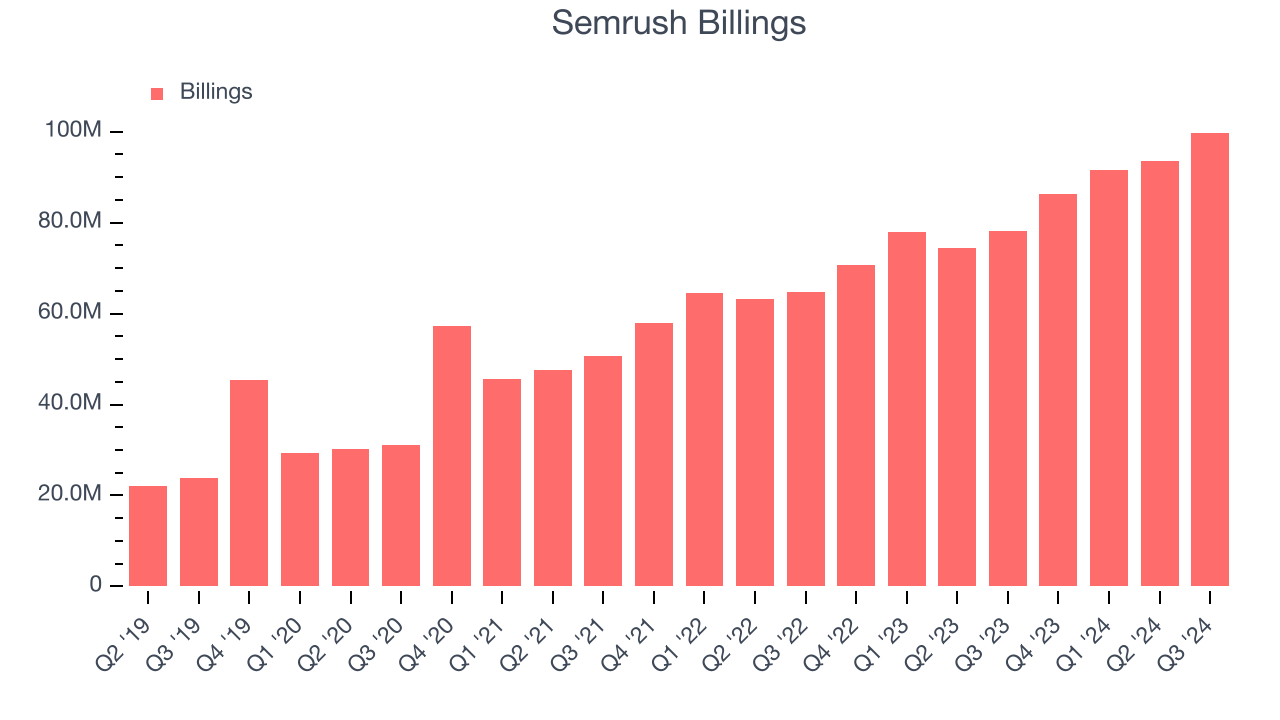

2. Billings Surge, Boosting Cash On Hand

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Semrush’s billings punched in at $99.79 million in Q3, and over the last four quarters, its growth averaged 23.2% year-on-year increases. This performance was impressive, indicating robust customer demand. The high level of cash collected from customers also enhances liquidity and provides a solid foundation for future investments and growth.

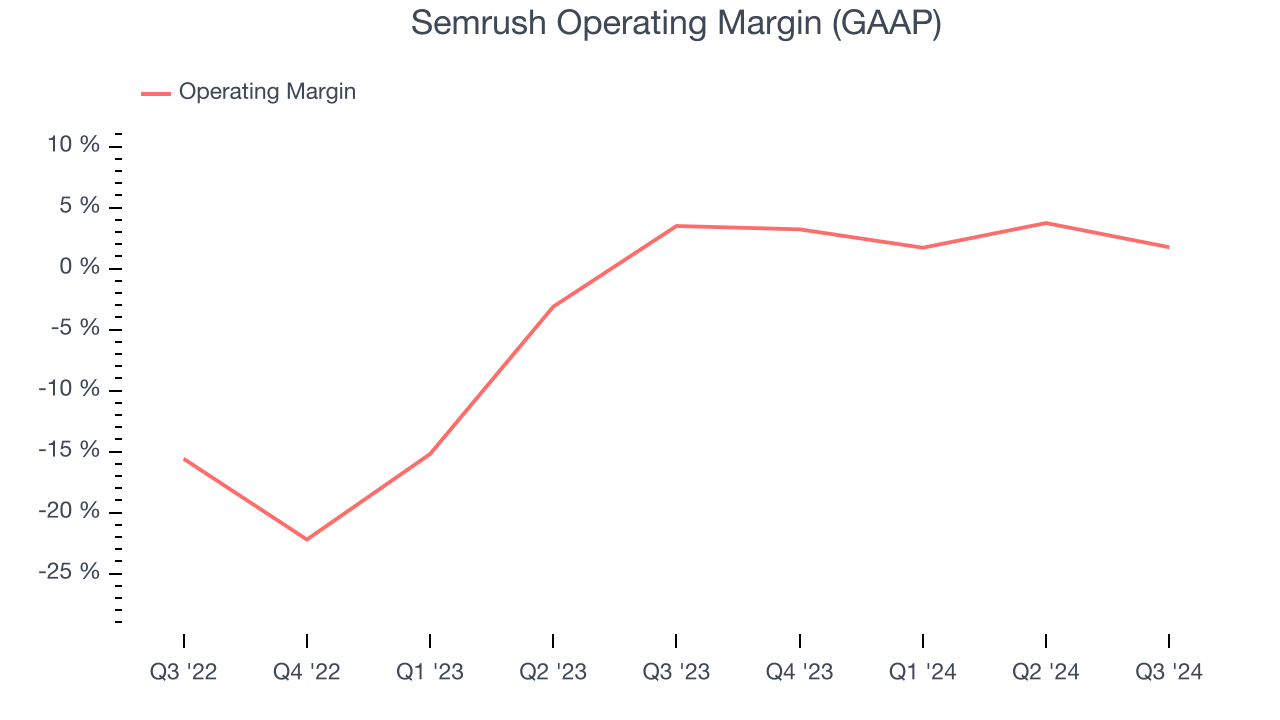

3. Operating Margin Rising, Profits Up

Many software businesses adjust their profits for stock-based compensation (SBC), but we prioritize GAAP operating margin because SBC is a real expense used to attract and retain engineering and sales talent. This is one of the best measures of profitability because it shows how much money a company takes home after developing, marketing, and selling its products.

Analyzing the trend in its profitability, Semrush’s operating margin rose by 11.3 percentage points over the last year, as its sales growth gave it operating leverage. Its operating margin for the trailing 12 months was 2.6%.

Final Judgment

These are just a few reasons why Semrush ranks highly on our list. After the recent drawdown, the stock trades at 4.9x forward price-to-sales (or $14.30 per share). Is now a good time to initiate a position? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than Semrush

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.