Vocational education Universal Technical Institute (NYSE:UTI) reported revenue ahead of Wall Street’s expectations in Q3 CY2024, with sales up 15.3% year on year to $196.4 million. The company’s full-year revenue guidance of $807.5 million at the midpoint came in 1.1% above analysts’ estimates. Its GAAP profit of $0.34 per share was 13.3% above analysts’ consensus estimates.

Is now the time to buy Universal Technical Institute? Find out by accessing our full research report, it’s free.

Universal Technical Institute (UTI) Q3 CY2024 Highlights:

- Revenue: $196.4 million vs analyst estimates of $191.2 million (15.3% year-on-year growth, 2.7% beat)

- Adjusted EPS: $0.34 vs analyst estimates of $0.30 (13.3% beat)

- Adjusted EBITDA: $37.31 million vs analyst estimates of $37.54 million (19% margin, 0.6% miss)

- Management’s revenue guidance for the upcoming financial year 2025 is $807.5 million at the midpoint, beating analyst estimates by 1.1% and implying 10.2% growth (vs 22.3% in FY2024)

- EPS (GAAP) guidance for the upcoming financial year 2025 is $0.97 at the midpoint, beating analyst estimates by 3.7%

- EBITDA guidance for the upcoming financial year 2025 is $122 million at the midpoint, above analyst estimates of $119.1 million

- Operating Margin: 13.3%, up from 6.1% in the same quarter last year

- Free Cash Flow Margin: 30.6%, up from 27% in the same quarter last year

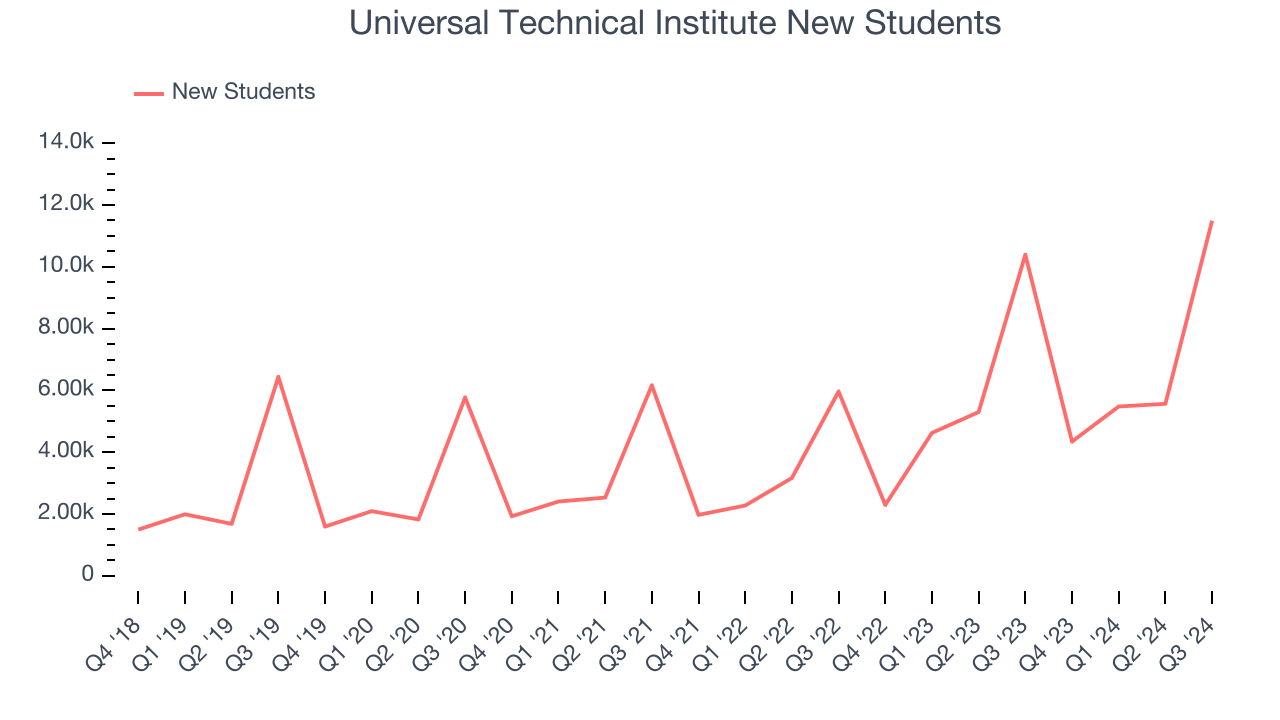

- New Students: 11,492, up 1,100 year on year

- Market Capitalization: $1.07 billion

"We concluded the first stage of our North Star Strategy in fiscal 2024 achieving both strong results and momentum," said Jerome Grant, CEO of Universal Technical Institute, Inc.

Company Overview

Founded in 1965, Universal Technical Institute (NYSE: UTI) is a leading provider of technical training programs, specializing in automotive, diesel, collision repair, motorcycle, and marine technicians.

Education Services

A whole industry has emerged to address the problem of rising education costs, offering consumers alternatives to traditional education paths such as four-year colleges. These alternative paths, which may include online courses or flexible schedules, make education more accessible to those with work or child-rearing obligations. However, some have run into issues around the value of the degrees and certifications they provide and whether customers are getting a good deal. Those who don’t prove their value could struggle to retain students, or even worse, invite the heavy hand of regulation.

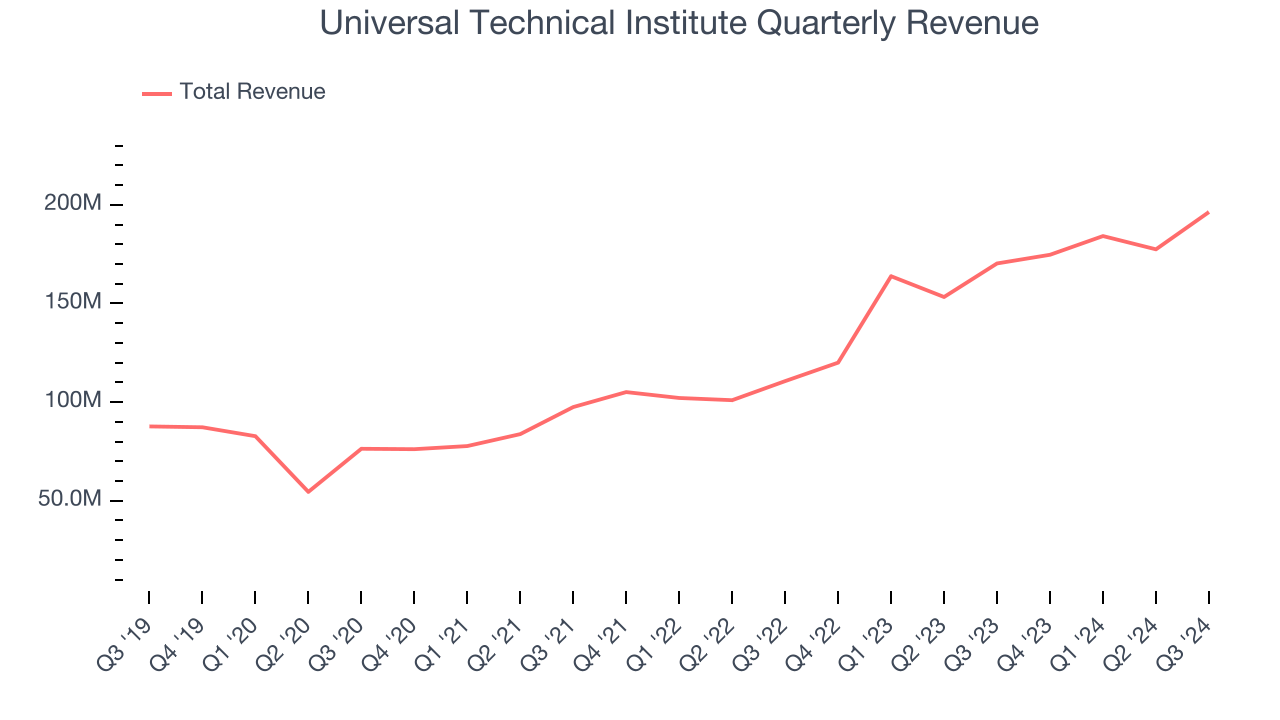

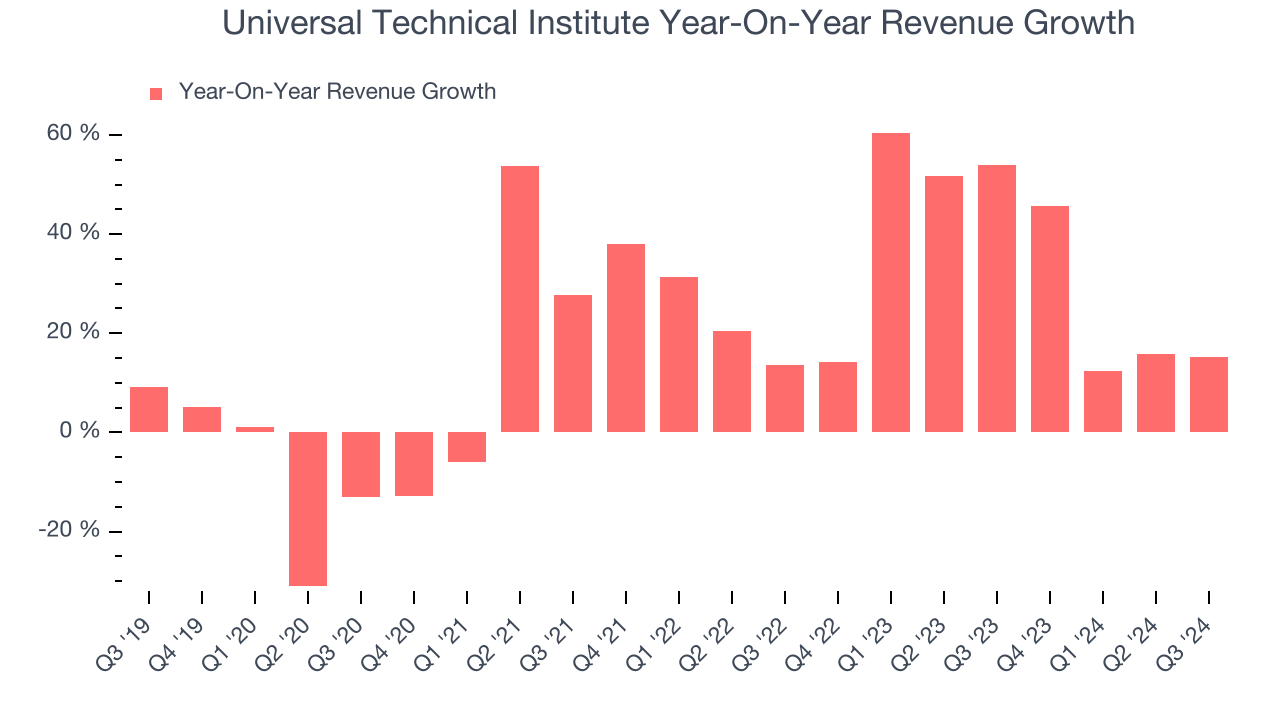

Sales Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Thankfully, Universal Technical Institute’s 17.2% annualized revenue growth over the last five years was decent. Its growth was slightly above the average consumer discretionary company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or emerging trend. Universal Technical Institute’s annualized revenue growth of 32.3% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

We can dig further into the company’s revenue dynamics by analyzing its number of new students, which reached 11,492 in the latest quarter. Over the last two years, Universal Technical Institute’s new students averaged 48.1% year-on-year growth. Because this number is higher than its revenue growth during the same period, we can see the company’s monetization has fallen.

This quarter, Universal Technical Institute reported year-on-year revenue growth of 15.3%, and its $196.4 million of revenue exceeded Wall Street’s estimates by 2.7%.

Looking ahead, sell-side analysts expect revenue to grow 9.1% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and indicates its products and services will face some demand challenges.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Cash Is King

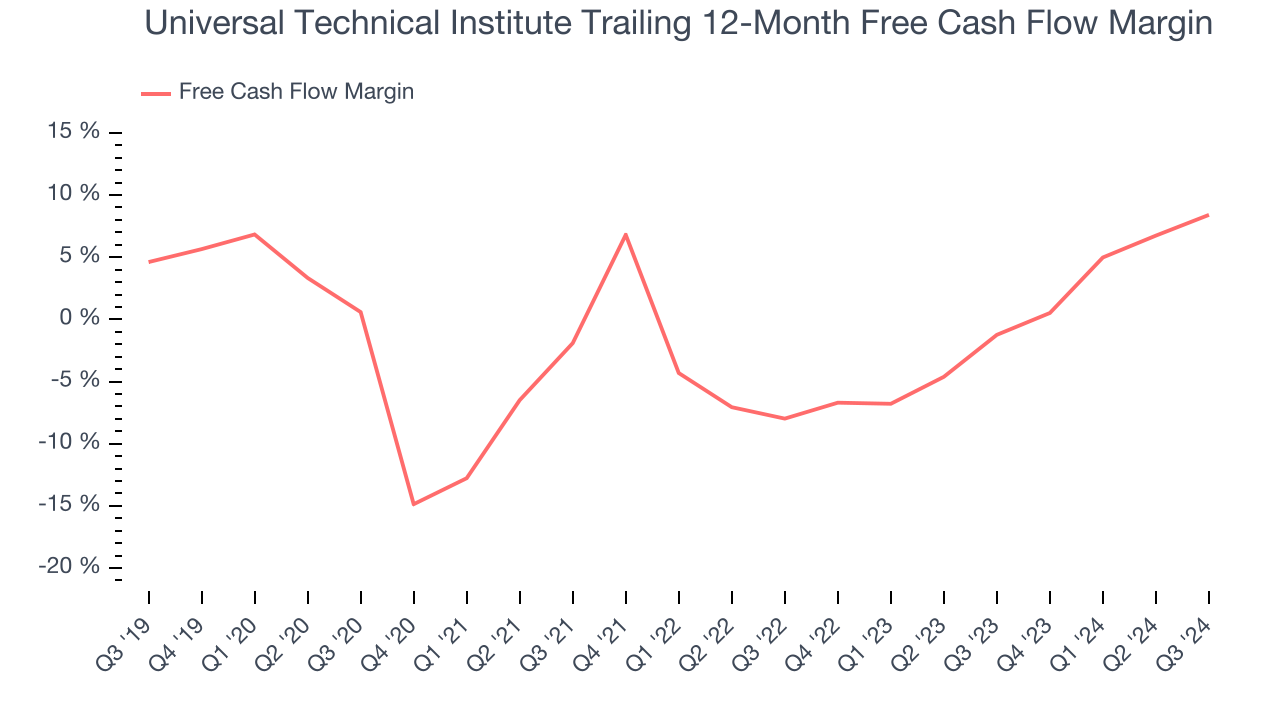

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Universal Technical Institute has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 4%, lousy for a consumer discretionary business.

Universal Technical Institute’s free cash flow clocked in at $60.01 million in Q3, equivalent to a 30.6% margin. This result was good as its margin was 3.5 percentage points higher than in the same quarter last year, but we wouldn’t put too much weight on the short term because investment needs can be seasonal, causing temporary swings. Long-term trends are more important.

Over the next year, analysts’ consensus estimates show they’re expecting Universal Technical Institute’s free cash flow margin of 8.4% for the last 12 months to remain the same.

Key Takeaways from Universal Technical Institute’s Q3 Results

It was encouraging to see Universal Technical Institute beat analysts’ EPS expectations this quarter. We were also glad its full-year revenue guidance came in slightly higher than Wall Street’s estimates. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 3% to $20.50 immediately following the results.

Sure, Universal Technical Institute had a solid quarter, but if we look at the bigger picture, is this stock a buy? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.