Outdoor living products manufacturer AZEK Company (NYSE:AZEK) announced better-than-expected revenue in Q3 CY2024, but sales fell by 10.4% year on year to $348.2 million. On top of that, next quarter’s revenue guidance ($263 million at the midpoint) was surprisingly good and 4.4% above what analysts were expecting. Its non-GAAP profit of $0.29 per share was 6.8% above analysts’ consensus estimates.

Is now the time to buy AZEK? Find out by accessing our full research report, it’s free.

AZEK (AZEK) Q3 CY2024 Highlights:

- Revenue: $348.2 million vs analyst estimates of $340 million (10.4% year-on-year decline, 2.4% beat)

- Adjusted EPS: $0.29 vs analyst estimates of $0.27 (6.8% beat)

- Adjusted EBITDA: $91.75 million vs analyst estimates of $88.65 million (26.3% margin, 3.5% beat)

- Management’s revenue guidance for the upcoming financial year 2025 is $1.53 billion at the midpoint, in line with analyst expectations and implying 5.8% growth (vs 5.9% in FY2024)

- EBITDA guidance for the upcoming financial year 2025 is $407.5 million at the midpoint, below analyst estimates of $412.1 million

- Operating Margin: 14.7%, in line with the same quarter last year

- Free Cash Flow Margin: 10.9%, down from 23.7% in the same quarter last year

- Market Capitalization: $6.70 billion

“Our investments in marketing and sales are driving significant momentum in our brand awareness among homeowners, dealers and professional contractors alike. TimberTech Decking and Railing and AZEK Trim were recently recognized by both Builder and Remodeler Magazine's Brand Use Studies as #1 or #2 in the “brand awareness”Post this CEO COMMENTS

Company Overview

With a significant portion of its products made from recycled materials, AZEK (NYSE:AZEK) designs and manufactures goods for outdoor living spaces.

Building Materials

Traditionally, building materials companies have built competitive advantages with economies of scale, brand recognition, and strong relationships with builders and contractors. More recently, advances to address labor availability and job site productivity have spurred innovation. Additionally, companies in the space that can produce more energy-efficient materials have opportunities to take share. However, these companies are at the whim of construction volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates. Additionally, the costs of raw materials can be driven by a myriad of worldwide factors and greatly influence the profitability of building materials companies.

Sales Growth

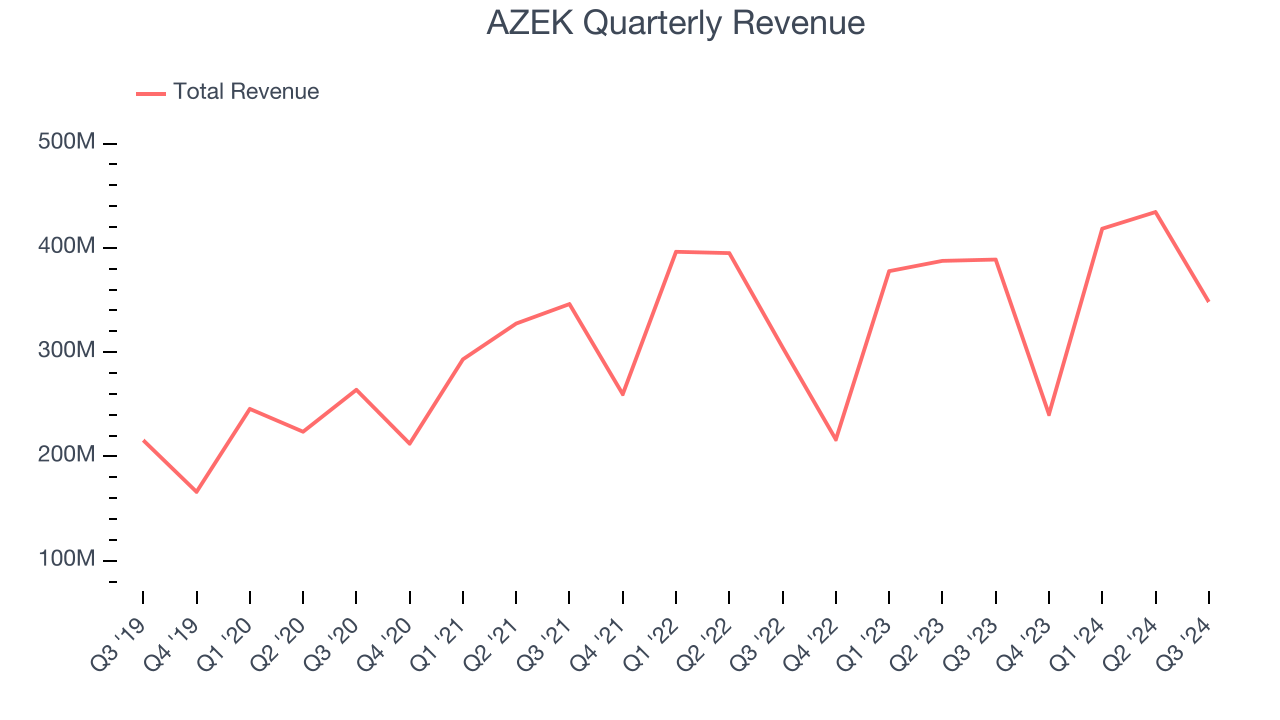

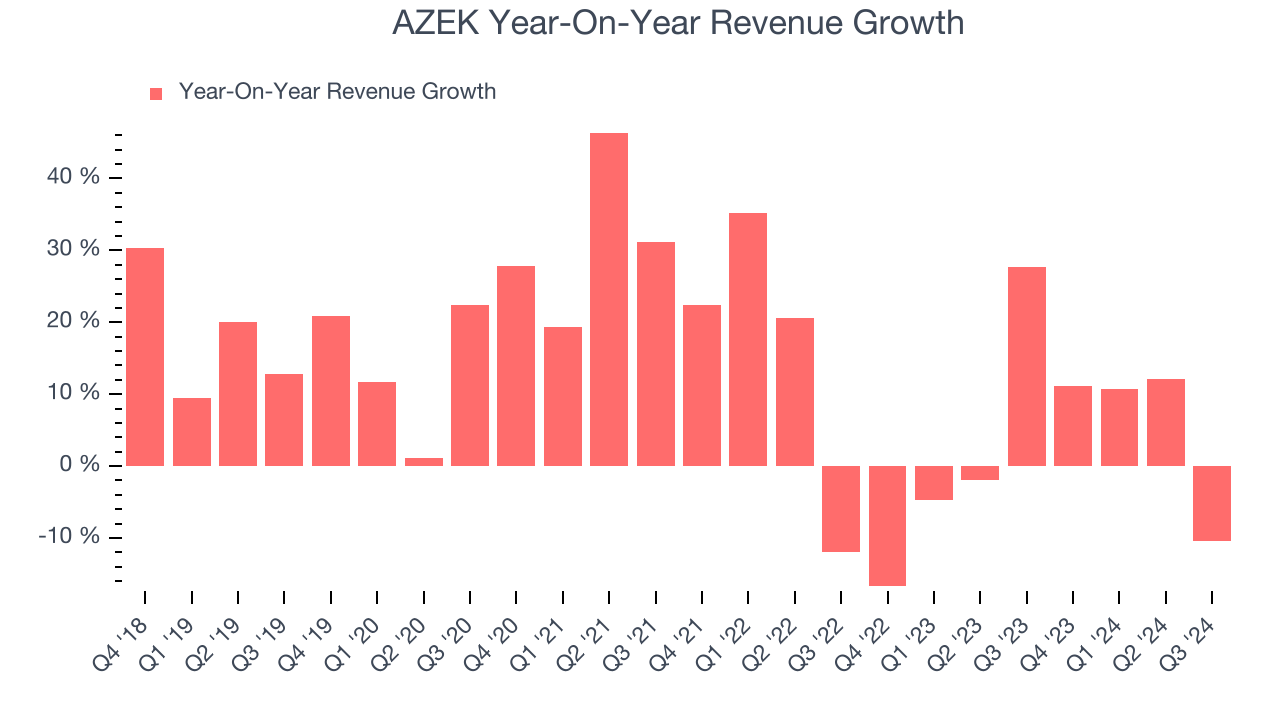

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for multiple years. Over the last five years, AZEK grew its sales at an excellent 12.7% compounded annual growth rate. Its growth beat the average industrials company and shows its offerings resonate with customers, a helpful starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. AZEK’s recent history shows its demand slowed significantly as its annualized revenue growth of 3.1% over the last two years is well below its five-year trend.

This quarter, AZEK’s revenue fell by 10.4% year on year to $348.2 million but beat Wall Street’s estimates by 2.4%. Company management is currently guiding for a 9.4% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 5.5% over the next 12 months, an improvement versus the last two years. While this projection indicates its newer products and services will catalyze better performance, it is still below the sector average. At least the company is tracking well in other measures of financial health.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

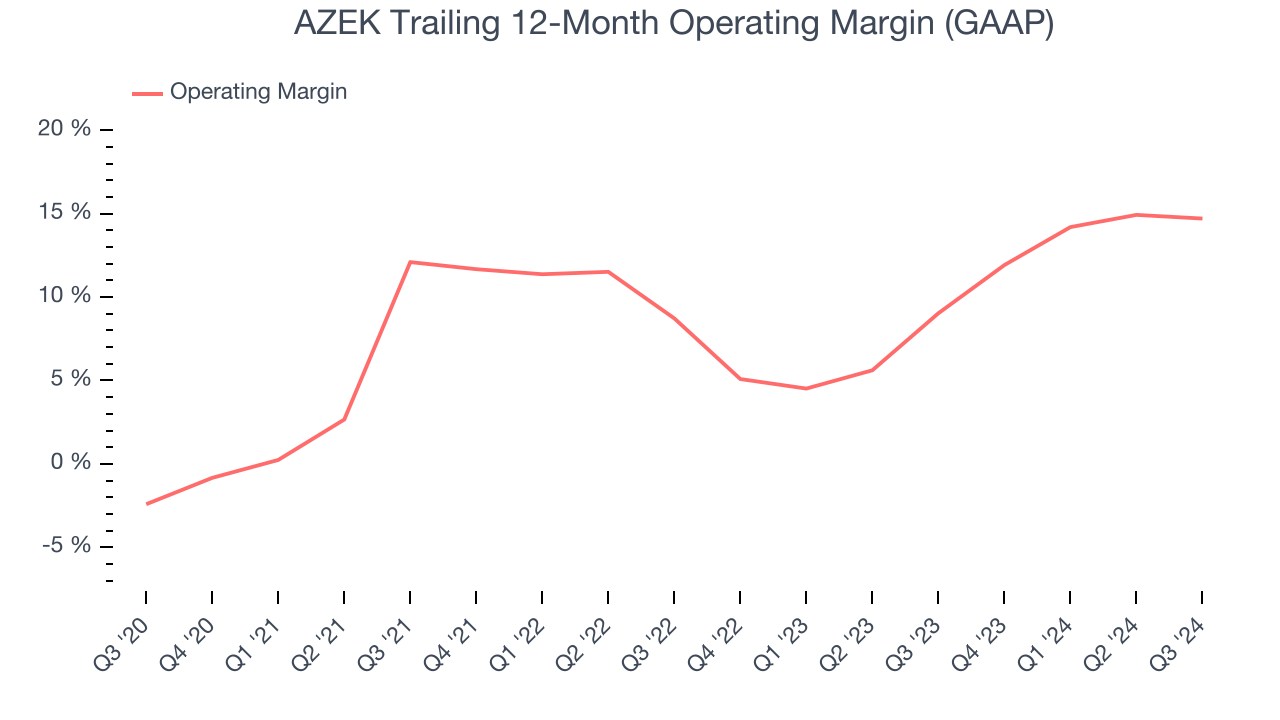

Operating Margin

AZEK has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 9.2%, higher than the broader industrials sector.

Analyzing the trend in its profitability, AZEK’s annual operating margin rose by 17.1 percentage points over the last five years, as its sales growth gave it immense operating leverage.

This quarter, AZEK generated an operating profit margin of 14.7%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

Earnings Per Share

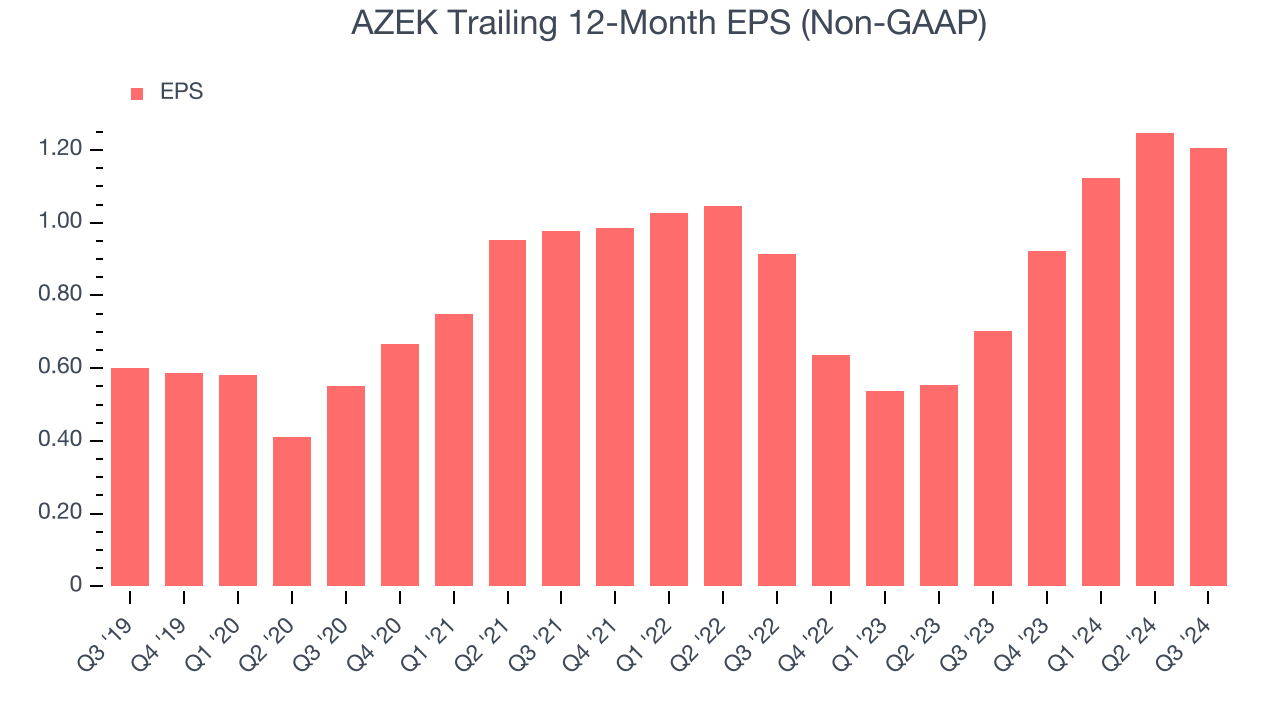

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

AZEK’s EPS grew at a spectacular 14.9% compounded annual growth rate over the last five years, higher than its 12.7% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Diving into the nuances of AZEK’s earnings can give us a better understanding of its performance. As we mentioned earlier, AZEK’s operating margin was flat this quarter but expanded by 17.1 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For AZEK, its two-year annual EPS growth of 14.9% is similar to its five-year trend, implying strong and stable earnings power.In Q3, AZEK reported EPS at $0.29, down from $0.33 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 6.8%. Over the next 12 months, Wall Street expects AZEK’s full-year EPS of $1.20 to grow by 16.1%.

Key Takeaways from AZEK’s Q3 Results

We enjoyed seeing AZEK exceed analysts’ revenue expectations this quarter. We were also glad its revenue guidance for next quarter came in higher than Wall Street’s estimates. On the other hand, its EBITDA guidance for next quarter slightly missed. Overall, we think this was still a mixed quarter. The stock remained flat at $46.46 immediately after reporting.

So do we think AZEK is an attractive buy at the current price? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.